Search the Community

Showing results for tags 'coe'.

-

Good Luck 3 useful links for MCFers Real Time COE Bidding Results Check Your COE Bidding Status Latest COE Prices and Trending Highest Record Cat A => $106,000 [Oct 2023] Cat B => $150,001 [Oct 2023] Cat C => $91,101 [Mar 2023] Cat D => $13,189 [Nov 2022] Cat E => $158,004 [Oct 2023] Lowest Record Cat A => $2 [Nov 2008] Cat B => $200 [Jan 2009] Cat C => $1 [Mar 2007] Cat D => $1 [Mar 2003] Cat E => $3,000 [Feb 2009] Upcoming Bidding Exercise The details of the March 1st open bidding exercise for Certificates of Entitlement (COEs) are as follows: Tender opens: Monday, 4 March 2024, 12 noon Tender closes: Wednesday, 6 March 2024, 4.00 pm Tender results: Wednesday, 6 March 2024 (Available on www.onemotoring.lta.gov.sg) The total quota available for this tender is 2,550 for the following vehicle categories: NON-TRANSFERABLE CATEGORIES Category A : Cars (up to 1,600cc and maximum power up to 97kW (130bhp); and fully electric car with maximum power up to 110kW (147bhp)) => 963 Category B : Cars (above 1,600cc or maximum power above 97kW (130bhp); and fully electric car with maximum power above 110kW (147bhp)) => 708 Category D : Motorcycles => 520 TRANSFERABLE CATEGORIES Category C : Goods Vehicles and Buses => 200 Category E : Open Category => 159

- 258 replies

-

- 15

-

-

What’s your thought on the 2024 COE trend? I read one article about many new cars were registered in Jun 2014 till end of 2015. Something like that. Hence the supply of these COE should flow back and make available from mid 2024 onwards. Hopefully the COE prices can further drop like $30 to $40K by end of 2024🙏

-

Singapore ‘open to’ idea of one-off rise in vehicle population, with higher usage-based charges: Chee SINGAPORE is open to reviewing the idea of a one-off increase in its vehicle population, spread over a few years and accompanied by higher vehicle-usage charges to prevent congestion, said Transport Minister Chee Hong Tat on Tuesday (Mar 5). But the trade-offs “are not straightforward, and need to be studied carefully before a decision is made”, he added during the debate in Parliament on his ministry’s budget. Member of Parliament Saktiandi Supaat had asked if distance-based charging could allow Singapore to increase the total vehicle population while still achieving its car-lite vision. Chee said his ministry was “open to reviewing the idea” of a one-off increase with higher charges. These usage-based charges could include location and time-based fees – as with the existing Electronic Road Pricing (ERP) system – or distance-based charging, where road users pay depending on how far they travel. “However, it is not feasible to (rely only) on usage-based charges to prevent traffic congestion, as these would have to be set at very high rates, which might not be acceptable to many car owners,” he said. Singapore would still need other ownership controls and measures such as parking charges, he added. He also noted that taxi, private-hire car and delivery drivers would face higher usage-based fees as they travel longer distances. “We will need to examine the impact on these groups, though usage-based charging is, in principle, a fair approach,” he said. The Land Transport Authority began the roll-out of the new ERP 2.0 system’s On-Board units last November. These units are equipped with satellite-based technology that can support distance-based charging, though the statutory board said at the time that there were “no immediate plans” to transition away from the current system. https://www.businesstimes.com.sg/companies-markets/transport-logistics/singapore-open-to-idea-of-one-off-rise-in-vehicle-population-with-higher-usage-based-charges-chee hmmm ...

- 129 replies

-

- 3

-

.png)

-

- car

- population

-

(and 1 more)

Tagged with:

-

Hey guys, been a long time since I've been active here, but you know what? I've been brewing a car taxation plan in the back of my mind for months, just never sat down to write it out. We all know the legendary COE and many of us by now have already said it needs a do-over, even the polimakers are starting to say something about giving it a do-over. But always without reconsidering what classifying cars should be. Since I'm never gonna get into the "job" of public service, here's my comprehensive... uh... suggestion? You wanna tl;dr? Fine, I'll leave one at the end. Total COE Restructure Let's start with the headliner, which is always our iconic certificates (we know our car don't last forever, because of COE). Since its inception, the COE has, for consumers, been fundamentally separated into categories A and B, which for now I will focus on. As a reminder; Category A represents passenger vehicles up to 1,600cc or 130hp (97kW), and Category B is just... anything over that, making the assumption that B category vehicles are inherently larger or more luxurious vehicles. Now, the main proclaimed goal of COE is managing the vehicle population, and ostensibly managing road congestion by limiting the volume of cars. With that stated intent in mind, who agrees that a car's power output and displacement has any real bearing on its ability to create congestion? Would ten buses cause more congestion than ten Golf Rs in the same stretch of road? Would ten Cat B Golf Rs cause more congestion than ten Cat A Golf (....what's it called now? 90TSI? Scrap that too) Ten buses would definitely block more road than ten Golfs, EA888 or not, but of course the counterpoint is that ten buses holds many times more people than ten Golfs, or even the equivalent number of Golfs in terms of length. Redefining the Categories... on Size. So my suggestion is, actually, quite simple - let's redefine COE categories based on the physical size of vehicles. This is easily accessible information, I cannot think of any car that you cannot get dimension information for, and if you really can't, there's nothing stopping the homologation department from breaking out a tape measure. I don't think I want to arbitrarily define numbers I think are suitable for separating Category A and B at the moment, but... If we consider trends, I'd say a comfortable position for Category A is 4,700mm long and below, as most "compact" sedans today remain in the ~4,650mm long range, and plenty of small hatchbacks are well low that. (Isn't it ridiculous that a 2020 G20 3-series now is longer than the 1994 Mazda Capella/626?) Anyway, keeping things simple would be using length, because that is usually what really determines how much space a car needs on a road. I consider 4.65m a median of sorts, 4.7~5m the range locals traditionally consider a large family car, and that anything over 5m, nobody is going to call that small. Cars under 4.4m are typically the 'small' ones today, you'd be hard pressed to still find something under 4m. Again, keeping it simple, if we were to retain a binary classification, Category A could be below 4.7m and Category B anything longer than that. Alternatively, we can expand it a little to include overall footprint, by taking length x width of the car, but given that lanes are lanes and people aren't supposed to be driving across two lanes, it occurred to me while writing this that that's really a little unnecessary, plus it makes it a tad harder to account for capacities. Long story short though, is let's just redefine COE categories based on size/length of a car, not its engine power/displacement, which no longer has any real direct bearing on its state of luxury, economy, efficiency, or, most importantly, physical size. COE Incentive for Family Vehicles With Singapore's infamously small land area, there's a consistent push for car sharing, reducing the number of individual vehicles, increasing the person per vehicle, and so on, but there's also a consistent and very unhappy demographic of families that for practical purposes need a vehicle on demand for themselves to manage their children. Yes, you can bring your kids on a bus, but with a stroller and all the like, managing a potentially rambunctious or easily upset child whilst carrying a baby or other nightmare scenarios, you can imagine all of that, and there are plenty of little articles about why families scrounge everything they can to afford a car even with the wide availability of ride hailing and our celebrated public transport. (Simply don't Go aside) By their nature, a sportscar, two seaters especially, have less capacity for transporting and are traditionally the domain of luxury, and rarely sit in the lower price classes. But at the same time, a tiny convertible like a Daihatsu Copen may be really just a recreational vehicle for two, but it takes up virtually no road at all compared to a Toyota Fortuner. With this in mind, I'd propose that any vehicle with less than five seats incur a COE multiplier - it should cost more to own a vehicle of this type, but it should still be in accordance with its size. As such, a 7-seater, which has the capacity to hold more people, and is often a choice made to accommodate a growing family, should be incentivized - it should have a COE reduction. Of course, it's always going to be true that cars spend a lot of time with less than their entire capacity filled, but there's really not a whole lot we can do to mitigate that. But the fact is that placing a Polo GTI in the same taxation category as a Nissan X-Trail, or a bus-lane demanding Aventador, is antithetical to the system's intent. Many of the times a family that really could do with a vehicle are the ones who are suffering the most from sky high COEs, whereas we know by now those who can afford their fifth Porsche don't really care too much about an extra $20k. Short version: COE classification based on size of the car COE Penalty for impractical sports vehicles with less usable seats COE benefit for practical family vehicles with more usable seats But hold on, why again do we need to fuss so much? The COE system has been unfairly cruel to the folks who can arguably need vehicles the most, and at real worst an annoyance to rental/fleet companies and affluent individuals with the means to own multiple cars. There needs to be a real restructuring to allow more cars to be used by these young families who struggle in many ways because they see cars as a necessity even with all their 'alternatives', while taking more from those who are ordering their third Cayman. Size is the thing that implicates congestion potential the most, and instead encouraging a population of many small cars, two Jazzes can hold five people (even if in relative discomfort) each compared to four in a standard S-class, while taking up only marginally more effective space on the road. A Prius makes barely over 130hp and gets shoved into Cat B, but who's gonna say a Prius is appreciably more luxury than a Corolla Altis? Power and displacement has long been detached from a car's class, but physically larger cars often really do be more inefficient and luxurious - compare, say, again, an Audi A1 to an Audi A6. You can have both with the 1.4TFSI engine, but the A4 is noticeably better built on the inside. Even accounting for the tune increase, the Cat B A4 1.4 is much less efficient because it weighs more. Then you have the obviously ridiculous Mercedes Benz MFA180 spec, (A180, B180, CLA180, etc.), which previously came with the M270 "RED" engine, RED standing for reduced - that brought the 1.6L engine from MFA200 specs of around 155hp to the Category A 130hp to allow the premium brand to sell Category A vehicles here. The thing that's widely ignored is that the Cat A "RED" engine is not only less powerful, but less efficient, both in the claimed numbers and in real use. A more recent example is the 2023 Honda Civic Turbo's local exclusive Cat A 129hp tune, a substantial reduction from the engine's normal 180hp variant, without being appreciably more efficient, and even before that KM is one of just 8 territories where the ancient 1.6L engine was recycled one more time for the 2017 Civic tenth gen. Many hybrids produce over 130hp but are more efficient, but automatically get discouraged by Cat B. I'll reiterate this point, but to summarise this section; The current COE structure is outdated, nonsensical even at its inception and does not keep cars affordable for lower income families who need them to better manage their children in their busy lives, an increasingly vocal demographic that we weigh all our hopes on. Managing one kid and one stroller on Bus MRT Walk is tough enough, but our population won't grow when it's so hard to care for your children. Plus, the absurd choice of metrics of power output and displacement to classify vehicles discourages innovation in powerplants that we seriously need for reducing the gasoline footprint, resulting in a larger population of cars with outdated engines. The World's Most Expensive Cars... with the lowest specifications We already know we have the most expensive cars in the world, but have you noticed we have the lowest specced cars in the world too? Why? ARF. The ARF taxation is why you pay for your car's value, at minimum, twice over - a car's ARF, before "incentives", is 100% of a vehicle's OMV, and gets worse from there. As such, higher spec vehicles incurring higher OMV incur higher ARF. This of course makes sense from the standpoint of taxing luxury, but it also means that dealers, with their immense margins, are not willing to bring in vehicles that are well equipped. Consider Citroën under C&C, which has for whatever reason decided that the storied French nameplate should be a lower cost brand. Their latest lineups have been exclusively brought in with pretty barebone specifications, lacking even electric seat options. "Premium" Automobiles has been perhaps the most depressing offender to me personally, with their hypocritical name - their cars routinely lack any manner of technology that befits Audi's slogan, just a few of the most obviously visible ones for "wow" factor - Virtual Cockpit for example was hyped early on. Due to the expensive taxation via ARF, batch homologation and lack of flexibility in bringing in cars of individually customized equipment levels, the dealers are largely discouraged from importing vehicles with full equipment lists - as someone who personally wants a car with all the trimmings, this has been a long running frustration of mine. Audi's presense active safety/assistance suite is available on...... I don't know, which? Only the A8? The Q8 doesn't even have the sunglasses compartment and lined interior visors, for crying out loud. You can get all of those on... a Skoda Octavia. For far less. Why do I care so much about these features? Because many of these are safety technologies that are being exorcised from premium cars, safety technologies I was one of the earliest to adopt. I've a 2015 model year vehicle featuring adaptive cruise, blind spot warnings and lane keeping assist, four years before these features have reached Singapore's mainstream. And you still struggle to get these as standard on an Audi, a BMW, or a Mercedes. Even though they're widely available from mainstream brands now (Peugeot, Toyota SafetySense, Honda Sensing, Subaru Eyesight, Mazda has it too, so on), the premium marques don't offer adaptive cruise or their full safety suites, at best a cut down variant. PML BMWs have begun to have Driving Assistant across all cars, but this is limited to camera based front active city braking, blind spot warning and lane keeping, you are still denied RADAR based active cruise. And the PA imported Audi S3 in 2019 did not come with a reverse camera. I want an upgrade, not a downgrade. There needs to be more emphasis on safety technologies and not "wow" technologies, and dealers need to start offering smaller vehicles with premium equipment lists. What's a solution? Obviously this problem also lies with dealers and consumer mindsets, the desires always to cut corners on our already expensive cars, and I think it's fine that we should have to pay more for options like Virtual Cockpit, or Alcantara trim. But I think we need to stop compromising on safety technology. This is to me, non-negotiable at this point. In other countries across the world, many marques have begun offering these features as standard. Hold on, you might say, why does it matter so much? I don't need this stuff, I drive fine. So in the eight years I've been driving my beloved Mondeo, I've used Adaptive Cruise nearly every journey... But I've had the emergency brake intervention trigger only twice. I was sleepy. You will never be driving in 100% perfect condition every day of your life. We already say we've got some of the worst drivers, the most kiasu, the most impolite, and my Mondeo isn't shy about warning me that I'm less than two seconds of following distance to the car in front (I have sensitivity on high for pedestrian detection), but what's to say we can't reduce the number of accidents with these features? Side anecdote, I'm still baffled by how seven cars can have a chain collision in the middle of the highway, an empty highway during Circuit Breaker, in broad, clear daylight. What kind of absurd scenario causes that? Yes, it'll make the cars more expensive, as these aren't without a cost, but can you imagine how much less we'd lose in time and money if we had virtually zero accidents across our roads? Less congestion, less time wasted, less fuel burnt in traffic jams, no need to waste TP resources dispatching to manage the scene, less money spent on EMAS recovery. Less money lost on people idling in a jam. So I propose that there be a discount incentive for safety technology equipment on cars. Say, a $500 incentive for forward collision detection. $500 off for Blind Spot warning. $250 off for adaptive headlights. $250 off for seatbelt airbags (my Mondeo didn't come with them, sadly) Something like that. I also think, really, we should consider making it possible to fine someone extra if they were involved in an accident while driving with that feature disabled (if equipped, obviously), or at least if I were an insurance officer I would probably increase the person's excess for that incident. The legislation has long been discouraging advanced technologies and our cars have been routinely some of the worst equipped in the world, while the COE system somehow results in some of the most inefficient powerplants reaching us. You might have noticed I didn't specify a discount on ARF, which has long been the typical means of providing incentives, notably through the EV early adopters incentive and the CEVS rebate. That's because anyone who knows ARF knows that ARF is what determines your PARF rebate, more commonly known as scrap value. The PARF rebate depreciates linearly from 100% ARF to 50% over the ten years of the car's original COE, which means that every $1,000 discount on ARF is really a $500 loss to your PARF rebate. Which is why cars, particularly EVs, that have high CEVS rebates, have spectacularly poor depreciation rates. (See, for example, SGCM's BMW iX3 vs X3 faceoff) Incentives need to be serious, and to be really serious about being an incentive they need to not take from the consumer's back pocket. I also suggest we start incentivizing real hybrids, and plug-in hybrids. In a meaningful way. Tons of dealers have started offering mild hybrids, which just include a small booster battery that helps start from a standstill. These do not confer any real efficiency benefit overall. Plug-in Hybrids are expensive now, but deserve to have more penetration. I asked many a dealer, why are you not offering PHEVs? The answer? Nobody wants them. My response; nobody I've asked knows they exist. Dear dealers, you make the markets, not the consumers, in Singapore. Do us better. I suddenly got really sleepy at this point, so I'll maybe elaborate in another post. All the essential info's above. But what else do I think I want to throw in? The diesel duty raise. That was dumb - commercial vehicles are the most frequent user of diesel, and increasing their cost to run has undoubtedly lead to delivery and freight costs rising and reaching the consumer. Rental companies propping up COEs with their indifference to high COE prices? Supposedly doesn't happen, but I doubt that. Almost definitely has to be happening, and then those cheap grade low spec cars get dumped on the preowned market exacerbating the problems I described. Not to mention that expensive COEs lead to more use of rental vehicles, which the rental companies can price up to recover their costs...? Makes for a self-sustaining cycle. Anyway, as promised, tl;dr; COE current system of displacement/power is dumb (and was dumb in 1990), change classification system to be based on length. Discount COE for more than 5 seats, penalty for less than 5 seats Revise ARF/add incentives for safety technology to encourage safer cars Revise incentives to encourage more efficient gasoline cars, not just EVs, because EVs are still not ready

