Search the Community

Showing results for tags 'bond'.

-

Hi, i am a newbie in investment. Are there any SGS right now which i can invest and will give a coupon rate of > 3% with maturity in 2 years? Thanks in advance for all advises.

- 71 replies

-

- investment

- bonds

-

(and 3 more)

Tagged with:

-

A new Bond is being issued in Singapore. Let's not start with the James Bond jokes. https://secure.fundsupermart.com/main/bond/bond-info/factsheet.svdo;FSMAPPID=wqTF3FdKG6YkmxI0t8GWCCSl2k25du3El4lWB39_yrmJoeyM9Py7!1867248078?DCSext.dept=21&WT.mc_id=58861&issueCode=JK5852351 I like the rate but as I don't undestand bonds I won't be investing. As I understand it although the coupon rate is 5.3% annually the price of the bond can go down as well. So at the end of the investment period money can be lost. Is that correct? Or can anyone provide a simple short version of how a bond works.

- 40 replies

-

- investment

- money

-

(and 2 more)

Tagged with:

-

LOS ANGELES (Reuters) - The next James Bond movie will be delayed indefinitely due to "uncertainty" from the still unfinished auction of MGM, the movie studio behind the film series, producers said on Monday. The so far untitled movie, which will be the 23rd in the series about the British spy, had been due for release in 2011 or 2012. James Bond is one of MGM's most lucrative franchises. But Michael Wilson and Barbara Broccoli, the producers of James Bond, said in a joint statement, "Due to the continuing uncertainty surrounding the future of MGM and the failure to close a sale of the studio, we have suspended development on BOND 23 indefinitely." The two producers added that they do not know when development of the film will resume and when it will be released in theaters. A representative for MGM could not be reached for comment. MGM last year began exploring a potential sale of itself, and sources said in March the company received a $1.5 billion bid from Time Warner Inc. It was the highest bid received for MGM, but still below the $2 billion or more that the storied Hollywood studio had initially hoped to receive, and it could still file for bankruptcy, sources have said.

-

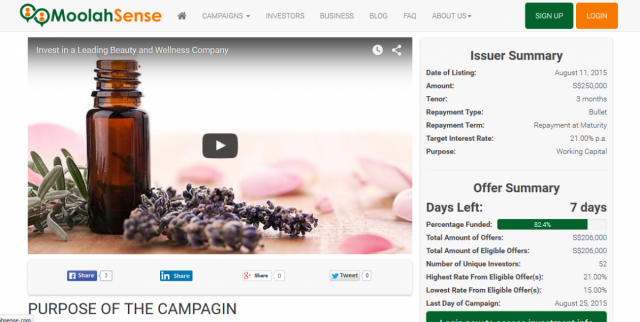

Came across this link in my facebook. https://moolahsense.com/running-campaign.php?company=Beauty Clicked, and woots... a bond that promises 21% returns per year. And already raised 82% of its required capital?? My first thoughts... why does the company raising the funds want to give 21% interest? Loan sharks is only 24% afterall!! 2nd thoughts. Deal sounds too good to be true for the investors. Damn bloody risky. But with just a simple video and wall of text, they can get $200K? S'poreans money very easy to take.

- 107 replies

-

- 2

-

-

- crowd funding

- moolahsense

-

(and 5 more)

Tagged with:

-

HONG KONG—Chinese financial regulators this year slashed red tape and laid out the welcome mat for global bond investors, hoping to lure fresh cash into the country’s $9 trillion market. But new players have been slow to accept the invitation, wary about lingering ambiguity over the rules and how they will be enforced. “There are still too many layers of regulation,” said Jean-Charles Sambor, deputy head of emerging-market fixed income at BNP Paribas Investment Partners in London, which manages $1.2 billion in assets. Mr. Sambor said he is interested in China’s domestic bond market, but isn’t buying yet. Cautious investors cite a wide range of ongoing concerns, from uncertainty over tax treatment to the depth of the government’s commitment to liberalization. Foreign bond buying has picked up since the liberalization took effect earlier this year. Between February and June, the most recent month data is available, foreign investor holdings jumped 15% to 764 billion yuan ($115 billion), according to the People’s Bank of China. That is still just 1.3% of the market, according to Bank of America Merrill Lynch. Among the new Chinese bond investors is Robert Simpson, a fund manager at London-based Insight Investment, which manages £499 billion ($662.73 billion) and bought a small batch of government debt this summer. “It’s a market that we wanted to be at the forefront of,” Mr. Simpson said. Yet Mr. Simpson said his firm is “taking our time to build up our expertise.” The PBOC didn’t respond to requests for comment. The National Association of Financial Market Institutional Investors, an industry body that helps oversee the bond market, declined to comment. The changes in China, the world’s third-largest bond market, are part of Beijing’s push to open up the country’s financial system and expand international use of the yuan, while steering domestic borrowers to seek funding from markets rather than bank loans. The bond-market liberalization follows a similar opening of the country’s stock market, where foreign ownership reached $90 billion in June, about 1.5% of the domestic market. Until this year, global fund managers had to apply for permission to buy bonds, and their purchases were limited by quotas governing how much they could buy. They could use only U.S. dollars or yuan parked outside of China’s mainland. In some cases, investors could only repatriate a capped amount each year, or had to keep their money inside the country for up to one year. The few foreign investors who were granted easy access included central banks, sovereign-wealth funds and multilateral lenders such as the World Bank. Advertisement ‘There are still too many layers of regulation.’ —Jean-Charles Sambor Now, a wider range of investors has access to Chinese bonds, including commercial banks, insurers, securities firms, mutual funds, pensions and charities. Instead of seeking regulators’ approval to invest, they can just register before buying. Regulators also lifted investment quotas and eased restrictions on repatriation, as well as limitations on the types of currencies that could be used. China’s bond market remains undeveloped compared with the U.S. and other advanced economies. It is a relatively small source of domestic credit in the bank-dependent economy, and the pool of investors is concentrated largely among the country’s banks. Some investors consider Chinese yields attractive, with the benchmark 10-year government bond returning 2.8%, compared with 1.6% for U.S. Treasurys, and negative yields in Japan and parts of Europe. But gauging risk is tricky, due to grade inflation by local raters, who classify more than 90% of corporate debt as investment grade. There are still boundaries for foreigners seeking to enter the market. Investors can’t buy and sell by themselves, but rather have to work through an approved settlement agency in China to register, trade and repatriate money. By contrast, foreigners can buy bonds in emerging markets such as Thailand and Malaysia simply by placing orders with a broker. China’s bond market also appears to be off limits to the likes of hedge funds. The PBOC said in its liberalization announcement that only “medium-to-long-term institutional investors” were qualified to register. Many foreigners remain fearful that when things get tough, regulators will find ways to clamp down on trading. During last summer’s stock-market crash, Chinese authorities allowed thousands of listed firms to freeze stock trading, forcing locals and foreigners into holding positions while the market fell. “There is a risk of policy reversing with some kind of capital controls being imposed,” said Luke Spajic, head of portfolio management in emerging Asia at Pacific Investment Management Co., which manages $1.5 trillion in global assets. “It could happen. Policy has been in flux.” Some investors also worry about taxes. China’s Ministry of Finance and the State Administration of Taxation say foreigners need to pay a 10% levy on interest earned from bonds. But Chinese bond issuers don’t withhold this tax, and the regulator hasn’t spelled out who should be collecting it. The tax authority hasn’t clarified whether foreigners must pay any capital gains tax at all. “One regulator (the PBOC) has opened up its market, but investors are still waiting for another regulator (the tax authority) to come up with rules pertinent to that development,” said TieCheng Yang, a Beijing-based lawyer with the London law firm of Clifford Chance LLP.

-

- deregulation

- china

- (and 6 more)

-

For those who dislike risky investments and wished money can grow more: http://www.straitstimes.com/business/invest/singapore-savings-bonds-rolled-out-for-first-issue Singapore Savings Bonds rolled out for first issue The MAS is set to issue between $2 billion and $4 billion of SSBs this year across three planned issuances.ST PHOTO: KUA CHEE SIONG PUBLISHED2 HOURS AGO Wong Wei Han SINGAPORE - The Monetary Authority of Singapore (MAS) rolled out the first issue of Singapore Savings Bond (SSBs) on Tuesday (Sept 1), promising a 2.63 per cent average annual return if they are held for 10 years. The interest rate - or rate of return - of the first issue SSBs will start at 0.96 per cent for the first year, data released by the MAS showed. The rate will then go up to 1.09 per cent for those holding the bonds into the second year, which translates to an average annual return of 1.02 per cent. For the third year, the rate of return will be 1.93 per cent, which means an average annual return of 1.32 per cent. Thereafter, the rate will go up to 3.7 per cent for the tenth year, when the average annual return hits 2.63 per cent. This reflects the "step up" feature of the 10-year bonds, which ensures gradually increasing returns for those who hold the bonds longer. A total of $1.2 billion of SSBs will be issued for this first tranche, which will be open for application between 6pm on Tuesday and 9pm on Sept 25. Interested investors must have an Individual Central Depository (CDP) securities account complete with Direct Crediting Service. They can then apply through the ATMs of DBS, POSB, OCBC and UOB, or through internet banking services of DBS and POSB. The SSBs can be applied in multiples of $500, up to a maximum $50,000 for a single issue. Returns will be paid out twice yearly - on April 1 and Oct 1 - for as long as the bonds are held. "SSBs are allotted after all applications have been collected in a way that distributes the available bonds as evenly as possible to maximise the number of successful applicants. This means that if a Savings Bond is over-subscribed, investors who applied for larger amounts may not get the full amount they applied for," MAS said, adding that the allotment results of the first issue will be announced on Sept 28. Related Story Singapore Savings Bonds: What you should know First announced in March, the SSBs have drawn investors' attention for their flexibility and security. Unlike the regular bonds, the SSBs still offer accrued return to investors who wish to redeem the bonds ahead of the full 10-year tenor. The investment is also capital guaranteed, and is backed by the Singapore government. The MAS is set to issue between $2 billion and $4 billion of SSBs this year across three planned issuances. It is also committed to issue every month for at least the next five years.

- 4 replies

-

- singapore savings

- bond

-

(and 2 more)

Tagged with:

-

http://www.malaysiaedition.net/ballpen-gun-not-e-cigarette-behind-mysterious-death-in-bintulu-market/ Made in HK in 1960s. http://www.retonthenet.co.uk/vintage-toy-carded-707-special-agent-ballpen-ball-pen-gun-redbox-toys-circa-1960s-007-james-bond-style-4498-p.asp

- 3 replies

-

- mati gun

- accidentally

- (and 5 more)

-

What happened to angmoh standard of Human Rights? Britain's MI6 aided torture of Nepal Maoists, book claims British authorities funded a four-year-long intelligence operation in Nepal that led to Maoist rebels being arrested, tortured and killed during the country's civil war, according to the author of a new book on Kathmandu. Launched in 2002, "Operation Mustang" targeted Maoist guerillas and saw British intelligence agency MI6 fund safe houses and provide training in surveillance and counter-insurgency tactics to Nepal's army and spy agency, the National Investigation Department (NID), writer Thomas Bell told AFP Saturday. Nepal's decade-long civil war left more than 16,000 dead, with rebels and security forces accused of serious human rights violations including killings, rapes, torture and disappearances. "According to senior Nepalese intelligence and army officials involved in the operation, British aid greatly strengthened their performance and led to about 100 arrests," said Bell, whose book "Kathmandu" hits stores in South Asia on Thursday. "It's difficult to put an exact number on it, but certainly some of those who were arrested were tortured and disappeared," he said. Maoist commander Sadhuram Devkota, known by his nom-de-guerre "Prashant", was among those captured during "Operation Mustang" in November 2004. Six weeks later, he was found hanging from a low window in his cell, with officials saying he had committed suicide. Despite protests, no independent investigation was ever carried out. British authorities helped construct a bug-proof building in the NID headquarters, created a secure radio network for communications and supplied everything from cameras to computers to mobile phones and night vision binoculars, according to Bell's sources in the Nepalese security establishment. "The agency also sent a small number of British officers to Nepal, around four or five -- some tied to the embassy, others operating separately," Bell said. The officers gave the Nepalese training in how to place bugs, how to penetrate rebel networks and how to groom informers. - 'They knew what was happening' - Bell spent about a year interviewing some 20 highly-placed sources to corroborate the details of the operation, and said a senior western official told him the operation was cleared by Britain's Foreign Office. A Foreign Office spokeswoman told AFP: "We do not comment on intelligence matters but, as we have repeatedly made clear, the UK does not participate in, solicit, encourage or condone the use of torture or cruel, inhuman and degrading treatment or punishment. "In no circumstances will UK personnel ever be authorised to take such action; we neither condone such activity, nor do we ask others to do it on our behalf. "We would never authorise any action in the knowledge or belief that torture would take place at the hands of a third party." A Nepalese general with close knowledge of the operation told the writer there was no doubt that British authorities realised that some of the arrested suspects would be tortured and killed. "Being British they must have thought about human rights also, but they knew exactly what was happening to them," the general said. "The thing must have been approved at a high level." Bell said it was "a peculiar contradiction that while calling for an end to abuses... the British were secretly giving very significant help in arresting targets whom they knew were very likely to be tortured". The British-born writer covered Nepal's civil war from 2002 to 2007, reporting for The Economist and the South China Morning Post before moving to Bangkok for a two-year stint as The Daily Telegraph's Southeast Asia correspondent. Tejshree Thapa, senior researcher at the Asia division of Human Rights Watch, said: "Nepal's army was known by 2002 to be an abusive force, responsible for... summary executions, torture, custodial detentions". "To support such an army is tantamount to entrenching and encouraging abuse and impunity," Thapa told AFP. Nepal army spokesman Jagdish Chandra Pokharel denied all knowledge of the operation, which apparently continued even after a coup in February 2005 by the then-king Gyanendra seizing direct control prompted the British to publicly suspend all military aid to the country. "I have no idea about MI6 training the Nepal army or any Operation Mustang," Pokharel told AFP. Nepal is in the process of drafting a new constitution, a key step in a stalled peace process begun after the end of the civil war in 2006. http://news.yahoo.com/britains-mi6-aided-torture-nepal-maoists-book-claims-025143311.html

- 1 reply

-

- 1

-

-

- britain

- human rights

-

(and 7 more)

Tagged with:

-

fans of james bond, can start collecting miniature 1:43 diecast metal cars from 7-11 every week. just bought the 1st model out, a bmw z8 from the bond movie, the world is not enough for S4.90 2nd issue lotus espirit driven by roger moore 3rd issue aston marttin DB5 driven by sean connery (this is the ultimate bond car) 4th issue jaguar XKR driven by the villan Zao

-

bond free....as free as the wind blows....as free as the grass grow...

- 15 replies

-

- Scholarship

- BOND

-

(and 1 more)

Tagged with:

-

LONDON - A US car enthusiast has bought James Bond's famous Aston Martin car, complete with ejector seat and revolving number plates, at auction in London for more than four million dollars. The 1964 silver Aston Martin DB5 was driven by Sean Connery when he played the fictional British spy in the films "Goldfinger" (1964) and "Thunderball" (1965). US collector Harry Yeaggy flew into Britain for Wednesday's sale and outbid his rivals to buy the car for 2.6 million pounds (S$5.3 million). Click here to find out more! This was less than its pre-sale estimate of more than five million dollars. Yeaggy said the car's new home would be in a US museum - but beforehand he planned to "have a bit of fun" taking the car for a spin around the streets of the British capital. "We're going to fire the car up and drive it round the streets of London tonight. We're going to have a bit of fun with it," he told BBC television. The US collector said he had taken a last-minute decision to fly into Britain for the auction, and confessed to being surprised that an American came out on top in the sale. "I thought a European would buy it. But I guess they didn't appreciate Bond as much as we do," he said. The Bond movie car was sold by its US owner, Pennsylvania broadcaster Jerry Lee, who bought it for 12,000 dollars in 1969. The proceeds will go to his charitable foundation. It is fitted with the full complement of operational "Q-Branch" gadgets, and auctioneers RM Auctions dubbed it the most famous car in the world. The car is also equipped with machine guns, bullet-proof shield, tracking device, removable roof panel, oil slick sprayer and smoke screen, all controlled by "toggles and switches hidden in the centre arm-rest". "The machine guns, as you can see, do come out of their intended place. As far as I know, they don't shoot bullets, but then again, I haven't tried," Don Rose, a car specialist for the auctioneers, told AFP. The gear stick top flips up to reveal the red ejector seat button. It also has a homing radar and a telephone mounted inside the driver's door panel. The car has been on tour over the past five months, with appearances in Britain, Germany, Monte Carlo, New York and Hong Kong. Admission to the sale in Battersea, south London, required the purchase of an official auction catalogue available for 50 pounds. Purchase of the car, lot 197 in the sale, also included a stay at the GoldenEye resort in Jamaica, the original Caribbean estate of Ian Fleming, the British author who created James Bond. A custom-made suit woven with gold thread made by the tailors who dressed Connery as Bond was also thrown in.

