Search the Community

Showing results for tags 'fees'.

-

Now you say "I do" also expensive liao. For those planning to tie the knot the later half of the year, the Registry of Marriages (ROM) has just announced that they will be increasing the fees starting from 1 July 2017. According to reports, the price hike will affect foreigners the most with the fees increased to a flat fee of $380 for all dates. Previously it costs $128 on weekdays, $198 on weekends and $298 on popular days. For Singaporeans and Permanent Residents (PR), the fees will be upped from $26 to $42 for the registration. A ROM spokesman states the price review was made to keep up with rising operational costs and ensuring quality service for the registrants. Sources: http://www.greatdeals.com.sg/2017/06/28/rom-marriage-registration-fees-increase-1-july-2017

-

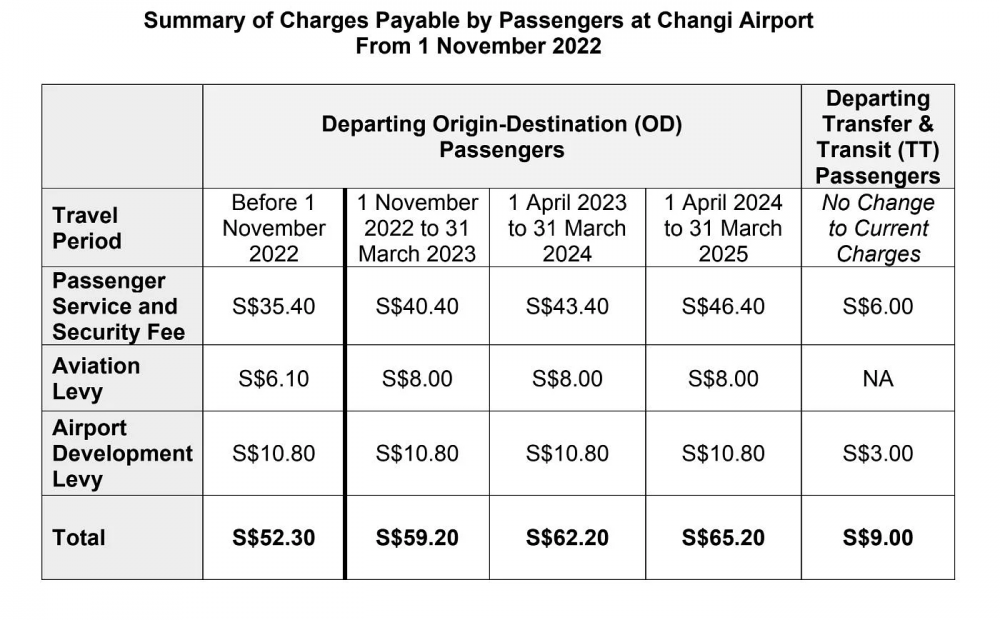

Travellers flying out of Changi Airport to pay higher fees, charges from Nov 1 https://www.straitstimes.com/singapore/transport/travellers-flying-out-of-changi-airport-to-pay-higher-fees-and-charges-from-nov-1 15 Sep 2022 10:00 PM SINGAPORE - Passengers flying out of Changi Airport will have to pay more in airport charges from Nov 1, as international air travel continues to recover from the effects of Covid-19. Passengers on flights originating from Changi Airport currently pay a departure fee of $52.30, comprising a $35.40 passenger service and security fee collected by Changi Airport Group (CAG), as well as a $6.10 aviation levy and a $10.80 airport development levy collected by the Government. With the fee hike announced on Thursday, the total departure fee will go up by $6.90 to $59.20 from Nov 1, and subsequently increase by $3 to $62.20 from April 2023 and by another $3 to $65.20 from April 2024. Passengers whose air tickets are issued before Nov 1 will not pay the higher fees and levies, said the Civil Aviation Authority of Singapore (CAAS) and CAG in a joint statement. There will be no change to the departure fee for transit passengers, who will continue to pay $9 in airport charges for each flight. Meanwhile, airlines will also have to pay more in aircraft parking and landing fees, CAAS and CAG added. The statement said the fees and levies charged will fund CAG's operations, the upgrading of terminals and its future development plans. The charges will also go towards the air hub development and regulatory functions of CAAS – such spending is expected to grow as CAAS works to rebuild Singapore’s position as a global air hub post-pandemic, the statement said. Work on the upcoming Changi Airport Terminal 5 has restarted after a two-year pause brought on by Covid-19, with the mega-terminal expected to serve 50 million passengers a year when completed in the mid-2030s – more than T1 and T3 put together. Airport charges at Changi were last revised in 2018. At that time, CAG said its passenger service and security fee would increase by $2.50 a year until 2024, which meant that the fee should have gone up from $35.40 in 2020 to $37.90 last year and $40.40 earlier this year. But the authorities held off the planned increases in 2021 and 2022 in view of the pandemic. From Nov 1, the fee will be raised to the planned $40.40 to cover the higher cost of operations, and increase again thereafter, CAG and CAAS said. The aviation levy collected by CAAS will be raised for the first time since it was introduced in 2009 as well – from $6.10 now to $8 from Nov 1. The levy, which applies only to departing passengers with flights originating from Changi Airport, will remain at $8 in 