- 42 replies

-

- 3

-

-

- coe

- car markets

-

(and 1 more)

Tagged with:

-

POV: me patiently waiting for Dec's COE thread 😆 i got vested interest lol

-

It's about time innit? https://www.businesstimes.com.sg/singapore/government-consider-separate-coe-category-private-hire-cars-chee-hong-tat

-

Source: https://www.straitstimes.com/singapore/transport/records-set-in-three-coe-categories-open-category-coe-soars-to-158004 SINGAPORE – Certificate of entitlement (COE) premiums reached new highs for the two car categories and the Open category at the latest tender exercise on Wednesday. The COE premium for larger cars with engines above 1,600cc or 130bhp and electric vehicles (EVs) above 110kW ended at $150,001, a 2.74 per cent increase over the $146,002 posted in the previous tender. The premium for the Open category – which can be used for any vehicle type except motorcycles, but ends up being used mostly for bigger cars – ended at $158,004, up 3.95 per cent over the $152,000 record set two weeks ago. This is the sixth consecutive time that records were broken for both the large car and Open COE categories. The COE premium for smaller cars and EVs climbed 1.92 per cent to $106,000, from $104,000 set two weeks ago. The previous record of $105,000 was set just two tender exercises ago, in September. Some motor traders said the demand for smaller car COEs was partly fuelled by The Car Expo event held last weekend. Organised by SPH Media, which publishes The Straits Times, the event had a stronger focus on smaller and less powerful car models than other types of new cars. By the end of the tender exercise on Wednesday, there were 1,028 bids for such COEs. This is only the second time since October 2021 that the number of bids for a COE category broke into four digits.

