Search the Community

Showing results for tags 'Resale'.

-

3 kids all squeeze into 1 room https://qanvast.com/sg/articles/familys-executive-apartment-in-tampines-gets-a-staggering-sgd325k-reno-2944 Family’s Executive Apartment in Tampines Gets a Staggering $325K Reno No expense was spared in this lavish home, where even the tiniest detail was chosen with great care! Going into a renovation, most homeowners tend to have a fixed budget – for resale flats, that usually hovers around $40,000 to $80,000. But for the homeowners of this executive apartment in Tampines, their desire for a spacious, luxury-themed home culminated in a home that cost a whopping $325,000 to renovate. “The owners actively made the choice to upgrade their materials,” says Shawn, the designer from Style Elements Studio. “Some of them – like the large-format floor tiles – are about $800 a piece, while the laminates we used are triple the price of regular ones.” This renovation, however, isn’t just the sum of all its materials. From embedding rockwool within the ceiling to customising doors, cabinets, and even mirrors, every element in the house was was carefully curated by the owners and designer – all in the effort to create the desired lavish home. To see how the house turned out – and to learn about the design process – we got Shawn to tell us more! Shawn (S): This home belongs to a couple and their three kids. They were previously staying in a 4-room BTO flat – and as we know, BTO flats are very small, so they lacked space and wanted an upgrade. For the new house, they had quite specific criteria – like having distinct living and dining spaces, an entertainment room, and so on. So, they had a rather different house-hunting approach – after seeing one they liked, they’d immediately consult me to ask if the layout could incorporate what they wanted. This was pretty helpful actually, because to designers, the layout is quite important. Before this, the other houses they looked at had odd layouts – the kind with the kitchen and living room in the middle, and the bedrooms on either side, which isn’t really ideal. Eventually, we agreed that this house was best. They fell in love with the space and location, and for me, I felt that the layout had a lot of potential. On planning the renovation S: To me, renovations aren’t just about the budget – it’s about the concept that the clients want to achieve. Technically, I can renovate any house within a given budget, but that limits the material choices for the clients, which may not be what they like. So, I tend to be very transparent with my clients, where I’ll educate them on the different materials and their prices to fit a client’s expectation. I was glad that my clients understood that the materials they wanted were more expensive than average, and were willing to pay more just to achieve their desired aesthetic or quality. About the dining room S: The husband has always been an avid collector for Bearbrick figures – he used to keep his collection in his office since his old house was too small. Since he hosts quite often, we saw the dining room as a potential area to show off his collection, and gave him the space he needed to do so. Other than that, I think the large-format homogenous tiles stand out. I selected 1.5m by 1.5m tiles, which are sizes that are usually only used in commercial or landed properties. Of course, they’re more expensive than your regular tiles – and on top of that, it takes about 2-3 workers to layer it on, so there’s a high labour cost as well. We also used epoxy grout, which is more resistant to fading and discoloration than regular grout. They’re very hard – you can’t just use a pen to scrape it out. You won’t have kids accidentally scraping them out with their toys. Oh, and all the laminates are from Lamitak’s Protak series, which have antibacterial, anti-fungal, and anti-fingerprint properties.They’re triple the price of regular laminates – but we figured that this was a worthy investment since it keeps the space clean for the children, and reduces the need for clean-up. On renovating the living room S: Since the dining room was designated as the husband’s area, we designed the living room more for the wife. She likes the luxury theme, so we thought it was fitting to create the TV feature area out of bookmatched quartz, with a bottom console made with quartz of a matching colour. All the lights