Search the Community

Showing results for tags 'funds'.

-

Respect. someone really dare to check their PM's personal bank account! http://www.wsj.com/articles/SB10130211234592774869404581083700187014570 Prime Minister Najib’s bank accounts are scrutinized in probe of investment fund 1MDB. By Tom Wright And Simon Clark July 2, 2015 4:42 p.m. ET KUALA LUMPUR, Malaysia—Malaysian investigators scrutinizing a controversial government investment fund have traced nearly $700 million of deposits into what investigators believe are the personal bank accounts of Malaysia’s prime minister, Najib Razak, according to documents from a government probe. The investigation documents mark the first time Mr. Najib has been directly connected to the probes into state investment fund 1Malaysia Development Bhd., or 1MDB. Mr. Najib, who founded 1MDB and heads its board of advisors, has been under growing political pressure over the fund, which amassed $11 billion in debt it is struggling to repay. The government probe documents what investigators believe to be the movement of cash among government agencies, banks and companies linked to 1MDB before it ended up in Mr. Najib’s personal accounts. Documents reviewed by The Wall Street Journal include bank transfer forms and flow charts put together by government investigators that reflect their understanding of the path of the cash. The original source of the money is unclear and the government investigation doesn’t detail what happened to the money that went into Mr. Najib’s personal accounts. Advertisement “The prime minister has not taken any funds for personal use,” said a Malaysian government spokesman. “The prime minister’s political opponents, unwilling to accept his record or the facts, continue to try to undermine him with baseless smears and rumours for pure political gain.” Mr. Najib has previously denied wrongdoing in relation to 1MDB and has urged critics to wait for the conclusion of four official investigations that are ongoing into 1MDB’s activities. Investigators have identified five separate deposits into Mr. Najib’s accounts that came from two sources, according to the documents viewed by the Journal. By far the largest transactions were two deposits of $620 million and $61 million in March 2013, during a heated election campaign in Malaysia, the documents show. The cash came from a company registered in the British Virgin Islands via a Swiss bank owned by an Abu Dhabi state fund. The fund, International Petroleum Investment Co., or IPIC, has guaranteed billions of dollars of 1MDB’s bonds and in May injected $1 billion in capital into the fund to help meet looming debt repayments. A spokeswoman for IPIC couldn’t be reached for comment. The British Virgin Islands company, Tanore Finance Corp., couldn’t be reached. ENLARGE Another set of transfers, totaling 42 million ringgit ($11.1 million), originated within the Malaysian government, according to the investigation. Investigators believe the money came from an entity known as SRC International Sdn. Bhd., an energy company that originally was controlled by 1MDB but was transferred to the Finance Ministry in 2012. Mr. Najib is also the finance minister. The money moved through another company owned by SRC International and then to a company that works exclusively for 1MDB, and finally to Mr. Najib’s personal accounts in three separate deposits, the government documents show. Nik Faisal Ariff Kamil, a director of SRC International, declined to comment. Mr. Kamil had power of attorney over Mr. Najib’s accounts, according to documents that were part of the government investigation. A 1MDB spokesman said, referring to the transfers into Mr. Najib’s account: “1MDB is not aware of any such transactions, nor has it seen any documents to this effect.” The spokesman cautioned that doctored documents have been used in the past to discredit 1MDB and the government. For months, concerns about 1MDB’s debt and lack of transparency have dominated political discussion in Malaysia, a close ally of the U.S. and a counterweight to China in Southeast Asia. When