-

Just in time before I fly. Good luck and bye... 3 useful links for MCFers Real Time COE Bidding Results Check Your COE Bidding Status Latest COE Prices and Trending Highest Record Cat A => $106,000 [Oct 2023] Cat B => $150,001 [Oct 2023] Cat C => $91,101 [Mar 2023] Cat D => $13,189 [Nov 2022] Cat E => $158,004 [Oct 2023] Lowest Record Cat A => $2 [Nov 2008] Cat B => $200 [Jan 2009] Cat C => $1 [Mar 2007] Cat D => $1 [Mar 2003] Cat E => $3,000 [Feb 2009] Upcoming Bidding Exercise The details of the November 1st open bidding exercise for Certificates of Entitlement (COEs) are as follows: Tender opens: Monday, 6 November 2023, 12 noon Tender closes: Wednesday, 8 November 2023, 4.00 pm Tender results: Wednesday, 8 November 2023 (Available on www.onemotoring.lta.gov.sg) The total quota available for this tender is 2,411 for the following vehicle categories: NON-TRANSFERABLE CATEGORIES Category A : Cars (up to 1,600cc and maximum power up to 97kW (130bhp); and fully electric car with maximum power up to 110kW (147bhp)) => 924 Category B : Cars (above 1,600cc or maximum power above 97kW (130bhp); and fully electric car with maximum power above 110kW (147bhp)) => 636 Category D : Motorcycles => 520 TRANSFERABLE CATEGORIES Category C : Goods Vehicles and Buses => 190 Category E : Open Category => 141

-

Comparing the highest and lowest record, really no eye see... Wanted to add in the usual "Good Luck to All Vested", but am wondering if any MCFer is still buying new car at the current climate (except @RadX who spend real $$$ like hell notes ) 3 useful links for MCFers Real Time COE Bidding Results Check Your COE Bidding Status Latest COE Prices and Trending Highest Record Cat A => $105,000 [Sep 2023] Cat B => $140,889 [Sep 2023] Cat C => $91,101 [Mar 2023] Cat D => $13,189 [Nov 2022] Cat E => $144,640 [Sep 2023] Lowest Record Cat A => $2 [Nov 2008] Cat B => $200 [Jan 2009] Cat C => $1 [Mar 2007] Cat D => $1 [Mar 2003] Cat E => $3,000 [Feb 2009] Upcoming Bidding Exercise The details of the October 1st open bidding exercise for Certificates of Entitlement (COEs) are as follows: Tender opens: Monday, 2 October 2023, 12 noon Tender closes: Wednesday, 4 October 2023, 4.00 pm Tender results: Wednesday, 4 October 2023 (Available on www.onemotoring.lta.gov.sg) The total quota available for this tender is 2,010 for the following vehicle categories: NON-TRANSFERABLE CATEGORIES Category A : Cars (up to 1,600cc and maximum power up to 97kW (130bhp); and fully electric car with maximum power up to 110kW (147bhp)) => 785 Category B : Cars (above 1,600cc or maximum power above 97kW (130bhp); and fully electric car with maximum power above 110kW (147bhp)) => 474 Category D : Motorcycles => 497 TRANSFERABLE CATEGORIES Category C : Goods Vehicles and Buses => 114 Category E : Open Category => 140

-

3 useful links for MCFers Real Time COE Bidding Results Check Your COE Bidding Status Latest COE Prices and Trending Highest Record Cat A => $103,721 [Apr 2023] Cat B => $129,890 [Aug 2023] Cat C => $91,101 [Mar 2023] Cat D => $13,189 [Nov 2022] Cat E => $131,000 [Aug 2023] Upcoming Bidding Exercise The details of the September 1st open bidding exercise for Certificates of Entitlement (COEs) are as follows: Tender opens: Monday, 4 September 2023, 12 noon Tender closes: Wednesday, 6 September 2023, 4.00 pm Tender results: Wednesday, 6 September 2023 (Available on www.onemotoring.lta.gov.sg) The total quota available for this tender is 1,933 for the following vehicle categories: NON-TRANSFERABLE CATEGORIES Category A : Cars (up to 1,600cc and maximum power up to 97kW (130bhp); and fully electric car with maximum power up to 110kW (147bhp)) => 645 Category B : Cars (above 1,600cc or maximum power above 97kW (130bhp); and fully electric car with maximum power above 110kW (147bhp)) => 470 Category D : Motorcycles => 573 TRANSFERABLE CATEGORIES Category C : Goods Vehicles and Buses => 115 Category E : Open Category => 130

- 316 replies

-

- 10

-

-

https://omny.fm/shows/coe-watch/why-6-digit-coe-prices-are-new-normal-ex-industr Description Hear how the final hour of bidding for COEs can typically go, from a ex-motor trade insider. Synopsis: The Straits Times offers expert insights to Singapore's mobility trends and the vehicle quota system, which includes the Certificate of Entitlement (COE). There are two tender exercises for these COEs every month. It typically opens for three days, from noon on a Monday and to 4pm on Wednesday. But the bidding action only comes alive in the final hour or so, as more bids start to appear and the premiums climb. To help us understand what goes on behind the scenes in that last 60 minutes, ST’s senior transport correspondent Lee Nian Tjoe speaks with Mr Say Kwee Neng, who has been in the motor trade for more than 20 years.

-

3 useful links for MCFers Real Time COE Bidding Results Check Your COE Bidding Status Latest COE Prices and Trending Highest Record Cat A => $103,721 [Apr 2023] Cat B => $121,000 [Jun 2023] Cat C => $91,101 [Mar 2023] Cat D => $13,189 [Nov 2022] Cat E => $125,000 [May 2023] Upcoming Bidding Exercise The details of the August 1st open bidding exercise for Certificates of Entitlement (COEs) are as follows: Tender opens: Monday, 7 August 2023, 12 noon Tender closes: Thursday, 10 August 2023, 4.00 pm Tender results: Thursday, 10 August 2023 (Available on www.onemotoring.lta.gov.sg) The total quota available for this tender is 1,886 for the following vehicle categories: NON-TRANSFERABLE CATEGORIES Category A : Cars (up to 1,600cc and maximum power up to 97kW (130bhp); and fully electric car with maximum power up to 110kW (147bhp)) => 632 Category B : Cars (above 1,600cc or maximum power above 97kW (130bhp); and fully electric car with maximum power above 110kW (147bhp)) => 470 Category D : Motorcycles => 522 TRANSFERABLE CATEGORIES Category C : Goods Vehicles and Buses => 122 Category E : Open Category => 140

-

3 useful links for MCFers Real Time COE Bidding Results Check Your COE Bidding Status Latest COE Prices and Trending Highest Record Cat A => $103,721 [Apr 2023] Cat B => $121,000 [Jun 2023] Cat C => $91,101 [Mar 2023] Cat D => $13,189 [Nov 2022] Cat E => $125,000 [May 2023] Upcoming Bidding Exercise The details of the July 1st open bidding exercise for Certificates of Entitlement (COEs) are as follows: Tender opens: Monday, 3 July 2023, 12 noon Tender closes: Wednesday, 5 July 2023, 4.00 pm Tender results: Wednesday, 5 July 2023 (Available on www.onemotoring.lta.gov.sg) The total quota available for this tender is 1,845 for the following vehicle categories: NON-TRANSFERABLE CATEGORIES Category A : Cars (up to 1,600cc and maximum power up to 97kW (130bhp); and fully electric car with maximum power up to 110kW (147bhp)) => 588 Category B : Cars (above 1,600cc or maximum power above 97kW (130bhp); and fully electric car with maximum power above 110kW (147bhp)) => 471 Category D : Motorcycles => 579 TRANSFERABLE CATEGORIES Category C : Goods Vehicles and Buses => 77 Category E : Open Category => 130

- 70 replies

-

- 21

-

-

.png)

-

@Carbon82where is the May COE Thread.?