in this house are from Sol Luminaire, who only supply warm lighting. So, behind the TV feature area, we put up a copper-tinted mirror – which complements the warm lighting better than a regular mirror, and adds a cosier vibe to the space. As the owners are fond of fluted panels, we erected a wall with this design to conceal the bedroom and entertainment room doors. From my perspective, I see it more as a way to contain everyone within the communal area – I guess you could say it separates the public area from the private. About the kitchen S: Compared to the rest of the house, I think the kitchen design was quite straightforward. There’s a lot of natural light coming in from the kitchen, which I wanted to take advantage of. But at the same time, the clients brought up a Chinese superstition that says we shouldn’t be able to see the stove from outside. So, the natural choice was to use a fluted glass door. We had it custom-made as there aren’t a lot of choices out there – and honestly, it was a really long wait, because it took six weeks from fabrication to installation (laughs). Regular HDB kitchens use wall tiles, so I wanted to go against that. I used outdoor weatherproof paint – which doesn’t absorb oil, grime, and cooking smells like regular paint does. The wooden area you see is actually a niche. Rhythmic flow is important to designers – if the whole area has a similar colour theme, it’ll be overkill. This way, there’s a smooth transition between the marble, the black sintered stone surfaces, and the wooden tones, all of which complement one another. About the entertainment room S: The couple loves singing, so we needed to soundproof the area to avoid complaints from the neighbours (laughs). We embedded rockwool within the ceiling and fluted walls to dampen the sound. If you noticed, the room looks smaller than usual – it’s because we had to make the walls thicker to accommodate the rock wool. Since there are a lot of elements in this room, we had to find ways to accommodate everything while keeping the space neat. The cabinet next to the SMEG fridge is actually where the subwoofers are – it has a customised door with a perforated bottom half and a top half covered with black-tinted glass. This way, it helps to reduce the visual clutter, while still allowing infrared connections to pass through. About the master bedroom and ensuite S: The wife wanted to incorporate more marble designs in the master bedroom. I was against this at first since the rest of the house already features marble – but as she really wanted it, I counter-proposed using marble-look laminates as accents around the fabric headboard. The his-and-her bedroom wardrobe was another thing the couple really wanted. Creating it was a bit challenging as we had to ensure there was enough walking space – if you realise, the wardrobe is slightly angled to ensure that they can walk to and fro comfortably. Oh, and fun fact: this wardrobe is four times the usual length of a HDB built-in wardrobe. Typically, they’re about six to seven feet, but this one is over 24 feet! I think it takes up almost the whole wall – which, in a way, looks more luxurious. Like the bedroom wardrobe, the master ensuite features his-and-her sinks. They’re integrated sinks made out of Quartz stone – I never really liked the regular freestanding sinks as their silicon edges are prone to mould. Also, the mirrors were a challenge to obtain. They’re not the type that you can just buy off the shelf – I had to look around to find someone to fabricate them. I think I took about two weeks just to find the right supplier. To sum up S: This house was renovated around October last year, and like a lot of 2021 renovation projects, it was affected by the pandemic – I know it sounds like an excuse, but it did affect manpower and logistics. There was a lot of back-and-forth between myself and the contractors, and I made sure to be as detailed as possible to minimise misunderstandings. Actually, I’m not really sure what else to say about the house without sounding cliche (laughs). I understand that the renovation price has piqued people’s interest, but from a designer’s perspective, all I wanted was to create a home that my clients are happy with. To me, it was more about educating the clients about the different materials out there, and letting them make the choice. And if they’re happy with what they chose, then so am I!