2023 and 2024. The latest fee hike comes during the same week that Changi Airport Terminal 4 welcomed its first flights on Tuesday, after it was shut in May 2020 due to plummeting air traffic at the start of the pandemic. The reopening of T4, which has a handling capacity of 16 million passengers a year, will add to Changi Airport's capacity, as will the reopening of the southern half of Terminal 2 from Oct 11. This will restore Changi Airport's handling capacity to its pre-pandemic level of 70 million passengers a year. Passenger traffic at the airport is now averaging 58 per cent of 2019 levels. Flight numbers are slightly higher, at 64 per cent. SOURCE: CAAS, CAG Changi Airport is not alone in increasing its fees, after more than two years of international border restrictions ate into the revenues of airports worldwide. Last year, Schiphol airport in Amsterdam announced plans to increase the fees levied on airlines by 37 per cent over the next three years – a move that drew a sharp rebuke from the International Air Transport Association (Iata). The Dutch government plans to more than triple the country’s air passenger tax in January next year to €28.58 (S$40), up from €7.95 currently. Mr Philip Goh, Iata’s regional vice-president for Asia-Pacific, said the timing of the fee increases at Changi Airport is less than ideal, as any additional costs will negatively impact the financials of airlines. He noted that the Asia-Pacific airline industry is still in the early stages of recovery from the Covid-19 pandemic, with international passenger demand in the region only at about 36 per cent of 2019 levels as at July this year. In comparison, other regions have seen demand rebound to more than 70 per cent of 2019 levels. “Aviation hubs like Singapore must ensure they remain cost-efficient in order to maintain their attractiveness to airline operators,” he said. “We hope the next regulatory review of these charges in 2024 will keep in mind a need for moderation and improvements when considering any further increase in aviation charges.” A spokesman for Jetstar Asia said it is disappointing that higher airport taxes are being introduced while airlines are still recovering from the pandemic, and from soaring fuel prices. “We are committed to ensuring our fares remain affordable but as a low-cost carrier, taxes make up a significant part of our fares. We will work to manage these additional costs to minimise the impact to our customers,” she said. SIA Group said it will implement all additional levies accordingly, and it aims to mitigate rising costs by improving productivity and operational efficiency, while exercising strict cost discipline. Mr Mohshin Aziz, director of the Pangolin Aviation Recovery Fund, which invests in aviation businesses, said he was surprised by the timing of the fee hike. “Shouldn’t we wait until the industry fully recovers?” he asked, noting that key markets like China and Japan have yet to fully reopen their borders. Mr Shukor Yusof, founder of aviation consultancy Endau Analytics, said it is inevitable that airport charges are hiked. He added: “There’s a cost to ensure Changi retains its position as one of the world’s best.” Ms Edlyn Phua, 31, who has plans to travel at the end of the year, said the increase in airport charges is not significant compared with other travel-related expenses, which have also risen in price. “I can accept the increased levy since it has been nearly three years since I’ve travelled. The bigger consideration for me will be the destination and airfares,” the market research consultant added.

- 11 replies

-

- 4

-

-

-

- travellers

- changi airport

-

(and 4 more)

Tagged with:

-

- 91 replies

-

- data roaming

- airplane mode

-

(and 7 more)

Tagged with:

-

Hi, kind of sick of calling the credit card company every year to ask for a waiver and threaten to cancel. Also, I can never charge enough $$$ to get the automatic waiver for the year. Recently applied for ABN-AMRO which is free forever, but it's MASTER card. Is there any credit card that is VISA and have many years or forever fees waiver? Topics merged.... new post today starts here: http://www.mycarforum.com/topic/2085531-visa-credit-cards-with-annual-fees-waiver/?p=5662317

-

For example the small projects like Balmoral Gardens, which has only 40 units and mixed studio and normal condo units. Since such condo is so small, does the resident must go to the AGMs? Or do they have to participate in the affiars of the condo? I like a quiet life with no disturbances from others, like neighbours, or management offices, etc, just like my corner HDB unit, besides signing up electricity with PUB when I got the key I never had any interaction with any strangers and my only neighbor never comes home more than 10 days a year.

- 26 replies

-

- 1

-

-

- condo

- life style

-

(and 5 more)

Tagged with:

-

Is it true that the legal sector charge clients like what is being accused here by Mdm Chang for such cases? Any lawyer bros or bros familiar with such care to comment? From ST Forum: http://www.straitstimes.com/STForum/Story/...ory_773737.html Offer guidelines for legal fees Published on Mar 5, 2012 I RECENTLY engaged a lawyer to settle a tenancy dispute. I was told that legal costs are time-based and my straightforward case would cost about $5,000. However, the final bill came up to $23,000 - about five times the original estimate. The lawyer claimed that the additional costs arose because he had to spend more time on my case, submitting five affidavits instead of three as expected initially. The charges were billed over three instalments, two of which amounting to $20,000 were when the case was in progress and I felt compelled to pay so as not to jeopardise the proceedings. Then came the final bill of $3,000. I called the Law Society of Singapore, only to find out that there are no guidelines for legal fees, unlike for the medical profession, which until recently had them to guard against overcharging. I was told to find out about the fees charged by other lawyers, and was given figures of $4,000 and $5,000 by two law firms. Proportionally speaking, if three affidavits cost $5,000, five should cost only about $8,000. And if the affidavits are largely the same, with each subsequent one incorporating new points to refute the rebuttals of the defendant, should the fees not be incremental instead of being multiples of five? There should be fee guidelines to ensure that professionals are not given a free hand when billing their clients. The Law Society and the Consumers Association of Singapore should look into how legal fees are charged. Chang Lee Lee (Madam)

-

http://www.sgcarmart.com/news/article.php?AID=18147 To support social spending ? Vehicle registration fees and transfer fees are just two of 24 car-related fees that will be raised, with effect from 20th December. 06 Dec 2017 | Local News : Singapore Vehicle buyers will have to pay more for a wide range of vehicle-related services from 20th December. The Land Transport Authority (LTA) is raising the rates for a slew of fees from vehicle registration to vehicle transfer. In a letter sent out to motor traders last Friday, the authority said the change was because of 'rising costs of providing these services'. These services, it said, included things like the setting up and maintenance of IT systems, as well as manpower cost. Some say the hike in car-related fees are small when compared to others such as the Vehicular Emissions Scheme (banding rebates and surcharges shown above)The biggest hikes include those made to registration fees, which will go from $140 today to $220, a 57 percent hike; and transfer fees (which is levied when a vehicle's ownership changes), which will more than double from $11 to $25. The cost to lay up a vehicle (to stop the vehicle from incurring tax and insurance costs for an extended period when it is not used) will more than triple from $5.35 to $17.12. In response to queries from The Straits Times, an LTA spokesman said the changes arose from 'a review of fees that are collected for administering vehicle services'. "From 20th December, 24 out of 61 existing fees will be adjusted upwards, as these fees have largely remained unchanged for more than 10 years," she said. Motor traders were surprised by the move. Mr. Nicholas Wong, General Manager of Honda agent Kah Motor, said, "These fees are small when compared with things like Certificate of Entitlement and the Additional Registration Fee, so I don't understand why they have to be raised. "I guess this is part of the tax increases was pre-empted recently." Mr. Neo Nam Heng, Chairman of diversified motor group Prime, said he would refrain from commenting on tax revenue issues, but pointed out that 'cost will be passed on to consumers'. Motorist Gay Eng Joo, 46, said, "Cars are big-ticket items here, so I don't think these changes will make much of a difference to consumers." Mr. Gay, an engineer, said other schemes such as the new Vehicular Emissions Scheme (VES), which starts next month will have a 'bigger bite'. The VES metes out tax rebates or surcharges according to a car's emission levels. The majority of cars available today will either lose their rebates or face surcharges from next month.

-

Hi guys, hope this is the right folder to ask. I have been with SCB for about 10 years, have an Xtrasaver chequeing account. Recently they issued a revision to fees and will commence charging $2 per month. Are there any banks that do not charge for chequeing accounts? I seldom use cheques and find it useful when I need, but having to pay $2 per month for something I don't use frequently, I rather not. Any recommendations for free chequeing account appreciated! :)

-

really that bad meh? the monthly amount spent is as good as somebody pay for a year! just heard on radio this morning getting 'tuitor' to do homework on behlaf is common, even for assignment, uni final year project, etc. wonder what Gearoil has to say on this? i remember when i did my master, i was so busy that i could meet the deadline, i told my lectuerer that i can't make it and ask him to fail me, lucky the final assignment only contribute 20% which i still pass the subject. Never in my mind to engage such 'services' though i knew their existence long ago. Paper qualification is so easy to come back and nothing is real on the surface nowadays.

-

Hi all, just a reminder that Acendas car park season fees will increase from usual $60 - $70 to $139.xx per month. I think all the Acendas car park will be affected. This will start from 1st April 2013 if I am not wrong. Just take note. If got query, can ask ur own company HR. Now I feel like crying and wanna sell my car. Sian 1/2

-

Many doctors and medical professionals here. Any thoughts? This seems to be a hot topic recently. Recently, I went through a procedure and was darn pissed with how much I had to fork out from my own pocket and according to my doctor, my company's appointed TPA is to be blamed. True?

- 26 replies

-

- healthcare

- cost

- (and 5 more)

-

By Dinesh Dayani | DollarsAndSense.sg Singaporeans are affluent and busy people. Many times, we end up either not having time to check through our bills or just trusting that everything is in order. The matter of the fact is that service providers, existing for the sole purpose of profiting usually, will always be incentivised to work in fees into their packages to ensure they extract the maximum value from a customer. Checking our bills every month may be hasslesome, but it take a few short minutes. Further, the accumulation of fees adds up to a substantial amount if gone unchecked for long periods. Here are four types of common fees that every Singaporean will face at some point of their life. 1. Credit Card FeesCredit cards have been created to keep people in debt and spend more than we can. Without doing so, credit card companies will never be successful. So working in additional fees and creating “better” features will only ever serve to keep you in debt. With that being said, here are some credit card fees to watch out for i. Annual FeesCredit card companies charge annual fees to ensure anyone not keeping tabs on their spending will automatically lose reward points or actually pay it as part of their monthly payment to the company. ii. Late Payment FeesThey also have strange ways to compute which day you have to repay your bill by. It’s never the same so be sure to look at the due date and pay your bills before then. Interest charges are scary at over 24% and this does not even include the late payment charge. iii. Delayed Payment FeesMany credit cards offer its customers the option of only having to pay $50 or a certain percentage of their bill each month. What customers do not know is that fees have been built into this method of payment either through preferred interest rates (which are still scary) or a processing fee which is charged as a percentage of the amount. These fees are also applicable when you transfer balances from another card. 2. Banking FeesThe lines are a bit blurred when I mention banking fees since most banks also offer credit cards. But we’ll stick to pure banking fees here. So in addition to the fees they collect on credit cards, banks also profit through these other fees.Minimum Amount Fees i. Minimum Amount FeesMany banks require you to keep a minimum balance, usually $500, in your account each month. Failing to do so will activate a fee of approximately $2. However, this is for savings accounts, note that there are also minimum fees for current accounts that require much higher fees and much higher minimum balances. As a side note, some current accounts also charge fees for their cheque books. ii. Short Term Borrowing FeesAdvertised as a quick and easy way to get instant cash, often within a few hours of application. Fees for such are very prevalent and are in addition to the interest rates charged. 3. Early Termination FeesOnce a company has tied you down to a contract, you can be sure they will fight tooth and nail to make you pay for it. Even when we experience the shameful Singtel TV outage, we had to continue paying for the service. And their discount was given on goodwill rather than an obligation. We’ll leave the debate on how fair this system is, and how big companies can bully consumers without the government intervening. And when the government intervenes, you’ll know that the situation has really been atrocious. i. InsuranceInsurance companies are another financial institution that exists only to profit. They profit by offering consumers insurance, this is not a public service they are doing, they are profiting, and if they don’t do it, someone else will. Of course then, once you sign a contract, usually for the next quarter of a decade, you’re pretty much locked with them. At this point, it should be highlighted that we think you should think hard about any decision regarding insurance when you sign up. It will affect you for a very very long time. ii. TelcosAs mentioned in the opening paragraph, you can’t back out even when you’re being offered a terrible deal. You’ve signed up for it. This is far more acceptable, or so people think, because it only locks you up for 2 years at a go. Nevertheless, you should consider your decision carefully before signing up. There are always other options, like not watching TV and being more productive and using pre-paid cards. iii. MortgagesAnother way banks can earn money from customers. The logic is that banks have already “locked in” a certain amount of interest income that you will pay them, and if you want to back out, you have to cough up for it. This is actually the most fair of the fees they charge. Nevertheless, it’s an additional fee for us to consider when determining how fast or slow we can pay back our mortgages. iv. Almost Anything ElseSame logic applies. When you sign up for a deal, you’re going to be held ransom to that signature. Think before signing for any service. Some common ones are gym membership. 4. Convenience/ Booking FeesThis type of fees is cringe-worthy, mostly because it’s term “convenience” when most consumers are being inconvenienced. i. Movie ticketsThere are ways booking fees when booking tickets online or through mobile apps. Golden Village ($2), Filmgarde ($1) and Cathay ($1.50) all have these fees. ii. Budget AirlinesUsually ranging from $16 to $20, these fees put additional revenue in budget airlines’ pockets for seemingly no reason whatsoever. Some, like Jetstar, offer free payment options via Singpost or 7-11 outlets. We say, why not reward the airlines that offer better deals for their customers. Help them make up for it with greater revenues. They deserve it. iii. Many Other ServicesWe can list down everything under the sun, but the basic premise is that service providers will try to take more money, every possible way, this includes services offering you convenient methods to top up your EZ link card via mobile apps or with credit cards (under $1). In Summary You will have to decide for yourself what fees are acceptable and what fees are not. If you ask us, we will try to cut out all the fees, as the additional headache will be rewarded in the form of huge savings over our lifetimes. Sometimes, all it takes is a phone call, and other times, we have to be a little more firm. Regardless, we think everyone can adjust their lifestyles to not have to pay these kinds of fees. https://sg.finance.yahoo.com/news/4-types-fees-singaporeans-not-003015173.html

- 35 replies

-

- 1

-

-

- save

- cash smart

-

(and 6 more)

Tagged with:

-

Why pay for ERP Admin fees if there is a preventive way?

- 32 replies

-

- 1

-

-

- cashcard; vcc; erp; admin fee

- no funds; erp;

- (and 5 more)

-

anyone facing fees problems when your broadband internet contract reaches maturity? eg, I had to pay a termination fee to SH when my contract matured ... but they waived it after they called me. what about the subscription fee following the maturity of your contract ? eg, special fee of $40 (after 60% discount) but last day is 31 Mar ... then when you bill come for Apr, you find out they started billing you for the full rate of $100/mth. I am still waiting for my SH bill to see because I did lapse a few days after the maturity as I was waiting for the landline to be ported.

-

Bros, bad news for most... Those staying in HDB units please brace yourselves for this ridiculously absurd price increase of as much as 73% while those staying in landed properties lucky you price decrease of 3% soon... From CNA: http://www.channelnewsasia.com/stories/sin...1204325/1/.html Waste collection fees expected to rise By Joanne Chan | Posted: 29 May 2012 2138 hrs SINGAPORE: Households in Singapore can expect to gradually pay more to have their trash collected. The National Environment Agency (NEA) said the move is aimed at uplifting the waste collection industry, which is struggling with rising operating costs while it grapples with improving service standards. Industry players said these challenges have been made harder by government contracts that have locked in fees for the past seven to eight years, with no provision for adjustments. With several contracts up for renewal over the next few years, the NEA, which manages the public waste collection scheme, is looking to reshape the industry. For the purpose of waste management, Singapore is currently divided into nine sectors, served by four companies. This will be reduced to six sectors, to help companies achieve economies of scale. Andrew Tan, CEO of the National Environment Agency, said: "This in turn will translate into greater affordability and at the same time, giving opportunities for the waste collectors to invest in the capital, in the training of their workforce and also the equipment needed to do a good job in terms of waste collection." Chairman of the Waste Management and Recycling Association, Guah Eng Hock, also pointed out that waste collection companies are required in their contracts to have a recyclable sorting facility in each sector. He said that with the larger sectors, companies will be able to enjoy greater economies of scale. A standard waste collection fee will also be introduced. Today, households pay as little as S$4.03 per HDB flat, or as high as S$22.50 for a landed home. Prices also differ between estates. For example, HDB flats in the city area currently pay S$4.03, while those in Pasir-Ris and Tampines fork out S$6.87. The difference in pricing is due to separate contracts being called for each sector, subjected to open bidding. Moving forward, all households will pay a "uniform fee" - depending on whether it is an HDB flat or landed property. The fee will be derived from the weighted average of successful tender bids submitted by public waste collectors. The first to come under the new fee structure will be households in Pasir-Ris, Tampines and Bedok. From July, HDB properties in those areas will pay S$7, while landed homes will pay S$23.19. The NEA said households would have had to pay more, if the new uniformed fee structure was not applied. The new uniformed fee structure will be progressively rolled out to the rest of Singapore by 2015. In return for higher fees, waste collection companies will have to meet higher service standards. This includes having quieter and cleaner vehicles, and responding quicker to public feedback. Companies will also have to provide better incentive schemes to encourage households to recycle. Singapore's only landfill on Semakau island is currently at half its capacity, and is expected to run out of space by 2040. Thus, recycling remains a key strategy for managing waste in Singapore and the government hopes that consumers and businesses will start at the source - by sorting their recyclables from other waste. Singapore's recycling rate currently stands at 59 per cent - a long way from its long-term target of 70 per cent. -CNA/ac

- 72 replies

-

- Waste

- Collection

-

(and 3 more)

Tagged with:

-

An automated multi-storey car park at the Club Street. The struggle for parking amid a growing carpark crunch in Singapore's congested CBD means that a sizeable portion of the estimated 200,000 professionals based there choose not to drive to work. Although he owns a car, Mr Seah Chee Koon, 35, prefers to take the train from his Jurong East home to his office in the Central Business District (CBD). "I don't see the need to drive to work. It is too expensive," said Mr Seah, who works in the banking industry. He spends about 45 minutes commuting each way. The struggle for parking amid a growing carpark crunch in Singapore's congested CBD means that a sizeable portion of the estimated 200,000 professionals based there choose not to drive to work. The parking situation is likely to get worse. Going by a transport masterplan released last week, the Land Transport Authority (LTA) expects the CBD parking supply to "gradually decrease over time as older buildings make way for newer buildings". Source: http://www.straitstimes.com/breaking-news/singapore/story/cbd-parking-high-fees-and-lack-season-carpark-spaces-drive-away-many-m

-

I remember more than 10 years ago when I was buying used cars, the first payment to make was a. Down payment depending on how much you like to finance b. Insurance c. First month instalment (if under financing) d. Transfer fee of ownership of vehicle (2% of sale price if remembered correctly) It was all the while the above fees to pay for until government decided to set to transfer fee to a standard $11.00 regardless of make and model some 4 or 5 years ago in order to relieve our burden in getting a used car. I have heard from friends that an "Admin Fees" was implemented and we don't know which department of the government actually implemented this. After a recent visit to the used car market, I was quoted a standard sum of $800.00 for the admin fee usually while a few others quoted $500.00. Some dealers even told me depending on how they play with the price. They can also waive the admin fees but it was already mark up in the car price. So I assumed this "admin fees" was implemented by Used cars traders since there isn't a real standard. All dealers I have spoke to so far all said that this is a fee buyer "must pay". Does anyone pay for this fee recently when purchasing a used car?

- 26 replies

-

- admin fees

- admin

-

(and 3 more)

Tagged with:

-

Real Madrid bao 4 out of the top 6, total spent £285m!! 1st Gareth Bale Tottenham to Real Madrid = £86m 2nd Cristiano Ronaldo Manchester United to Real Madrid = £80m 3rd Luis Suarez Liverpool to Barcelona = £75m 4th James Rodriguez Monaco to Real Madrid = £63m 5th Zlatan Ibrahimovic Inter Milan to Barcelona = £59m 6th Kaka AC Milan to Real Madrid = £56m 7th Edinson Cavani Napoli to PSG = £55m 8th Radamel Falcao Atletico Madrid to Monaco = £51m 9th Fernando Torres Liverpool to Chelsea = £50m David Luiz Chelsea to Paris Saint-Germain = £50m 10th Neymar Santos to Barcelona = £48.6m

- 3 replies

-

- transfer fees

- highest

- (and 5 more)

-

Hi just wanted to do a sanity check on my 80k servicing fees (Lancer GLX) at Eng Hup... i am thinking of using them long term so the check is for my reference... 1. normal 10k servicing (synthetic oil change / filters changes) / Spark plugs / Auto transmssion oil change / tyre rotation - $220 4. Timing belt - $300 5. Engine mount - $480 thanks in advance...

-

wow ... don't look down on this jit pa kor ... huat ah ... can expect GST to go down? 288,000,000 / 18 months / 30 days = $533,000 per day ... aka 5330 sporean/pr go to casino everyday ... Source from ST Josephine Teo, Casino $288m in casino levies collected in last 18 months By Ng Kai Ling Singaporeans and permanent residents paid a total of $288 million in casino levies in 2011 and the first six months of this year. Last year, $195 million was collected while another $93 million was collected from January to June to this year. Singaporeans and permanent residents who want to enter the casinos here have to pay $100 for a daily entry levy or $2,000 for an annual entry levy. Ms Josephine Teo, Minister of State for Finance, revealed the figures in parliament on Tuesday without giving a breakdown of how much was collected in daily and annual levies.

-

anyone paying your town council conservancy fees via credit card (recurring) ?? i can't seem to find ECTC on any credit card's list .... anyone in ECTC ??

- 25 replies

-

- conservancy

- fees

-

(and 2 more)

Tagged with:

-

Additional Transfer Fee for vehicles removed The Additional Transfer Fee for the transfer of vehicle registration will be removed with effect from Feb 18 this year, Minister of Finance Tharman announced in his FY2012 Budget Statement. RELATED STORIES

-

Breaking news from CNA: Public transport fares will increase by 2 cents per journey from 8 October - concurrent with the full opening of the Circle Line.

-

Thought we have low inflation? http://www.straitstimes.com/BreakingNews/S...ory_635824.html

-

hip hip hurray :D :D