he founded 1MDB in 2009, Mr. Najib promised it would kick-start new industries and turn Kuala Lumpur into a global financial center. Instead, the fund bought power plants overseas and invested in energy joint ventures that failed to get off the ground. The fund this year has rescheduled debt payments. The Journal last month detailed how 1MDB had been used to indirectly help Mr. Najib’s election campaign in 2013. The fund appeared to overpay for a power plant from a Malaysian company. The company then donated money to a Najib-linked charity that made donations, including to local schools, which Mr. Najib was able to tout as he campaigned. “We only acquire assets when we are convinced that they represent long-term value, and to suggest that any of our acquisitions were driven by political considerations is simply false,” 1MDB said last month. The four probes into 1MDB are being conducted by the nation’s central bank, a parliamentary committee, the auditor general and police. A spokeswoman for Bank Negara Malaysia, the central bank, declined to comment. Malaysia’s police chief and a member of the parliamentary committee also had no comment. The auditor general said this week it had completed an interim report on 1MDB’s accounts and would hand it to the parliament on July 9. The prime minister is facing increasing pressure over 1MDB. The country’s longest-serving prime minister, Mahathir Mohamad, who left office in 2003, publicly has urged Mr. Najib to resign. This week, Malaysia’s home minister threatened to withdraw publishing licenses from a local media group, citing what he said were inaccurate reports on 1MDB. The $11.1 million of transfers to Mr. Najib’s bank account occurred at the end of 2014 and the beginning of 2015, according to the government investigation. Among the companies that investigators say it passed through was Ihsan Perdana Sdn. Bhd., which provides corporate social responsibility programs for 1MDB’s charitable foundation, according to company registration documents. Attempts to reach the managing director of Ihsan Perdana weren’t successful. Documents tied to the transfer said its purpose was for “CSR,” or corporate social responsibility, programs. The Wall Street Journal examination of the use of funds tied to 1MDB for Mr. Najib’s election campaign showed that the money was slated to be used for corporate social responsibility programs as well. The government probe documents detail how investigators believe SRC International transferred 40 million ringgit on Dec. 24 last year to a wholly owned subsidiary. This company on the same day wired the money to Ihsan Perdana, according to the documents. Two days after receiving the money, Ihsan Perdana wired 27 million ringgit and five million ringgit in two separate transfers to two different bank accounts owned by Mr. Najib, the government documents show. In February, 10 million ringgit entered the prime minister’s account, also from SRC International via Ihsan Perdana, the documents show. The remittance documents don’t name Mr. Najib as the beneficiary but detail account numbers at a branch of AmIslamic Bank Bhd. in Kuala Lumpur. Two flow charts from the government investigation name the owner of these accounts as “Dato’ Sri Mohd Najib Bin Hj Abd Razak,” the prime minister’s official name. A spokesman for AmIslamic Bank declined to comment. In another transaction, Tanore Finance, the British Virgin Islands-based company, transferred $681 million in two tranches to a different account at another Kuala Lumpur branch of AmIslamic Bank. The government probe said the account was owned by Mr. Najib, according to the documents. The transfers came from an account held by Tanore Finance at a Singapore branch of Falcon Private Bank, a Swiss bank which is owned by IPIC, the Abu Dhabi fund, according to the documents. A spokesman for Falcon Private Bank declined to comment. The $681 million was transferred to Mr. Najib’s accounts on March 21 and March 25, 2013, the government documents show. Write to Tom Wright at [email protected] and Simon Clark at [email protected]

