Search the Community

Showing results for tags 'dbs'.

-

Happen to found while using my ibanking. Do you all think this kind of mobile wallet will be feasible? Personally, i still like cash in hand.

-

Let's start with this https://www.straitstimes.com/singapore/courts-crime/ocbc-bank-customer-lost-120k-in-fake-text-message-scam-another-had-250k-stolen Young couple lost $120k in fake text message scam targeting OCBC Bank customers SINGAPORE - It took a man and his wife five years to save about $120,000, but in just 30 minutes, scammers using a fake text message stole the money they had kept in their OCBC Bank joint savings account. The couple in their 20s were among at least 469 people who reportedly fell victim to phishing scams involving OCBC in the last two weeks of December last year. The victims lost around $8.5 million in total. The husband works in the e-commerce sector, while his wife is in the hospitality industry. The man said he received the phishing message with a link at around noon on Dec 21 last year. A 38-year-old software engineer who fell prey to the same scam on Dec 28 told ST that he lost about $250,000 he had been saving since 2010. The father of a young child with special needs said the loss has been devastating, and he has been hiding it from his family. The bank said it has since halted its plans to phase out physical hardware tokens by the end of March this year, and has also stopped sending SMSes with links in them in the light of the spate of phishing incidents. Cyber security expert Anthony Lim, who is also a fellow at the Singapore University of Social Sciences, said scammers have advanced software enabling them to spoof telecommunications services and send SMSes that appear in the same threads used by real organisations. He added that even if victims did not provide their one-time passwords (OTPs), they would have sealed their fate when they entered other bank details on the fraudulent sites. "Once the victim unwittingly responds by entering the bank account credentials, the hackers' technologies can divert and capture a copy of the SMS OTP issued by the bank," he said.

-

Tai jee liao liao. Heng, limpeh cancel the account years ago. Knn paylah also cant use. https://www.channelnewsasia.com/singapore/dbs-customers-unable-use-bank-digital-services-paylah-digibank-online-3381206 In a Facebook post, DBS says it is resolving the issue and will give an update as soon as services are recovered. MAS should issue them a hefty fine. No standard.

- 465 replies

-

- 7

-

-

.png)

-

- dbs

- bank services

-

(and 2 more)

Tagged with:

-

<Aston Martin V12 Vantage officially coming in 2022 Aston Martin’s dreamy small body/big engine combo is back, a new V12 Vantage is coming next year The Aston Martin V12 Vantage is officially on its way for the 2022 model year, with confirmation a top-spec Vantage is set to return to top the current Vantage range. Destined to follow the well-trodden and desirable path of shoehorning Aston’s most potent engine into its most compact model, the new V12 Vantage has already been spotted in its development phase and so far promises to be one of next year’s most exciting supercars. Official details are still scarce, but we do know that Aston Martin will be utilising a twin-turbocharged 5.2-litre V12 engine borrowed from both the DB11 and DBS models. Peak power is unconfirmed, but we suspect given the DBS’s flagship status that power will instead reside somewhere between the DB11 AMR’s 630bhp and the 700bhp of the DBS. Like all modern Aston Martin sports cars, power will likely be sent through an eight-speed automatic transmission sourced from ZF, rather than the Mercedes-sourced nine-speed found in the new DBX. This is mostly due to its location on the rear axle, which will also help the inevitable shift in weight distribution given the considerable weight gain from the V12 engine. We also know that both Vantage and DB models are due an update in the near future, suggesting that the V12 Vantage might introduce some of these elements, some of which might have already appeared in the limited-run V12 Speedster. This might include an adoption of the V12 Speedster’s dash layout, which is completely different to both the current Vantage and DB, incorporating more touch-sensitive control elements and a larger touchscreen interface that features a newer version of Mercedes’ MBUX interface. Exterior styling should also be given a substantial update to coincide with the V12 engine, incorporating new front and rear bumpers alongside a modern interpretation of the distinctive slatted bonnet that dominated the previous generation V12 Vantage’s aesthetic. We’ll have to wait until next year to quantify these ruminations upon its reveal, but the one thing we do know is that this V12 Vantage won’t be a limited edition, but rather a final edition, as Aston Martin has since confirmed that it won’t produce any more V12 Vantages after this model’s production run is through. With tightening emissions regulations, and the push towards new hybridised powertrains in its future supercars like the Valhalla, it looks like time is being called on this most iconic of Aston Martin nameplates, but let’s just be thankful we’ve got one more generation to enjoy.>

