Search the Community

Showing results for 'morgan' in topics.

-

https://finance.yahoo.com/news/morgan-stanley-cut-around-50-025801952.html more please

- 836 replies

-

- Haiz

- retrenchment

-

(and 1 more)

Tagged with:

-

https://sg.yahoo.com/news/93-hes-fit-40-old-205950972.html At 93, he's as fit as a 40-year-old. His body offers lessons on aging. Gretchen Reynolds Updated Sat, 20 January 2024 at 12:08 am SGT For lessons on how to age well, we could do worse than turn to Richard Morgan. At 93, the Irishman is a four-time world champion in indoor rowing, with the aerobic engine of a healthy 30- or 40-year-old and the body-fat percentage of a whippet. He's also the subject of a new case study, published last month in the Journal of Applied Physiology, that looked at his training, diet and physiology. Subscribe to The Post Most newsletter for the most important and interesting stories from The Washington Post. Its results suggest that, in many ways, he's an exemplar of fit, healthy aging - a nonagenarian with the heart, muscles and lungs of someone less than half his age. But in other ways, he's ordinary: a onetime baker and battery maker with creaky knees who didn't take up regular exercise until he was in his 70s and who still trains mostly in his backyard shed. Even though his fitness routine began later in life, he has now rowed the equivalent of almost 10 times around the globe and has won four world championships. So what, the researchers wondered, did his late-life exercise do for his aging body? Lessons on aging from active older people "We need to look at very active older people if we want to understand aging," said Bas Van Hooren, a doctoral researcher at Maastricht University in the Netherlands and one of the study's authors. Many questions remain unanswered about the biology of aging, and whether the physical slowing and declines in muscle mass that typically occur as we grow older are normal and inevitable or perhaps due, at least in part, to a lack of exercise. If some people stay strong and fit deep into their golden years, the implication is that many of the rest of us might be able to as well, he said. Helpfully, his colleague Lorcan Daly, an assistant lecturer in exercise science at the Technological University of the Shannon in Ireland, was quite familiar with an example of successful aging. His grandfather is Morgan, the 2022 indoor-rowing world champion in the lightweight, 90-to-94 age group. What made Morgan especially interesting to the researchers was that he hadn't begun sports or exercise training until he was 73. Retired and somewhat at loose ends then, he'd attended a rowing practice with one of his other grandsons, a competitive collegiate rower. The coach invited him to use one of the machines. "He never looked back," Daly said. - - - Highest heart rate on record They invited Morgan, who was 92 at the time, to the physiology lab at the University of Limerick in Ireland to learn more, measuring his height, weight and body composition and gathering details about his diet. They also checked his metabolism and heart and lung function. They then asked him to get on a rowing machine and race a simulated 2,000-meter time trial while they monitored his heart, lungs and muscles. "It was one of the most inspiring days I've ever spent in the lab," said Philip Jakeman, a professor of healthy aging, physical performance and nutrition at the University of Limerick and the study's senior author. Morgan proved to be a nonagenarian powerhouse, his sinewy 165 pounds composed of about 80 percent muscle and barely 15 percent fat, a body composition that would be considered healthy for a man decades younger. During the time trial, his heart rate peaked at 153 beats per minute, well above the expected maximum heart rate for his age and among the highest peaks ever recorded for someone in their 90s, the researchers believe, signaling a very strong heart. His heart rate also headed toward this peak very quickly, meaning his heart was able to rapidly supply his working muscles with oxygen and fuel. These "oxygen uptake kinetics," a key indicator of cardiovascular health, proved comparable to those of a typical, healthy 30- or 40-year-old, Daly said. - - - Exercising 40 minutes a day Perhaps most impressive, he developed this fitness with a simple, relatively abbreviated exercise routine, the researchers noted. Consistency: Every week, he rows about 30 kilometers (about 18.5 miles), averaging around 40 minutes a day. A mix of easy, moderate and intense training: About 70 percent of these workouts are easy, with Morgan hardly laboring. Another 20 percent are at a difficult but tolerable pace, and the final 10 at an all-out, barely sustainable intensity. Weight training: Two or three times a week, he also weight-trains, using adjustable dumbbells to complete about three sets of lunges and curls, repeating each move until his muscles are too tired to continue. A high-protein diet: He eats plenty of protein, his daily consumption regularly exceeding the usual dietary recommendation of about 60 grams of protein for someone of his weight. - - - How exercise changes how we age "This is an interesting case study that sheds light on our understanding of exercise adaptation across the life span," said Scott Trappe, director of the Human Performance Laboratory at Ball State University in Indiana. He has studied many older athletes but was not involved in the new study. "We are still learning about starting a late-life exercise program," he added, "but the evidence is pretty clear that the human body maintains the ability to adapt to exercise at any age." In fact, Morgan's fitness and physical power at 93 suggest that "we don't have to lose" large amounts of muscle and aerobic capacity as we grow older, Jakeman said. Exercise could help us build and maintain a strong, capable body, whatever our age, he said. Of course, Morgan probably had some genetic advantages, the scientists point out. Rowing prowess seems to run in the family. And his race performances in recent years have been slower than they were 15, 10 or even five years ago. Exercise won't erase the effects of aging. But it may slow our bodies' losses, Morgan's example seems to tell us. It may flatten the decline. It also offers other, less-corporeal rewards. "There is a certain pleasure in achieving a world championship," Morgan told me through his grandson, with almost comic self-effacement. "I started from nowhere," he said, "and I suddenly realized there was a lot of pleasure in doing this."

