Search the Community

Showing results for tags 'cpf'.

-

https://www.businesstimes.com.sg/banking-finance/ocbc-offers-fixed-deposit-placements-for-cpf-ordinary-account-savings-at-34-a-year Why liang po po said cpf 2.5% best rate huh 🙉🙊🙈

-

Been happening for some time but this is a very good case where both cannot meet minimum sum https://singaporeuncensored.com/couple-divorce-so-they-can-buy-another-hdb-flat-to-earn-rental/ COUPLE DIVORCE SO THEY CAN BUY ANOTHER HDB FLAT TO EARN RENTAL ByHello Its me September 8, 2022 Bumped into an ex-colleague (who is the same age as me) earlier and had an interesting brief catch up chat over coffee. He and his wife are now divorced. But except that there is nothing wrong with their marriage and they are still living together. The sole purpose of getting the divorce is to be able to buy ANOTHER HDB FLAT (under the singles scheme). So they collectively own two HDB flats as two single individuals. You see, he was a manager that had recently been displaced by cheaper foreign labour. As all of us know, at our age, there is a real challenge in getting a job that would pay him a decent salary. Yes, there are lots of employers that wants to hire him. He is, afterall, a qualified professional with a wealth of 30 years’ experience behind him. However, these greedy employers are just not willing to pay him his worth and wants to exploit his skills and experience for a mean salary. He refused to prostitute his skills for a low salary. He end up driving a cab that (ironically) pays him more than any of the offers that he had received. He won’t be getting any of his CPF money next year because he won’t be able to meet his minimum sum. All his past CPF contributions (more than $800K) had already gone into his 5rm HDB flat that they are staying in now. His wife has some CPF left but she (too) won’t be able to get a single cent out in a few years’ time because she (too) won’t be able to meet the minimum sum as well. So they planned, got a divorce and bought a second HDB flat just before they could lock away her CPF as the minimum sum in her CPF. They then moved into the new flat and rented their older flat out legally because he had already and duly met the “Minimum Occupation Period” required for the legal renting out for that flat. And this rental income will serve an additional passive retirement income. When I asked if he would be flouting any HDB regulations by doing that, he replied, 1) They are legally divorced and they are both legally SINGLE now. 2) He can retain the existing 5rm flat under the singles scheme and his wife is eligible to buy another flat under the singles scheme. 3) There is no law in this land that prohibit two single persons (divorced or not) from living together as a couple regardless if they were previously married or not. 4) At his age, being legally married is just a marital status. It doesn’t stop them living together as man and wife. They both had made their wills. 5) Instead of having the money stuck as a minimum sum in their CPF, they might as well utilise whatever that they can get out of their CPF so as to get an alternative passive income since:- – – a) they won’t be able to get any of their CPF money anyway – – b) even when they do get their CPF monthly payouts after the age of 65 yrs old (which is still a long way to go), the amounts will be so miserable that they would hardly be able to do anything decent with it anyway… – – c) so…. they might as well get a second HDB flat with whatever money that they can siphoned out from their CPF (before the money is being locked away instead under the minimum sum)…. rent it out and (at least), the monthly rental income of $2,500 can help them live a more dignified retirement IMMEDIATELY (right away) rather than waiting till they reach 65 yrs old for that miserable delayed CPF payout that is so insignificant…. Thinking aloud now…. could this be the new norm of retirement in Singapore that Singaporeans will be planning for? Wouldn’t it be so sad that we have to come to this, in order that we can respond to how our hard-earned CPF money is being wilfully and forcefully withheld from us…

- 67 replies

-

- 9

-

-

-

-

.png)

-

- divorce

- retirement

- (and 15 more)

-

https://tnp.straitstimes.com/news/singapore/man-71-jailed-cheating-cpf-board-giving-him-income-over-10-years Man, 71, jailed for cheating CPF Board into giving him income for over 10 years For over a decade, the elderly man duped the Central Provident Fund (CPF) Board into thinking that he and his wife were employees of a company earning $1,000 a month so they would get payouts and CPF contributions. This led CPF Board to disburse more than $86,000 to Tan Kah Poh, 71, his wife, Toh Poh Choo, 70, and the defunct company he was the sole director of.