-

- 1

-

-

- aston martin

- v12

- (and 10 more)

-

https://m.facebook.com/story.php?story_fbid=10157731133872610&id=572922609 OTP FRAUD So this happened months ago, in January 2021, and has dragged on long enough to wear us out. At this point, we are helpless and have no idea how to move forward. It seems the last resort is to refer the case for adjudication and risk DBS retracting their offer of waiving 30% of the amount (and having to pay a 5-figure sum). Here’s what happened: Sometime in early January 2021, I tried using my supplementary credit card to make a purchase online but the transaction could not go through. I thought there was a glitch and simply used another card to make the purchase. A few days later, I tried using the same card and was told that my card was declined. Curious, I called DBS to find out why I hadn’t been able to use my card. It was then that I found out that I had almost exceeded the credit limit. Baffled, I asked for details of the transactions charged to my card since I only recalled using it for some items we needed for our new home. To my horror, I learnt that a total of SEVEN consecutive transactions were charged to my card, each amounting to approximately $1,400. The total damage was $10,150. Note that we had not received the hard copy of our credit card statement then. I informed the staff that I most definitely did not carry out these transactions and requested that they look into the case. Unfortunately, the bank told us that there is no way they are able to refund the money because these were secure transactions, made with OTP. But guess what? I did NOT receive any OTP for these seven transactions at all. The bank claimed I could have keyed in the OTP by mistake. But seven times?! Did the bank seriously think I would be tricked into giving the OTP to a stranger seven times? Long story short, we are liable for the charges. We were advised to lodge a police report so the police could investigate the matter, and were told that an investigation could help with our request for a refund. Imagine being told that there’s nothing you can do but to pay $10,150. I was heavily pregnant then, and was sooo flustered 😭 We rushed to the nearest police station to lodge a police report. So these seven transactions were made to TransferWise (now Wise), a website for monetary transfers abroad. Neither of us knew of TransferWise until this incident. The following morning, I called TransferWise to see if there was anything they could do. The transactions had gone through and there was no way they could reverse the transactions. By the time I called, they had suspended the account used to process these transactions. I was told that the bank had brought to their attention that the account could possibly have been used in a case of fraud, so they acted on the bank’s suspicion and suspended the account. A check showed that the transactions were wired to a Malaysian company, CWP Global Enterprise. The transactions were transferred and processed in ringgit. I then called the police officer assigned to our case and told her of what I had learnt and was asked if I could make a trip down to the station to add these details to my statement. The police has since concluded the case with no favourable outcome. We were told that there were no more leads so her superior advised her to conclude the case. She interviewed the TransferWise account user and found that it was a case of identity theft. Someone had used this person’s personal details to create an account on TransferWise. The transactions were not carried out by this person. A dead end is what we’ve come to. The bank refuses to do anything about the case and insists that we pay the sum of $10,150. In fact, they were unwilling to waive the monthly interest while the police investigation was ongoing. We explained that we had lodged a police report and were waiting for the police to get back to us. Still, they did not want to waive the interest of a few hundred bucks despite my husband putting in an appeal. If we had done nothing, the amount would have snowballed in no time. So I told hubby to go to our MP to see if he could get the bank to waive the interest for us. Days after Ethan’s birth, N went to see our MP, Mr Gan Kim Yong. His assistant helped send an email to Monetary Authority Of Singapore and DBS. The following day (yes, all it took was a day), a manager from DBS called N and told him that the bank would waive the interest for us while the investigation was ongoing. How efficient. Fast forward today.. We acted on the officer’s recommendation to bring our case to FIDReC, an independent and impartial alternative dispute resolution institution. The result? The bank explained that all the disputed transactions were deemed authorised by me since they could only go through with SMS OTPs. There were apparently SMS alerts sent to my mobile number once each disputed transaction was completed. At this point, I wish to reiterate that I did NOT receive a single SMS OTP or alert regarding any of the seven transactions, so help me God.. We are clearly victims of a fraud case. What do we do now? 😭 StarHub says they are only able to track incoming and outgoing calls, and outgoing messages — basically, “anything chargeable”, according to the customer service representative I spoke with. I asked if receipts of text messages are recorded in their system, and was told that Singapore Police Force would have to approach StarHub HQ for access to this data (still unsure at this point if they even have this data). This was communicated to the police officer but as I have said above, there is no favourable outcome — to be honest, I am not sure if she tried. Has any of you experienced something similar? Or do you know of someone who experienced something similar? If it’s not too much trouble, please help to share this post. Thank you 🙏🏼 EDIT: We did try to escalate the case to a higher authority i.e. the head of credit cards. Was told he would get the frauds team to look into the case, and that they’ve not encountered bypassing of OTP before. Frauds team concluded it isn’t fraud because the transactions are “secure with OTP”. I realised I didn’t mention that a total of 10 transactions were made and 7 went through because DBS only started to reject after the 7th transaction and sent a message or email to Wise warning of possible fraudulent activity. Yet they are telling me this isn’t fraud 🙄🤷🏻♀️ This, I found out through Wise, not DBS. The bank did not inform me about the attempt to charge 10 transactions to my card. https://mothership.sg/2021/06/dbs-credit-card-fraud-bypass-otp-sms/