-

Community Service brought to you by MCF Good Luck to all vested! 3 useful links for our dear MCFers: Real Time COE Bidding Results Check Your COE Bidding Status Latest COE Prices and Trending Past Bidding Results (2001 - 2021) Past Bidding Results (2022) 24 Months Trend Chart (Jul 2020 - Jun 2022) *chart taken from www.sgcarmart.com PQP (2010 - 2021) PQP (2022) The details of the July 2022 1st open bidding exercise for Certificates of Entitlement (COEs) are as follows: Tender opens: Monday, 4 July 2022, 12 noon Tender closes: Wednesday, 6 July 2022, 4.00 pm Tender results: Wednesday, 6 July 2022 (Available on the www.onemotoring.lta.gov.sg website) The total quota available for this tender is 2,023 for the following vehicle categories: NON-TRANSFERABLE CATEGORIES Category A : Cars (up to 1,600cc and maximum power up to 97kW (130bhp); and fully electric car with maximum power up to 110kW (147bhp)) => 617 Category B : Cars (above 1,600cc or maximum power above 97kW (130bhp); and fully electric car with maximum power above 110kW (147bhp)) => 527 Category D : Motorcycles => 582 TRANSFERABLE CATEGORIES Category C : Goods Vehicles and Buses => 102 Category E : Open Category => 195

- 557 replies

-

- 10

-

-

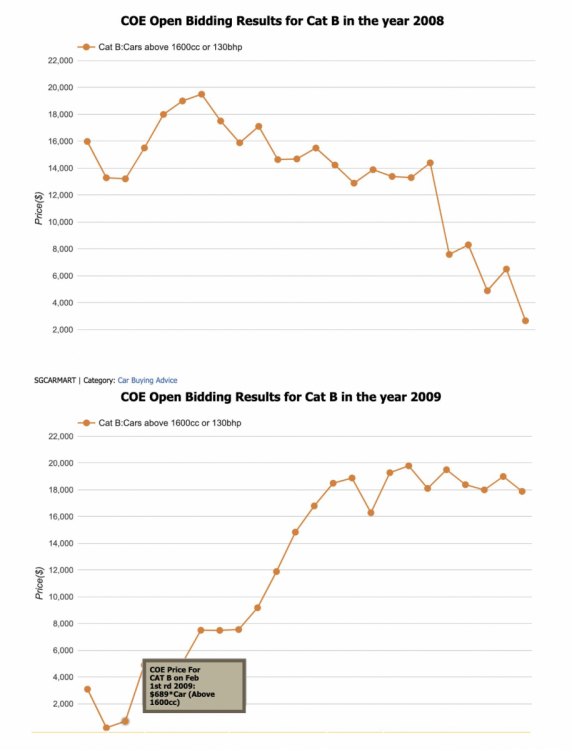

https://carsnkopi.wordpress.com/2023/05/08/a-rocky-road-ahead-the-tough-realities-for-todays-young-car-enthusiasts-in-singapore/ It wasn’t easy being an automotive fan when I was a young, overweight boy growing up in neighbourhood schools as my strange obsession with machines so out of reach naturally led to constant ridicule from my peers. Yet, I think I was lucky. Lucky because I spent my primary and secondary schooling days in the glorious 80s and 90s. Which meant that after wasting no time joining the workforce after the army (and through sheer effort, perseverance, plenty of luck and a small loan from my amazing girlfriend), I was smack right in the middle of 2008 and 2009 when the sums added up to allow me to buy my very own set of wheels. Now, if you’ve been paying attention. The years 2008 and 2009 are rather significant. Because for us car-owning, car-loving geeks in Singapore, those were the glory days when COEs dropped to levels so low, rumours were going on about how the Government might even consider scrapping the entire system altogether. Alas, as we now know, that never came to pass. Quite the opposite in fact. Today, our Transport Minister S. Iswaran told Parliament that as a one-off exercise, the Land Transport Authority (LTA) “will bring forward and redistribute the supply from five-year COEs due to expire in the next projected supply peak”. Essentially increasing the supply of certificates of entitlement (COEs) by 24 per cent for smaller, less powerful cars (Category A) and 15 per cent for bigger, more powerful cars (Category B) for the current three-month quota period until July. While it might seem like a sign of relief to the general public, those of us with a tad more vested interest in the matter will understand that such a measure will only serve to sully any chances of a steep increase in COEs quotas in the near future and as such, all hopes of a significant drop in COE prices. It seems to us that the powers that be are happy with COE levels hovering where they are now and have no interest in curtailing what had led to such a dramatic rise. If you are a young enthusiast in Singapore dreaming of one day owning a fun new performance car, I feel for you. Add to that, massive increases in taxes for what many consider their dream cars now mean that even when used, those dreams will no longer be attainable for the vast majority. It doesn’t stop there, with OMVs for many of these beauties now capped at 60k, it would logically make little sense to deregister them, meaning that the majority of these cars will have their COEs renewed once they hit the 10 year mark, which means even less COEs will return to the pool the next decade, which, you guessed it, will only mean even higher premiums for COEs. If you are a young enthusiast in Singapore dreaming of one day owning a fun used performance car, I feel for you. What about cars that have been registered way before these recent rules were implemented? Well, a quick glance through our local automotive classifieds will be more than enough to show you what happens to the resale market when the price of a base-spec Toyota Altis is now asking for over S$160,000. It’s not all local forces at play here of course, with the advent of social media, the hype surrounding certain makes and models of old performance machines have led to a series of “taxes” laid on. “JDM tax”, “Tofu tax”, “Initial D tax”, “Mighty car mods tax”, they all basically mean the same thing, astronomical prices increases on cars that just a couple of years ago no one would even bother to even look at. It’s not all the internets fault of course, the pivot towards SUVs have also contributed to this calamity as the world suffered from years upon years when automotive manufacturers thumbed their collective noses at enthusiasts who were literally begging for the affordable, attainable fun legends we grew up loving. But nein, it was all for nought. To rub salt into our wounds, Mitsubishi even brought out their new Eclipse as an SUV. Today, Mitsubishi is a shadow of its once glorious self and they really only have themselves to blame. And so, with manufacturers no longer building brand new fun sports cars for a period of time, the market for used fun sports cars naturally (with the help of social media) blew the F up and along with that, dragging up the prices for pretty much everything else with a remote chance of being a “classic”. And in a country where such cars are especially rare, you don’t need to be a genius to know what has happened. Things are starting to change of course, we Toyota leading the charge with their GR Yaris, GR Corolla and Supra, but then, you’d have to contend with their equally charged up brand new prices. If you are a young enthusiast in Singapore dreaming of one day owning a fun classic performance car, I feel for you. So, where do we go from here? It’s a tough one to answer. As covered in the media recently and I’m sure plenty of us have talked about it, we all know who are the ones driving up the prices of COE fast and furiously, and I’m sure we all know (even if some might not want to admit it) why nothing is being done or even mentioned about curtailing these car-sharing companies and other PHV registered vehicles. As mentioned once again by our transport minister, “we must expect the long-term trajectory for COE prices to be upwards“. In short, don’t expect COEs to ever come down, and don’t expect the current Goverment to ever be kind to your car-loving dreams. With so many obstacles now neatly in place, It is going to be a painful, rocky road ahead for all car-lovers. And so, if you are a young enthusiast in Singapore, I feel for you and hope that you will also get lucky one day. I’m afraid with the way things are, mine might be running out come December 2026.

- 111 replies

-

- 16

-

-

-

Community Service by MCF Good Luck to all vested! 3 useful links for MCFers Real Time COE Bidding Results Check Your COE Bidding Status Latest COE Prices and Trending Highest Record Cat A => $93,503 [Mar 2023] Cat B => $116,201 [Mar 2023] Cat C => $91,101 [Mar 2023] Cat D => $13,189 [Nov 2022] Cat E => $118,001 [Feb 2023] The details of the April 1st open bidding exercise for Certificates of Entitlement (COEs) are as follows: Tender opens: Monday, 3 April 2023, 12 noon Tender closes: Wednesday, 5 April 2023, 4.00 pm Tender results: Wednesday, 5 April 2023 (Available on the www.onemotoring.lta.gov.sg) The total quota available for this tender is 1,592 for the following vehicle categories: NON-TRANSFERABLE CATEGORIES Category A : Cars (up to 1,600cc and maximum power up to 97kW (130bhp); and fully electric car with maximum power up to 110kW (147bhp)) => 515 Category B : Cars (above 1,600cc or maximum power above 97kW (130bhp); and fully electric car with maximum power above 110kW (147bhp)) => 430 Category D : Motorcycles => 466 TRANSFERABLE CATEGORIES Category C : Goods Vehicles and Buses => 47 Category E : Open Category => 134

- 717 replies

-

- 10

-

-

Source: https://www.straitstimes.com/singapore/transport/lta-tweaks-calculation-of-commercial-vehicle-coe-quota-to-even-out-supply SINGAPORE - Buyers of commercial vehicles can expect less fluctuation in the supply of certificates of entitlement (COEs) for such vehicles, after the Land Transport Authority (LTA) revised the way it calculates the quota available for bidding. The LTA now takes the average number of commercial vehicle registrations under the Early Turnover Scheme (ETS) from the previous four quarters, or 12 months, to calculate the COE supply for each three-month quota period, starting with the current quota for May to July 2023. Previously, it used the number of ETS registrations from the previous three months. The LTA told The Straits Times that the change “provides more stability to our COE supply and reduces the likelihood of ETS numbers exceeding deregistrations in a single quarter”. There would have been zero commercial vehicle COEs available for tender from May to July 2023 if the LTA had not modified its method for calculating COE supply for this category. This is because the number of ETS registrations from January to March 2023 – used to calculate the COE supply for May to July – exceeded the number of scrapped commercial vehicles captured in the formula after taking away the contribution to Open category COE. The number of ETS registrations was unusually high in March 2023, with 1,482 such registrations out of 2,512 recorded in the first three months of this year. With the change, ETS registration figures will be recorded in the same way as vehicle deregistrations in the COE supply calculation. The LTA began using the average number of vehicles deregistered in the past four quarters to calculate COE supply starting with the quota for February to April 2023. The number of commercial vehicle COEs available for tender is driven primarily by two components: the number of vehicles that were scrapped, which forms the basis of the upcoming COE supply, and ETS registrations, which is deducted from the deregistration figure. Under the current policy, the supply of commercial vehicle COEs is allowed to grow by 0.25 per cent a year. This is set to remain until January 2025. Under the ETS, the owner of an older commercial vehicle can switch to a new one with cleaner emissions by paying a discounted rate of the COE price instead of having to bid for a new one. The exact amount payable depends on the existing vehicle model and the replacement model that will be registered under the scheme. The current iteration of ETS kicked in on April 1, 2023, and expires on March 31, 2025. In 2021 and 2022, ETS registrations outnumbered commercial vehicle registrations using new COEs. The trend continued in the first three months of 2023, where 2,512 ETS registrations represented 86.03 per cent of the 2,920 commercial vehicle registrations for the period. The dominance of the ETS route to register new commercial vehicles in the first quarter of 2023 may have been driven by the general shortage of commercial COEs available for tender when dealers were rushing to register vehicles before April 1, 2023. The date was when incentives under the Commercial Vehicle Emissions Scheme were halved for some vehicles from $30,000 to $15,000. The ETS benefit was also reduced. In the case of light commercial vehicles, retiring an old van with Euro III emission levels for a new, lower emission model such as a Suzuki Every after the switchover would see the ETS incentive reduced from 45 per cent to 20 per cent. A stricter emission test protocol also came into force. Mr Neo Tiam Ting, director of Think One, which deals in commercial vehicles, said there was a big rush in March for ETS-eligible vehicles that can be used to register new vans before April 1. This has since subsided. In the current three-month period till July, there is a monthly average of 137 commercial vehicle COEs available for tender. This was an increase of 59.3 per cent over the monthly average of 86 such COEs in the previous three months. The price of commercial vehicle COEs has risen significantly, hitting a record high of $91,101 in March 2023. It was $48,889 in March 2022. With the current elevated COE prices, the resale value of a used vehicle in the open market can be higher than the revised ETS incentive. This makes it difficult for motor traders to source ETS-eligible vehicles for buyers keen to grow their fleet. Between 2013 and 2022, ETS has accounted for 63,449 commercial vehicle registrations, compared with the 61,866 units that were put on the road with new COEs in the same period. In November 2022, the LTA and National Environment Agency announced that ETS for light commercial vehicles will end on March 31, 2025. The agencies said they would be looking at other means to encourage owners to switch out of older commercial vehicles and buses.

- 22 replies

-

- 4

-

-

.png)

-

- lta

- commercial vehicle

-

(and 1 more)

Tagged with:

-

Hi all, i have a similar question as OP as well. Can't create a new topic as i'm new to this forum, apologies. Thinking of buying my first car, budget around 30-40k and looking for manual cars preferably. With these 2 criteria in mind, i have shortlisted 2 cars - 2009 Honda Civic 1.8M and Subaru Impreza/STI (more out of budget). 1. For my first car, should i go for one with renewable COE (so that i can still sell next time) or just try try for 2-3 years and then scrape? 2. Any other manual cars available you guys would recommend? Quite hard to find manual cars nowadays... Any help would be much appreciated, cheers!

- 71 replies

-

- 2

-

.png)

-

COE Bidding – May 2023 and new COE measures

kobayashiGT replied to ER-3682's topic in General Car Discussion

Source: https://www.straitstimes.com/singapore/latest-coe-measures-meant-to-improve-overall-functioning-of-market-iswaran SINGAPORE - Measures will be taken when needed to reduce frictions and deter speculation in the certificate of entitlement (COE) market so that supply better matches demand, said Transport Minister S. Iswaran. But he ruled out changes such as subdividing COE categories, and said the fall in motorcycle COE premiums in the most recent bidding exercise shows that the market is functioning as it should be. Ultimately, COE prices are a function of demand and supply, he added, and the Ministry of Transport will continue to monitor the situation and make adjustments when needed. Mr Iswaran was speaking to the media on the sidelines of the launch of a minimart and integrated community service centre for low-income families on Sunday. His remarks on COE come amid rising premiums, which has seen some categories hit record highs in recent tender exercises. COE premiums for smaller cars breached the $100,000 mark for the first time in April, while motorcycle premiums also went above $13,000 in the past year. But rules were put in place to curb speculation for motorcycle COEs, and in the last tender exercise held last Thursday, premiums for such COEs fell sharply by more than half to $5,002. Referring to how motorcycle COE premiums have corrected, Mr Iswaran said this shows that the market is working as intended. The Land Transport Authority had raised the bid deposit for motorcycle COEs from $800 to $1,500, and also cut the validity period for temporary motorcycle COEs from three months to one month. Some 450 motorcycle COEs that were secured in the bidding in end-2022, but not used within the validity period and forfeited, were also added to the COE quota for May to July. Mr Iswaran said: “What it tells us is the market is working in the sense that when the price is correct, there’s a response to that from the dealers. “But it also tells us that we can do more to improve the functioning of the market and to deter any speculative activities, and that’s why we made a few further moves.” But he warned that it was premature to predict any trend in COE premiums and said prices may still fluctuate. He noted that COE premiums are also dependent on demand, and underlying demand for motorcycles remains strong as they are used for economic activities such as delivery work. “We should also be cautious about expectations going forward because there are many factors at play and we should allow these to work themselves through the system. Our system design is really to make sure that supply and demand adjust to each other. And what we have done in this latest set of measures is really to improve the overall functioning of the market,” he added. Asked by the media about whether the Government would consider subdividing COE categories to separate higher-end motorcycles from the rest, Mr Iswaran said a smaller supply for each category would mean more volatile prices, as a small increase in demand would drive prices up significantly. As to whether the measures to bring down motorcycle COE premiums may also work on car COEs, he said there are differences in how dealers bid for car COEs. For car COEs, there is already a buyer when dealers put in a bid, whereas dealers typically bid for motorcycle COEs first, then sell to buyers later on. “I think there are some fundamental differences in the way the different categories function,” he said. “Having said that, we are studying this and... we’ve always been ready to make refinements and adjustments in response to material developments in the market.” Mr Iswaran on Sunday also launched Jampacked@West Coast, a minimart that will be open to 161 vulnerable families in the area to purchase food items with credits of $50 per month. Previously, they had to travel to MacPherson every two months to collect food rations from a food bank, and had no choice in selecting the items they want. The minimart is open from 10am to 8pm on weekdays and 9.30am to 1pm on Saturdays. He said the joint project between Jamiyah Singapore and the West Coast grassroots organisations complements government measures in easing the financial burden on families. The centre will also conduct counselling and medical and legal aid referral services, as well as provide academic support, character building, and social and emotional learning. It also offers a comfortable space for youth to study. One of the beneficiaries, Ms May Ong, said she prefers having her choice of food items to being given a basket of items. While the 51-year-old usually goes for essentials such as noodles, milk and biscuits, the minimart allows her to pick up frozen nuggets and fries which her kids like. Ms Ong, who works part-time in the food and beverage sector, has been raising her kids alone since her husband died in an accident in 2022. Her two children are in Primary 6 and Secondary 3. “It’s good that there are more options to help them with their studies,” she said. -

Till recent, the term "Car-Lite City" have been used more than once by our ministers and PM. Come share your views and opinions what will be government action/plans to achieve this "Car-Lite City" vision. 1. Reduce COE Quota (OCS) 2. Increase Tax (Road Tax, PARF, ARF) 3. Increase ERP Charges 4. ???