- 12 replies

-

- 1

-

-

https://www.channelnewsasia.com/news/asia/malaysia-epf-withdrawal-anwar-najib-relieved-prudent-13602184 I read this news with great interest.. We have some Singaporeans clamouring for their early withdrawal of the SG equivalent: CPF. Now that a neighbouring country which literally took our system and implemented it in their own nation is allowing this, we can see how prudent this will be. Can we really manage our own funds if we get a large windfall? Now we aren't talking about armchair intellectuals here.. we are talking about the masses, who may not deal with large sums of money on a regular basis, and may rush headlong into unwise investments or get forced into giving it to their kids.. So this will be an interesting study of whether it's a good idea or not IMO. https://www.thestar.com.my/opinion/columnists/the-star-says/2020/11/08/epf-account-1-withdrawals-welcomed---but-must-be-treated-cautiously Already words of caution are sounding out..

-

CPF’s Retirement Sum Scheme payout period to be capped at age 90 from 2020 Read more at https://www.todayonline.com/singapore/cpfs-retirement-sum-scheme-payout-period-be-capped-age-90-2020-josephine-teo SINGAPORE — The payout rules for the Retirement Sum Scheme under the Central Provident Fund (CPF) will change in 2020, with payouts lasting up to age 90 at most, instead of up to age 95 today. The change comes after feedback from CPF members who felt that a payout duration up to age 95 was too long, the Ministry of Manpower (MOM) said. With the change, members whose payouts were originally projected to end beyond the age of 90 will now have their payouts end when they turn 90 instead, and they will thus effectively see an increase in their monthly payout amounts, Manpower Minister Josephine Teo said in Parliament on Monday (Nov 4). The extent to which the monthly payout will increase for these members will depend on his or her individual circumstances, such as age, Retirement Account balance and existing payout amount. It will also take into account any top-ups to and withdrawals from his Retirement Account, MOM said. Mrs Teo said that the new rules will apply to all CPF members who turn 65 from July 1 next year. For older members who have already chosen to start their Retirement Sum Scheme payouts under the current rules, the new rules will apply to them from Jan 1 onwards — provided the resulting amount is higher than what they are presently getting, she said. As of Jan 1 next year, CPF will send out a letter to members who are already receiving their payouts under the scheme. This letter will detail if and how they are affected by the changes. This includes whether they will see any changes to their payouts or not, and how their payout duration has changed. Mrs Teo also stressed that changes to the rules of the scheme will not affect the payout eligibility age of 65, for members born in 1954 and later. The Retirement Sum Scheme is the main retirement payout plan for CPF members who were born before 1958, and it kicks in when they reach the age of 65. MOM stated that around 160,000 members have passed their payout eligibility age and have started receiving payouts through the scheme. Of this group, around 60,000, or over a third, will get higher payouts under the new rules. WHY SHORTEN THE PAYOUT DURATION? The decision to shorten the duration came after MOM and CPF concluded a review on the payout rules. MOM announced on Oct 7 that it had conducted the review of the scheme after receiving feedback from CPF members that the current duration is “too long”. Taking into account the 4 per cent base interest rate on the CPF Retirement Account savings, the scheme is designed to provide members with monthly payouts for 20 years, or until their Retirement Account balance is exhausted. The addition of the Extra Interest and Additional Extra Interest component, which were introduced in 2008 and 2016 respectively, allows the scheme's payout duration to be extended beyond 20 years, which the MOM had previously said “reduces the risk of members running out of savings in old age”. For members who prefer to receive monthly payouts for life, Mrs Teo reminded them that they can opt for CPF Lifelong Income For the Elderly (Life), which was introduced in 2009. CPF Life is optional for members under the Retirement Sum Scheme, who can apply to join CPF Life anytime between their payout eligibility age and before they turn 80 years old.

