Search the Community

Showing results for tags 'sales'.

-

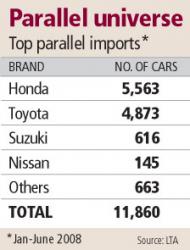

Business Times - 23 Jul 2008 Sales of grey imports continue to surge Nissan is now a key parallel import brand due to the iconic GT-R model By SAMUEL EE PARALLEL imports continued to power ahead in the first six months of this year, with 11,860 units registered, or 23.5 per cent of the 50,549 new cars registered in Singapore during that period - up from 2007's 20.9 per cent market share. The parallel import (PI) figure for the first half is contrasted against that of the 36,891 units by the Motor Traders Association of Singapore (MTA). MTA is a grouping of authorised distributors, although not all such distributors here are members. The ratio of PI to MTA sales is about 1:3 - the same as in Q1. This means that for every car sold by a parallel importer, three were sold by MTA members. Last year's ratio was 1:4. In the grey market, Honda currently holds sway, unlike Toyota in the authorised realm. Honda, Japan's No. 2 car maker, accounts for 46.9 per cent of all new parallel imports sold between January and June 2008, while Toyota, the world's biggest car maker, makes up 41.1 per cent. Together, Honda and Toyota constitute 88 per cent of all first-half parallel imports. The pace of Q2 sales has not slowed down compared with Q1. In fact, Q2's volume is slightly higher than Q1's. One interesting feature of H1 2008 is that the Nissan brand is suddenly a PI favourite with 145 units sold during this period, compared with just 27 grey imports for the whole of 2007. This is mainly due to the overwhelming popularity of the high-performance Nissan GT-R sports car (88 units in H1 2008) and the compact Dualis SUV (37 units). The first GT-R arrived here in January as a grey import and it will only be available from authorised Nissan distributor Tan Chong Motor Sales sometime in the second quarter of 2009. The four Japanese brands combined - Honda, Toyota, Suzuki and Nissan - account for a whopping 94.4 per cent of all PI year-to-date sales. Among PI models, the most popular is the Honda Fit with 2,058 units. This diminutive five-door hatchback arrived here last November while the Jazz, the export version from authorised distributor Kah Motor, will only be ready for registration nearer year-end. The Stream compact MPV is No. 2 with 1,865 units, while No. 3 is the domestic Japanese version of the ever popular Toyota Corolla, called the Axio (1,406 units). Also noteworthy is the number of Mercedes-Benz cars - 142 units in the first six months versus 236 for 2007 - a fact that can be attributed largely to the new C-Class model (43.7 per cent of total Merc registrations).

-

Hi everyone, just wonder if any of our bros here in the car sales industry? I want to try this job but is it a gd time to join now? Average potential income? Any info comments n info welcome. Thks!

-

Any bro and sis buying tickets tomorrow? Which will you buy? I think I can only afford max $300...so sad still not called up for volunteer job yet...wonder if there will be a mad rush for tickets. Taken from the official website http://www.singaporegp.sg/news/14_02_2008.html: Three-day passes to the 2008 FORMULA 1