-

Purchases made this week using debit card transaction most likely tio double charged. Please check your debit card transactions and report if affected. I bought something on shopee and grabfood delivery this week and tio double charged. Seems many are affected.

- 52 replies

-

- 10

-

-

-

-

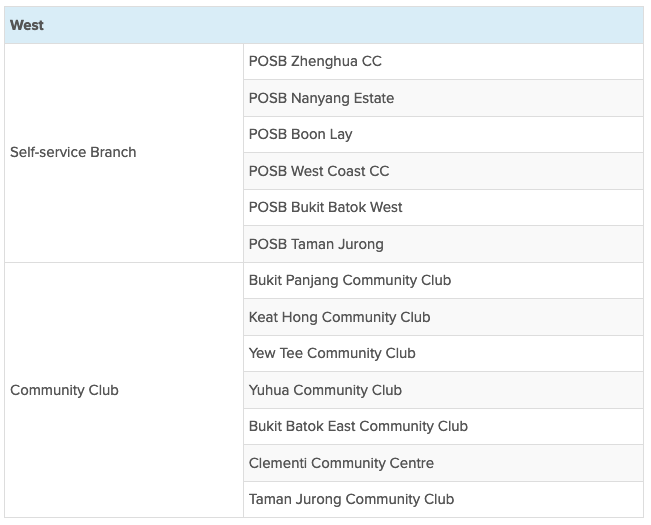

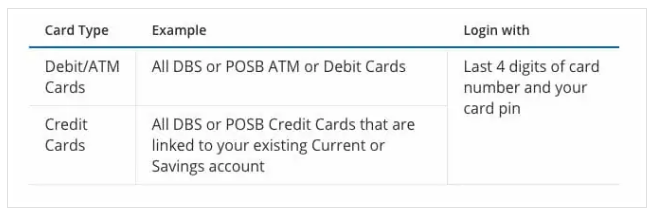

Getting new dollar notes for red packets? This year, there are a total of 41 POSB & DBS pop-up ATM locations and self-service branches islandwide you can withdraw new notes from. Two ways to get them There are a couple of ways you can get your new notes this year. The first is from pop-up ATM machines located at Community Clubs and bank branches around Singapore. Here’s the list of locations sorted by region. North North-East East South Central West Do note that some community clubs have both pop-up ATMs and self-service branches. Withdrawal Packages The CNY new notes withdrawal will be available from 25 January to 10 February from 10am – 10pm, and on 11 February from 10am – 1pm. Denominations are available in S$2, S$10 and S$50. There are 4 packages available to withdraw: $100 ($2 x 50pcs) $300 ($10 x 30pcs) $500 ($50 x 10pcs) $600 ($10 x 20pcs) + ($50 x 8pcs) Online Reservation The 2nd method to get your new notes is by reserving new notes online and collecting them at the selected branch of your choice. There are two periods for online reservation: 18 Jan to 23 Jan 2021 for collection dates between 25 Jan to 29 Jan 2021 24 Jan to 5 Feb 2021 for collection dates between 26 Jan to 10 Feb 2021. Reserve your CNY notes online in just 5 simple steps: Step 1: Visit POSB & DBS secured online notes reservation site (open only during the periods stated above). Step 2: Key in your ATM/Debit/Credit Card Number and PIN for verification. Step 3: Indicate the number of QR Gift Pack(s) and desired quantity of notes for $2, $10, $50 (notes denomination). Step 4: Confirm your details and selection. You will receive a confirmation email within 24 hours upon submitting your request. Step 5: Collect your notes at the selected branch during the specified date and time. Simply log in with your ATM/Debit Card and PIN to place your reservations. Each customer is limited to 1 reservation and amendments will not be allowed upon submission. Source: https://www.greatdeals.com.sg/2021/01/15/posb-dbs-pop-up-atm-new-notes-cny-2021

-