- 53 replies

-

- 3

-

.png)

-

-

- josephine teo

- cpf

-

(and 1 more)

Tagged with:

-

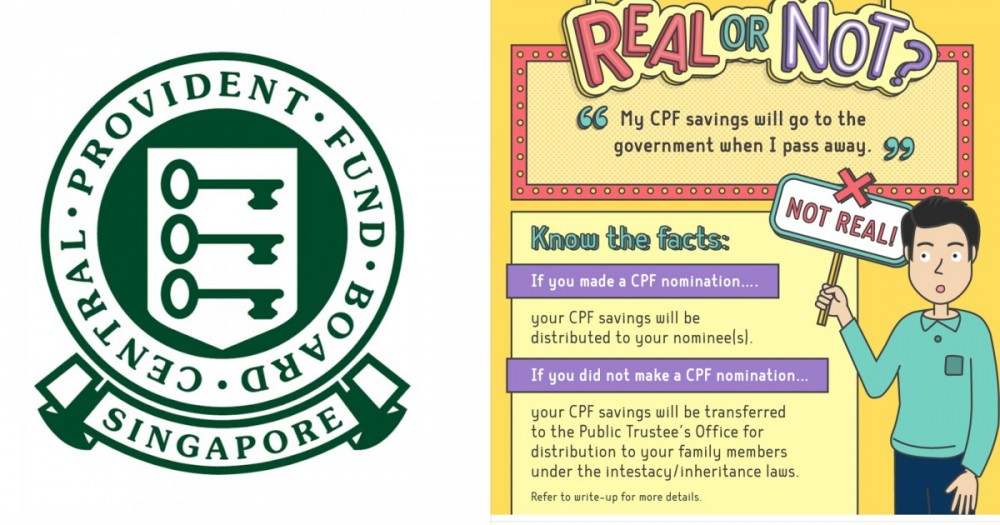

Members of the public are advised to make nominations for their central provident fund (CPF) monies as early as possible, after CPF monies left unclaimed with the Insolvency and Public Trustee’s Office over the last six years reached a total of S$211 million. The Straits Times reported that the bulk of these unclaimed monies belonged to dead people who did not nominate anyone to receive their CPF funds. According to the Ministry of Finance, the monies are said to be unclaimed if owners are uncontactable after repeated attempts by the agencies to do so. All valid claims will be repaid, regardless of how long the monies have been held. According to the Ministry of Finance and the Ministry of Law, about S$240 million in unclaimed monies was left with the government over the last six years https://mothership.sg/2019/10/nominate-benefactor-early-unclaimed-cpf-money-211-million/

-

https://www.channelnewsasia.com/news/singapore/hdb-flats-housing-grant-income-ceilings-higher-11891818 Bto income ceiling increased to 14k. EC up to 16k. Increased grants depending on income levels. 👍

-

I wonder how many of us here are clear about how the CPF Life balance sum is computed before returning to the beneficiaries upon demise of the account holder ? Here is my understanding. Assuming a person Mr. A has $170k in his RA at age 55. by the time he reaches 65, his RA account should have $242k assuming a compounding interest of 4%. to simplify our discussion, i stop the interest accruing from 65 onwards. At 65, Mr, A start drawing out $1,2k per month for 8 years, 96*$1.2k = he would have drew out $115.2k when he is 74 year old. Assuming Mr. A unfortunately pass away at 74, the BIG question is how much would the balanced sum be returned to the beneficiaries? The answer is $170k - $115,2k = $54.8k. the deduction is not from $242k, because the sum to be returned is without interest, letting alone the balanced sum also has accrued compound interest YoY during the disbursement period from 65 to 74. so go digest and think about how much money from the earned interest is evaporated from our account. Dont get me wrong, I support CPF Life, but the way the refund being computed is sucks. Over and above, not to forget that the monthly disbursement amount is based on the assumption that a member would exhaust his account by age of 93. meaning, if anyone pass away before 93, all the interest earned along the way from 55 year old would all be gone.

-

Is the HDB housing loan a reducing balance loan? If so, how is the monthly instalment amount calculated? I understand that if the monthly instalment is X, then X = Y+Z where Y goes toward principal and Z toward interest. Over time, X remains constant but Y and Z will change. How is X determined? How are the proportions of Y and Z determined? attached: example using CPF website calculator

-

just now i was in Toa Payoh central when i was waylaid by an AIA agent having their road show. to cut to the chase, he told me that from middle of Sep 18, we cannot use the CPF SA to invest anymore ... is this true ?

- 59 replies

-

- cpf

- special account

-

(and 3 more)

Tagged with:

-

i saw jobs posting, $1700 for f&b service crew this include $1700 + 17% employer cpf? or gross $1400 + 17% employer cpf = $1700 gross?