-

- car

- enthusiast

- (and 5 more)

-

The mantle of "world's most famous car" is a heavy one indeed. But if any single automobile ever created deserved the honorific, surely it's the 1964 Aston Martin DB5 used on-screen in the production of the iconic 007 films Goldfinger and Thunderball. And in case you were disappointed at having missed the opportunity to get your hands on one of the stunt cars, the real thing is now up for grabs in London, where RM and Sotheby's will be auctioning it off to the highest bidder. The car in question was prepared by Aston Martin for use in the Bond films. After that it went back to the manufacturer, which then sold it to radio host and philanthropist Jerry Lee, who's been holding onto it for the past 40+ years. In pursuit of his charitable work, Lee is finally putting the car up for sale, with bids expecting to top $5 million when it goes under the hammer on October 27. One of only two made and the only one still in existence, the custom DB5 comes packed with all the extras the Q-Branch installed for Bond's use, from the revolving license plates and tracking device to the oil slick dispenser and smoke screen. Source: RM Auctions

-

Anyone heard of the above?? Seem to be an additive to engine oil to enhance efficiency. Good?? Available for sale any where? Distributed by Profitable Group, the co that bought over Liverpool FC. Got a call from some guy asking me to invest in this. Dunno what kind of investment scheme it is...Curious...

-

At a gathering with singapore's youth at the Istana yesterday, Nathan mixed with his youthful guests and talked about his experiences including his handling of the Laju terrorist incident in 74' which then elicited this response from NUS undergrad Mallory Ho, 21 " I thought of him as James Bond"!! Nathan may then have told her "shaken but not stirred, Moneypenny" lol

-

Escaped terrorist helps Singaporeans bond Wah, let a terrorist escape can actually be a GOOD thing! Help the people bond! Maybe we should let a few more escape then. Once a year, have an Allow a Terrorist to Escape Day to facilitate national bonding. From the Straits Times: "S'poreans' response as 'one people' lauded THE response by Singaporeans to Mas Selamat's escape from detention is a good example of how the community should respond in such a situation, said Senior Minister of State for Foreign Affairs Zainul Abidin Rasheed yesterday. He said people's reactions to the incident at the grassroots-level Inter-Religious Confidence Circles (IRCCs) have been the same, regardless of race, and that it is good the community is taking the matter as seriously as the Government. 'It shows we are responding as one people and in times of need, we are there to help Singapore, which is reassuring,' he said." Even Finance Minister Tharman weighed in: "S

-

Ukraine's Olga Kurlyenko picked as new 'Bond girl' LOS ANGELES - IN the secretive world of movie spy James Bond, the 'Bond girl' for the new instalment in the movie series had been top secret, but on Monday Bond's backers said Ukrainian bombshell Olga Kurylenko is the actress. Columbia Pictures, the film studio behind the popular movies about the British secret agent, said the 28 year-old Kurylenko has been cast in one of the most coveted roles in the movies - 007's sidekick for the still untitled Bond flick. The film, which is the 22nd in the series that dates back to 1962's 'Dr. No,' is due in theatres in November and stars Daniel Craig as the dashing British spy who regularly saves the world from a destructive evil villain. Early reports had actress Gemma Arterton as the new Bond girl, but even though Arterton has a role in the new film it is not as large as Kurylenko's, said a source close to the film. The Ukrainian actress joins a long list of leading ladies to be cast alongside the super spy including Ursula Andress in 'Dr No,' Halle Berry, Kim Basinger and most recently Eva Green in 'Casino Royale,' which grossed nearly US$600 million (S$866.4 million) in worldwide ticket sales. In the past, being a 'Bond girl' has given actresses massive exposure and launched lucrative careers. A former model, Kurylenko was most recently seen alongside Timothy Olyphant in last November's 'Hitman.' British actor Craig made his first appearance as the secret agent in 'Casino Royale' and returns for this newest movie directed by Marc Foster, better known for his widely acclaimed dramas like 'Finding Neverland' and 'The Kite Runner.' Also returning from 'Royale' are Judi Dench as Bond's boss M, Jeffery Wright as CIA agent Felix Leiter and Mathieu Amarilic, currently playing French film 'The Diving Bell and the Butterfly,' as the new Bond villain. http://www.straitstimes.com/Latest%2BNews/...ory_193944.html beri difficult the spelling her name....