Search the Community

Showing results for tags 'Asia'.

-

SINGAPORE'S Central Provident Fund (CPF) system ranks top among similar social security systems in Asian countries, but it is Denmark's well-funded pension system which has emerged the best globally. The 2014 Mercer Melbourne Global Pension Index identified Singapore's CPF is a "sound structure, with many good features, but has some areas for improvement that differentiates it from an A-grade system". The Singapore retirement system continues to score a grade of B, but is expected to be upgraded once shortcomings are addressed, said Neil Narale, Mercer's Asean Retirement Business Leader. "The lack of tax-approved group corporate retirement plans and retirement savings for non-residents continues to isolate Singapore from other highly-graded countries on the global scale," he said. http://www.globalpensionindex.com/country-summaries-2/singapore/ http://www.businesstimes.com.sg/government-economy/singapores-cpf-system-ranked-top-in-asia-denmarks-system-leads-globally-mercer

- 44 replies

-

- 1

-

-

- cpf global ranking denmark

- pension

- (and 7 more)

-

Hi guys any story/experience to share driving in other asian countries/cities other than MALAYSIA? Let me share mine first, since I am relatively young, I have driven in Thailand and Indonesia before, driven car friend in bkk for half day only but was unlucky as traffic really jam. Drive around the sathorn area as well as sukhumvit area 3-4 years back in his CRV. Really pain in @ss driving in bkk as had to wait long in traffic light. Then in indonesia i have driven before in Surabaya, Bali and. Batam before through car rental. In Bali it was challenging as roads very narrow and gps somehow brought me to small road for one car only for shortcut BUT that road is for 2 ways. So when there is oncoming car, I had to keep the most left, ask my gf to check out left side of the car and then i fold the mirror, think left and right less than 15cm! Then also managed to drove to kintamani mountain for 3-4 hours drive from the denpasar city. Its tiring but fun Then in Surabaya, i rented an Innova and went to Taman Safari Prigen about 1 hr drive from the city. The fun part is that the safari is like jurassic park, lions and other animals is at ur car window as we drive in to see those animals using our own cars. Unforgettable experience indeed. Think if u watch one of the Running Man episode in Indonesia, its exactly the same. U can feed some herbivores food by opening ur window slightly. Its fun! Last but not least in Batam, rented a car drive to barelang bridges. Not much experience but fun part is when u cross the first bridge. Then i think in 4th or 5th island drive through viets village. Thats all about my Asia Driving experience

-

Seems like the North Koreans are the best as far as 2014 is concerned. In SG, hardly see any female soccer matches. http://www.japantoday.com/category/sports/view/n-korea-beats-japan-in-womens-soccer-to-win-gold-at-asian-games INCHEON — North Korea upset defending champions Japan 3-1 to win the Asian Games women’s soccer gold on Wednesday—and again it was all down to leader Kim Jong-Un for sharing his wisdom. Kim Yun-Mi, captain Ra Un-Sim and Ho Un-Byol were all on target as the North Koreans totally outplayed World and Asian Cup holders Japan to avenge their loss in the final four years ago. The North’s players squealed with joy, some bursting into tears, at the final whistle as around 60 of their flag-waving comrades in official tracksuits hopped with delight in the stands. After the match, their coach dedicated the gold to North Korean leader Kim, a big sports fan who is reportedly ailing. “This was an inevitable result as the North Korean players trained with dedication and never stopped fighting to return the warm love of our dear leader Kim Jong-Un, who watched over us” Kim Kwang-Min told reporters. “Our respected leader visited our training camp on July 11 and gave the team valuable instruction on how to win the gold medal at the Asian Games. This victory reflects the boundless feelings of the players for our dear leader.” South Korean fans chanted support for their neighbors from north of the border throughout, many waving unification flags showing the Korean peninsula in blue on a white background. The North’s players sprinted over to the main stand after a celebratory team hug and unfurled their country’s flag as thousands of local fans seated behind huge unification banners with the same design serenaded them with: “We are one At the medal ceremony, local fans and the delirious North Korean delegation continued to chant the same mantra to each other from opposite sides of the pitch. “When our team was being cheered on by South Korea I felt we are one nation,” said coach Kim. “We are all brothers and sisters. I could sense a feeling of Korean unification.” North Korea took the lead after 12 minutes when midfielder Kim stabbed home from close range following some dreadful Japanese defending. They produced a moment of true class to double their lead seven minutes after the interval, Ra latching on to a long diagonal from Jon Myong-Hwa to finish with a clinical right-foot shot.

- 9 replies

-

- 2

-

-

- asia footbal soccer champions

- woman

- (and 5 more)

-

Asia's first! ATMs that sells gold . . . http://www.straitstimes.com/news/business/more-business-stories/story/asias-first-gold-dispensing-atms-installed-singapore-20140 SINGAPORE - Singapore now has its first automated teller machines (ATMs) that dispense gold. Two such ATMs were launched on Wednesday morning at Resorts World Sentosa and Marina Bay Sands.The custom-built machines will dispense a variety of pure gold items that produced by top Swiss refiner, PAMP. The gold products - available in a variety of sizes from one to ten grams - will have different prices daily, pegged to the day's global prices. Singapore now has its first automated teller machines (ATMs) that dispense gold. -- On the day of the launch, a one gram pendant cost $100 while a ten gram one cost $660. The company behind the machines, Asia Gold ATM, says it intends to launch two or three more machines "in the near future" as it looks for more locations to base the ATMs.It also touted its ATMs as Asia's first. - See more at: http://www.straitstimes.com/news/business/more-business-stories/story/asias-first-gold-dispensing-atms-installed-singapore-20140#sthash.GFBbOuXR.dpuf

-

Commercial real-estate yields in Asia are the lowest in the world, forcing investors to pay top prices for the highest-quality buildings, take on more risk or consider property investments outside of their regions for the first time. Yields for centrally located office buildings are just 2.2% in Taipei, 2.8% in Hong Kong and 3.5% in Tokyo and Singapore. By comparison, they are 4.7% in New York and 3.8% in London's West End, according to CBRE Group Inc. Pension funds, sovereign-wealth funds and other institutional investors have been willing to accept such low returns because they look attractive in a low interest-rate environment. But it also means that buyers are exposed to a loss in value if interest rates rise and demand for such low yields cools. Yields have fallen so far in Taiwan that financial regulators last year instituted a new rule that limits domestic insurance companies' investments to properties that offer a rental yield of 2.875% or above. Authorities also have allowed insurance companies to buy real estate outside the country's borders for the first time. Investors are modifying their strategies. Terence Loh, executive director at China-focused investment fund CDH Investments, said he has been investing in development projects in cities such as Beijing, Hangzhou and Xi'an rather than buying existing buildings. "The risk-reward is more compelling," he said. Yields are an important measure of commercial-property values because lower yields typically mean higher prices. They are calculated by dividing the annual income by the price. Traditionally, yields in Asia are lower than they are in Europe and the U.S. because often there are more buyers chasing fewer properties. Pension funds, sovereign-wealth funds and other institutional investors favor fully leased, well-located buildings and there are fewer of these in Asia. Also, many of these investors, until recently, have been reluctant to venture outside the regional markets they know best. But lately yields in Asia have fallen to unusually low levels, along with the rest of the world. Buyers can tolerate smaller yields partly because they can borrow at lower costs and the lower returns still look attractive compared with the debt market. Yields also have been falling in many countries because the annual incomes of properties aren't keeping up with rising prices. Prime office rents in Beijing and Shanghai, for example, have stayed flat over the past two years, according to CBRE, while those in Hong Kong and Taipei rose 2.3% and 1.1%, respectively, in the past year. In some Asian cities, including Taipei and Beijing, yields are at or near historical lows, according to CBRE. In Hong Kong, they are at similar levels to the last major property boom in 1997. In Tokyo, the yields are at their lowest levels since 2005, CBRE says. In Taipei, for example, Mercuries Life Insurance Co. Ltd. in April bought almost 8,000 square meters of retail space in the podium at Taipei TiT Tower Square for 3.95 billion New Taiwan dollars (US$131.5 million), with a rental yield of 3%, according to Real Capital Analytics, a real-estate data firm. The seller, Homax Group, acquired the same property in June 2011 at a price of NT$2.8 billion for a yield of 4.5% at the time. In Singapore, a group of local companies in May bought a 93% stake from Keppel REIT in the Prudential Tower in the city's central financial district for 512 million Singaporean dollars (US$409.3 million). The deal boasted a 3.5% yield, according to Real Capital. By comparison, Keppel REIT in 2011 bought the Ocean Financial Centre, also in the heart of Singapore, for S$2.0 billion in a deal that offered a 5.3% yield, Real Capital says. Investors have started to leave their comfort zones to find higher yields. Some have targeted Australia. Yields are at 6% in Sydney's and Melbourne's main office districts. Singapore-based real-estate company Hiap Hoe Group bought an office building in Perth for 90 million Australian dollars (US$84.8 million), at a yield of 8.3%, according to research by property firm JLL. Other investors are seeking distressed properties, hoping to boost yields by increasing revenue. Gaw Capital Partners, a Hong Kong-based private-equity real-estate firm, earlier this year paid US$30 million for the Hyatt Regency Osaka in hopes of turning around a hotel that lost US$10 million in the year ending March. "We saw a lot of quick fixes that we could do and cost-cutting that would make the hotel cash-flow positive right away," said Christina Gaw, managing principal and head of capital markets at the firm. Some real-estate experts say investors are willing to accept low yields because they feel that property incomes are poised to rise after years of stagnation, especially in Japan as it emerges from a long slump. They point out that commercial property often benefits from rising inflation because it allows landlords to raise rents. "Investors are going into Tokyo with the expectation of rising rents," said Alistair Meadows, international capital group head at JLL. But others say investors accepting low yields are walking a thin line. Many of them have been trying to boost returns by adding leverage, a risky formula that exposes investors to default if rents or values decline. Also, if interest rates rise faster than inflation, owners could get squeezed, especially if they have floating-rate debt, experts say. "These tight [yield] rates will have a very small margin of error," said Nicholas Wilson, research manager for capital markets in Asia Pacific, at JLL.

-

Date / Time: 21 -23 Mar / 11am - 9pm Venue: Singapore Expo Hall 5 More details at http://www.smartkidsasia.com MyCarForum will be there to give out freebies to its members. Premium Members, simply send an SMS* to 84502687 with your MyCarForum username as the message body. If you are not yet a Premium Member, upgrade here for free. We will then send you a SMS coupon to take part in our sure win lucky draw. Simply show this SMS coupon at our booth, H15. Totally no gimmicks. This is a pure rewards program for our premium members. *You must SMS from a number that matches the number registered for your Premium Account. Our sure win lucky draw prizes as below.

-

- 10 replies

-

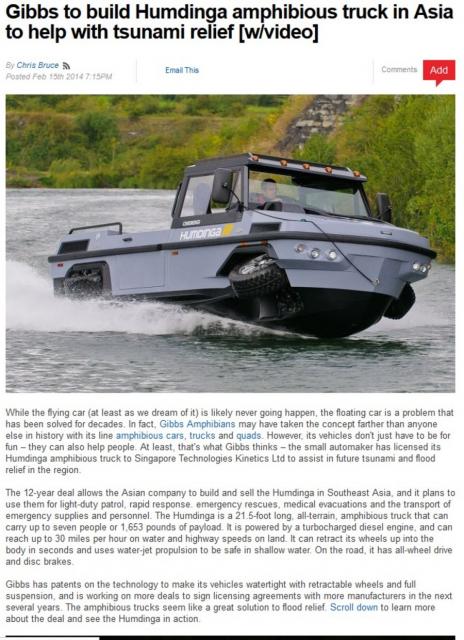

- amphibious truck

- gibbs

-

(and 5 more)

Tagged with:

-

A Singapore Insurance Company Working 24/7 For You DirectAsia.com allows consumers to purchase insurance products directly from them via two means - online or over the phone. The Singapore insurance company pledges to be in touch with clients with better understanding of the marketplace, as well as the local consumers. The result is insurance products and services that are more suited to clients’ needs. With their staff based in Singapore, customers will not have to be transferred to overseas call centres – and they are always on hand 24/7 to provide valuable help no matter where the customers are. https://www.youtube.com/watch?v=dDZeeAgkzSs&feature=youtu.be Robin Hood – Getting You a Fairer Deal on Your Insurance Robin Hood – the mascot of DirectAsia.com - has become a familiar figure on our local shores. It stands for the firm’s commitment towards providing high quality, low cost insurance through simple and direct communication. It also adds a sense of fun to an industry that has been relatively plain and restricted in advertisements. The face of DirectAsia.com’s car, motorcycle, home, travel, personal accident and term life insurance, Robin Hood has made numerous appearances on TV, billboards and online. He reminds Singaporeans that high quality insurance and excellent customer service is available at a low price – and is easily accessible. WE Put An Emphasis On Customer Service Because happier customers is what makes our team happy Our team doesn’t talk to you using service scripts , we treat each caller uniquely Our Customer Satisfaction Score is 98% ( the industry averages below 80% ) Our insurance experts go through a 6 – 8 week comprehensive training Roughly 90% of auto quotes can be done over the phone in less than 10 mins 8 out of 10 calls are answered in 20 seconds or less Our team is in Singapore , so you’ll speak to someone who understands local culture , needs . Our Promise : Local , Genuine And Professional Service We treat customers like our family and friends At DirectAsia we always put you first in everything we do – from creating policies that put you first , to the service you receive when you call to buy or make a claim . We believe insurance is more than a piece of paper you keep in your vehicle or filing cabinet , it’s a relationship . And like any good relationship , we promise to be there for you when you need us most . DirectAsia Named Top Brand in Direct – To – Consumer Insurance Category in 2015 Asia’s Top Influential Brands DirectAsia.com 88 South Bridge Road, Singapore 058716 Phone: 6665 5555 Website: http://www.directasi...randing_LeadGen

-

- 1

-

-

- direct asia

- insurance

- (and 5 more)

-

FALLING temperatures across the Asian region are chafing farmers and threatening to upset the supply of farm produce, even as the cold snap killed more than 60 people in Thailand. On Malaysia's Cameron Highlands, famed for its strawberries, tea leaves and vegetables, farmers are frustrated as crops are taking a longer time to harvest. "When the minimum temperature was 18 deg C, we harvested cabbages in three months," Mr Chai Kok Leong, 45, who owns a vegetable farming business in the Brinchang township, was quoted as saying by The Star. "Now that the temperature has declined to 12 deg C, we are forced to wait an extra half a month before we can sell them." Source: http://www.straitstimes.com/breaking-news/se-asia/story/farms-languish-cold-snap-hits-south-east-asia-20140124

- 2 replies

-

- cold snaps

- farms

-

(and 7 more)

Tagged with:

-

Hi all Any nice ideas of let's say a 8-10 days trip ard late oct F & E I be going with my boy n wife Most probably my in laws would be joining Our last trip together was to taipei n Tainan This late oct to celebrate wife's bday Thoughts were Taipei + kaoshiung + Taichung But after reading thru tripadvisor Nothing much in kaoshioung n Taichung??? Now thinking of Angkor wat or Thai hua hin vineyard Hope to get some genuine ideas here From those who been to nice places ard SE Wife's initial wish was somewhere temp <20deg Haha Cheers

-

[extract] While some automakers such as Mazda and Honda are shifting their production to Mexico, the Blue Oval, Ford, is planning to do just the opposite. The American automaker is planning to shift its Fiesta production from Chennai and Cuautitl

-

Singaporeans are the region's top spenders for dining, according to a MasterCard survey of consumer dining habits across the Asia-Pacific region. The Republic overtook Japan to climb to top spot, with an average monthly dining spend of US$262 ($323). This is up nearly 25 per cent from US$212 in June 2011. Japanese and Chinese consumers follow closely behind with an average monthly dining spend of US$225 and US$203 respectively. The global survey was conducted with residents aged between 18 and 64. The online interviews, conducted between November and December 2012, lasted about 45 minutes each. A total of 455 Singapore residents were interviewed, out of close to 8,000 respondents globally. Source: http://www.straitstimes.com/breaking-news/...survey-20130508

-

Unfazed by the Eurozone debt crisis and the 'Fiscal Cliff' episode in the US, Lamborghini's sales in 2012 improved by 30% as compared to a year ago. In terms of absolute figure, the supercar brand moved 2,083 vehicles last year comprising of 922 units of the Aventador and 1,161 units of the Gallardo. Asia took up the largest portion of the sales pie, accounting for 35% of global sales. The China market itself already account for 15%. This should not come as a surprise as Asia continues to be at the forefront of wealth creation, minting millionaires at a faster pace than any other region in the world. Strong sales is only part of Lamborghini's success story. The company's turnover climbed 46% from EUR 322 million in 2011 to EUR 469 million in 2012. With the global economic climate looking brighter, the bull run looks set to continue in 2013.

-

- super cars

- sales report

-

(and 7 more)

Tagged with:

-

Anyone has interesting Bizarre Food Videos to introduce? Okay, i know im a girl but i really do love to watch videos on bizarre foods. Was hooked into andrew zimmens videos, now im searching for other available channels

-

Unfazed by the European debt crisis and sluggish global economy, Rolls-Royce plans to increase the number of dealers from 105 to 120 worldwide in countries such as Vietnam, Thailand and Chile to target the well-to-do. Rolls-Royce is counting on the growing wealth in Asia and South America to generate demand as the debt crisis dampens sentiment among Europe's rich. The number of households in these regions with more than $5 million in assets is set to grow by 3 to 5 percent per year in the coming years, said Torsten Mueller-Oetvoes, Rolls-Royce's CEO. "Of course, we feel that the mood isn't the best in certain markets, but we're able to compensate with growth in places such as Russia, the Middle East and China," he said. "Our goal is to grow sustainably and not chase volume. Rolls-Royce will remain exceptional," Torsten added. The concentration of wealth is increasing in developing markets. The Asia-Pacific region overtook North America with the most high-net worth individuals in 2011. Earlier this year, Rolls-Royce created a Year of the Dragon special edition of the Phantom for the China market, featuring a hand-painted gold dragon on each side of the wheelbase. They were sold out within two months. China is the perfect example rising affluence in Asia.

-

- other news

- china

- (and 9 more)

-

as we know, direct asia has a lot of approved workshops should one get into an accident. can anyone advise which workshop is good?

-

CNA report : Singapore fast becoming Asia's clubbing hotspot By Alvina Soh | Posted: 10 June 2012 2144 hrs SINGAPORE: Singapore is fast becoming a clubbing hotspot of Asia, and this has led to a rising demand for new nightlife trends. Veterans said the industry has taken on a new lease of life, with a relaxation of guidelines and the onset of technology. Buzzing business hub by day, pulsating nightlife by night. Asia's clubbing hotspot sees partygoers revel the night away at nightclubs islandwide. Clubbing pioneers like CEO of St James Holdings, Dennis Foo, said the nightlife scene has come a long way from its humble roots. "I remember in the 80s, it was a handful at most of bar operators outside the hotels and there were very few people like us. And the real action was in the hotel lobby lounges." Co-Director of Filter and Mink, Phillip Poon, echoes this sentiment. "I remember not that long ago when clubs used to close at 3 o'clock in the morning and everyone was scrabbling for after-hour parties at peoples' houses." The pace picked up in the past decade as regulations were relaxed, to encourage a livelier and more vibrant scene. Phillip Poon said: "Licenses have been extended, the government has spent a lot more, relaxed on certain rules and regulations so it has become a lot more dynamic." Nightclubs are also shifting towards a more entertainment-oriented concept. Besides dancing, patrons also expect clubs to offer more variety, such as interactive contests and over-the-top themed nights. Zouk DJ, Adrian Wee, knows all about living up to the expectations. "People get excited about dancers, pyrotechnics, headliner DJs who are not just DJ-ing, they're entertaining. They get excited when the DJs takes off his shirt or climbs the console or dance really silly stuff." Adrian added that patrons are spoilt for choice, and it's no wonder they are demanding more. "They are like 'oh can I have this music and I want to listen to it now,' so that's what most DJs go through these days because they always get this kind of request and most of the time, I get a bit annoyed by the frequency of the request and how demanding these requests are. If we can accommodate, we'll do it. If we can't, then we have to fake or pretend to faint." Got meh !!!!!! This cannot, that cannot can become Asia HotSpot..... No way we can beat Thailand, Pattaya district night live ...

-

any bros went to the show today ? any pictures to shares ?

-

Asia's worrying European exposure 04:45 AM Jun 01, 2012 by Stephen S Roach Asian authorities were understandably smug in the aftermath of the financial crisis of 2008-09. Growth in the region slowed sharply, as might be expected of export-led economies confronted with the sharpest collapse in global trade since the 1930s. But, with the notable exception of Japan, which suffered its deepest recession of the modern era, Asia came through an extraordinarily tough period in excellent shape. That was then. For the second time in less than four years, Asia is being hit with a major external demand shock. This time it is from Europe, where a raging sovereign-debt crisis threatens to turn a mild recession into something far worse: A possible Greek exit from the euro, which could trigger contagion across the euro zone. This is a big deal for Asia. Financial and trade linkages make Asia highly vulnerable to Europe's malaise. Owing to the former, the risks to Asia from a European banking crisis cannot be taken lightly. Lacking well-developed capital markets as an alternative source of credit, bank-funding channels are especially vital in Asia. MORE EXPOSED THAN BEFORE Indeed, the Asian Development Bank estimates that European banks fund about 9 per cent of total domestic credit in developing Asia - three times the share of financing provided by banks based in the United States. The role of European banks is especially significant in Singapore and Hong Kong - the region's two major financial centres. That means that Asia is far more exposed to an offshore banking crisis today than it was in the aftermath of Lehman Brothers' collapse in 2008, which led to a near-meltdown of the US banking system. The transmission effects through trade linkages are just as worrying. Historically, the US was modern Asia's largest source of external demand. But that appears to have changed over the past decade. Seduced by China's spectacular growth, the region shifted from US- to China-centric export growth. That seemed like a good move. Combined shipments to the US and Europe fell to 24 per cent of developing Asia's total exports in 2010 - down sharply from 34 per cent in 1998-99. PAINTING THE WRONG PICTURE Meanwhile, over the same period, Asia's dependence on intra-regional exports - trade flows within the region - expanded sharply, from 36 per cent of total exports in 1998 to 44 per cent in 2010. These numbers seem to paint a comforting picture of an increasingly autonomous Asia that can better withstand the blows from the West's recurring crises. But research by the International Monetary Fund shows that, beneath the veneer, 60-65 per cent of all trade flows in the region can be classified as "intermediate goods" - components that are made in countries like South Korea and Taiwan, assembled in China, and ultimately shipped out as finished goods to the West. With Europe and the US still accounting for the largest shares of China's end-market exports, there can be no escaping the tight linkages of Asia's China-centric supply chain to the ups and downs of demand in the major developed economies. Moreover, there is an important and worrisome twist to those linkages: China itself has tilted increasingly towards Europe as its major source of external demand. In 2007, the European Union surpassed the US as China's largest export market. By 2010, the EU accounted for 20 per cent of total Chinese exports, while the US share was just 18 per cent. MAKING THE WRONG BET In other words, a China-centric Asian supply chain has made a big bet on the grand European experiment - a bet that now appears to be backfiring. Indeed, in China, a now-familiar pattern is playing out yet again - another slowdown in domestic growth stemming from a crisis in the advanced economies of the West. And, as goes China, so will go the rest of an increasingly integrated Asia. The good news is that, so far, the downside has been much better contained than was the case in late 2008 and early 2009. Back then, China's exports went from boom to bust in just seven months - from a 26-per-cent annual growth in July 2008 to a 27-per-cent decline in February 2009. This time, the annual export gain has slowed from 20 per cent in last year to 5 per cent in last month - a significant deceleration, to be sure, but one that stops well short of the previous outright collapse. That could change in the event of a disorderly euro break-up, but, barring that outcome, there is reason to be more sanguine this time around. ASIAN FIREWALL MISSING The bad news is that Asia seems to be learning little from repeated external demand shocks. In the end, internal demand is the only effective defence against external vulnerability. Yet the region has failed to construct that firewall. On the contrary, private consumption fell to a record-low 45 per cent of developing Asia's GDP in 2010 - down 10 percentage points from 2002. In these circumstances, immunity from external shocks - or "decoupling", as it is often called - seems fanciful. As with most things in Asia nowadays, China holds the key to supplying Asia's missing consumer demand. The recently enacted 12th Five-Year Plan (2011-15) has all the right ingredients to produce the ultimate buffer between the dynamism of the East and the perils of a crisis-battered West. But, as the euro crisis causes China's economy to slow for the second time in three-and-a-half years, there can be little doubt that implementation of the plan's pro-consumption rebalancing is lagging. There are no oases of prosperity in a crisis-prone globalised world. That is equally true for Asia, the world's fastest-growing region. As Europe's crisis deepens, the twin channels of financial and trade linkages have placed Asia's economies in a vice. Rebalancing is the only way out for China and its partners in the Asian supply chain. Until that occurs, the vice now gripping Asia will only continue to tighten. PROJECT SYNDICATE Stephen S Roach URL http://www.todayonline.com/CommentaryandAn...ropean-exposure Copyright 2012 MediaCorp Pte Ltd | All Rights Reserved

-

I'm flying to KL for a short holiday soon, bought Air Asia tickets long ago. Few days ago received email and SMS that my return flight is rescheduled to more than 2 hours earlier, which means that I'll have to wake up very early to catch the flight back to SG, which is certainly a mood spoiler. I want to change to a later flight back to SG. There was a malaysia number to call and a password that is supposed to get me to an agent, tried calling but got error message 'invalid or incorrect password' after keying in the password. I'm sure I keyed in correctly. Tried the 'live chat' function on their website, but there was no one attending to me after a long wait. Have just tried to email them, hope to get a reply soon. Anyone had similar experience before? I flew by Air Asia once or twice before and had no problems with it. Think this might be my last time flying with them, flight can get rescheduled as and when they like? What if it disrupts our travel plans? And seems like no customer service provided. Ok don't remind me it's budget. And for those who are thinking about flying with them, may need to reconsider.

- 31 replies

-

- Asia

- rescheduled

- (and 4 more)

-

S$23,000 stolen from 17 DBS Bank accounts By Julia Ng | Posted: 23 February 2012 2204 hrs Singapore: DBS has been hit by another round of unauthorised ATM withdrawals. This time, 17 customers were affected and they lost S$23,000. In a statement on Thursday night, DBS Bank said that on 19 February, the bank received calls from a handful of customers who were alerted to unauthorised ATM withdrawals in Singapore, after receiving real-time SMS alerts from the bank. But DBS said this incident is "not a result of any new skimming activity but a residual effect of the same card skimming operation that took place at the end of last year". The statement said that DBS has fully compensated all affected customers within 24 hours. DBS is working closely with the authorities on the investigation and confirms that over the past few days, there have been no unauthorised withdrawals made in Singapore. But based on the withdrawals on 19 February, DBS analytics team had identified a further group of customers who were potentially at risk of fraudulent domestic withdrawals. To safeguard them against unauthorised ATM withdrawals, the bank had proactively de-activated the cards of this group of customers, and took immediate steps to replace their cards. These customers were also informed of the card de-activation on the same day and new ATM/Debit cards have since been issued to them. The bank says it appreciates customers' understanding for the inconvenience caused as it moves to take prompt precautionary measures. DBS says it is monitoring the situation closely. In addition to sending out SMS alerts, the bank proactively contacts customers to validate ATM withdrawals, if and when any suspicious activity or unusual usage patterns are detected.

-

In terms of military, who is the most powderful in Asia? Is it Japan? China? India? North Korea? Maybe Australia in a FT kind of way?

-

Hi all, Friends asking to go Europe package from M Asia Travel. I believed it's a small time travel agency who sub out land tour to the local agents. Price wise cheaper than some big names. Just want to hear if anyone personally took up their services/heard anything from them before? Thanks.

-

Hi, Anybody know how I can get tickets and hotel package for the Liverpool tour in KL? Any tour agency having any package? Thanks and regards. Rayd8or