- 221 replies

-

- 6

-

-

.png)

-

- renovate

- renovation

- (and 10 more)

-

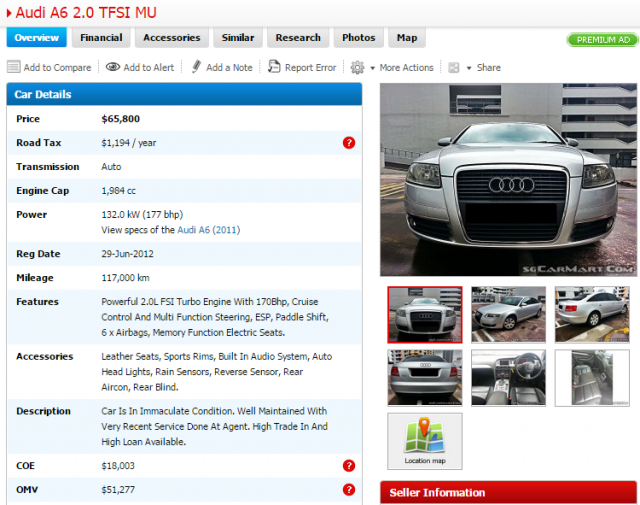

Took me quite some time to piece all the information together for this thread, which I have wanted to start a few months back. No right or wrong here, just some personal opinions on why I think the AD plays an important role in determining the resale value of the model sold by them. Feel free to share your thoughts (a forum is meant for members to engage in meaningful discussion, isn't it?) Many ADs has been playing hard to maintain the sales price of new car sold by them, citing reasons such as protecting customer's interest (by not having an unusually wide price fluctuation from month to month), guarantee a good resale value in the used car market (used car price is tagged almost directly to new car pricing), better service if buying the car from them directly, etc. But is that always the case? It is an open secret that when ADs are not able to meet their sales target, they will register the new car and sold it as used car through their used car division of even 3rd parties. I am using PML and Wearnes as an example below, to highlight the adverse effects of doing so. PML (BMW) With the new X3 priced from $302,888 (xDrive20i) / $308,888 (xDrive20i M-Sport) before over trade, the profit margin is between $68K to $71K, which is almost 150% of their respective OMV! Even after an generous O/T of say ~$30K, the net car price will still be around $270K to $280K. Yet PML would rather sell brand new unit at a much lower price (estimated to be ~$250K+) every month to used car dealers, only for it to be listed as used car, than to price it down to similar level for genuine buyers (direct PML customer). This is the screen grab I have taken from sgcarmart.com and the list is not exhaustive. You can even find pre-facelift X3, which was registered exactly a year ago, on the list (there are actually several units available, but the dealer don't want to give potential buyer the impression that they have to lelong the car in their inventory)! Based on the info I have, used car dealers got these units last year at just $200K thereabout, so they can continue to hold and wait (for uninformed buyer). So what does it got to do with resale value? Well, we all know that in a few years time, when the owner want to sell their ride, used car dealers will probably offer PARF + remaining COE value + another few $$$K for the body, and given the record breaking COE premium currently, the owner is likely to burn >$150K in just <5 years (buy at $280K, sell at $105K - $120K max. at 5th year). That's when some will KPKB that BMW has low resale value, nope? Wearnes (Volvo) Let look at the total number of V60 Cross Country and V90 Cross Country registered in the first 5 month of this year, 13 units in total. Want to make a guess how many of this units are sold as brand new used car? 1, 2 or 3? Well, I found 5 units listed on sgcarmart.com (I have reasons to believe there are more units available but not advertised - 'cos I saw at least another 1 - 2 units parked outside Wearnes Pre-Owned, probably management unit, which will eventually be sold as used car). That translate to ~40 to 50% of the new car sold as used. Reason for doing that? Having to meet sales quota without lowering the new car price. BTW, the profits for both model range from ~$67K to >$100K (before O/T), I will leave it to the readers to decide if that is reasonable for the brand. In the case of Volvo, it is a double whammy for the owners (be it brand new from Wearnes or brand new used car / management unit), as not only they are experiencing paper lost as what I have described above, with many used car in the market with transfer count of more than 1, the resale value will be further suppressed. One just need to browse the used car list on sgcarmart.com for the earlier model, and some can be had for ~$14K annual depreciation (in the current climate of $100K COE, so I cannot imagine when the COE return to $50K, these used car will have <$9K depreciation??) One particular unit of V60 Cross Country has been put up for sales for at least 2 months, with asking price of <$190K (for a 6 months old car) till the owner gave up and sell it to Eurokars Pre-Owned, so does that paint a picture that matches what I have written so far?

- 86 replies

-

- 41

-

-

- resale value

- new car

-

(and 7 more)

Tagged with:

-

Source: https://www.straitstimes.com/opinion/forum/forum-windfall-gains-from-selling-flats-should-be-taxed The Straits Times' associate editor Chua Mui Hoong wrote an excellent piece on returning the Housing Board to its original mandate (Returning HDB to its roots of building homes, not short-term assets, June 25). It resonates with the letter I wrote to the Forum in December suggesting that focus be placed on the resale market to address the lottery conundrum in public housing (Focus on resale market to address public housing issues, Dec 21, 2020), as well as the opinions of many other writers on how to address this inequitable phenomenon. As Ms Chua aptly pointed out, windfall gains that go to those who could afford high-priced Build-To-Order flats in the first place defeat the purpose of subsidised public housing. It is therefore pertinent that taxes of some sort be levied on such capital gains. Ms Chua's suggestion of treating such gains (on the sale of all subsidised HDB flats in all locations) as income is a brilliant idea, as this mechanism promises to give precisely the equitable effect that is sought. In the same way that the additional buyer's stamp duty and other property cooling measures were rolled out fairly quickly in various stages, is it not possible to tackle this facet of the lottery effect while the authorities continue to seek and digest public feedback on a new/enhanced public housing model? It is quite unbelievable that the number of HDB resale flats costing more than $1 million has been on the rise, with 87 sold in the first five months of this year.

