Search the Community

Showing results for tags '2023'.

-

I didn't expect to read about "some customers" and "these people" when I click on the article. Sounds like there're more rich crooks in SG than I imagined. Dealers, who declined to be named because of the sensitivity of the matter, said some customers want to avoid the scrutiny that may come with such high-value purchases. One dealer said: “It doesn’t matter whether they are in so-called legitimate businesses or not. These people just want to play it safe and not get into any trouble.”

- 36 replies

-

- 5

-

.png)

-

- car sales

- million dollar

-

(and 1 more)

Tagged with:

-

POV: me patiently waiting for Dec's COE thread 😆 i got vested interest lol

-

Just in time before I fly. Good luck and bye... 3 useful links for MCFers Real Time COE Bidding Results Check Your COE Bidding Status Latest COE Prices and Trending Highest Record Cat A => $106,000 [Oct 2023] Cat B => $150,001 [Oct 2023] Cat C => $91,101 [Mar 2023] Cat D => $13,189 [Nov 2022] Cat E => $158,004 [Oct 2023] Lowest Record Cat A => $2 [Nov 2008] Cat B => $200 [Jan 2009] Cat C => $1 [Mar 2007] Cat D => $1 [Mar 2003] Cat E => $3,000 [Feb 2009] Upcoming Bidding Exercise The details of the November 1st open bidding exercise for Certificates of Entitlement (COEs) are as follows: Tender opens: Monday, 6 November 2023, 12 noon Tender closes: Wednesday, 8 November 2023, 4.00 pm Tender results: Wednesday, 8 November 2023 (Available on www.onemotoring.lta.gov.sg) The total quota available for this tender is 2,411 for the following vehicle categories: NON-TRANSFERABLE CATEGORIES Category A : Cars (up to 1,600cc and maximum power up to 97kW (130bhp); and fully electric car with maximum power up to 110kW (147bhp)) => 924 Category B : Cars (above 1,600cc or maximum power above 97kW (130bhp); and fully electric car with maximum power above 110kW (147bhp)) => 636 Category D : Motorcycles => 520 TRANSFERABLE CATEGORIES Category C : Goods Vehicles and Buses => 190 Category E : Open Category => 141

-

Comparing the highest and lowest record, really no eye see... Wanted to add in the usual "Good Luck to All Vested", but am wondering if any MCFer is still buying new car at the current climate (except @RadX who spend real $$$ like hell notes ) 3 useful links for MCFers Real Time COE Bidding Results Check Your COE Bidding Status Latest COE Prices and Trending Highest Record Cat A => $105,000 [Sep 2023] Cat B => $140,889 [Sep 2023] Cat C => $91,101 [Mar 2023] Cat D => $13,189 [Nov 2022] Cat E => $144,640 [Sep 2023] Lowest Record Cat A => $2 [Nov 2008] Cat B => $200 [Jan 2009] Cat C => $1 [Mar 2007] Cat D => $1 [Mar 2003] Cat E => $3,000 [Feb 2009] Upcoming Bidding Exercise The details of the October 1st open bidding exercise for Certificates of Entitlement (COEs) are as follows: Tender opens: Monday, 2 October 2023, 12 noon Tender closes: Wednesday, 4 October 2023, 4.00 pm Tender results: Wednesday, 4 October 2023 (Available on www.onemotoring.lta.gov.sg) The total quota available for this tender is 2,010 for the following vehicle categories: NON-TRANSFERABLE CATEGORIES Category A : Cars (up to 1,600cc and maximum power up to 97kW (130bhp); and fully electric car with maximum power up to 110kW (147bhp)) => 785 Category B : Cars (above 1,600cc or maximum power above 97kW (130bhp); and fully electric car with maximum power above 110kW (147bhp)) => 474 Category D : Motorcycles => 497 TRANSFERABLE CATEGORIES Category C : Goods Vehicles and Buses => 114 Category E : Open Category => 140

