Search the Community

Showing results for tags 'money'.

-

Hi, my family have some saving with the foreign banks in sgp like Citibank, Standchart and etc. As you know, the current covid19 situation in these foreign countries are pretty serious. In facts, this pandemic is impacted the world economy and many big corporate names could be fallen. I dont know how bad could this pandemic goes around affecting the market becos I'm not an economist. But I knew that oversea banks are not bullet-proof too and they could also be collapsed which indeed it happened in other countries before. Not forgetting that the worst is yet to come. Do you think depositors like us with money in foreign banks are protected in Sgp?

-

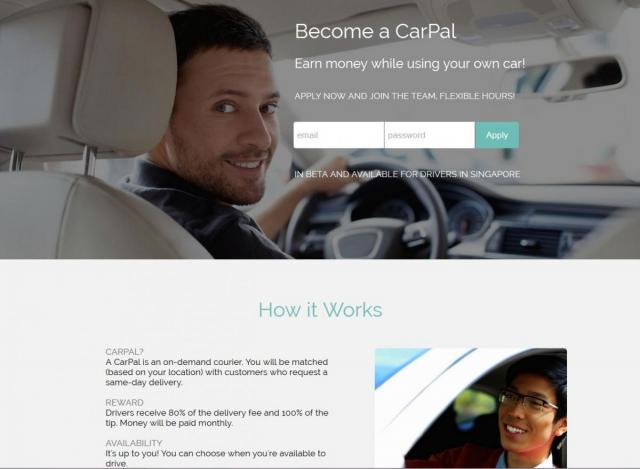

Come across this advertisement in my Facebook , for those who wish to earn while driving , this maybe be a great opportunity.

- 59 replies

-

- 4

-

-

- courier service

- online business

-

(and 4 more)

Tagged with:

-

Running Shoes - Are expensive running shoes a waste of money? 57 yr old Tarahumara runner ran the 100 km race with a pair of sandals made from old rubber tyres and came in first - so much for expensive high end running shoes :-) Date: Wednesday, September 29, 2010, 9:35 PM The painful truth about trainers: Are running shoes a waste of money? Thrust enhancers, roll bars, mic rochips ... the $20 billion running - shoe industry wants us to believe that the latest technologies will cushion every stride. Yet in this extract from his controversial new book, Christopher McDougall claims that injury rates for runners are actually on the rise, that everything we've been told about running shoes is wrong - and that it might even be better to go barefoot. By CHRISTOPHER McDOUGALL Last updated at 8:01 PM on 19th April 2009 Every year, anywhere from 65 to 80 per cent of all runners suffer an injury. No matter who you are, no matter how much you run, your odds of getting hurt are the same At Stanford University , California , two sales representatives from Nike were watching the athletics team practise. Part of their job was to gather feedback from the company's sponsored runners about which shoes they preferred. Unfortunately, it was proving difficult that day as the runners all seemed to prefer... nothing.

-

Yesterday i checked exchange rate for Aussie dollars was 1.266.. I needed to change AUD600 to pay some upfront the apartment i will be stayin when in perth. So i went to this money changer at bedok central near the interchange.. the blardy indian man told me 1.31! i said but i juz bought a bankdraft a day before from posb at the rate of 1.2758 and was at 1.266 dat morning! The all the stupid reasons he mentioned about buy n sell different la dis la dat la.. i got no time to go to other money changers to check around for better rates.. so i juz changed there.. after dat i calculated the difference.. aud600 i used sgd786 to buy at the rate 1.31, when it shud hv been 762 at 1.27.. so i paid extra sgd24! Two things i need to know.. 1) are money changers rates always exchange at different rates from banks? 2) bros here have any 'more honest' money changers to recommend?

-

https://m.facebook.com/watch/?v=351168979094837&_rdr He called the police so no reason to post this on FB. Poor girl. I would have paid for her and gave her my contact to return the money. Many uncles here would do the same hor.......

- 158 replies

-

- 13

-

-

Just realised that it's really worth getting or converting to OPC. 1) Reduced initial investment 2) Lowered Taxes 3) Cheaper Insurance 4) Deferred Day Licensing - upto 23.59 next day to purchase license via various media 5) Even if you forget its ok you have 5 working days to do "self-declaration" Of which all could be redundant since there isn't any concrete control in place to truly catch you using without paying the license...u dun say...people dun tell on you....practically won't ever get caught... "Everyone does it...." Seen so many OPC in use everyday outside the licensing hours...dun think these people pay license everyday else would cost more than regular cars what's the point. So...until a concrete control mechanism in place...we should take the opportunity...!

-

It's always been a passion for me to generate income online. so far I can only hit 10k on a good month but otherwise borders 3k. Hope to hear your success stories and best practices and tips for all. start the ball rolling!

- 60 replies

-

- make online revenue

- seo

-

(and 3 more)

Tagged with:

-

What would you do if money started falling from the sky? People walking along Fuk Wa Street in Sham Shui Po, Hong Kong, witnessed the baffling sight of banknotes floating down from above on Saturday afternoon (Dec 15). Videos posted online suggest that the notes were thrown from the roof of a building, fluttering through the air before landing on the busy street below. Passers-by can be seen eagerly grabbing the notes, with some climbing on to the roof of the subway exit to pick up the banknotes. Photos on social media show that the notes were of the HK$100 (SG$17.60) denomination. One Facebook user appeared to have picked up at least six notes. Police were called to the scene after receiving reports of someone distributing money at Fuk Wa Street, and told people not to pick up the money, said South China Morning Post (SCMP). Officers collected around HK$5,000, according to the report. A live video on the Facebook page of Epoch Cryptocurrency that began at 2.42pm showed a man dressed in a black hoodie saying in Cantonese: "I hope everyone here will pay attention to this important event… (I) don't know whether any of you will believe money can fall from the sky." The man is believed to be the owner of Epoch Cryptocurrency, a Facebook page that promotes cryptocurrency. The man is widely known online as "Coin Young Master" and his real name is Wong Ching-kit, reported SCMP. Bowen Press said that the 24-year-old man refuted claims that he was behind the incident when interviewed at his home. However, Agence France-Presse (AFP) later reported that he was arrested on Sunday for causing disorder in a public place, after he drove back to the neighbourhood in his Lamborghini. Wong had said in a Facebook post that he wanted to “help the poor by robbing the rich”.

- 4 replies

-

- 1

-

-

- money fall from sky

- robin hood

-

(and 7 more)

Tagged with:

-

hi all, just thought that i should share my sister's experience with her helper that borrow from 2 loan sharks and 3 or 4 ( not sure )credit company, total amount about 9k initially, didnt want to bring it up but found out that the former helper is trying again to come back singapore and presumably, repeat the same trick of applying lots of illegal and legal loans then escaping back to Philippines below are her details, her name Maribel Cabigas Turalba attachment=272632:Screenshot_20181127-001422_Samsung Internet.jpg] hopefully, might save future employers from further troubles and this thread might be a good reference point for prospective employers

- 26 replies

-

- 9

-

-

- maid

- loan sharks

-

(and 6 more)

Tagged with:

-

Over the weekend, my cousin called my brother to inform him that they will be selling off my grand parents estate and my late mum will receive a portion of it. We are to go and apply for Letter of Administration from the courts to be able to receive the inheritance. Not sure the details yet, dont know how much will be receiving as there are eight sibling. But thinking of it, brings a smile to my face. Hope that it will be a substantial amount. I also hope not to spend all of it away. Hope to keep it for retirement. Anyone been through this?

- 203 replies

-

- 15

-

-

A new Bond is being issued in Singapore. Let's not start with the James Bond jokes. https://secure.fundsupermart.com/main/bond/bond-info/factsheet.svdo;FSMAPPID=wqTF3FdKG6YkmxI0t8GWCCSl2k25du3El4lWB39_yrmJoeyM9Py7!1867248078?DCSext.dept=21&WT.mc_id=58861&issueCode=JK5852351 I like the rate but as I don't undestand bonds I won't be investing. As I understand it although the coupon rate is 5.3% annually the price of the bond can go down as well. So at the end of the investment period money can be lost. Is that correct? Or can anyone provide a simple short version of how a bond works.