Can someone familiar with credit card transaction advice on this matter? I signed up for an online course in 2019, it was charge to my credit card on a yearly basis and i've the card details saved in the merchant's portal. This Sept is the 2nd year billing, i dont intend to renew and forgotten to cancel with the merchant - they had already billed to my card. I noticed my card had expired in Jun, so why can can the transaction still went through? I called the bank, they took few days to investigate and responded back saying this is possible cos the transaction is recurring so they cannot stop it. Is the bank correct ? cos i feel this is a security issue.

- 23 replies

-

- dbs

- creditcard

-

(and 1 more)

Tagged with:

-

Does anybody knows how do we get ESSO DBS 20% discount? I always see the advertisement at the petrol station. However the Max I have gotten is 17%. And most of the staff is clueless about it also.

- 77 replies

-

- esso dbs 20%

- esso

-

(and 2 more)

Tagged with:

-

Aston Martin Debuts an All-New $300,000 DBS Superleggera Coupe The $304,995 V12 will compete against Ferrari’s 812 Superfast. Aston Martin has just debuted the DBS Superleggera on Tuesday, June 26. Based on Formula One styling, the $304,995 coupe will replace the Vanquish, a so-called super-grand touring two-door that Aston Martin has made since 2001. The new car revives two historic nameplates from the Aston Martin line: The DBS title first appeared in a line of coupes starting in 1967, while Superleggera, which means “super light” in Italian, hasn’t been used since the DB4 Superleggera stopped production in 1961. The DBS Superleggera has a bi-turbo, 5.2-liter V12 engine that will be the basis for all forthcoming V12 models as well, since it is highly modifiable and can allow the integration of improvements for various trim lines and future products. The engine made its debut in this year’s DB11 coupe. It gets 715bhp and 664 pound-feet of torque—an astounding amount, considering that even 10 years ago only the most expensive, crazy-looking hypercars crested the 700hp mark. This one looks as if it could saunter down a high-fashion runway. It will give the 789-horsepower Ferrari 812 Superfast a firm challenge for dominance within the set. (The 812 Superfast, by the way, is the only other front-engine, rear-wheel drive, luxury super GT car on the market today. The British company is targeting Ferrari in other ways too.) Zero to 62 miles per hour in the Superleggera is 3.4 seconds. Top speed is 211mph.