-

Without seeking help from Google, can you guess which model is the donor for this fake Dodge Challenger? Coachbuilding is almost a lost art, but Japanese company Mitsuoka is trying to keep the magic alive. It has built some weird cars over the years, including a retro Miata that looked like a Morgan Aero 8 and a Jaguar XK120 had an affair. The most unconventional build in recent memory was this – the M55. Initially a concept, the fake muscle car is going into production. Unveiled in November 2023 to celebrate Mitsuoka's 55th anniversary, the quirky Dodge Challenger lookalike is actually a Honda Civic underneath its vintage body. In the months that have passed, the company has received more than 1,300 messages from people wanting to buy the contraption: "This was the first time for us to receive such passionate messages directly from so many people of all ages and both sexes." Due to popular demand, Mitsuoka has decided to make the M55 a reality. However, it's going to take a while. The company intends to have the car on sale near the end of 2025. Additional details are yet to be disclosed but we'll remind you the concept was based on the Civic five-door hatchback and had a 1.5-liter engine hooked up to a six-speed manual gearbox. While the car's front says Challenger, the rear makes us think of 1970s Japanese coupes, such as a Nissan Skyline or a Mitsubishi Galant GTO. The profile is an obvious reminder that the automotive oddity is a Civic at its core. Inside, Mitsuoka went through the trouble of adding retro-looking blue upholstery and it swapped out the Honda badge on the steering wheel for its logo. Mitsuoka certainly has imagination, and there are apparently enough people interested to warrant the development of a production model. This is more than just a comprehensive body kit since the headlights and taillights are also tailor-made, as is the front grille. The rear window louvers seem to take inspiration from a 1969 Ford Mustang Mach 1. Mitsuoka reckons it won't be able to build enough cars to meet demand because the conversion will take time since all necessary changes will be performed manually. Pricing has yet to be disclosed but given the extent of the modifications, it's safe to say it won't be cheap.

-

S'poreans want to buy Newcastle United source: https://mothership.sg/2020/08/singapore-investors-newcastle-united/ Singaporean entrepreneurs, Nelson Loh and Terence Loh, have put in a bid to buy English Premier League club Newcastle United. Together with another person, Evangeline Shen, who is also part of the bid, they are part of the Bellagraph Nova (BN) Group. In "advanced stage of negotiation" In a statement to CNA, BN Group said that they are in an "advanced stage of negotiation", after already providing a letter of intent and a proof of funds. BN Group also said that it has roped in former England captain and Newcastle player Alan Shearer, as well as former Newcastle forward Michael Chopra, to back the bid. It added, according to CNA: Who are they? According to its official website, BN group is an established multinational company that owns 31 entities across 100 countries and is worth US$12 billion (S$15.6 billion). Its business activities cut across various industries, including luxury, consumer lifestyle, financial services, and real estate. One of its most well-known subsidiaries, Bellagraph Jewelry, notably famed for holding the world record for highest ever online single sale transaction. The Lohs are cousins and former investment bankers at JP Morgan. They also co-founded Novena Global Lifecare Group in 2010. First Singaporeans to own an EPL club? If BN Group's bid goes through, the Lohs will be the first Singaporeans to own an EPL club. Peter Lim, who now owns Spanish team Valencia, came close in 2010 when he attempted to take over Liverpool. Founded in 1892, Newcastle is a strongly supported club that finished the 2019-2020 EPL season in 13th place. The club has won four first division/ League titles and six FA Cups. They are eighth in the all-time Premier League table and have the ninth-highest total of major honours won by an English club with 11 wins. Previous bid fell through Before BN Group expressed their interest, Newcastle was offered a £300 million (SS$538.2 million) bid funded by Saudi Arabia's Public Investment Fund (PIF). The bid was led by British financier Amanda Staveley, but PIF was set to take an 80 per cent stake. The bid fell through in June after being scrutinised under the Premier League's owners' and directors' test. The test is a set of rules to which owners and directors -- or potential owners and directors -- must adhere to. Some of the the disqualifying factors include criminal convictions, a ban by a sporting or professional body, or breaches of certain key football regulations. Problems with the takeover process stemmed from Saudi Arabia's questionable human rights record and accusations of TV piracy, although the country has denied it is behind the illegal broadcasting of EPL matches.