-

3 useful links for MCFers Real Time COE Bidding Results Check Your COE Bidding Status Latest COE Prices and Trending Highest Record Cat A => $103,721 [Apr 2023] Cat B => $129,890 [Aug 2023] Cat C => $91,101 [Mar 2023] Cat D => $13,189 [Nov 2022] Cat E => $131,000 [Aug 2023] Upcoming Bidding Exercise The details of the September 1st open bidding exercise for Certificates of Entitlement (COEs) are as follows: Tender opens: Monday, 4 September 2023, 12 noon Tender closes: Wednesday, 6 September 2023, 4.00 pm Tender results: Wednesday, 6 September 2023 (Available on www.onemotoring.lta.gov.sg) The total quota available for this tender is 1,933 for the following vehicle categories: NON-TRANSFERABLE CATEGORIES Category A : Cars (up to 1,600cc and maximum power up to 97kW (130bhp); and fully electric car with maximum power up to 110kW (147bhp)) => 645 Category B : Cars (above 1,600cc or maximum power above 97kW (130bhp); and fully electric car with maximum power above 110kW (147bhp)) => 470 Category D : Motorcycles => 573 TRANSFERABLE CATEGORIES Category C : Goods Vehicles and Buses => 115 Category E : Open Category => 130

- 316 replies

-

- 10

-

-

3 useful links for MCFers Real Time COE Bidding Results Check Your COE Bidding Status Latest COE Prices and Trending Highest Record Cat A => $103,721 [Apr 2023] Cat B => $121,000 [Jun 2023] Cat C => $91,101 [Mar 2023] Cat D => $13,189 [Nov 2022] Cat E => $125,000 [May 2023] Upcoming Bidding Exercise The details of the August 1st open bidding exercise for Certificates of Entitlement (COEs) are as follows: Tender opens: Monday, 7 August 2023, 12 noon Tender closes: Thursday, 10 August 2023, 4.00 pm Tender results: Thursday, 10 August 2023 (Available on www.onemotoring.lta.gov.sg) The total quota available for this tender is 1,886 for the following vehicle categories: NON-TRANSFERABLE CATEGORIES Category A : Cars (up to 1,600cc and maximum power up to 97kW (130bhp); and fully electric car with maximum power up to 110kW (147bhp)) => 632 Category B : Cars (above 1,600cc or maximum power above 97kW (130bhp); and fully electric car with maximum power above 110kW (147bhp)) => 470 Category D : Motorcycles => 522 TRANSFERABLE CATEGORIES Category C : Goods Vehicles and Buses => 122 Category E : Open Category => 140

-

This should be a more important piece of news for Singapore, NOT some extramartial affairs! The part on disbursement using personal bank account is a major lapse to me, as it may lead to misappropriation of public funds as well as promoting scamming activities (when recipients of such funds thought that it is normal to transact via personal accounts). S$1 million over-disbursement of grants by CAAS, weakness in controls at PA among lapses flagged by Auditor-General SINGAPORE: The over-disbursement of grants by S$1 million (US$754,000) by the Civil Aviation Authority of Singapore (CAAS) and weaknesses in controls at the People’s Association (PA) were among the lapses flagged by the Auditor-General’s Office (AGO) in its report on Wednesday (Jul 19). The AGO’s audit report of public agencies in Singapore for the financial year 2022/2023 also focused on four COVID-19 grants – the Jobs Support Scheme, Rental Relief Framework (Rental Cash Grant), Rental Support Scheme and the SingapoRediscovers Vouchers scheme. The AGO audited 16 government ministries, eight organs of state, four government funds, eight statutory boards, four government-owned companies and two other accounts. The report noted lapses in procurement and weaknesses in controls at the PA. This includes lapses in the evaluation and award of three tenders. The scores given by the tender evaluation committee for certain sub-criteria could not be substantiated or were incorrectly assessed. For two of the tenders, the evaluation sub-criteria and scoring methodology were determined only after the tenders had closed. Three grassroots organisations had also awarded or renewed contracts with two debarred contractors. The AGO also found inappropriate money management practices for welfare assistance schemes at two grassroots organisations. One of these organisations transferred S$707,000 from April 2019 to May 2022 to personal bank accounts so staff could withdraw the money for cash disbursements to welfare assistance recipients at festive events. The money was transferred over seven instances, with amounts ranging from S$10,000 to S$200,000. For the second grassroots organisation, S$334,500 was transferred from July 2020 to November 2021 to a staff member’s personal bank account. This was used to reimburse hawkers and merchants for their claims under a voucher assistance scheme. This money was transferred over 46 instances, in amounts ranging from S$500 to S$21,200. According to the PA, these practices were implemented due to operational needs, said the AGO report. It added that this practice of transferring grassroots organisations' money to personal bank accounts was “inappropriate”. “While AGO’s test checks did not find any evidence of money being lost or misappropriated in the above two cases, such practices pose significant risk of loss or misappropriation,” said the report. “It would also be unfair for the staff to bear the consequences should the money be unaccounted for during the process.” For two community service projects that had been in operation for more than 10 years, the grassroots organisations did not enter into formal agreements with the external service partners, setting out the terms and conditions of the partnership arrangement. In a separate press release, PA said it takes the AGO findings very seriously and is committed to resolving and improving its governance, procurement and oversight processes.