- 2 replies

-

- aston martin

- aston martinaston martin

- (and 10 more)

-

Anyone using the DBS Lifestyle app on iphone? Ever tried the Christmas spend and redeem promotion where every $100 spend got a chance to choose a gingerbread man for prize? Starts everyday from 8am and by 8.03am, all 1400 redemptions have been fully redeemed My iphone7 keep just going in circles (checking & launching) but cannot get to choose the gingerbread man......have delete app and reinstall, restart phone etc...but keep having same problem Anyone else?

- 15 replies

-

DBS Car Marketplace, in partnership with sgCarMart and Carro - Singapore's largest direct seller-to-buyer car marketplace is officially launched in Singapore. http://www.sgcarmart.com/news/article.php?AID=17433 What's more, from now till 4th October, you can post an ad on sgCarMart thru DBS for FREE! Link can be found below. https://www.dbs.com.sg/personal/landing/carloans/marketplace/list-my-car

-

- 1

-

-

- dbs

- car marketplace

-

(and 6 more)

Tagged with:

-

Just came across this DBS ad on the internet was impressed, very much like the touching Thai ads, and the Malaysian CNY ads I wonder was it done by a Thai ad agency https://www.youtube.com/watch?v=ghDQjbDeqxE

-

http://www.singaporelawwatch.sg/slw/headlinesnews/44136-fail-to-pay-tax-despite-reminder-bank-can-step-in.html Fail to pay tax despite reminder? Bank can step in Share on facebookShare on twitterShare on email Source Straits Times Date 26 Jun 2014 Author Nur Asyiqin Mohamad Salleh SINGAPORE'S taxman and DBS Bank yesterday gave an explanation for a retiree's claim that her bank account was hacked into when she forgot to pay her property tax. The Inland Revenue Authority of Singapore (Iras) said that when a person fails to pay property tax even after a reminder has been sent, it will appoint a bank to use the person's money which it holds to pay on his behalf. DBS added that it will inform the person in writing before it makes the deduction. Both organisations were responding to queries from The Straits Times after retiree Irene Yap, 76, claimed at a Central Provident Fund (CPF) dialogue on June 14 that her DBS account was hacked into after she forgot to pay her property tax. The former teacher said the bank had "scoured" her account for money to give to the Iras, and questioned whether it was ethical. But under Section 38 of the Property Tax Act, banks can pay overdue taxes from money held for or on behalf of the taxpayer, DBS said yesterday. The Iras said when a taxpayer does not pay taxes by the due date, it will send the person a "notice to pay", with a 5 per cent penalty added. "The penalty will be waived if (the) taxpayer has genuine reasons for failure to pay," it said. "A taxpayer who is stretched in his or her finances should contact Iras to work out an instalment plan." The Iras website shows payment must be made within 14 days of the reminder. Yesterday, the Iras said it will appoint a bank to pay taxes owed to the Government by a person only if he does not respond to the "notice to pay'' reminder. The bank is released as agent only after the tax and penalty are fully paid, said its website. At the same dialogue, which was conducted by Member of Parliament Hri Kumar Nair, Ms Yap also claimed she was not able to withdraw money from her CPF Retirement Account (RA). Last Friday, the CPF Board and Senior Minister of State for Manpower and Health Amy Khor cleared the air about her situation. The Board said it will send CPF members who reach their drawdown age a letter to inform them that they can apply to receive monthly payouts from their RA. Ms Yap was notified four months before her drawdown age in 1998, but she did not respond. In 2012, the CPF Board reminded her again that she could start receiving her monthly payouts. Again, they did not receive any instructions from Ms Yap, said Dr Khor. The CPF Board said it is in contact with Ms Yap to help her withdraw her RA savings if she wants to. Ms Yap could not be reached for comment yesterday. be careful hor...................next time any tax also they can take from your bank account...................no need to sign any form one...................but when you need to draw your cpf (technically your own money)........please fill up forms.............no automatic hor............

-

[extract] Do you love your 5 year old Aston Martin DB9 so much until you won

-

- Edo Competition

- Aston Martin

-

(and 3 more)

Tagged with: