Search the Community

Showing results for tags 'inflated'.

-

Kissed someone behind, one small dent. At first received letter from insurance say kena claim estimated a few k Now received letter from insurance say kena claimed 5 digits. The videos/photos were submitted to the insurance. If the see the video, will know obviously cannot be claim so high. What's going to happen now? Insurance say they will be handling the claim. Will they fight it if they think is too high? Since they say they will be handling, any inputs needed from my side?

-

Read this on ST not too long ago. Wah sei......looks like our resident MCF table wiper need to upgrade his title to Chief Dining Hygiene Specialist. --------------------------------------------------------------------------------------------------------------------------------------------------------------------- Some employers are tackling the chronic talent shortage by dangling a carrot that requires no extra cash but carries more than a hint of added prestige. These bosses are tempting new hires with grand-sounding, inflated job titles in the hope of attracting and retaining staff. Some experts believe such titles are particularly alluring to younger workers looking for instant gratification, rather than working their way up the ladder to a loftier title. One example of an inflated title on a business card might be "Chief of customer experience". This may be impressive at first sight, but less so, however, if the employee is simply a customer service officer and reports to a manager. Others might be an "order cash specialist head" or a "revenue assurance manager" - primped-up, modern-day versions of account receivables clerks, whose job is to review payment collections. Inflated job titles have been mushrooming across Asia, including in Singapore, in the last two to three years, recruitment experts told The Straits Times. "With more markets opening up rapidly in Asia, good talent has been in short supply and competition is stiff," said Ms Yuniatiria Simatupang, head of South-east Asia at Hong Kong-based executive search firm Bo Le Associates. "But a lot of companies lack the economies of scale to attract good employees, so they offer beefed-up titles instead." She estimates that as many as 20 per cent of the job seekers that Bo Le Associates deals with have inflated job titles. "Such a strategy could come with good intentions," she said. "An employer could be offering you the title of a division head or director, with the expectation that you will earn the position in a year's time. "But this might not happen, and, if you fail to perform, it's going to backfire. Both you and the company could end up on the losing end," she said. Ms Linda Teo, country manager of ManpowerGroup Singapore, noted that both multinational corporations (MNCs) and small and medium-sized enterprises (SMEs) are "equally eager in the exaggeration". The practice is most prevalent among consultancies and business services firms, and in the banking and finance sectors. She cited one candidate with the lofty title of a credit controller but the experience of a lowly account receivables assistant or executive. In the finance industry, the monthly remuneration for the two roles differs by at least $6,500. "Embellished job titles can attract candidates, especially the younger generation, who could be more inclined towards instant gratification," said Ms Teo. She added that this is compounded by a culture where the need for "face", or the prestige accorded through success and outward show, is highly significant. The experts agreed that companies offering such fancy, albeit superficial, job titles to their staff could end up losing credibility in the long run. "This creates a false impression for clients that the employee manages greater responsibilities," said Ms Teo. "And it will not reflect well on the employer's brand if he fails to deliver the level of service expected of him." By accepting such titles, employees, too, can create problems for their own job prospects. Said Ms Simatupang: "You may be able to get away with your inflated job title for one company, but not another. If you can't prove your worth, the market is bound to recognise it, and this can put an end to your career altogether." Mr Tim Klimcke, associate director of Robert Walters Singapore, said that with more people using social media these days, it has become easier for employers or hiring managers to carry out checks on whether one's job scope tallies with his job title, as "a job title doesn't always reflect what someone has actually done". He added: "We always encourage people to focus on the content of the position, as opposed to the title." Hiring managers, for their part, should look towards other methods to motivate staff, such as giving out best employee awards, instead of "paying lip service" by inflating job titles, said Ms Teo. "Expanding their staff's job scope and responsibilities... or empowering them to make decisions also goes a long way to building a good supervisor-worker relationship, which would help to retain and motivate them."

-

Now he also chup motor insurance liao? Anyway a good reminder article nonetheless Just doubt the relevant folks would listen... From ST Forum: http://www.straitstimes.com/premium/forum-...claims-20121113 Motor insurers should tackle root causes of inflated claims Published on Nov 13, 2012 ACCORDING to the General Insurance Association of Singapore, regulations introduced in May last year require motorists making property damage claims to give other motorists or their insurers the opportunity to inspect the damage to the vehicles before repairs are undertaken ("Pre-repair inspection rule for accident vehicles"; last Friday). The association should state the percentage of third-party claims that follow this regulation. Anecdotal evidence indicates that payments for third-party damages continue to be high, contributing to hefty motor insurance premiums. Also, are a significant proportion of these claims made through lawyers, and do their fees add to the cost of the claims? Perhaps the insurer paying the claim should also be given the opportunity to settle it without the need to incur legal fees. The requirement to report directly to the paying insurer should be made mandatory by law, rather than being a non-binding regulation by the insurance industry. This will be more effective in addressing the exorbitant cost of third-party claims. In my consulting work in the region, I know that the cost of motor repairs in Singapore is several times that in neighbouring countries. While this can be partly explained by the higher cost of doing business here, the scale of the difference indicates that there are other contributing factors. The motor insurance industry should address the root causes of inflated claims and bring relief to consumers, who now continue to suffer increases in premiums. Tan Kin Lian President Financial Services Consumer Association

-

Yesterday while I was on the expressway, I caught up with this Altis on Lane 1 where I can see the right rear was under inflated and it looks like the sidewall is going to burst anytime. I horn at the driver to get his attention but either he didn't hear or just ignore me as he didn't even look at the rear view mirror. As I had to exit, so I didn't bother to get his attention anymore and quickly get as far as I could away from him. This is the kind of driver I'm most afraid to meet on the road as they are posing danger on the road and have totally no clue what's going on.

-

Well done Patrcik ! June 17, 2008 Valuation the culprit in artificially inflating HDB flat prices OVER the past 18 to 24 months, HDB resale property prices have shot through the roof and many lower-income families have been priced out of the market. Although this is partly driven by the shortage of HDB flats and increased demand, what is not apparent to many people is the manner in which valuations have artificially fuelled inflation. Take the three-room flat, for example. This is the smallest HDB flat and is targeted at the lower-income group. Between March and May, prices of a three-room flat in Yishun, in the same block and with the same floor area, have shot up by between $18,000 and $30,000. The price of a similar three-room flat in Ang Mo Kio ranges from $184,000 to $300,000 in the same period. Similar trends are observed in almost every estate and in almost every flat type. I accept that several factors may account for the differential in the value of a property, but is it realistic to expect the valuation of the same type of flat in the same block to have risen by 10 to 50 per cent over a short three month period? Even if the interior renovation of a unit is particularly good, could it account for such a difference? And why does the trend keep increasing? A check with several properties in the weekend classifieds shows that the valuation of similar properties in these locations has gone up by at least another $10,000 since the last transacted prices last month. What can justify the drastic increases? A three-room flat in a choice location, such as Bishan and Ang Mo Kio, now costs more than $300,000. A two-bedroom private apartment in an older development costs only slightly more - a clear sign that HDB flats are over-priced and out of reach for some lower-income families. It seems that, in valuing a property, the valuer takes the last transacted price as a benchmark. Since the last transacted price includes the cash top-up sellers usually demand from buyers, the value of the property is artificially inflated. Past experience in Singapore and Britain shows that when property prices are artificially inflated by valuation, sooner or later, prices will crash and many people will suffer. The HDB should bar inclusion of the cash top-up in valuations. Patrick Tan

- 176 replies

-

- Artificially

- inflated

-

(and 2 more)

Tagged with:

-

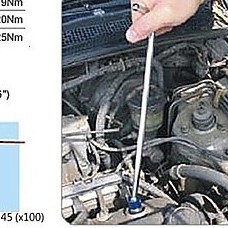

Checked my space saver spare yesterday and visually it looked fine. Prodded it and din feel soft. Never used it b4 and it's abt 1yr old. But since i was pumping the tyres yesterday, i decided to open up the boot, etc (damn leceh..) to check the spare's pressure too. The spare's sidewall indicated in bold, "Inflate to 60psi". Got a shock when it was onli 28psi all this while tho it looked fine. Thot i'd share this so MCFers to go check their spares too.