- 19 replies

-

- 18

-

-

-

3 useful links for MCFers Real Time COE Bidding Results Check Your COE Bidding Status Latest COE Prices and Trending Highest Record Cat A => $103,721 [Apr 2023] Cat B => $121,000 [Jun 2023] Cat C => $91,101 [Mar 2023] Cat D => $13,189 [Nov 2022] Cat E => $125,000 [May 2023] Upcoming Bidding Exercise The details of the July 1st open bidding exercise for Certificates of Entitlement (COEs) are as follows: Tender opens: Monday, 3 July 2023, 12 noon Tender closes: Wednesday, 5 July 2023, 4.00 pm Tender results: Wednesday, 5 July 2023 (Available on www.onemotoring.lta.gov.sg) The total quota available for this tender is 1,845 for the following vehicle categories: NON-TRANSFERABLE CATEGORIES Category A : Cars (up to 1,600cc and maximum power up to 97kW (130bhp); and fully electric car with maximum power up to 110kW (147bhp)) => 588 Category B : Cars (above 1,600cc or maximum power above 97kW (130bhp); and fully electric car with maximum power above 110kW (147bhp)) => 471 Category D : Motorcycles => 579 TRANSFERABLE CATEGORIES Category C : Goods Vehicles and Buses => 77 Category E : Open Category => 130

- 70 replies

-

- 21

-

.png)

-

-

Lets begin our rebuild this summer (2023) Let me starts : Many unconfirm reports of players linking with Liverpool FC this summer. 1) Central Defender PAVARD from Bayen Munich

-

This compact electric SUV will be even smaller than the XC40, with an estimated dimensions of 4.2m (L) x 1.8m (W) x 1.6m (H). Design wise, the line between products from Volvo and Polestar is getting blurry, and can see that the rear windscreen is very narrow (by SUV standard), again compromising practicality for aesthetic appeal...

-

Ann Kok Giving Out 100 Free Scoops Of Ice Cream To Thank Her IG Followers And Those Who Voted For Her For Star Awards 2023 https://www.8days.sg/entertainment/local/ann-kok-free-ice-cream-vote-star-awards-2023-768481 friend asking if Ann Kok jie jie will personally scoop and serve the 100 scoops ...

- 267 replies

-

- 2

-

.png)

-

- star awards

- mediacorp

-

(and 1 more)

Tagged with:

-

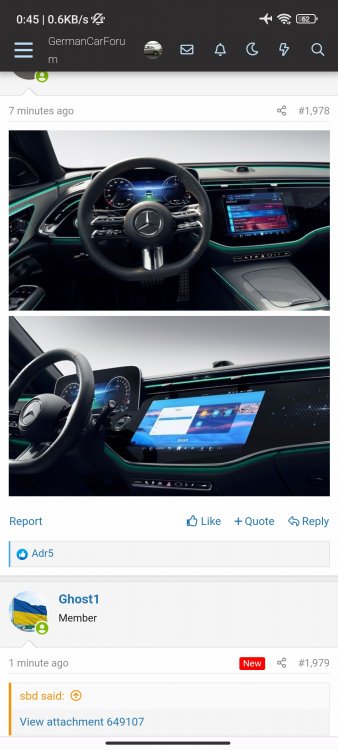

Eh...is there more to this video? Rather short. Will be interesting if can show more.

- 9 replies

-

- bangkok motorshow

- 2023

-

(and 2 more)

Tagged with:

-

Changi Airport clinches World’s Best Airport 2023 after losing for past 2 years https://mothership.sg/2023/03/changi-airport-world-best-airport-skytrax/ https://skytraxratings.com/singapore-changi-airport-is-named-the-worlds-best-airport-2023

- 70 replies

-

- 9

-

-

.png)

-

- changi airport

- world best airport

-

(and 1 more)

Tagged with:

-

Community Service brought to you by MCF Good Luck to all vested! 3 useful links for MCFers Real Time COE Bidding Results Check Your COE Bidding Status Latest COE Prices and Trending Highest Record Cat A => $92,100 [Jan 2013] Cat B => $115,388 [Nov 2022] Cat C => $87,790 [Feb 2023] Cat D => $13,189 [Nov 2022] Cat E => $118,001 [Feb 2023] Past Bidding Results (2001 - 2021) Past Bidding Results (2022 - 2023) 24 Months Trend Chart (Mar 2021 - Feb 2023) *chart taken from www.sgcarmart.com PQP (2010 - 2021) PQP (2022 - 2023) The details of the March 1st open bidding exercise for Certificates of Entitlement (COEs) are as follows: Tender opens: Monday, 6 March 2023, 12 noon Tender closes: Wednesday, 8 March 2023, 4.00 pm Tender results: Wednesday, 8 March 2023 (Available on the www.onemotoring.lta.gov.sg) The total quota available for this tender is 1,590 for the following vehicle categories: NON-TRANSFERABLE CATEGORIES Category A : Cars (up to 1,600cc and maximum power up to 97kW (130bhp); and fully electric car with maximum power up to 110kW (147bhp)) => 517 Category B : Cars (above 1,600cc or maximum power above 97kW (130bhp); and fully electric car with maximum power above 110kW (147bhp)) => 431 Category D : Motorcycles => 467 TRANSFERABLE CATEGORIES Category C : Goods Vehicles and Buses => 43 Category E : Open Category => 131

-

Community Service brought to you by MCF Good Luck to all vested! 3 useful links for MCFers Real Time COE Bidding Results Check Your COE Bidding Status Latest COE Prices and Trending Highest Record Cat A => $92,100 [Jan 2013] Cat B => $115,388 [Nov 2022] Cat C => $81,802 [Nov 2022] Cat D => $13,189 [Nov 2022] Cat E => $116,577 [Nov 2022] Past Bidding Results (2001 - 2021) Past Bidding Results (2022 - 2023) 24 Months Trend Chart (Feb 2021 - Jan 2023) *chart taken from www.sgcarmart.com PQP (2010 - 2021) PQP (2022 - 2023) The details of the February 1st open bidding exercise for Certificates of Entitlement (COEs) are as follows: Tender opens: Monday, 6 February 2023, 12 noon Tender closes: Wednesday, 8 February 2023, 4.00 pm Tender results: Wednesday, 8 February 2023 (Available on the www.onemotoring.lta.gov.sg) The total quota available for this tender is 1,589 for the following vehicle categories: NON-TRANSFERABLE CATEGORIES Category A : Cars (up to 1,600cc and maximum power up to 97kW (130bhp); and fully electric car with maximum power up to 110kW (147bhp)) => 509 Category B : Cars (above 1,600cc or maximum power above 97kW (130bhp); and fully electric car with maximum power above 110kW (147bhp)) => 430 Category D : Motorcycles => 477 TRANSFERABLE CATEGORIES Category C : Goods Vehicles and Buses => 44 Category E : Open Category => 129

- 155 replies

-

- 26

-

.png)

-

-

Replacement for the 8 years old CX-9 is scheduled to debut on the 31 Jan 2023. Here are some teaser shots, videos and quick bites released by Mazda. Stay tuned for more... Highlights Turbocharged 3.3-liter IL6 engine 340 hp / 254 kW 500 Nm torque Available with Plug-in Hybrid (PHEV) Front-engine, Rear-drive architecture Mazda's Kinetic Posture Control (KPC) system borrowed from the MX-5 Miata

- 45 replies

-

- 11

-

-

This is a good start The bosses interviewed said the surcharge is similar to previous years and has not been significantly increased due to recent inflation.

- 144 replies

-

- 9

-

-

.png)

-

- cny

- chinese new year

- (and 10 more)

-

Community Service brought to you by MCF Good Luck to all vested! 3 useful links for our dear MCFers: Real Time COE Bidding Results Check Your COE Bidding Status Latest COE Prices and Trending Highest Record Cat A => $92,100 [Jan 2013] Cat B => $115,388 [Nov 2022] Cat C => $81,802 [Nov 2022] Cat D => $13,189 [Nov 2022] Cat E => $116,577 [Nov 2022] The details of the January 1st open bidding exercise for Certificates of Entitlement (COEs) are as follows: Tender opens: Tuesday, 3 January 2023, 12 noon Tender closes: Thursday, 5 January 2023, 4.00 pm Tender results: Thursday, 5 January 2023 (Available on www.onemotoring.lta.gov.sg) The total quota available for this tender is 1,533 for the following vehicle categories: NON-TRANSFERABLE CATEGORIES Category A : Cars (up to 1,600cc and maximum power up to 97kW (130bhp); and fully electric car with maximum power up to 110kW (147bhp)) => 462 Category B : Cars (above 1,600cc or maximum power above 97kW (130bhp); and fully electric car with maximum power above 110kW (147bhp)) => 410 Category D : Motorcycles => 445 TRANSFERABLE CATEGORIES Category C : Goods Vehicles and Buses => 70 Category E : Open Category => 146

-

My New Year Wish to all forumers & their families for 2023: Stay healthy & Covid-free Safe and trouble-free motoring throughout the new year Drastic drop in COE price 😁 God of Fortune come knocking at your doors 💲💰💲

-

Both the exterior and interior have the Land Rover vibe, and seems up market.

- 24 replies

-

- 13

-

-

https://www.abc.net.au/news/2022-10-01/david-taylor-global-financial-crisis-2/101492384 The world is flirting with another global financial crisis, and the next few weeks are key It's hard to overstate the magnitude of the financial trouble Britain and, because of its financial heft, the world found itself in this week. We came within inches of "global financial crisis mark 2". That's not hyperbole. Towards the end of 2008, it was clear many Wall Street investment banks were on the brink of collapse. They were sitting on tens of billions of dollars' worth of rubbish assets – mortgage-backed securities attached to properties plummeting in value. A credit crunch was sparked when the US government allowed Lehman Brothers to collapse. It was sitting on a lot of these worthless assets. Suddenly, it was unclear who could afford to repay loans and who couldn't. We've just flirted with a scenario of similar magnitude. The problem now is, well, the flirtation is not over. Comedy of errors Liz Truss – Boris Johnson's replacement as British prime minister – inherited an economy at risk of entering a protracted and deep recession. Truss delivered a "mini-budget" last week which offered up lots more government spending and the biggest package of tax cuts in 50 years to help stimulate the economy. Great, right? Well, not so much. Financial markets asked an obvious question in response: "how are you going to pay for this?", when the UK's budget deficit (or net borrowing) is already in the hundreds of billions of pounds. The BBC reported conservative MPs walking the corridors "in shock" after the mini-budget was handed down. The ultimate response from the money markets was a vote of no confidence in the fiscal package. The bond market "sold off". Bond prices in the fixed income market plummeted. As bond prices fall, yields rise. It's really not necessary to understand the bond market machinations here, but it is important to understand the next point. That is, for Britain's pension scheme to work, or continue as a going concern, interest rates can't rise too high too quickly — which is what happened. The funds found themselves unable to pay pensions because they were losing too much money on their investments. To stop this, the Bank of England came in to buy up bonds on an enormous scale to increase the price of bonds and lower the interest rates on those bonds. "To achieve this, the Bank will carry out temporary purchases of long-dated UK government bonds from September 28. The purpose of these purchases will be to restore orderly market conditions," the Bank of England said. "The purchases will be carried out on whatever scale is necessary to effect this outcome. The operation will be fully indemnified by HM Treasury." But here's the killer line. "Were dysfunction in this market to continue or worsen, there would be a material risk to UK financial stability." What the Bank of England was suggesting, according to former London City trader Henry Jennings, is that when the bond market moved violently against these pension funds, they were at risk of being placed into margin calls. That is, many funds had borrowed money to make more money. They were heavily in debt to enhance their returns. They were about to be asked to "pay up". If they were asked to pay up, they would have been forced into liquidating their assets, which he says would have led to a financial markets "death spiral". The sheer weight of global assets being sold off would have, in Jennings' opinion, led to a global "confidence crisis". Problem not going away The Bank of England bailout of Britain's pension schemes is limited. "These [bond] purchases will be strictly time limited," the BofE said. "They are intended to tackle a specific problem in the long-dated government bond market. Auctions will take place from today until 14 October." So, what happens when they stop buying gilts, or British bonds? The chief economist of the National Australia Bank says the forces that led to Britain's financial system edging to towards the brink remain firmly in place. "Markets are getting a bit worried," Alan Oster says. He says interest rates in Britain will keep climbing, and may do so quite aggressively in the coming months. "[Markets] are talking – well, it's frightening, they're starting off from a cash rate of 2-ish per cent and they're talking about a 1.25 per cent or 1.5 per cent interest rate increase [at the next Bank of England meeting]". "It's extraordinary and of course the pound is being absolutely killed." In other words, the problem facing the pension fund scheme is set to return. It's heavy stuff So, let's just do a quick stop-and-check at this point, because it's heavy stuff. The UK is still at risk from a financial crisis because a major investment scheme remains vulnerable to a bond market that's still at risk of plummeting due to the UK's economic woes (in part created by a dire mini-budget). This is all being reflected in a recent collapse of the pound. A financial crisis in the UK would, analysts say, lead to a global economic rout. Is Australia immune? The short answer is no. The Australian dollar is hovering around two-year lows against the greenback, and the stock market is down 15 per cent from peak to trough. We're inching towards a share "bear market". This has obvious implication for those in and approaching retirement. A destabilisation of the global financial system, more broadly though, would produce the same shock waves as 2008 and 2009. It leads to higher unemployment and a recession. The problem this time around is that the Australian government, and indeed the Reserve Bank, are in no position to engage in extraordinary economic stimulus measures. But … so far so good However, it seems the majority of Australians, right now, have the financial capacity to continue on in a relatively normal fashion. Australian retail turnover rose 0.6 per cent in August, according to Retail Trade figures released by the Australian Bureau of Statistics earlier this week. The August increase was the eighth consecutive rise and follows a 1.3 per cent rise in July and a 0.2 per cent rise in June. "This month's rise was driven by the combined increase in food related industries, with cafes, restaurants and takeaway food services up 1.3 per cent and food retailing up 1.1 per cent," Ben Dorber, head of retail statistics at the ABS, said. The dark cost-of-living clouds hanging over millions of Australians is "being balanced by people saying, 'well, I'm not going to lose my job' ", NAB chief economist Alan Oster says. "The economy is doing really well." But, and that's a big but, he says ominously, the "next four weeks will be interesting". That's a reference to the fact that the bulk of already-announced Reserve Bank interest rates hikes will hit bank accounts over the next couple of months. It's unclear to most observers how, exactly, this would damage the Australian economy. Work is already underway though to put policy makers in a better position to make the right calls when it come to pulling the levers. The ABS, for example, is now delivering monthly inflation or cost of living data. The first monthly Consumer Price Index (CPI) indicator rose 7.0 per cent in the year to July and 6.8 per cent to August. The largest contributors, in the 12 months to August, were new dwelling construction, up 20.7 per cent, and automotive fuel, up 15.0 per cent. Now the Reserve Bank is in a better, or timelier, position to see how its policy tightening is influencing prices in the economy. This, in practice, is meant to avoid hiking interest rates too far. The RBA meets on Tuesday. At the moment it's a coin toss as to whether the bank raises its cash rate target by 0.25 or 0.5 percentage points. How serious is all this? Naturally, with any major financial event, the question is: do I need to worry about this? The answer is that you need to keep watching this story unfold. AMP's chief economist, Shane Oliver, suggests while the Bank of England's short-term effort to bring back the UK financial system from the brink has worked, the country's financial system is set to go right back there again soon. "The Bank of England's intervention to calm the gilt market (which was threatening financial problems for UK pension funds) by buying bonds (ie restarting QE) has helped calm things – directly in the UK and indirectly elsewhere by showing that authorities will still intervene in a crisis," Dr Oliver said. "Unfortunately, the return to QE [bond buying] may just add to inflationary pressures if it has to be sustained for long, which may necessitate an even higher interest rate hike when the BoE next meets in early November with many talking about a 1.25 per cent hike, which leaves the BoE in the silly position of easing and tightening at the same time." So, the options are that the Bank of England keeps coming to the rescue of the UK financial system with the risk of exacerbating inflation which will lead to much higher interest rates, or allow the market to take over, and risk a full-blown financial crisis when the bond market collapses again. Australia seems to be in a reasonable position now to manage a financial shock, but it's unclear whether that will still be the case in just a few weeks' time. Huge risks remain. Printing trillions of dollars of money, globally, during the pandemic to support the global economy was always fraught with risk. As it stands we are unable to remove that economic support without the whole system collapsing, but we need to remove it before we create even bigger economic problems. It's an extremely uncomfortable position to be in.

-

2023 BMW XM Officially Revealed As The Ultimate M SUV With 735 HP BMW took everyone by surprise in November 2021 with the reveal of its aggressively angular Concept XM. Get ready to meet the subsequent production version with largely the same polarizing design, including the love/hate split headlights we've recently seen on the new 7 Series and X7 facelift. The edgy SUV available exclusively with a plug-in hybrid powertrain is the first standalone M product since the original M1 was discontinued in 1981. Everything is big about the M division's partially electrified mastodont, including the 23-inch wheels with 275/35 R23 front and 315/30 R23 rear tires as standard equipment. Alternatively, you can optionally go down one size. It does have two roundels at the back as a throwback to the M1 but this is pretty much where the similarities end. As with all fully fledged M cars, the XM has a quad exhaust system, only this time with stacked tips to make the sporty luxobarge stand out. Impressively wide taillights complement the muscular body and flank a prominent XM badge with a gold contour to echo other exterior details. The first M product with a PHEV setup features a charging port on the left-front fender, which will be the same story as the next-generation M5. Under the hood, BMW has installed its new S68 engine, a twin-turbo 4.4-liter V8 with mild-hybrid tech. On its own, the combustion engine is good for 483 horsepower at 5,400 rpm and 650 Newton-meters of torque from just 1,600 rpm. Integrated into the eight-speed automatic transmission is the electric motor, rated at 194 hp and 280 Nm. With the power of the two combined, the XM offers 644 hp and 800 Nm. The electrified punch enables a 0 to 100 km/h sprint time of 4.3s). The ultimate M SUV is electronically capped at 250 km/h from the factory, but add the M Driver’s Package and BMW will loosen up the limiter to 270 km/h. The e-motor draws its juice from a lithium-ion battery pack with a usable capacity of 25.7 kWh. The XM will hit 140 km/h in electric mode, and BMW estimates a full charge will last for 48 kilometers based on EPA’s testing procedures. Over in Europe, the super SUV named after a 1990s Citroën model has a WLTP rating of 82 to 88 kilometers.

-

The heart of this new beast is NOT a V8, or even V6, but a 2.0L IL4 unit! These spec should WOW you more than it's outlook. Max Horsepower: 671 hp / 680 ps Max Torque: 1,020 Nm 0 - 100 Km/h: 3.4 sec Top Speed: 280 Km/h (electronically controlled) The engine is AMG’s M139L 2.0-liter inline four-cylinder as seen on the SL43 roadster and the C63’s little brother, the C43. Like those cars it features an electrically-driven turbocharger, but for the C63 the blower is much bigger. So while the SL43’s gas motor peaks at 376 hp (381 PS), and the C43 tops out at 402 hp (408 PS), the C63 kicks both into the weeds with a 470 hp (476 PS) output. That doesn’t only match the old base model C63’s V8 for muscle despite being half the size, it makes this new version of the M139 the most powerful four-cylinder production engine in the world, and with 545 Nm, it must be the torquiest too. And that’s before we’ve factored in the electric boost that’s also new for 2024. That boost happens at the rear wheels courtesy of a 150 kW (201 hp /204 PS) electric motor packed into the rear axle together with an electronically-controlled limited slip differential and a two-speed drive unit. It can power the car as an EV at up to 125 km/h and for up to 13 km, if driven gently, which makes it sound like a PHEV from a decade ago, but that’s because AMG has prioritised power over efficiency for this hybrid system. Drawing from a 6.1 kWh battery the motor delivers its 150 KW maximum for up to 10 seconds at a time, but is always on hand with at least 70 kW (94 hp / 95 PS), and engages its second gear from 140 km/h once it kissed its 13,500 rpm rev limiter. The result is a fairly spectacular combined gas-electric output of 671 hp (680 PS) and 1,020 Nm, making the C63 not only far more powerful than the old V8-engined C63 S and its 503 hp, or the 503-hp BMW M3 Competition but punchier than super sedans from the class above like the 617-hp BMW M5 Competition. 0 to 100 km/h takes 3.4 seconds (down from 4.0 seconds for the old C63 S) and the 250 km/h top speed can be raised to 280 km/h with a suitable bung to your Mercedes dealer at order time. The electric motor acts only on the rear axle, and you can configure the gas motor to do the same. But for the first time the model operates by default in all-wheel drive. Power flows to the 4Matic+ four-paw transmission via a conventional nine-speed epicyclic auto, but one fitted with a wet clutch pack instead of a torque converter. Rear-axle steering also makes its debut on the new C63, and carbon brakes join a list of standard equipment that includes adaptive dampers for the steel-spring suspension and an AMG Dynamics drive mode selector with a new “Master” mode that allows the kind of oversteer antics C63s have become famous for. Drivers also get AMG-specific graphics in the digital instrument cluster and head-up display, plus a button on the steering wheel giving four levels of energy recovery ranging from almost nonexistent to strong enough to allow one-pedal driving.

- 26 replies

-

- 16

-

-

-

This is supposedly the 3rd generation XC90, which Volvo decided to give it a name change to signify the switch to all electric drive train. Earlier reports, however, suggested that the model, which it is said will blend SUV and sedan design elements, will be named Embla, after the first woman in Norse mythology. Next-Gen Volvo XC90 EV Design Allegedly Revealed In Patent Images In any case, Volvo announced in February that it would be keeping the XC90 around for a few more years. The SUV that heralded the brand’s modern revival will continue to be produced in Torslanda, Sweden, after a visual update.