-

June 27, 2008 Pricey petrol dampens appeal of 'budget' cars Models priced under $60,000 are hardest hit as monthly payment matches petrol bill By Christopher Tan, Senior Correspondent RECORD pump prices have put the brakes on budget-car sales, as monthly petrol bills begin to match or overtake car-loan instalment payments for some models. Trade figures for the first five months of the year showed sharp falls of 50 per cent or more in sales of brands like Chevrolet, Hyundai, Kia and Ford. Models priced below $60,000 were hardest hit. The Chinese brands are also reeling. Mr Paul Ng, general manager of Vertex Automobile, which distributes China's Chery, said buyers may be able to afford monthly instalments on a car, 'but what about petrol, electronic road-pricing and parking?'. 'Budget cars are bought by budget buyers. With inflation so high, these people would want to take care of necessities rather than spend on a big-ticket item,' said Mr Ng. A Straits Times estimate shows that some car buyers may have to fork out as much for fuel as their car-loan instalments. For instance, the monthly payment on a 90 per cent, 10-year loan for a Chinese car like the Chery QQ is $290. Based on an average annual mileage of 22,000km, petrol bills for the car are not much lower at around $236 a month. Early last year, the monthly instalment and fuel bills were $280 and $173 respectively. The same monthly payment for an off-peak Geely is $193. Assuming off-peak cars clock 30 per cent less mileage, the monthly fuel bill would be about $215. Last year, the monthly instalment and petrol bills were $174 and $161. Mr Kevin Kwee, executive director of Geely agent Group Exklusiv, said rising running costs have dampened buying sentiment, especially in the lower end of the market. 'We are still very clear that Geely is targeted at off-peak car buyers and buyers who want low maintenance and low insurance cost,' Mr Kwee said. 'But based on sales results, we're not yet successful in reaching out to them.' Mr Albert Pang, managing director of Chevrolet dealer Alpine Motors, attributed the sharp drop in Chevy sales to 'a lack of new models in the first part of the year', but said that 'the price of petrol has a part to play too'. Besides inflationary pressure, which affects mostly first-time buyers, industry observers also cite the problem of 'negative equity' that many car owners face today. The term refers to the resale value of their existing car being lower than the loan balance owed to the bank. Motorists in this situation find it harder to trade in for a new vehicle. According to Motor Traders Association data, 23 out of the 33 member brands suffered a drop in sales in the first five months of the year. And of the 10 which bucked the trend, seven were luxury brands, including Mercedes-Benz, BMW, Audi, Maserati and Ferrari. Honda and Subaru were two mass-market marques with improved sales. Mr Ng of Vertex commented: 'For luxury-car owners, petrol and ERP are not big considerations.' [email protected] http://www.straitstimes.com/Free/Story/STIStory_252012.html

-

Sales of sport-utility vehicles have plunged this year because of rising petrol prices but larger premium models seem to be less affected than those from the smaller and cheaper brands. Generally, SUVs consume more fuel as they often have permanent four-wheel-drive and also because they are usually bigger and heavier than many saloons and hatchbacks. But they have been popular among car buyers because of their rugged styling and commanding view of the road, due to the higher driving position. In the first four months of this year, total sales of SUVs dived almost 30 per cent to 1,326 units compared with the same period last year among members of the Motor Traders Association of Singapore (MTA), a grouping of authorised distributors. But if this number is divided into mid-sized SUVs (usually smaller and cheaper) and large-sized SUVs (more upscale), then the former was hurt more badly with sales plunging 37.4 per cent to 817 units this year. Those categorised as mid-sized SUV models here include the Hyundai Tucson and Santa Fe, Kia Sportage, Mitsubishi Outlander, Mazda CX7, Suzuki Vitara, Honda CR-V and Toyota RAV4, among others. By comparison, the number of larger and more expensive SUV models has only slipped 4.7 per cent to 509 units. These include the BMW X5, Lexus RX series, Volvo XC90 and Nissan Murano, among others. Last year, MTA members sold 3,329 mid-sized SUVs and 1,569 larger SUVs for a combined 4,898 units in a market of 81,493 cars (excluding parallel imports), or a 6 per cent market share. So far until April this year, the SUV market share among MTA members is 5.4 per cent of the 24,515 total. 'An SUV is a bigger car and consumes more petrol,' says one motor distributor. 'With fuel prices so high now, of course not as many people will buy one.' He adds that another factor could be the lack of new models. 'Most of the popular models are not new, so there is less buying interest,' he says. One model which has not seen as big a drop in sales as the rest of the market is the popular Honda CR-V. Authorised distributor Kah Motor says this is because of its 'good fuel economy'. For example, the two-litre model with its relatively small engine is 10 per cent more fuel efficient than the previous model. As a result, total CR-V sales of 314 units in the first four months of 2008 are only 19.9 per cent lower than in the same period last year. On the other hand, a bigger-capacity model like the 3.6-litre Volkswagen Touareg has seen monthly sales fall by half. 'At the moment, most people are staying away from cars with big engines,' says a salesman. But not all big SUV models are in the same situation. BMW's X5 is bucking the trend, with 80 units sold in the first five months of this year. The premium German make's seven-seater SUV has 3.0 and 4.8-litre engines and costs between $250,000 and $350,000. It is a relatively new model as it was launched only in the second half of 2007. Another luxury marque which is seeing rising sales is Land Rover. Its ruggedly handsome models include the stylish Range Rover Sport with a 4.2-litre supercharged V8 engine costing $380,000. In the first four months of this year, total sales were 28 units, up 180 per cent over the same period last year. A spokesman for Vantage Automotive says its customers are attracted to Land Rover's strong brand heritage and its unique driving experience. He adds: 'Fuel consumption has never been the major consideration of our target group.' SUV really Is a Water Drinker

-

surprise to see so many FN2R on sale. all so new! anyone knows why? http://www.sgcarmart.com/main/listing.php?...=&sb.x=0&sb.y=0

-

I understand that many sales people always do their own personal things at office hours or maybe look for places to go to "kill" time. Can i just know what kind of products u sell if u have lots of free time? Also like to know for those who are always somehow busy 80% of the time, what products/services u are selling? I am just curious to know.

-

May 16, 2008 Further drop in new home sales and launches in April Prices also show signs of weakening as buyers adopt a more cautious stance By Fiona Chan THE private home market continued to weaken last month, with launches of new homes falling to their lowest level in at least 10 months. Sales volumes and median prices also dipped, according to monthly figures released by the Urban Redevelopment Authority yesterday. Developers launched only 271 homes last month, fewer than half the 642 units launched in March. The number of homes sold also fell, to 274 in the month, from 322 previously. These figures exclude executive condominiums. 'It is clear that homebuyers were in no hurry to make purchases and were taking more time to assess the market,' said Mr Li Hiaw Ho, the executive director of CB Richard Ellis (CBRE) Research. He attributed this trend to the continuing instability of financial markets and increasing concerns over the higher cost of living. Perhaps as a result of the slowdown, prices have begun to show signs of strain. An analysis by property firm Knight Frank found median prices of new homes sold last month had slid 9 per cent to $943 per sq ft (psf), from $1,035 psf in March. One reason for the lower prices could be that most of the homes launched and sold were in cheaper mass-market developments. Eight out of 10 homes sold in the month cost $1,000 psf or less. Only seven homes, or about 2 per cent of the total sold, fetched more than $2,000 psf. This is a major reversal from previous months. As recently as in December, more than 70 per cent of the homes sold for the month cost more than $2,000 psf. The strength of the mass-market segment last month was the bright spot in an otherwise dismal set of figures yesterday. The best-selling project was a suburban development: Stadia in Yio Chu Kang Road, which sold more than 90 per cent of its 56 units within the month. 'Latent demand remains strong, especially for the mass-market projects that are reasonably priced between $750 and $850 psf,' said Mr Chua Yang Liang, the head of South-east Asia research at Jones Lang LaSalle. On the other hand, only three units were launched in the prime core central region. Demand for homes in this high-end area and in the mid-tier city-fringes remained fragmented and weak, said Mr Chua. Property consultants said they expect buying activity to remain slow in the coming months as the current gloomy sentiment persists. But some, such as CBRE's Mr Li, expect sales to start improving next month as developers begin stepping up launches. Mr Ku Swee Yong, Savills Singapore's director of business development and marketing, said buyers are starting to return to the market. 'I dare say last month's sales numbers will be the lowest we will see this year,' he said. 'Showflat crowds are still pretty good, and from now on, we should see launches picking up.' Having some high-profile launches would give the market a boost, said Mr Nicholas Mak, the director of research and consultancy at Knight Frank. 'Essentially, the lukewarm sentiment can be explained primarily by the lack of launches of major developments that might cause excitement.'

-

Hi, A kpo qn. I know we can get the sales by make from the one motoring website. But is there any way we can see sales by make and models? Eg Honda Civic 1.6, 1.8 etc?

-

Hi Was wondering how much is the estimated difference between a second owner car instead of the first owner? Is there sort of any unwritten rules or calculations? Tried asking one dealer but the price is like , quoting "cos you're the 2nd owner else 1st owner give you 5-10k more". Though my car is like only 1 year old and tip-top. Sort of gave up after that.

-

Business Times - 23 Apr 2008 Honda races to top of parallel import sales chart By SAMUEL EE PARALLEL imports (PIs) continued to race ahead in the first quarter of this year. And the most popular PI brand is now Honda, not Toyota. Between January and March, the 100 or so PI retailers here sold 5,669 cars, according to the Land Transport Authority. This accounted for 22.9 per cent of the 24,798 new cars registered in Q1 - an increase from 20.9 per cent for the whole of 2007. And where Toyota once ruled the parallel universe, the first three months saw it being overtaken by Honda. Honda PIs notched up 2,491 registrations in Q1, slightly ahead of Toyota's 2,397. The current position of Japan's second-biggest carmaker as the most popular PI make mirrors that of its ranking, for now, among authorised distributors belonging to the Motor Traders Association of Singapore (MTA). In Q1, Honda also upstaged Toyota among MTA members to claim top spot. But there are still three quarters to go in 2008, and the Toyota juggernaut could easily end the year as the best-selling marque in the MTA and PI arenas - just as it has every year since 2002. For now though, Honda is the leader and its Stream compact MPV is the most popular PI model. In Q1, 1,062 units were sold, or almost in every five PI cars. This is no surprise because the Stream also ended 2007 as the top model. The No 2 PI spot in Q1 went to the Toyota Corolla Axio (722 units) and No 3 to the Honda Fit (640), a new generation of the popular small hatchback which is yet to be imported by authorised distributor Kah Motor. The once popular but now ageing Toyota Wish (377 units) ranked fifth position, behind the Honda Airwave (390). The jump in PI numbers is especially significant in the context of a shrinking overall market. Last year, 106,710 new cars were registered - an 8.8 per cent fall from the all-time high of 117,062 in 2006. This year the industry is not expected to sell more than 98,376 cars because of a reduction in the COE quota. With PI sales surging in a shrinking market, they must be eating into the share of authorised distributors. MTA members sold 18,384 units in Q1 this year. In other words, one PI car was registered for about three MTA cars - a ratio that has been rising steadily in the PIs' favour. In 2007 it was one PI car for roughly four MTA cars. In 2006, it was one for about six. The improvement marks a turnaround for the PI trade from just a few years ago, when it appeared close to collapse. In 2004, the number of PI cars was about 4,000 after the government cracked down on rampant under-declaration, among other things. That figure was a big drop from 2003's 7,500 or so units and at odds with the strong growth of the overall passenger car market, which was riding on an increasing supply of COEs. But the PI business turned around in 2005 - sales rose to 6,282 units before rocketing to 16,137 in 2006. One year later, 2007's 22,304 grey imports set another record. So will 2008 be a boom year for PIs? It could be because of a parallel-imported car's more attractive pricing. But authorised distributors complain that this is due to grey importers' lower OMVs (open market values) and willingness to offer CNG (compressed natural gas) conversions, which reduce the selling price of the new car through a 40 per cent green vehicle rebate.

-

Thursday, April 10, 2008 Subaru Halts Sales Of WRX, Legacy And Forester Due To Engine Issues If you were planning on buying a new Subaru WRX, or any other Subaru using the EJ25 for that matter, you might want to hold off on your purchase for a while... The automaker has received a low number of complaints regarding big-end bearing failure on a small number of brand-new WRX's and has directed dealers to halt all sales until the cause is pinpointed and a remedy, if necessary, is found. The problem only affects turbocharged models using the EJ25, which means that all brand-new Forester XTs, Impreza WRXs and WRX STIs, and Liberty/Legacy GTs built since early January will be affected by the hold up. Given the low number of actual bearing failures (less than 10), some might see the sales stoppage as an extreme reaction by Subaru. We're glad they're playing it safe and doing the right thing by the customer, and although they're shooting themselves in the foot sales-wise it's a move that should hopefully increase buyer confidence in the brand for the long-term.

-

Pioneer P80 and 12 pcs CD changer for sales. Local set but warranty over, used for a year plus. Good condition. $480 for both. Sms 90666330 to deal.

-

I'm just curious, if you are an Out-Door Sales Personal like me, what do you do during your spare time at work? Its no secret that Out-Door Sales People have more spare time at hand & we manage our own time. So what do you do when you have time to spare? Care to Share?

-

Anybody have any idea where to find free online car classifieds? I check yahoo but bo liao appreciate any help...it would be great if you can provide links also! TKs

-

To those in either Marketing or Sales as a career I was having a chat with a group of friends when this observation came about 1)Sales jobs seem to pay on the lower end compared to other functional displine such as HR, of course there is commission but as an employee you are indirectly participating in the profits of the co (i.e the value you can add which determines your salary, is to a great extent determined by the kind of company / business you work for eg if you work for sme, there is a limit to how much you can participate in the biz's profits due to the scope and reputation of the biz, if you work for mnc, they don t need you to push their products that hard (in most cases) so this results in a)more sme opportunities i find in sales b)Pay of Sales job generally lagging behind c)Abundance of supply of Sales and Marketing people perhaps leading to more competition in job leading to lower salary d)facing targets for not so attractive pay my friends in hr easily earn 7-8k and they are only middle hr managers(age 31-33), don t have to face targets and generally work for mncs which have a more stable and comfortable work environment and most probably on their way to 5 digit salaries in a few years. barring those real estate agents and insurance agents, i don t really see this opportunity in sales and in marketing with the specific experience (industry) usually being a barrier it does nt seem as attractive. HR on another hand is more versatile and functional The truth is i am a little tired with chasing targets and the prospects of sales seem waning with the above factors and am contemplating a chance of job function to hr (start from scratch) while i am still not too old - was told i most probably start again from 2.5 - 3k but will go up to 5-6k in 4 to 5 years and etc. In addition sales jobs are very age sensitive so i might expire early if i go on. guys need your comments from those who have experienced a career transition or whatsoever

- 29 replies

-

- Career

- Transition

- (and 4 more)

-

1. Despite the facts that we're seeing the emergence of better spec Korean cars but when we look at the Sales figure of Hyundai in Singapore, it has been declining since year 2004. Year 2004 = 13,796 Year 2005 = 12,860 Year 2006 = 10,007 Year 2007 = 5,440 and Kia is no where to be seen on the Top 10 list. 2. This make me pondering that a simple economy theory exists where when the economy is good, people will buy more expensive stuff than cheaper items. Regards,

-

Anyone visited the Prima Deli outlets today yet? The saying goes that "Singaporeans have short memories, if the food is good and cheap, they will still flock to buy" So what strategy will PD deploy this week?

-

Hi All, Just received a sales booklet from Audio house. they pricing is really mad.. and i saw Garmin Nuvi 200 selling at 200 plus only... not just only that, other stuffs are selling very cheap too.. so who is using nuvi 200, is it good?

-

from CB: http://www.carbuyer.com.sg/?s=news_main&id=516 November round 1: Slow sales, despite a COE rebound A rebound in Category A COEs sees them close to $17,000 again. So why is the motor trade worried? PRICES FOR CERTIFICATES Of Entitlement ended higher today, but not to the extent one would have expected of a healthy car market. Category A COEs (for cars up to 1.6-litres as well as taxis) ended today

-

Deregistrations fall, pointing to slower sales of new cars ahead Dealers of Japanese cars may be hit hard as Cat A leads drop THE first nine months of 2007 were characterised by a remarkable reduction in the number of deregistrations, and this could point to a slowdown in new car sales for the near future. This drop in cars being scrapped means that in the short term, there will be fewer buyers of new cars because fewer owners are replacing their vehicle for a new one, say some motor distributors. 'The drop in Category A deregistrations is even more pronounced, and since this is the bread and butter category which accounts for volume sales, it could hit us badly,' says the senior executive of a popular Japanese dealership. Cat A certificates of entitlement are used to registers cars below 1,600 cc. Since the beginning of the year, there has been a 31 per cent plunge in the number of deregistrations. In January 2007, 4,425 cars were taken off the road. In August, the number was just 3,058. For Cat B - cars above 1,600 cc - it was 2,532 cars scrapped in January and 1,809 in August. Fewer cars are being deregistered these days after the Preferential Additional Registration Fee (Parf) benefits - or scrap rebate - were lowered for cars registered after May 2002. Then in 2003, the government eased restrictions on car financing and the liberalisation led to the industry offering 100 per cent loans and 10-year repayment periods. Car owners who took auto financing with such conditions later found it difficult to settle their outstanding loans if they wanted to trade in their cars for a new one. 'There are no new hot, mass-market models to get people excited. There has to be a real incentive to draw them into the showroom,' says one sales manager. He adds that one such incentive could be if the COE premium suddenly dives, like it did for Cat A in the second half of August. 'But when that happens, people rush in to buy and push the premium up again. Then everyone holds back because the COE premium is now so high. So car bookings cool down and market becomes lacklustre again,' he says.

- 45 replies

-

- Deregistrations

- fall

- (and 5 more)

-

Toyota remains the market leader in Singapore By SAMUEL EE HONDA is racing ahead in the sales stakes and is now in the No 2 spot among members of the Motor Traders Association of Singapore (MTA), after claiming the No 3 position just last year. Toyota is still Singapore's most popular make among MTA members after the first nine months of 2007 - a position it has been enjoying since 2002. From January to September, authorised distributor Borneo Motors sold a total of 13,822 Toyota or Lexus cars. Lexus is the luxury division of Japan's biggest car maker. But today, Toyota is looking at a very different competitor just below it. Where Nissan used to reside as the runner-up for five consecutive years, Honda is now comfortably ensconced. In the first nine months of this year, authorised distributor Kah Motor registered 8,567 cars. Nissan, on the other hand, had 7,850 units in the same period. Nissan, which had been runner-up to the Toyota juggernaut for five consecutive years, was overtaken by Honda in early August. This is the second time in two years that Honda has surged ahead in the MTA rankings. In July 2006, it overtook Hyundai for the No 3 spot and ended the year by finishing in the top three, after Toyota and Nissan. In 2006, the top three makes were Toyota, Nissan and Honda, in that order. Last year's all-Japanese line-up was achieved after Honda edged out Hyundai from its traditional third place. For 2007, it looks like Team Japan will make a further improvement by sweeping the top four positions because the current No 4 spot is occupied by Mitsubishi, which sold 6,544 cars. It has displaced Hyundai, which has fallen to No 5 with just 4,515 cars sold. Even if its 1,778 Sonata taxis are included, Hyundai's grand total of 6,293 is not enough to beat Mitsubishi. The traditional price advantage which Hyundai models used to enjoy has been eroded by a move upmarket as well as the stronger Korean won. These factors allowed entry-level Japanese alternatives like the Nissan Sunny and Mitsubishi Lancer to race ahead on the weaker Japanese yen. Not unexpectedly, Honda and Mitsubishi were among those makes which also posted an increase in market share among MTA members. Honda's year-to-date market share of 13.5 per cent is a 2.6 per cent improvement over the same period last year, while Mitsubishi's 10.3 per cent market share is 1.6 per cent higher. An estimated 63,600 cars were sold by MTA members from January to September. Toyota's market share continues to slip but the juggernaut's huge base means it is in no danger of losing its market leader status. For the first nine months of 2007, it had a market share of 21.7 per cent, down 3.8 per cent over the same period in 2006. This means that about one out of every five cars sold by MTA members is either a Toyota or Lexus. But compared to four years ago, this proportion is down from what used to be almost three out of every 10 new cars. Just last year, Toyota accounted for 25 per cent of the 98,699 units sold among MTA members. An ageing model line-up and aggressive marketing by parallel importers are among the reasons for its diminishing volumes. This is MTA figure

-

October round 1: Sales slowdown brings COE pullback COE premiums fell dramatically today, confirming car dealers