-

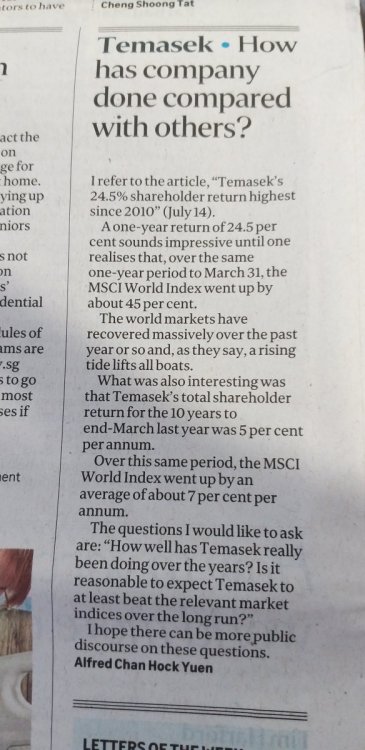

Saw this recently https://www.straitstimes.com/business/temaseks-245-shareholder-return-highest-since-2010 Saw this today

-

Hi guys, I'm into baking now. So far being successful with pineapple tarts, choc chip cookies, muffins. I'm thinking of helping people affected by Covid 19. Anyone know of any charity initiative or project that I can work with, to raise funds through my baking? It also give me a chance to perfect my baking skills. LOL

-

What it means to be a successful investor in 2016 can be summed up in four words: bigger gambles, lower returns. Thanks to rock-bottom interest rates in the U.S., negative rates in other parts of the world, and lackluster growth, investors are becoming increasingly creative—and embracing increasing risk—to bolster their performances. To even come close these days to what is considered a reasonably strong return of 7.5%, pension funds and other large endowments are reaching ever further into riskier investments: adding big dollops of global stocks, real estate and private-equity investments to the once-standard investment of high-grade bonds. Two decades ago, it was possible to make that kind of return just by buying and holding investment-grade bonds, according to new research. In 1995, a portfolio made up wholly of bonds would return 7.5% a year with a likelihood that returns could vary by about 6%, according to research by Callan Associates Inc., which advises large investors. To make a 7.5% return in 2015, Callan found, investors needed to spread money across risky assets, shrinking bonds to just 12% of the portfolio. Private equity and stocks needed to take up some three-quarters of the entire investment pool. But with the added risk, returns could vary by more than 17%. Nominal returns were used for the projections, but substituting in assumptions about real returns, adjusted for inflation, would have produced similar findings, said Jay Kloepfer, Callan’s head of capital markets research. The amplified bets carry potential pitfalls and heftier management fees. Global stocks and private equity represent among the riskiest bets investors can make today, Mr. Kloepfer said. “Stocks are just ownership, and they can go to zero. Private equity can also go to zero,” said Mr. Kloepfer, noting bonds will almost always pay back what was borrowed, plus a coupon. “The perverse result is you need more of that to get the extra oomph.” Bonds historically produced a source of safe, good-enough streams of profit that allowed long-term, risk-averse investors to hit annual targets. The era of low rates has all but erased that buffer. The absence of a few extra percentage points of yield means investors must now compensate by embracing unsafe bets that could strike big—or flop. The Callan report highlights how risky an endeavor that is. “Not nearly enough attention has been paid to the toll these low rates—and now negative rates—are taking on the ability of investors to save and plan for the future,” BlackRock Inc. Chief Executive Officer Laurence Fink said in a recent letter to shareholders. Some investors such as David Villa of the $100 billion State of Wisconsin Investment Board argue that at near zero, rates are artificially suppressed, and it’s creating bubbles in asset prices. Advertisement “We know the Federal Reserve is trying to trick us—we’re dealing with distortions,” said Mr. Villa, referring to how low rates have historically encouraged investors to take on more risk. “They want us to invest in building new things, but what [investors are] doing is trading existing assets at higher and higher prices.” Many large investors aren’t gambling that big—and their returns are lagging well behind internal targets. The nation’s largest public pension fund, the California Public Employees’ Retirement System, has one-fifth of its assets in bonds and is down 1.3% since July 1, according to public documents. The system, known by its abbreviation Calpers, also has 53.1% of its assets in stocks, 9% in real estate and 9.4% in private equity. In 2015, Calpers posted a return of 2.4%, below its target rate of 7.5%. The risk dilemma for investors has real-life consequences. Retirement plans, including Calpers and the New York State Common Retirement Fund, are lowering what they predict they can earn on their investments, a move that means workers and cities likely face higher contributions and taxes. For insurers, lower bond returns mean life-insurance policyholders pay more for coverage. It wasn’t always this complex. Two decades ago big investors had their money sitting primarily in U.S. stocks and bonds. Inflation was 4% and yields on investment-grade bonds roared upward at double that rate. After the 2008 financial crisis, central bankers pushed down rates to stimulate growth, dropping real returns close to zero for higher-quality debt. Government bonds in Japan and Europe now have nominal yields below zero. Cheaper borrowing costs generally spur new investments from companies or consumers. But instead, global production is flat or declining, and consumers face stagnant wages that crimp their ability to spend. That has pushed down the “neutral rate,” or the real rate of interest that neither accelerates nor decelerates the economy. It is now basically flat, compared with 4% or 5% in prior decades, said Roberto Perli, a partner at Cornerstone Macro, a macroeconomic research firm. While some investors are loading up on traditionally risky assets as a way of hitting ambitious targets, others—concerned about a slowing global economy—are wrestling with how to reduce risk without piling into bonds. ‘I can’t just reach out and grab a high-quality bond that’s yielding 6% or 7%. They don’t exist.’ —Tom Girard, New York Life Insurance Co. The nation’s second-largest public pension plan, the California State Teachers’ Retirement System, has shifted a significant amount of money away from some stocks and bonds to protect against a downturn. It moved assets into U.S. Treasurys and so-called liquid-alternative funds, which mimic hedge-fund strategies. Calstrs, as the pension is called, reported gains of 1.5% during a choppy 2015, with returns on its fixed-income investments up just 0.6%. “We used to say bonds would be that risk protection,” saidChristopher Ailman, chief investment officer at Calstrs. “Now we can’t.” For instance, in 2002, safer corporate bonds returned about 11%, while U.S. stocks fell roughly 22%, according to a Segal Rogerscasey analysis of the Russell 3000 stock index, plus historical bond returns tracked by Barclays and Citigroup. But during the 2008 crisis, stocks fell more than 37% and higher-quality bonds declined 3.3%, according to the Segal Rogerscasey analysis. More recently, those types of bonds fell during stock-market tumbles in August and December, Segal Rogerscasey said. Others are willing to accept lower returns for now and wait for better days ahead. The Wisconsin pension sold off trophy real-estate and private-equity holdings when it believed prices were high over the past two years and switched into publicly traded stocks and bonds that can be sold quickly, Mr. Villa said. Not all investors have the luxury of avoiding bonds. New York Life Insurance Co., which has about 89% of its $220 billion in assets in bonds, once could find what it needed among well-known, plain-vanilla securities. Insurers typically have large holdings of high-quality government and corporate bonds, because of state-regulatory guidelines encouraging safe investments. But now the insurer has to scour the globe for suitable bets in assets in which it had never before dabbled—such as complex bond deals involving railcar leases, shipping containers and legal-settlement payouts. The insurer has “looked under rocks, far and wide” to find suitable fixed-income investments, said Tom Girard, who leads New York Life’s fixed-income team. “I can’t just reach out and grab a high-quality bond that’s yielding 6% or 7%.” he added. “They don’t exist.”

-

By RYAN DEZEMBER In the latest effort by private-equity firms to broaden their customer base, Carlyle Group LP is letting some people invest in its buyout funds with as little as $50,000. The move comes as other large firms

-

anyone parked $ into SRS for purpose of tax planning? I have already used some of my SRS to purchase Singpost for dividend yields. Was hoping to use my remaining SRS to buy into safe S$-denominated money mkt funds which can reap higher returns than 0.05% pa. Current DBS SRS interest rate is about 0.05% pa. source: http://www.dbs.com/posb/others/additionali...ry/default.aspx Am comparing among Philip SGD Money Mkt fund, LionGlobal SGD Money Mkt fund and UOB SGD Fund now..any opinions?

-

dear all, human nature are greedy by nature. we have had so many cases of people mismanaging funds and using money which is donated to enrich themselves either directly or indrectly. may i suggest that charities or public funds be managed by billionaires. for eg. wee cho yaw has a net worth of $4B. for him to manage $100m of public funds, i think it would be in very very safe hands. anyone has any comments?

-

In traditional Yamaha fashion, the company announced a move that may finally allow it to stake a claim as the first big player in the breakout electric motorcycle category. By putting the For Sale Sign on 63.25 million corporate stock shares, the tuning fork company hopes to raise an impressive 812 million dollars that it will dedicate to a highly charged electric and hybrid engine development plan across both their two-wheeled (motorcycle and electric bicycle) as well as aquatic (boat and outboard motor) product lines. We have seen many concepts and indications of Yamaha's intent, but very little follow through up to this point. The plan seems to be part of a healing process following 2009 in which the company posted losses north of $2.3 billion. Yes folks, we said billion... ouch! Yamaha, a company that traditionally has been eager to carve its own path in the powersports segment, hopes new fuel efficient and electric designs will lead to increased popularity in developing markets that have an ever-growing importance to manufacturers industry wide. We are left holding our breaths as to when these developments will make their way into the U.S. That will, no doubt, be largely dependent upon our buying trends. In addition, the company has also pledged to make all of its offerings more competitive throughout its lineup. Most importantly, this means we will see some much needed diversity in the development of electric motorcycles. This from the company that brought us the fist modern four-stroke motocross bikes, as well as snowmobiles. We will eagerly look forward to Yamaha's new offerings, and the following jolt that it could mean for the company as a whole. Now, to figure out how to commute in the bicycle lane on our shiny new Yamaha electric motorcycle.

-

I always thought the if you can buy funds with CPF funds, then the MAS or CPF board would have vetted the investment vehicle HOW come now MAS has nothing to say now and play such low key the more i read about the minibond saga, the more are more dissappointed by the hands off approach by the government I am wrong to think this way http://tankinlian.blogspot.com/ Dear Mr. Tan, I refer to the plight of a small group of investors who uses their CPF funds, namely the SRS retirement fund, to purchase Lehman Brothers minibonds. I am sure many of these investors were literate in stocks but not sophisticated enough to understand the instruments used in a complex structure like minibonds especially back in early 2006. In those days when subprime and CDO problems have not surfaced, only Lehman Brothers and maybe the distributors knew how good a product Minibonds are. And i know several of these investors keeping the sadness and hatred to themselves. Maybe they were literate and they believed in the brochure and had not read further. Some i heard are government servants and they dont want to voice their feelings. I wonder why citizens in First World countries should hide their feelings. Back in the early launch of the minibonds I and II, retirement funds were allowed to be invested. Shortly thereafter all later series of minibonds were not allowed to be invested with retirement funds. Most of these investors receive mailers (like that attached) from the distributors in their letter box. Some of them receive it month after month . Looking at the brochure itself you can tell the strong powerful entities are in bold. The small prints if there is, will refer you to refer somewhere else (you got to get) from the distributors where they will elaborate on the "junk" CDO. The brochure also shows the investor sitting safely on the shoulder of a strong gaint. Isnt all these misleading. One investor told me, after looking at the quality of the reference entities of the brochure and since he has not invested in bonds before(when most of his investments are in risker stocks), he decided to use his long term old age retirement funds (SRS) to buy some safe bonds. Yes altho he did this all on his own accord but knowing SRS is allowed for minibonds , he was more confident of the product and immediately sign up to purchase the bonds. His intention and objective of using retirement funds are definitely safe and security and long term. This is definetely not appropriate to allow retirement SRS funds to be invested in something unsafe that can have $0 value. Something totally not right to call quality bonds when they are not bonds at all . A brochure that shows you sitting on the shoulder of a safe strong gaint. That is all totally misleading. I think a caring government ought to debate on whether this group of investors who are educated but prefered something safe with retirement funds but was misled by the brochure and have kept quiet because they are afraid the government is not happy if they were to voice their opinion. I think we should ask why retirement funds was allowed for bonds I and II and why they were removed for subsequent minibonds and who should bear this responsibility. Miss W Posted by Tan Kin Lian at 8:04 PM 0 comments Links to this post

-

hiz all, juz to check with the bros who are in funds super mart in this forum. trying to register and put in my bank details...those holding DBS acc will know there're only 9 digits but the com say should be 10 digits long... so how do i go abt doing it???

-

Are Town Councils really investing in stocks? Can someone who has a Creative annual report verify this? I hope this is not some cannot-clear-CFA-stage 3 fund mgr wannabe action that went unnoticed by audit inspections. http://www.mrbiao.com/blog/town-councils-i...ock-market.html

-

Hi, Anyone here in MCF have any experience with ETFs? How does it work? Care to share on your earnings/losses? Strategies? Thanks