-

We love cars! Or at least, I do. I assume you do too, since you’re on this platform. But as an aspiring car owner, I also grapple with the realities of living in Singapore. We have again been acclaimed as the “World’s Most Expensive City” together with New York City, our inflation is the highest it’s been in 15 years, and our homes start at hundred of thousands of dollars. In the face of such problems, a car seems like the least important of my worries. But let’s say in about 10 years time (can you tell I’m a young person yet?) I have enough money to get a car. Nothing special, a Toyota Corolla from Sgcarmart perhaps? How would I get there? And what are the costs that I’ll face afterwards? Join me and let’s see if buying a car is still worth it in Singapore. The many hidden costs of owning a car in SG To understand what it takes to buy a car I think a good place to start is to see the costs involved. As I’m sure you all know, we need to deal with COE (Certificate of Entitlement). It’s a metaphorical piece of paper that you buy in order to give you the right to own and use a car in the streets of Singapore. The COE lasts for 10 years. After 10 years, you have the option to refresh the COE and continue to use your car, or let it expire and be forced to de-register your car. Let’s say I’m a first time buyer, and that I’m getting a brand new Toyota Corolla Altis. The standard variant. This is what you’ll see in the official Toyota website. Now don’t worry, this is already taking into account COE for this year, as of April 2023. This specific model makes 96 brake horsepower with a 1,598cc engine. Therefore, this model would qualify for a Cat A COE. This category is for cars that have an engine less than or equal to 1600cc & make 130bhp or less. However, let’s take a look at how much this COE costs as of March 2023. You have spent almost 2 thirds of the entire car’s cost on the right to have gotten the car in the first place. Now let’s fast forward 10 years. The maths is going to get real complicated real quick. 10 years later.... I’ve had a wonderful time with my Corolla. It has served me well. It has seen me through so many things. My marriage. My first kids, my divorce, my wallowing loneliness. Ok, that got dark but you see what I mean. Some time has passed. I now need to make a decision to renew my COE or let it expire. To renew it, I will need to pay the PQP (Prevailing Quota Premium) of the COE. PQP is the moving average of the COE prices in the past 3 months. To calculate PQP, simply take the existing COE prices of the most recent three months and find its average. We can take the PQP from the above image and see that it is $85,845. I’ll let you decide whether it’s worth renewing the COE. In another scenario, let’s say I let it expire. And there’s actually a proper reason to do this called rebate. For any fellow Gen Z, this is our “cashback”. Upon de-registering a vehicle, we get a certain value by adding up our COE rebate and PARF (Preferential Additional Registration Fee ) rebate. Our COE rebate is based on the Quota Premium paid and the remaining COE left. Here’s a formula: Your COE rebate = [(Quota Premium Paid x Number of months left)/120 months]. Here’s an example: It is 2021. Adam has 12 months of COE left on his car. Assuming that his Quota Premium (QP) paid back in 2012 was $40,000, the COE rebate he will receive is ($40,000 x 12) / 120 = $4,000 PARF rebate is based on the Additional Registration Fee (ARF) value. Your PARF rebate = [ARF x % based on the age of your car] ARF is a tax imposed upon the registration of your vehicle, which depends on your car's Open Market Value (OMV). A car's OMV is the original cost of production of the vehicle before surcharges, taxes and the dealer's profit. Here’s a table to help you visualise the PARF rebate. According to Budget Direct Insurance, the Toyota’s OMV is $19,436. So the ARF for this car, as it is less than $20,000, will be 100% of its value at $19,436. However, as in this scenario I have spent over 10 years with my car, there will be no PARF rebate. I will also have no COE rebate because I have no months left on that either. I will get a tidy sum of... So if I'd like to continue using my vehicle after likely having paid for it in full, I'd need to once again pay for a permit worth several times over the actual cost of my car, even after taxes. Some people have clearly gotten sick of this, like this biker, who started a discussion on Facebook after showing why he doesn't use his motorycle anymore, calling it a ransom. It's clear that many people felt the same as him, calling the COE system a con or daylight robbery, that once their COE expires, they will likely stop using their vehicle. And yet, COE is at a record high this year. So I'd like to ask you all, what does owning a car mean to you? For more information about renewing COE, do head over to this guide on COE renewal. ========= Be the first to get the latest road/ COE news and get first dibs on exclusive promos and giveaways in our Telegram SGCM Community. Join us today!

-

Community Service brought to you by MCF Good Luck to all vested! 3 useful links for MCFers Real Time COE Bidding Results Check Your COE Bidding Status Latest COE Prices and Trending Highest Record Cat A => $92,100 [Jan 2013] Cat B => $115,388 [Nov 2022] Cat C => $87,790 [Feb 2023] Cat D => $13,189 [Nov 2022] Cat E => $118,001 [Feb 2023] Past Bidding Results (2001 - 2021) Past Bidding Results (2022 - 2023) 24 Months Trend Chart (Mar 2021 - Feb 2023) *chart taken from www.sgcarmart.com PQP (2010 - 2021) PQP (2022 - 2023) The details of the March 1st open bidding exercise for Certificates of Entitlement (COEs) are as follows: Tender opens: Monday, 6 March 2023, 12 noon Tender closes: Wednesday, 8 March 2023, 4.00 pm Tender results: Wednesday, 8 March 2023 (Available on the www.onemotoring.lta.gov.sg) The total quota available for this tender is 1,590 for the following vehicle categories: NON-TRANSFERABLE CATEGORIES Category A : Cars (up to 1,600cc and maximum power up to 97kW (130bhp); and fully electric car with maximum power up to 110kW (147bhp)) => 517 Category B : Cars (above 1,600cc or maximum power above 97kW (130bhp); and fully electric car with maximum power above 110kW (147bhp)) => 431 Category D : Motorcycles => 467 TRANSFERABLE CATEGORIES Category C : Goods Vehicles and Buses => 43 Category E : Open Category => 131

-

Community Service brought to you by MCF Good Luck to all vested! 3 useful links for MCFers Real Time COE Bidding Results Check Your COE Bidding Status Latest COE Prices and Trending Highest Record Cat A => $92,100 [Jan 2013] Cat B => $115,388 [Nov 2022] Cat C => $81,802 [Nov 2022] Cat D => $13,189 [Nov 2022] Cat E => $116,577 [Nov 2022] Past Bidding Results (2001 - 2021) Past Bidding Results (2022 - 2023) 24 Months Trend Chart (Feb 2021 - Jan 2023) *chart taken from www.sgcarmart.com PQP (2010 - 2021) PQP (2022 - 2023) The details of the February 1st open bidding exercise for Certificates of Entitlement (COEs) are as follows: Tender opens: Monday, 6 February 2023, 12 noon Tender closes: Wednesday, 8 February 2023, 4.00 pm Tender results: Wednesday, 8 February 2023 (Available on the www.onemotoring.lta.gov.sg) The total quota available for this tender is 1,589 for the following vehicle categories: NON-TRANSFERABLE CATEGORIES Category A : Cars (up to 1,600cc and maximum power up to 97kW (130bhp); and fully electric car with maximum power up to 110kW (147bhp)) => 509 Category B : Cars (above 1,600cc or maximum power above 97kW (130bhp); and fully electric car with maximum power above 110kW (147bhp)) => 430 Category D : Motorcycles => 477 TRANSFERABLE CATEGORIES Category C : Goods Vehicles and Buses => 44 Category E : Open Category => 129

- 155 replies

-

- 26

-

-

.png)