-

Hi all, Just wondering whats the best thing to do or rather what are my options if i have access in OA account and still servicing a HDB bank loan. Theres about enough to pay 24months of installments in my OA(cos my house is dirt cheap so installment is pretty low) Is there any way i can make advanced payments or clear my OA to decrease the total sum? If yes, is that a smart move? What else can i do with this access? Thanks in advanced guys

-

This was brought up a few days ago, in the "President" 's policy suggestions... Instead of stopping people using their CPF to pay for their mortgages, why not reduce the prices if HDB flats and not peg them to market prices with land prices? Then Singaporeans will have more money to save with lower HDB flats prices. What Would Happen if You Couldn't Use Your CPF Savings to Buy a Home? https://sg.finance.yahoo.com/news/happen-couldn-apos-t-cpf-213202807.html In response to President Halimah's call for policy suggestions, economist Walter Theseira suggested disallowing the use of CPF savings for home purchases. The measure was proposed in order to address inadequate retirement saving. This could be a logical concern, as putting a significant amount of one's retirement into home may leave them with too few remaining assets to retire comfortably, especially given the uncertainties around the 99-year HDB lease. This proposal would likely have a massive impact on the housing market—over the past decade, around S$82 billion was withdrawn from CPF accounts in order to purchase HDB flats. Given the scale of this proposal, it is worth asking: how would homeowners and prospective homebuyers be affected? How Does The Current System Work? Currently, the Public Housing Scheme (PHS) allows individuals to use their CPF Ordinary Account to pay for a part of their HDB flat purchase. However, homebuyers are limited in the amount that they can withdraw from their CPF savings for the purchase of a HDB lease. Limits are based on the number of years remaining in the lease at the time it is purchased. How Would This Proposal Affect the Real Estate Market? In the short-term, we expect that housing prices would drop as result of proposed rule. The rule will likely prevent many prospective homeowners from being able to afford to purchase homes, as they would have significantly less money to contribute to the purchase. The decreased ability to buy a property should lead to a decline in market demand, which should in turn cause a decrease home prices. For example, we can approximate the scale of change with some basic calculations. In 2017, $7.4 billion was withdrawn for the purpose of purchasing new and resale HDB flats. There were 22,077 resale applications and approximately 17,500 new units in 2017. Assuming average resale values of S$450,000 and average BTO prices of S$310,000, the S$7.4 billion withdrawn in 2017 represents about half (48%) of the total HDB market transactions (S$15.4 billion). Although these are rough estimates, roughly 20% of this might be supporting the actual home value, while the other 30% is being used to pay interest on home loans. In the long run, it seems reasonable to expect that HDB prices could drop by 10-20% as developers acquiesce to consumers' reduced purchasing power while prospective buyers take longer to build enough savings to buy a flat. Good News for Prospective Home Buyers? Overall, this proposal appears that it would be a net-neutral event for prospective home buyers. On one hand, these individuals may have to save longer in order to purchase a home since they will not be able to access their CPF savings. On the other hand, a drop in housing prices could offset their reduced ability to purchase homes. Additionally, these individuals will benefit from having additional retirement savings since their CPF will be able to compound untouched over a long period of time. Bad News for Existing Homeowners However, this proposal definitely could have a negative impact for current property owners. If all buyers in the market are less able to afford current real estate prices, the market forces tend to adjust the prices lower until people can afford flats without the help of their CPF accounts. This would ultimately mean a reduction of wealth for those who already own HDB flats. Additionally, current homeowners may face another negative consequence. Currently, individuals re-selling their HDB flats must refund their CPF account based the principal amount withdrawn for their HDB flat purchase, as well as the amount of accrued interest that the savings would have earned if they had not withdrawn from the CPF account initially. If property values drop significantly, these homeowners will have much more difficult time meeting this refund requirement. How to Make a Smooth Transition The proposal would certainly incentivize increased personal savings and promote wealthier retirement, which could be a financially responsible goal. In order to make this transition easier, however, there are a few concepts to consider. First, because existing homeowners must refund their CPF account based on the amount withdrawn for purchasing a home, declining home prices could put them at significant financial risk. One way to make the proposed rule more palatable would be to decrease the refund requirements for current homeowners. Additionally, if HDB leases were extended, policy makers might be able to both buoy short-term home prices as well as mend a long-term structural issue related to HDBs. It could also help the owners of older flats, whose retirement savings could benefit from increased resale value if leases were easily extended beyond 99 years. ____________________________________________________________________________________________________________ The truth behind proposal to prevent CPF for housing https://sg.finance.yahoo.com/news/truth-behind-proposal-prevent-cpf-065043359.html An academic’s suggestion which seemed to propose that the Central Provident Fund (CPF) monies no longer be allowed to be used to buy residential properties, has in recent days stirred the hornet’s nest. Walter Theseira, professor of Economics at UniSIM, made that suggestion in responding to President Halimah’s call for policy suggestions. Prof Dr Theseira said that the use of CPF savings for housing should be curbed in a bid to prevent the people from over-investing their savings on housing. He noted that people typically over-invest on housing as a way of “unlocking their CPF funds” and that installing measures to limit the use of CPF monies for housing could help the people conserve their savings for retirement and health. He said: “My view is that the CPF system tries to do a little too much, and we should consider focusing CPF on retirement and health…I do believe there is some over-investment in housing, which creates retirement risks if housing values do not grow, and this over-investment is because Singaporeans see housing as a way of unlocking their CPF funds.” One such measure the authorities could instate is slashing CPF contribution rates, Theseira suggested. This would mean that workers would receive more take-home pay that they could allocate to housing. “A CPF system focused on retirement and health would require lower contribution rates, and allow people more choices in using their higher take-home income on housing, investments, business, and family.” While Theseira advocated for a redesign of the CPF system “so that people no longer need to pay for housing out of CPF, by cutting contribution rates to focus on retirement and health,” he added that he is unsure what the right contribution rate should be. His views on the redesign of the CPF system drew sharp criticisms from the members of the public. Some were initially even confused that it was President Halimah who had made that suggestion in her call that there were ‘no sacred cows’. After the public uproar, the professor took to his Facebook to clarify that he did not argue for CPF to be removed completely or even for the housing component of CPF to be removed completely – since it may help people save for their first home. Theseira said: “What the right contribution rate should be, I cannot say. Perhaps some housing component remains important to help people save for their first home. Nor would I argue to remove CPF, because mandating retirement savings remains important, even for (especially for?) people who believe they can do a better job on their own. But this is a topic for another day.” Elaborating, the economist asked: “What choices would we make if a different policy was in place? What trade-offs would we accept if we designed policy? It’s easy to make fun of policymakers, and it’s also easy to critique policy. Finding workable solutions that promote the public interest is a lot harder, but more than ever, we need to work together to help improve policy in Singapore.” Prominent commentator on economic policies, Chris Kuan, said that Theseira’s views on CPF usage are generally sound. Kuan explained: “This bring Singapore back to normality in terms of what social security is used for and will go a long way to minimise the large trade-off between paying for housing and saving for retirement and healthcare. It will also reduce the known tendency of Singaporeans of over-extending housing affordability and hence driving up prices because of the instant gratification they received over CPF being released to pay for property when that gratification can only otherwise be realised decades into the future.” Kuan added that the trade-off between CPF being used for housing and retirement is a complex one, to which there are no easy answers. “There is always that easy argument that the whole problem of the trade-off between housing and retirement is due to HDB affordability and that tiresome mantra that all it takes is just make HDB affordable. Well, making HDB affordable from this point forward is the easy part. The difficult part is how to make HDB affordable without destroying the housing equity and hence retirement proposition of current HDB owners. That is the intractable part of the problem.” “I always held that the huge increase in CPF assets due to the high contribution rates are too much of a temptation for the government,” Kuan, a former international banker, said. Adding: “What better way to use it up than let public housing prices rise – it increases the government reserves which is essentially a very large transfer of wealth from households to the state and slow down the accumulation of government indebtedness.” Although highly unlikely, if Theseira’s proposal was accepted by the Government, it would mean that housing prices will drop drastically. This is because without CPF, many home buyers will be deterred by the large out-of-pocket down-payment that they would have to pay for their prospective homes. This would in turn lead to a decline in demand in the residential property market, driving down prices significantly. A scenario which would be prevented from happening at all costs by policymakers who have vested interests in a healthy real estate market. ____________________________________________________________________________________________________________ What the forefathers has given Singaporeans the flexibility to buy homes with their CPF money in the past, and now these people are thinking of removing this scheme? https://www.cpf.gov.sg/Members/AboutUs/about-us-info/history-of-cpf The evolution of CPF a) CPF and housing – the twin pillars of retirement adequacy To help workers save for retirement, the CPF was established on 1 July 1955. Workers contributed part of their monthly income to their CPF to build up their retirement savings. In 1968, the government introduced the Public Housing Scheme, allowing Singaporeans to pay for the mortgages of their HDB flats using their CPF savings instead of having to use their take-home pay. This increased the affordability of housing and provided many Singaporeans with a home. Home ownership became a key pillar of retirement security as it relieves Singaporeans from having to pay rental fees out of their retirement funds during their senior years.

-

https://mothership.sg/2018/05/married-couple-divorced-buy-hdb-flat-as-single/?nlarticleid=11561273 Husband and wife agree to a divorce of convenience A husband and wife in Singapore had apparently agreed to divorce — just so that they can each own a HDB flat. This was after they figured marriage is just a status, and by divorcing, they can unlock their Central Provident Fund monies in a different way. Wife bought another flat under singles scheme The couple originally bought a HDB flat together when they got married. It was paid for using the husband’s CPF. The husband is now a cab driver. He is likely to be 54 this year, or somewhere in his mid-fifties. He claims he cannot withdraw his CPF money by next year because it does not meet the Minimum Sum, or Retirement Sum, which is the minimum amount of money needed in your CPF account when you turn 55 before withdrawals can be made. The wife too will not be able to withdraw any CPF money in a few years’ time, since she also does not meet the minimum sum. The plan Husband and wife then divorced. On paper. But they are obviously still very much together. This frees up the wife to buy a HDB flat of her own as a single under the Single Singapore Citizen (SSC) scheme. She is able to get a housing grant for the flat as a second-timer single Singapore citizen applicant. She can pay for it with her CPF — which otherwise would be locked in once she turns 55. The man now owns the first flat as a single. Rental income Since he has lived in the house for longer than the five-year Minimum Occupation Period, he is able to rent it out. The husband then proceeds to live with his now ex-wife in the new flat, while both enjoy the passive income from the rental of the first matrimonial flat — said to be about $2,500 monthly.

-

i hope somebody can share his experience with me on this. i wanted to enrol my son to NAFA school for his diploma next year. I know we can use our ordinary acct for our child's education loan. but my ordinary acct is drained and my monthly contribution goes to my housing loan. next chance is my special acct. so i wrote to CPF board to see if i could use my special acct. replied from CPF below so my question is, anyone tried seeing their MP and could get special arrangement? or heard of any successful story pertaining to this type of scenario? my credit rating no as good, i think i cannot borrow from bank. thanks for reading.

-

http://www.channelnewsasia.com/news/singapore/re-employment-age-raised/2678966.html Dear bros, Do you think that the government will raise the age that you can start withdrawing from the CPF Retirement Account from the current 65 to 67 in 2017?

- 241 replies

-

- 4

-

-

- cpf

- retirement age

-

(and 4 more)

Tagged with:

-

The CPF salary ceiling, the maximum amount of ordinary wages that employee and employer contributions are calculated on, was raised from $5,000 to $6,000. "Middle-income Singaporeans will be able to accumulate more CPF savings during their working years," Deputy Prime Minister Tharman Shanmugaratnam said when he announced the latest change during the Budget in February last year. At least 544,000 CPF members are expected to benefit. - See more at: http://news.asiaone.com/news/business/more-cpf-savings-new-rules#sthash.pajiY2Zl.dpuf ==== 1. There are 544,000 people earning $5000 or more here. Excluding sole proprietors, directors and private tutors. 2. Each person (and employer) will pay $370 more monthly. Gov will receive >$200mil cash monthly. Or gov really short of cash meh? 3. $370 more in the CPF account. About $200+ can be used for housing loan. Positive impact to the property price. 4. $200 less take home pay.... Retail business and COE.... down down down. 5. Boss will tell us... "You already got $170 increase in your CPF. No increment this year." Are we really richer? The ChengHu is for sure.

- 275 replies

-

- 15

-

-

i was appalled when i saw this. This is just morally wrong. And they just wanted the money to pay for funeral expenses. This is like stealing from the dead. CPF, have you no moral sense of decency? Trusts, estates, probate & wills Sisters give up bid for grandma's CPF money Source Straits Times Date 09 Dec 2015 Author Olivia Ho They can't find documents proving their ties; authorities say CPF sum not covered by will They were hoping to use their late grandmother's Central Provident Fund (CPF) savings to pay her funeral expenses. But after waiting for more than a year, property agent Chan Jee May and her two sisters have decided to give up the fight. The sisters lack the documents to prove they are related to Madam Lau Pei Ling, who died last October aged 93. In a forum letter to The Straits Times published on Nov 30, Ms Chan lamented the "many hurdles" they faced in trying to prove their relationship to a woman who had left everything to them in her will. Ms Chan, 36, said: "It's not like anyone is disputing our claim. The rest of our family thinks the money should go to us. I think the claims procedure could be more flexible." A spokesman for the Public Trustee's Office (PTO), which disburses the CPF money of those who did not nominate beneficiaries before their death, said: "Under the CPF Act, CPF monies do not form part of the deceased member's estate and are not covered by a will." The spokesman added that the PTO "will hold onto the monies indefinitely until the beneficiaries come forward to claim (them)". Madam Lau had not nominated anyone to receive her CPF money, which Ms Chan estimated to be between $6,000 and $7,000, before she succumbed to colon cancer. Ms Chan and her sisters, who are civil servants aged 36 and 38, are not the biological grandchildren of Madam Lau, who married their grandfather after the death of his first wife. The couple wed in a last-minute arranged ceremony during World War II and did not have a marriage certificate. The sisters were orphaned as teenagers and were close to Madam Lau growing up. After she had a bad fall five or six years ago, they paid her hospital bill as well as for a helper to take care of her. And, until her death, the sisters would visit her almost every weekend, Ms Chan said. To prove their relationship, the sisters tried to submit to the PTO a 1978 grant of probate in which their grandfather left his Toa Payoh flat to Madam Lau after his death, but this was not accepted as valid. They then considered asking their grandmother's brother, who is in his 90s, to help them claim the CPF money. However, the PTO required his birth certificate, which was also lost in the war. Lawyers The Straits Times spoke to said the Chans could get their grand-uncle to make a statutory declaration about their kinship. WongPartnership lawyer Sim Bock Eng said: "Where there is no clear documentary evidence, in law, it is possible to persuade the CPF Board to accept other forms of evidence, such as a statutory declaration stating the relationship from one or more persons who would have the requisite knowledge of the relationship. "The person will then need to sign the statutory declaration in front of a Commissioner for Oaths as a witness." The PTO spokesman also said the office had advised Ms Chan to get Madam Lau's brother to make a statutory declaration on their relationship, either with a lawyer or at the PTO's premises. The sisters, however, have since decided it is not worth the effort. "If we are going to have to trouble an old man who is not really mobile to help us get the money, we would rather just let it go," said Ms Chan. "The money would probably end up going to the lawyer anyway." Man died before marriage could be annulled When Ms Caroline Edmund read about the Chan sisters' plight in Ms Chan Jee May's forum letter on Nov 30, she could sympathise. The accountant, in her 50s, told The Straits Times that her family has been waiting for four years now to collect nearly $50,000 from her late brother's CPF account. Her brother Ignatius Edmund, a 42-year-old boarding officer, had been trying to get his marriage to a Filipino woman annulled, after not hearing from her for seven years. But before the annulment could be finalised, he was killed in a traffic collision in India. Under Singapore's inheritance laws, Mr Edmund's parents can get only half his CPF money unless his wife comes forward to state that she does not want the money. Ms Edmund said they hired a lawyer to track down the woman, who was found to be living in the United States with another man. All their attempts to contact her have been ignored. Ms Edmund's mother last went to the Public Trustee's Office (PTO) in May to plead their case. She died last month. Ms Edmund's 83-year-old father is now living in India. Ms Edmund said: "If we had the rest of the money, my dad could afford to buy an apartment in Singapore and live here... We've tried to come at it from all angles, but they (the PTO) are so rigid. I'm so tired of this whole thing." Olivia Ho - See more at: http://www.singaporelawwatch.sg/slw/headlinesnews/74348-sisters-give-up-bid-for-grandmas-cpf-money.html#sthash.vHNEml0i.ZHtRwR2W.dpuf

-

source: http://www.tremeritus.com/2015/07/02/writ-of-possession-issued-against-man-with-terminal-cancer/ Not sure how accurate this story is .. but seems such a sad case. Sell house but cannot get money to treat his cancer. Is it that difficult to touch the CPF even if may die before reaching 65?

-

Who feels this way? In fact, if u consider that when you die or no longer need a home and u sell ur house u will calculate that most of us will actually get paid to stay at your home! And because of our forced tax/savings called CPF, we can own a home purely by using this fund (which u cannot see if u dont use anyway). So housing in SG is free or more accurately, u get paid for buying a house (when u or kids evetually sells it)!

-

Many CPF investors get their fingers burnt MOST investors who use Central Provident Fund (CPF) savings to invest would have been better off leaving their money in their Ordinary Accounts, according to the CPF Investment Scheme's (CPFIS) annual profit and loss report. This is despite the good performance of investment funds included in the scheme. In the financial year ended Sept 30 last year, 902,300 investors sold their CPFIS investments. Only 15 per cent of them made a profit larger than the guaranteed annual 2.5 per cent interest rate for Ordinary Account savings. Another 45 per cent made profits of up to 2.5 per cent. The remaining 40 per cent made a loss. Under the scheme, members can invest in CPFIS-included funds such as approved unit trusts and equity funds, as well as other investment products such as stocks and shares. The CPFIS-included funds themselves have performed well. They posted an average return of 5.17 per cent in the first three months of this year, according to a report by research firm Lipper last month. The funds have grown by about 29 per cent over the past three years. But individual investors may perform poorly as a result of investing in riskier instruments instead of CPFIS-included funds, said experts. The gap could reflect a difference in financial knowledge, investment skills and discipline, said Mr Lance Tay, chief executive officer of Tokio Marine Life Insurance Singapore. "This can be improved with increased financial literacy and discipline, or with guidance from financial advisers," he added. Barclays senior economist Leong Wai Ho noted that stocks and shares were subject to many more market fluctuations. "It's better that people stick to professionally guided products like approved funds," he said. "That's more appropriate for something that's supposed to be a person's store of value, their life savings." Earlier this year, Institute of Policy Studies research fellow Christopher Gee argued that the default risk-return balance on CPF savings is good enough for most members. "A lack of adequate financial literacy among CPF members and potential retirees may result in sub-optimal decision-making," he noted. On the one hand, fewer CPFIS investors are making losses now compared with the past decade. From 2004 to 2013, 47 per cent of them incurred realised losses, more than the 40 per cent who made a loss last year. On the other hand, more investors used to earn profits above the 2.5 per cent Ordinary Account interest rate. From 2004 to 2013, 18 per cent of investors did better, compared with 15 per cent in the last financial year. More than 25 per cent did from 1993 to 2004. - See more at: http://business.asiaone.com/news/many-cpf-investors-get-their-fingers-burnt#sthash.QvQulhsB.dpuf

- 71 replies

-

- 1

-

-

- cpf

- make money

-

(and 5 more)

Tagged with:

-

saw this recent, dated May 2015, letter from CPF with regards to grand-dad passing (which was more than 2 decades ago).. it mentioned that it was just notified that xxx had passed and yyy as related is entitled to some funds and needs to fill up the attached form. (something like that as i only took a quick glance at mom's letter) the absence of CPF nomination caused the held back of his CPF monies for more than 2 decades.. what horror!! QN: does anybody know if this is normal or should the normal process be faster? how much faster will the CPF nomination speed things up? i should be going to do up my CPF nomination as well, but it seems like you can only submit the nomination in person.. will be grateful if others can share their experiences or stories that you may have hear from your friends. TIA!

- 31 replies

-

- cpf

- cpf nomination

-

(and 1 more)

Tagged with:

-

I have a CPFOA investment account with DBS for normal shares investment. But how do I invest in gold using CPF? (that 10% from total investible)

- 21 replies

-

- 1

-

-

Dear All My dad last time had used his cpf to buy Sbs transit share using cpf only. The previlige is that he is able to buy the bus stamp which he likes.. Ill fate has fallen upon him and now he is literally deaf in both ears.... cause of that he cant really hold permanent job and he is due to get his money from cpf which is not that much soon...now he wants to sell half of it and i have been calling cpf... and up to now i was asked to call here n there... may i know if any1 here has any contacts or know how to sell...but he wants to sell only half cause he still wanna keep some so he can still buy the bus stamp.... will they still allow him to buy if he sells half of his share