- 105 replies

-

- 2

-

.png)

-

-

- singaporean

- newcastle

-

(and 3 more)

Tagged with:

-

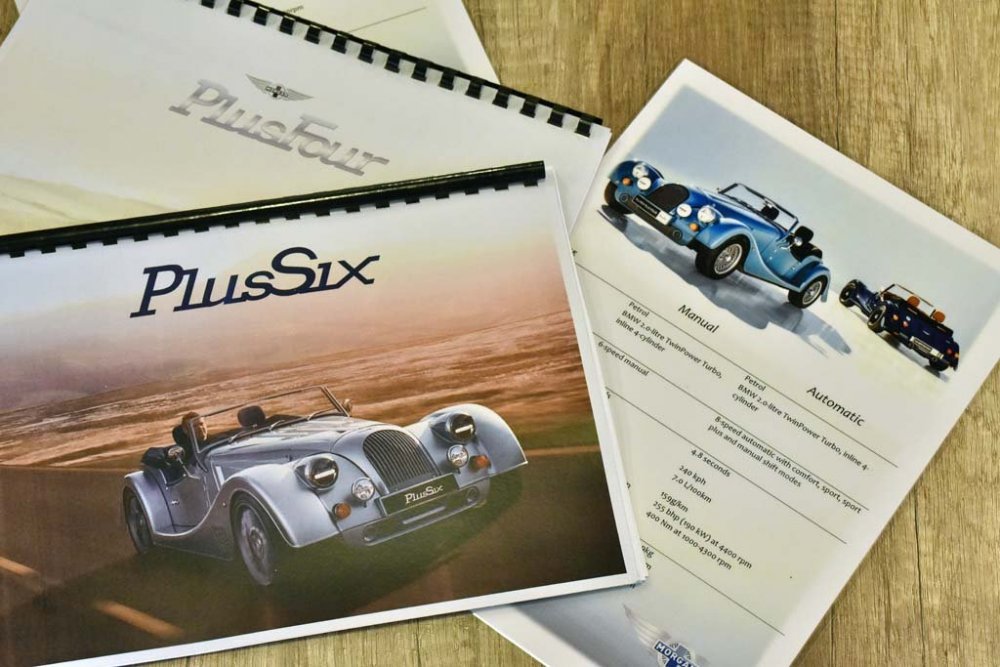

Morgan is a British automobile maker that makes some very unique, vintage-inspired cars. It’s also very likely that many readers would have never heard of them. But you can now buy them in Singapore as the cars are now being sold here by NB Auto, from a modest facility tucked away in Tuas, along Benoi Crescent. We spoke to the firm’s director, Douglas Ng, on why there was a decision to become the dealership for such a niche product. He explains that his family had always held great enthusiasm for old-school British sports cars, and he was also heavily influenced by his father in this aspect. When the idea of actually importing and selling Morgans here came up, the family decided that it was worth a shot as an additional facet of a number of other businesses that they already manage. “Before this, others have imported Morgans into Singapore on their own before, and every one of them was by a car enthusiast who wanted something special in their collection,” Ng tells us. Yet the process of getting them in officially was a complicated affair, not helped that it was all conducted online as it happened while most of the world, including Singapore, was in lockdown because of the Covid-19 pandemic. Weeks worth of video calls to England and plenty of discussions with homologation officers from Singapore’s Land Transport Authority were what Douglas had to deal with for months to get all the official paperwork approved. “As you can see, Morgan cars are quite unique, so it’s hard to apply the LTA’s standard assessment criteria to them. Some of the brand’s models cannot be homologated here because they stray too far outside the rule,” Ng explains. “For example, the famous Morgan Three Wheeler, powered by a front-mounted Harley-Davidson engine, will not pass muster here because it has no doors, and is technically a motorcycle rather than a four-wheeled car. Yet thankfully the operations guys at the LTA are also real car enthusiasts that took a real interest in making it work for the models that can be imported here.” Currently, Morgan only has two models in its catalog that can legally be sold in Singapore: the Plus Six and Plus Four, two identically-bodied cars with different engines. The cars are still made in Malvern, Worchestershire in England, and the company has a history going back more than a century. The chassis may be all metal, but on top of that the cabin is built on a painted ash-wood frame for that authentic vintage feel. The two drop top automobiles are a throwback to an earlier age of motoring, with nearly no storage space, a manually folding roof, and doors so small that you don’t really expect them to offer much protection from side impacts. There’s actually no boot space in the Plus Six and Plus Four at all. A round hatch at the rear looks like it could cover a cargo space, but it’s actually the access panel for rear axle maintenance. The cars do fully modern drivetrains however. The Plus Six uses the engine and transmission from the BMW Z4 M40i. The 3.0-litre turbo inline six cylinder engine with 335 horsepower sends power to the rear wheels through a BMW automatic transmission with no traction control or electronic stability assistance. Meaning that if the car skids or spins its wheels from a poor launch, it’s all up to the driver to rescue it. The whole car weighs just 1,075kg. In other words, it’s a very light car with a very powerful engine, and can be yours from S$415,888, before COE. The identically shaped Plus Four is a little less scary, with a 2.0-litre, four-cylinder turbo BMW engine with 255 horsepower in the front. The manual version goes for S$325,888 before COE, while the automatic costs an extra S$10k. “We’re not big name car dealers,” says Ng. “While it’s easy to set up shop along Leng Kee Road and hope for customers to walk in, the nature of a Morgan and the kind of cliente it attracts wouldn’t allow that business strategy to make any sense at all, and we’re taking baby steps as we move along.” NB Auto currently has one Morgan Plus Six already on display, with the Plus Four expected to make its way here soon. The facility is also able to offer full servicing, and Ng says that the Morgan HQ in England has been very supportive in helping them to establish the place. “As they are not a big company themselves, getting parts flown over or documentation endorsed is a surprisingly quick process, as they have nearly no hoops to jump through or complicated supply chain issues that larger carmakers may face.” For now though, Ng reveals that HQ has given him a “modest sales target” to meet for the first year of operation. It’s not a car for everyone, but there is enough interest amongst the well-heeled car nuts here, as well as in neighbouring countries, that are interested, and that should give some legs to the enterprise for some time yet. https://www.carbuyer.com.sg/morgan-cars-singapore-price/ richard hammond has one too the morgan plus 6 the dealership reminds me of perodua albeit a more atas one niche brand bt we have enough rich ppl in sg for it to succeed din even know we have morgans in sg... none in the used car pages morgan plus 4 fancy cars but not so suitable for us average drivers thou i reckon if u collect rolexes then u have space in ur garage for this

- 19 replies

-

- 6

-

-

.png)

-

- morgan

- automotive

-

(and 2 more)

Tagged with:

-

Having explored the Welt and the Museum, let’s venture to another destination for those who wish to kickstart their Bavarian day with a dose of automotive delight. Situated a short distance from the city centre in Freimann, Motorworld is a veritable treasure trove of automotive wonders representing a wide array of manufacturers. It serves not only as a collective of showrooms but also functions as a storage facility, an event venue, workshops, and even hosts cafes and boutiques, all tailored to satiate our gasoline-fueled passions. Oh, and here’s an added bonus – Motorworld opens its doors at 7:30 am too! If you happen to visit on weekdays, you’ll find that one of the cafes within Motorworld, Caffè Pol GmbH, starts serving at 8 am. It’s the ideal place to kickstart your day. Having frequented Motorworld on several previous occasions, my intention for today was to make a relatively short visit before relishing the remainder of the day in the city, perhaps picking up anything interesting in the memorabilia store along the way. Located within the premises of Motorworld in Munich, McLaren’s primary showroom consistently offers a captivating array of vehicles. During my previous visit, I had the pleasure of witnessing both a Speedtail and a Senna GTR on display. This time around, an Elva graced the showroom, which was already quite remarkable. However, the true highlight was another car, one that held an even more intriguing allure. You’d never be able to guess. This is it. What exactly is it? This is a 1969 McLaren M12 Coupe. While the McLaren F1 might be their first official road car, this particular M12 was in fact the first-ever McLaren to hit the streets, albeit somewhat unofficially after being made “street legal” in France by one of its previous owners. This McLaren M12 Coupe #60-14 remains the only one of its kind that has retained its original Big Block Chevy V8 engine and it has been shown at many concours events. It was even on loan for several months as a display car at the McLaren factory and if you have the means, you can buy it. How much? Well, if you had to ask… A little further down the luxury ladder of showrooms in Motorworld is Morgan. While not quite as exotic as a McLaren I can imagine these cars being just as fun to throw down a winding countryside road. With a curb weight of just slightly over 1,000 kilograms, I can only imagine the sheer driving pleasure these cars must offer when it comes to driving. Of course, when we talk about “Sheer Driving Pleasure,” we can’t overlook Munich’s very own Bayerische Motoren Werke. Unsurprisingly, BMW has its own dedicated space within these halls, known as the BMW Studio. Here, they showcase a rotating selection of curated cars, adding to the overall automotive delight of the venue. On this occasion, their exhibit featured an absolutely stunning 1600Ti. Fresh from BMW Group Classic, this particular unit was in impeccable condition. I can only dream. And yet again, while the sight of a lovely 1600 would make most BMW fans giddy with excitement, they had another vehicle on display that was unquestionably even more exceptional and undoubtedly of a significantly higher value. That car ladies and gents, is the Ken Done Group A E30 M3. This remarkable vehicle is one of the two E30 M3 racing cars commissioned by BMW in 1989 to a pair of Australian painters. With the second car going to Michael Jagamara Nelson. Through deep immersion in encyclopedias and the natural environment that enveloped him, Done cultivated a profound fascination with nature. He developed a special affinity for animals, especially creatures like butterflies, parrots, and fish. For his Art Car, Ken Done aimed to encapsulate the joyful essence of modern Australia. To achieve this, the M3 was adorned with a vibrant palette of exotic colours, reflecting the vitality of his homeland. He incorporated quintessentially Australian elements, such as the sun, beaches, and tropical landscapes, as well as abstract interpretations of the animals which had been hallmarks of his previous artistic endeavours. This particular E30 M3 boasts an impressive racing history preceding its transformation. It achieved remarkable success by claiming victory in Class B for eight out of the nine rounds during the 1987 season. Additionally, it secured outright victories, even outpacing more potent Class A rivals, most notably a Nissan Skyline GTR32 driven by Glenn Seton. After its illustrious racing career, it transitioned into a serene retirement, taking on a new life as a rolling sculpture displayed in museums and galleries. As one might anticipate in a facility of this kind, automotive marvels are not limited to the showrooms alone; you’ll encounter vehicles adorning the expansive corridors throughout the venue. The hallways also provide some interesting backdrops for photographs. Here, it’s not about having a collection of million-dollar dream cars; it’s about featuring vehicles that are captivating and intriguing in their own right. Like this pair of Fiat Cinquecentos! What about this gorgeous Giulia? However, considering that Motorworld also serves as a storage facility for collectors, you can often find some high-performance machines discreetly shielded behind protective glass. Like, say, a Stratos… Or, perhaps, a Porsche 935/K3/K4. Or something a tad “tamer”? Like this BB-Auto 911 to round off the visit? As I finished my rounds and found nothing of interest (within my budget anyway) to purchase in the shops, it was time to head back into town, but not without walking through the carpark of course where some interesting cars might be lurking, like this lovely 911 Speedster.

-

❤️Simi Covid, DORSCON Green Liao - What Did You Makan Today? ❤️

Etnt replied to Carbon82's topic in Makan Corner

mr and mrs morgan. today is ms morgan OJT, so only plain, egg and mutton curry on the menu. Can pass lar, Ms Morgan please expand your menu. -

The author, Morgan hausel, has an active blog. https://collabfund.com/blog/ It's like a continuation of the book.

-

𝑻𝒉𝒆 𝑷𝒔𝒚𝒄𝒉𝒐𝒍𝒐𝒈𝒚 𝒐𝒇 𝑴𝒐𝒏𝒆𝒚 by Morgan Hausel. A must read for anyone into savings, investing and the management of money. Currently I am reading the book Hidden Genius (great book about mindset from Polina Marinova) and also the book "All in on AI" by Thomas Davenport, one of the latest book from Harvard Business Review press.

-

I agree with Piers Morgan. It will not win any support by disrupting traffic flow. It will only irritate people. It's chaos that does nothing to stop the oil flow. The amdk mindset is undeniably there.

- 76 replies

-

- 6

-

-

- oil

- exploration

-

(and 3 more)

Tagged with:

-

Definitely possible, there is no more 'ulu' location - eg: today even far flung Woodlands Yishun Punggol etc sold for a million dollars. We can continue to be in denial, I reckon within the next decade or so, 2 mil HDB may be a reality. As mentioned - 'Expensive SG, playground of the Rich'. 😉 2017- https://www.cnbc.com/2017/04/13/singapores-property-prices-to-double-by-2030-morgan-stanley.html 2018 - https://www.straitstimes.com/business/banking/singapore-property-curbs-wont-cool-private-home-prices-says-morgan-stanley

- 8,340 replies

-

- 3

-

-

- property news updates

- property

-

(and 2 more)

Tagged with:

-

The Perfect Storm of the Stock Market II

Windwaver replied to RadX's topic in Investment & Financial Matters

https://asia.nikkei.com/Spotlight/Market-Spotlight/India-stocks-and-bonds-lure-in-foreign-investors India stocks and bonds lure in foreign investors Growing expectation of inclusion in benchmark global index BENGALURU -- Foreign investors have India in their sights as its equity markets provide respite from widespread economic gloom while its bonds are expected soon to be added to a benchmark global index. After a muted first half of the year, global investors turned net buyers of Indian stocks in July. Since then net foreign investment in Indian equities has reached 657 billion rupees ($8.3 billion), compared with net outflows of 2.17 trillion rupees (approximately $27.5 billion) between January and June. The renewed interest in the country is partly a reaction to fears of recession that are gripping many other large economies and the hope that India, the world's fifth largest economy, may be left relatively unscathed. The revival in foreign inflows has helped India's benchmark stock index to outperform its Asian peers. India's benchmark Sensex index rose 14.5% in the three months to September 14. By contrast Japan's Nikkei 225 grew 4.5%, the Shanghai stock exchange rose 0.3% and Hong Kong's Hang Seng Composite index fell 10.5% during this period. Nitin Bhasin, head of research at Ambit Capital, said while foreign investors are back in the fray, domestic investors have also stepped up their game. By Ambit's estimates, net inflows from domestic investors totaled $30.8 billion between January and August. The turnaround of the Indian bourses -- in mid-June the benchmark index was down 17% from an all time high in October 2021 -- seems ahead of the country's economic realities. While India's gross domestic product grew 13.5% year on year in the April-June quarter, it lagged the central bank's estimates of 16.2%. Retail inflation topped 7% in August, higher than the 6.71% in July, exceeding the Indian central bank's target of 6% for eight months in a row. Still, in comparison to India, GDP in the U.S. shrank 0.6% in the April-June quarter. In China, the economy grew by a meager 0.4%, stymied by the government's zero-COVID policy that led to protracted lockdowns and threatened exports. In comparison, India is more of an importer. According to government data, India's imports surged more than 37% to $61.9 billion in August, driven by an increase in procurement of crude oil, vegetable oil and chemicals. With exports rising 1.62% to $33.92 billion, India's current account deficit is set to increase and further weaken the rupee, which has fallen about 7.5% against the U.S. dollar this year. "If the U.S. goes into recession, then revenues of information technology companies in India will be hit, and so will overall export growth," said Ambit's Bhasin. "But remember, India is not as heavily reliant on exports as China." A sharp fall in crude oil prices has added to the optimism over India, which is the world's third largest oil importer and meets about three-quarters of its domestic needs through imports. Besides, while Indian stocks command a premium over its emerging market peers, prices have come off their peak. They were trading at about 18 times the expected one year forward earnings in July, when foreign investors turned net buyers, below the 10-year average of 19.5. Ashhish Vaidya, head of treasury at DBS Bank, said a string of policy reforms rolled out by the Indian government -- including incentives to spur local manufacturing of electronic components and electric vehicles -- will enable the country to "add value to the global supply chain." Coupled with a global push to develop manufacturing hubs outside China and a general aversion to invest in China and Russia, that augurs well for India. "The way India's macro (indicators) are stacking up because of [the] current account deficit and trade deficit obviously doesn't look exciting," said Vaidya. "That said, let's also look at the structural reforms happening in India." Global capital is also likely to start chasing India's sovereign bonds after reports that J.P. Morgan is considering inclusion of a large chunk of India's $1 trillion of rupee-denominated bonds in its flagship GBI-EM global diversified index, which also features Asian economies such as China, Indonesia, Malaysia and Thailand. The bank's consultation with potential investors revolves around 20 so-called "fully accessible route" bonds, which allow foreign institutional investment without any restriction. Investment bank Morgan Stanley says India has issued FAR bonds to the tune of $263 billion, and expects $360 billion of the bonds to be available by the second half of 2023. It believes that the inclusion will draw at least $30 billion into India by the financial year ending March 2024, reducing the cost of borrowing for the government. An inclusion in global indices can increase foreign holdings in India's government bonds from 1.2% at present to 9% by 2030, Morgan Stanley estimates. Foreign investors already appear to have stepped up purchases of FAR bonds in anticipation of their inclusion in the GBI-EM index. According to Reuters, they bought FAR bonds worth 66 billion rupees in the six weeks to September 9, while selling securities in other categories worth 18 billion rupees. International interest in Indian debt would help the government, whose resources have been stretched by stimulus packages in the aftermath of COVID-19. The fiscal deficit rose from 4.59% of GDP in fiscal 2020 to 9.3% the year after. Higher tax revenues helped to cut the deficit to 6.71% in fiscal 2022. "The fact that Indian bonds don't feature in global indices has led to a muted demand despite them offering better returns than many other countries," said Sujan Hajra, chief economist and executive director at financial services firm Anand Rathi. While discussions on India's inclusion into global indices have been going on for a few years, the Indian government and bankers could not agree on whether to allow offshore settlement of the bonds. The government contended that offshore settlement would disadvantage domestic investors, who pay the state a capital gains tax on selling the bonds. Madan Sabnavis, chief economist at Bank of Baroda, cautioned that inclusion in global indices may render Indian bonds more vulnerable to volatility in global markets, particularly when yields are rising. Yields on government bonds have risen above 7% from about 5.5% in January last year. But the positives range from a boost to India's foreign exchange reserves to a lower cost of borrowing for corporate borrowers. "A surge in demand for government paper will lead to a drop in yields, and automatically yields for corporate bonds will also come down," said Sabnavis.- 14,228 replies

-

- stock

- stock market

-

(and 2 more)

Tagged with:

-

Malware to drain your bank accounts. Take note. Dangerous Android trojan targets 600 banking apps — and it's draining accounts Android smartphone owners are once again under attack from the dangerous Anatsa banking trojan which has been updated with new capabilities and can now target even more banking apps. As reported by BleepingComputer, this new mobile malware campaign has been active since March of this year and so far, banking customers in the U.S., U.K., Germany, Austria and Switzerland have been targeted by Anatsa. Just like during a previous Anatsa campaign from back in November 2021 which saw the malware downloaded over 300,000 times, the hackers behind this new campaign are using malicious apps hosted on the Google Play Store to infect vulnerable Android smartphones. This updated version of the Anatsa banking trojan was first spotted by security researchers at ThreatFabric who revealed in a new report that it can now take over nearly 600 different banking apps and commit fraud right on an infected device. A number of big banks including JP Morgan, Capital One, TD Bank, Schwab, Navy Federal Credit Union and others can be targeted by Anatsa which is why this banking trojan is a threat Android users will want to take seriously. Delete these apps right now In their report, security researchers at ThreatFabric highlighted five of the apps that are being used by the hackers behind this campaign to take over and drain bank accounts. If you have any of these apps installed on your Android smartphone, it’s recommended that you uninstall them immediately. Below, you’ll find the apps in question along with their package names: PDF Reader - Edit & View PDF -lsstudio.pdfreader.powerfultool.allinonepdf.goodpdftools PDF Reader & Editor - com.proderstarler.pdfsignature PDF Reader & Editor - moh.filemanagerrespdf All Document Reader & Editor - com.mikijaki.documents.pdfreader.xlsx.csv.ppt.docs All Document Reader and Viewer - com.muchlensoka.pdfcreator While all of these apps have since been removed from the Play Store, you will need to manually delete them if you have any of them on your smartphone.

-

the above is true.....but when we drill it down, the word "happy" is hard to define because it can mean many things. However, it does have a common denominator for most people Morgan Hausel, the author of Psychology of Money said it best : “Happiness is a complicated subject because everyone's different. But if there's a common denominator in happiness - a universal fuel of joy - it's that people want to control their lives.”

-

The Perfect Storm of the Stock Market II

awhtc replied to RadX's topic in Investment & Financial Matters

JP Morgan, Goldman economists now expect Fed to raise rates by 75 basis points on Wednesday Published: June 13, 2022 at 7:40 p.m. ET The ‘true surprise’ would actually be a 1% rate hike, something a JPM economist sees as ‘a non-trivial risk’ Economists at JP Morgan and Goldman Sachs said in client notes Monday that they now expect the Federal Reserve to raise its policy rate by 75 basis points on Wednesday. https://www.marketwatch.com/story/jp-morgan-goldman-economists-now-expect-fed-to-raise-rates-by-75-basis-points-on-wednesday-11655163658?mod=bnbh- 14,228 replies

-

- 1

-

-

- stock

- stock market

-

(and 2 more)

Tagged with:

-

https://garage36.wordpress.com/2022/04/05/chill-cars-notcarskopi/ First and foremost, this is, sadly, not a Cars & Kopi meet. While the ongoing restrictions brought upon us by the Covid Pandemic have been relaxed to quite an extent, there is still a legal limit to the maximum number of participants an “unofficial” event like a car meet can have (10), but considering that this limit had been capped at 5 for the longest period, It was really nice to once again meet up with like-minded friends, have brekkie and talk cars over a (very) smol car gathering (7 of us) after an almost 2 years hiatus. With other smaller groups doing the same on a lovely Sunday morning, it was a welcomed sight indeed. Welcome to #NotCars&Kopi. Once again I was early so I did what auto otakus do when given some free time. Take pictures of their own rides. I haven’t really done much else to the Mark II since the last post save for a small new accessory. You probably can’t guess what it is. Kitty-chan’s back!!! This one’s a custom piece from Etsy, not that anyone really bothers. I know, I know, you hate it but it makes me laugh so it’s staying. JDM yo. Cars & Cat. Probably eyeballing me wondering what was I up to with my Kitty tsurikawa. Soon, friends started rolling in with some chill rides. Beautiful period Nardi in the Mercedes TE. Then this Morgan Plus4 arrived as the newest but oldest-looking car of the bunch. 2-litres of pure BMW turbo power. Mated to a 6-speed manual! Tasteful (but very expensive!). One of the highlights of the morning for me was this Toyota BJ60 Landcruiser sitting next to a vintage MG Y-Type. It doesn’t get any more chill than this classic off-roader. It even smells like how you’d imagine an old Toyota Landcruiser would smell. Perfect colour and wheel combination too. While it might dwarf the EF Civic sitting alongside, it’s really not that sizable by modern-day SUV standards. What it lacks in girth, tech, power and safety, it more than makes up for with its overflowing charm and character. I wish I had one. There were quite a number of interesting rides from other groups out for breakfast too, while both of these might not have been as loved back in the day, they are now getting the appreciation they deserve. Bonus points for keeping the NB clean and stock. A team of Cavallinos also pulled in after their morning run. While the 328 does look slightly fussier than the perfectly penned 308, it’s still a marvellous piece of automotive art I yearned for, ever since I was but a wee lad. Something looks slightly off with that blue one though. My other highlight for the morning was this historical Aston Martin. Having little to zero knowledge of cars from this period I shall not shame myself with my attempts to identify it but safe to say, it was absolutely stunning and visually spotless. I can’t imagine how much time the owner must have spent cleaning it! You don’t need anyone telling you you’re too cool for school when you roll in a pre-war Aston Martin. How very very lovely and special indeed. With the heavens that had up till then mercifully held up (even though online forecasts predicted otherwise) now starting to show signs of letting go, it was time for us to bid each other farewell as we headed home once again after this small but very significant meet. Let’s hope we can all meet again very soon. Stay safe, stay legal.

- 15 replies

-

- 29

-

-

.png)

-

- carsnkopi

- notcarsnkopi

-

(and 1 more)

Tagged with:

-

❤️Simi Covid, DORSCON Green Liao - What Did You Makan Today? ❤️

Etnt replied to Carbon82's topic in Makan Corner

enaq for westies. mr and mrs morgan is the go-to for easties. -

Yes, the head gasket...... often caused by the thermostat. I had the 1.6 in a Rover216 and never had any issues. My friend has a 1.4 in his Morgan, also so-far-so-good.

-

❤️Simi Covid, DORSCON Green Liao - What Did You Makan Today? ❤️

Etnt replied to Carbon82's topic in Makan Corner

-

Tesla hits record high in first trading session of 2021 source: https://www.theedgemarkets.com/article/tesla-shares-set-start-2021-record-high NEW YORK/BENGALURU (Jan 4): Tesla Inc shares rose to a record high in the first trading session of 2021, extending last year's more than eight-fold surge that helped it become the world's most valuable carmaker. The company on Saturday (Jan 2), beat Wall Street targets for annual vehicle deliveries but missed by 450 units of Chief Executive Officer Elon Musk's target of half a million cars in 2020. The stock's meteoric rise was supported by five straight quarters of profit, which helped the electric-car maker stand out in the global auto industry that has been witnessing a slump in sales, quarterly losses and supply chain disruptions. "We are raising our forecasts to reflect higher 4Q deliveries and reports of strong demand for the Model Y in China, which is also suggestive of higher future deliveries," J.P. Morgan analysts said in a client note. The brokerage also raised its price target on Tesla to US$105 from US$90. Street's median target on the stock is US$424.50, US$319 below its current trading price, according to Refinitiv data. Tesla, however, faces an uphill task of ramping up production. Its delivery push so far has been supported by the new Shanghai factory, the only plant currently producing vehicles outside California. "The bad news is to keep up with this demand, the company needs to quickly build new factories in Austin, Texas, and Brandenburg, Germany," said Gene Munster, managing partner at Loup Ventures. "... Ramping production is difficult and will be one of the most important Tesla topics in 2021, along with the status of FSD (Full Self-Driving)". Shares of the company, which joined the benchmark S&P 500 index in December, were up as much as 5.4% at US$743.74 in early trading.

-

❤️Simi Covid, DORSCON Green Liao - What Did You Makan Today? ❤️

Etnt replied to Carbon82's topic in Makan Corner

it's 5, but she later came with anotehr plate as said this one too boney. got service leh. ms morgan (the daughter) still young lar. today is her ojt so menu down to 3 items only. I was saying need to expand back to full menu. -

❤️Simi Covid, DORSCON Green Liao - What Did You Makan Today? ❤️

Etnt replied to Carbon82's topic in Makan Corner

-

Need unconventional method to channel the urge to something more beneficial to society. Someone like Harry Morgan. THis is Harry's code. https://dexter.fandom.com/wiki/Code_of_Harry#:~:text=The Code of Harry is,created by only Harry himself.