- 40 replies

-

- investment

- money

-

(and 2 more)

Tagged with:

-

I read our minister say how much money our saf save.... but my experience with my reservist unit feels the exact opposite. It feels like they have to spend their Budget else it will be cut next year kind of feeling. I am curios is it like a widespread kind of thing or it’s just my unit? My unit is not conbat fit so maybe it is different from mainstream saf.

-

With an aging population, me included. I am not sure what most retirees do and how they 'kill' their time here in Singapore. Post-retirement periods can stretch to 20 years or more and the last lap which can be more than 10 years of your life can be very challenging. This scene was once common in CC but today, you would have problem even to find them in kopi shops or even HDB void decks. How about another 5-10 years? Surely we cannot do this in MBS. Any old folks club beside old folks home

- 374 replies

-

- 15

-

-

Pet owners appear to be spending more on furry companions, going by the business at the shops and farms. Shop owners said customers are willing to pay more for the premium breeds, compared to five years ago. They are also prepared to spend more on grooming and veterinary fees. The Holland Lops, Miniature Lion Lops and Netherland Dwarf rabbits do not come cheap. Pet shop owners said some of the more exotic breeds cost between S$800 and S$1,000. One of the rabbits is touted as a champion at a rabbit show in the US, and comes with a price tag of S$8,000. According to pet shop owners, interest in these American-imported rabbit breeds began two years ago. Pet owners are also splurging on pet care, with some prepared to pay up to S$10,000 for surgery. Eric Lim, director of Ericsson Pet Farm, said: "Spending on animals has increased a lot. Like for example, in those days, they're willing to spend S$1,000 to S$2,000 on a dog. But today, people can spend up to S$10,000 on the dogs." Dr Jason Teo E-Shen, a veterinary surgeon, said: "They treat their pets as part of their family and are willing to go all the way. I think the newer generation is more educated. They do know a lot more about animals and they are willing to come down to consult a doctor when there is a problem." Source: http://www.channelnewsasia.com/stories/sin...1205341/1/.html

-

I chanced upon this site and they have some TECH stuff that can save some money. Sharing w the guys here or even ladies also. cheers! https://www.techconnect.com/article/3144990/hardware/cyber-monday-deals-tech-bargains-that-truly-save-serious-money.html?idg_eid=b74b6b2f5e851201e29510e8b251bede&email_SHA1_lc=&cid=tcon_nlt_techconnect_daily_2017-12-05

-

https://sg.finance.yahoo.com/news/much-earn-above-singapore-average-000031337.html How much do you need to earn to be above Singapore’s “average”? Forbes has named Singapore as the third richest country in the world. This wealth is measured using the Gross Domestic Product (GDP) per capita. Simplistically, it adds up everyone’s income for the year – to obtain GDP – before dividing it by the country’s population. So how much should the “average” Singaporean be making based on this calculation? Read More: Singapore, world’s richest. At what cost? The golden number is $5,943! At end-2014, Singapore’s GDP was recorded at SGD390.1 billion with population size of 5.47 million (Singapore residents + foreign talents). Table 1: National Accounts and Population in Singapore FY2011 FY2012 FY2013 FY2014 GDP(SGD mils) SGD 346,354 SGD 362,333 SGD 378,200 SGD 390,089 Population (mils) 5.18 5.31 5.40 5.47 GDP per Person SGD 66,816 SGD 68,205 SGD 70,048 SGD 71,318 Income per month SGD 5,568 SGD 5,684 SGD 5,837 SGD 5,943 Source: Singapore Department of Statistics Since simplistic GDP means adding up everyone’s income for the year, we will also assume that CPF contributions are included into this number. Add your gross salary (take home salary + CPF contribution) to your employer’s CPF contribution. If this number is not greater than SGD5,943, you are below the average amongst our population. Is $5,943 the correct number as the average wage? As mentioned, GDP per capita is a simple method to define how rich a country is by understanding how much everyone in the population earns per annum. However, using the entire population is not a good gauge, as children, students and retirees are not working, and hence should be excluded from the calculation. Table 2: National Accounts and Labour Force in Singapore FY2011 FY2012 FY2013 FY2014 GDP (SGD mils) SGD 346,354 SGD 362,333 SGD 378,200 SGD 390,089 Labour Force (mils) 3.24 3.36 3.44 3.53 GDP per Worker SGD 106,995 SGD 107,779 SGD 109,824 SGD 110,482 Income per month SGD 8,916 SGD 8,982 SGD 9,152 SGD 9,207 Note: The labour force comprises of people who are working or seeking work Source: Comprehensive Labour Force Survey, Ministry of Manpower Using labour force instead of total population will be more accurate since we are basing our calculation only on those who are working. In this case, average wages inclusive of CPF contribution would be SGD9,207 per month per person. So what are your numbers telling me? If you are like us, then this number may appear exceedingly high to you, perhaps even unattainable. Do not worry, you’re not alone. The median salary in Singapore is SGD3,770. That means the majority of us are not earning the average. This is normal, as wages are usually skewed towards the higher income earners and thus medium hardly ever equates to mean. What you should make out of this number is that you have the potential to increase your wages. Unlike poorer countries, where your future growth in earnings would be easily capped by the low potential in the country, we do not lack this in Singapore. There is money to be made, somewhere and somehow, in Singapore. You just need to figure our where and how. If you require upgrading and improvements, do check out skillsfuture to see how can our government help you achieve better productivity and higher wage growth.

-

They are really really dumb. http://www.todayonline.com/singapore/two-men-jailed-roles-counterfeit-money-scheme SINGAPORE — Two men were today (Feb 3) jailed three years each by the district court for their roles in a counterfeit money scheme. They are the final two to be sentenced, following four others who have already been dealt with. Odd-job workers Adi Soffian Bakhtiar Effendi and Fauzi Mohammad — both 22 years old — admitted to being accomplices in the scheme to forge and use 24 fake S$1,000 notes. The scheme was hatched by Abdul Adziz Asmon, then an operations assistant with marine service agency Nautical Trade, who was eventually jailed six years and seven months in October last year. The court heard that in 2012, the six involved in the scheme tried to create the fake notes using a scanner, transparencies, paper and eggs. The egg white was spread onto the counterfeit notes to give them a crisp texture, mimicking that of real Singapore currency. The tasks were divided among the six involved. As for the pair sentenced today, Adi scanned the genuine currency notes and printed the counterfeit ones, while Fauzi used a paper cutter to cut the fake notes to the correct size. The notes were forged at a chalet in Costa Sands Resort at Jalan Loyang Besar. The crime was discovered when Abdul Aziz used the fakes when handing S$30,000 to a supplier, who eventually called Nautical Trade to complain. The pair could have been jailed up to 20 years and fined for the offences. CHANNEL NEWSASIA

-

How to be a Money Savvy Teen in SG with these 8 Simple Tips! May 14, 2017 Source : http://accdenteach.blogspot.sg/2017/05/how-to-be-money-savvy-teen-in-sg-with.html Being a teenager in Singapore is no joke. Almost every activity on our beloved little red dot requires money! So many things to do but so little money - What should I do? Fret not! Want to “Yolo” without breaking the bank? Here are our eight great tips on how to manage your money in Singapore! 1 : Start habit of saving spare cash when young We have heard too many stories of fellow teens overspending their allowances – spending on whatever takes their fancy with nary a thought. I suppose you think that it doesn’t matter right? Since Mom or Dad will always 'bail' you out if you're short of cash. Such thinking is wrong and dangerous as your parents will not always be with you in your life to save you from your financial mistakes!. Cultivating a habit of savings is a good virtue and will set you on the right way in life. How to do this? Read on in our next tip. 2 : Establish a steady income We don’t mean to give up your full-time studies now but to find opportunities to gain a steady source of income. It could be helping out at your parent’s food stall. Or helping your siblings in exchange for some allowance from your parents. Or perhaps you could offer your services to help clean your neighbour’s car every week! If you have a bicycle or motorbike why not take up delivery (UberEats, Deliveroo) while you are at it. You can keep yourself fit while earning money! The point is to obtain a source of steady income so that you will rely less on your parents and be more independent. It will also set you well for adult life and help you to discover where your interests are! 3 : Set a budget and start a savings account Now with a steady source of income it is important for you to set a budget each month. Hopefully with this means of steady income you will understand that money does not come easily and has to be earned. And with this virtue you can perhaps resolve to set aside a fixed portion of your income every month. It also pays to set goals while setting a budget. Want to go for a bikepacking trip to Thailand? Start saving for it every month! 4 : Learn to recognize wants and distinguish them from needs. This is one of the most important virtues to learn at a young age. Sure that brand new Samsung S8 might be all so desirable. But a XiaoMi does the same functions for so much less money! Identifying what you need from what you want will help you save so much money! 5 : Make use of your student pass! You might not know this but being a student entities you to some great deals in Singapore. KFC for example offers student meals on weekday afternoons and evenings. Various restaurants such as Jacks Place and Manhattan Fish Market also offer special meals for students! Running low on mobile data? Make use of your student pass and sign up for the youth mobile plans to get free extra data at Starhub! Yes don’t hide away your student pass with the dorky photo. Your student pass is useful in Singapore! 6 : Have fun working together with friends to avoid spending! Peer support is the biggest motivator among teens. Instead of competing to see who can spend more – compete to see who can save more! Anyone can spend but it takes someone with real passion and determination to save real cash in Singapore! Pair up with your friends to get that one for one deal! Want to watch a movie? Go to Johor Bahru! You can watch 2 movies for the price of 1 in Singapore! 7 : Reduce, Reuse, Recycle! Wise old adage and still so applicable in our time. Don’t feel down getting those hand-me-downs from your older sibling. Rejoice for you can save up on those textbooks for your next big bike packing trip! Have some old junk lying around – don’t just throw them away. Put them up on Carousell! People might be willing to pay to offload your unwanted items off you! 8 : Start retirement savings as early as possible. It is never too early to think about retirement. The truth is that the earlier one starts saving the earlier one can retire. Starting a savings plan from young, even depositing small amounts each month can eventually lead up to a sizable and secure retirement amount well into your future!

- 11 replies

-

- 5

-

-

- personal financeteens

- money

- (and 5 more)

-

hi folks, need some inputs from techies here. any suggestions for 5MP camera phones or simply great camera phones when $$ is not an issue. please do not tell me to buy a seperate camera and phone as i already have them. looking to integrate them as to bring out only 1 device instead. thanks.

-

http://newpaper.asia1.com.sg/news/story/0,...,151459,00.html? If so happens that u found out your gf or wife used to be a social escort for whatever reasons, how would u react? I believe the above article showcase the minority of sg women so guys pls refrain from flaming other women.

-

Hi Bro, Any way for better use of our money in the bank that earn so little interest? Pls share your idea to increase our money!!!

-

Just complaining looking at the list of things to buy for CNY. reunion dinner good food... to spruce up the homes, new clothes, new shoes, and of course to spruce up my car for the CNY. sian.... think this year i am skipping buying new clothes liao... already a bit sian of all the xmas gifts to buy fro colleagues and friends. didnt even get any good xmas exchange gifts. all silly stuff that i won't have bought on my own

-

Spin off from the earlier thread which was locked... Just wondering how you blokes out there perceive or define how a man's financial responsibilities are - in a marriage? There's no right or wrong, I guess largely, it also depends on a person's upbringing and family environment. I strongly believe that husband and wife should both contribute financially. Doesn't matter who contributes more, mostly the man, but its the core principle that a marriage is shared responsibilities and hence, in a world where women are increasingly independent and demands equality, I reckon this is fair practice. Marriage is a partnership, and with dual contribution, the potential to achieve greater things grows 2 fold. Of course, I know of many women who disagrees... So just wanna hear your views.

-

What car would you buy for your 18 year old that just got their license? Something wonderful and flashy? (eg: Bently) A good and solid Euro? (eg: Polo) A true B n B car? (Altis) A sports car? For me, I think I would buy them a beater - teach them to understand car better, will be better drivers and I wouldn't want green eyes to turn on my kids.

-

as requested by our dear mod [laugh] seriously, ride gonna expire in 4 months, options, 1) renew COE, but probably gonna spend 5-10k on changing quite afew things to last the additional 10yrs 2) spend extra 100-150k on a new ride which currently none i have taken fancy to, except the skoda kodiaq which is not available in sg yet 3) save the $$$ and buy a few lolec to post on watches thread, use RYDE app to activate @radx when required

.png)