-

https://www.todayonline.com/singapore/record-23-flats-non-mature-hdb-estates-sold-over-s800000-first-quarter-2021 Record 23 HDB flats in non-mature estates resold for over S$800,000 in 1Q 2021 The highest was a five-room flat in Punggol, which sold for S$910,000 Prices of resale HDB flats in Choa Chu Kang, Woodlands, Sembawang, Bukit Panjang and Hougang have risen over 10 per cent since before the pandemic Experts predict that a Punggol resale flat could fetch S$1 million flat within the next year or so SINGAPORE — Amid a pandemic property upswing that has already set off concerns about home affordability, the rising prices of resale flats in non-mature estates such as Punggol, Sengkang and Choa Chu Kang have also caught the attention of some industry watchers. In the first quarter, from January to March this year, 23 flats in non-mature Housing and Development Board (HDB) estates transacted for at least S$800,000, a record number of such units sold above that level in a quarter, a recent property report found. This made up nearly 10 per cent of the 245 flats in non-mature estates that have sold above S$800,000 since 1990, achieved in a single quarter. If this trend continues unhindered, analysts told TODAY an HDB resale flat in Punggol could soon fetch S$1 million. Said Ms Christine Sun, senior vice president of research and analytics at realtor OrangeTee & Tie: “Barring further external shocks, an influx of flat supply or cooling measures, we may see more flats inching closer to the S$1 million mark (in non-mature estates) ... at the current rate of price increase.” This milestone had been frequently breached by flats in mature estates, but never in non-mature towns. One transaction in Punggol last month came fairly close. On Tuesday (April 27), a report from Ms Sun’s company noted that a five-room, nine-year-old premium flat in Punggol changed hands for S$910,000 in March. It is a two-storey, 147-sqm HDB loft unit on the top floor of the Treelodge@Punggol project — attributes which are relatively rare in public housing. Since 1990, there have been only 15 flats in non-mature estates that have fetched above S$900,000, four of which occurred between 2019 and 2021, excluding the sale of the Punggol flat in March. When asked why people were willing to splurge on a flat in Punggol, which has been regarded by some as far-flung and inaccessible, Ms Sun said enhancements to the estates and extensive town planning such as the upcoming Punggol Digital District seem to have drawn buyers to the area. “A new university campus, market village, heritage trail, offices, logistic hub and amenities will be established over the next few years. The progressive enhancements have continued to entice buyers to Punggol and Sengkang,” said Ms Sun. Mr Alan Cheong, executive director of research and consultancy at real estate services provider Savills Singapore, added: “These two estates are demographically dominated by younger families, and this youthful vibrancy reinforces the positive view amongst those who are looking for a home.” HIGHER PRICES IN NON-MATURE ESTATES Apart from Punggol, analysts said that the surging trend of HDB resale prices has also been seen in all other non-mature estates. The HDB does not set out a precise criteria on why mature or non-mature estates are categorised as such and the main distinction is the unit price at launch — Build-to-Order (BTO) prices of non-mature estates are lower than mature estates. Resale data for all other non-mature estates reveal a general price increase during the pandemic, with Choa Chu Kang, Woodlands, Sembawang, Bukit Panjang and Hougang recording price growth in double digit percentage terms. The average price of a five-room flat in a non-mature town in the first quarter this year was around 11 per cent higher than in pre-pandemic 2019, according to data compiled by property consultancy Huttons Asia: Bukit Batok — S$532,038, which was 3.8 per cent more than in 2019 Bukit Panjang — S$543,755, which was 13 per cent more than in 2019 Choa Chu Kang — S$486,734, which was 19 per cent more than in 2019 Hougang — S$532,038, which was 3.8 per cent more than in 2019 Jurong East — S$562,734, which was 8.9 per cent more than in 2019 Jurong West — S$481,647, which was 9.4 per cent more than in 2019 Punggol — S$565,589, which was 9.6 per cent more than in 2019 Sembawang — S$456,309, which was 14.4 per cent more than in 2019 Sengkang — S$520,986, which was 7 per cent more than in 2019 Woodlands — S$470,457, which was 16.7 per cent more than in 2019 Yishun — S$520,394, which was 8.9 per cent more than in 2019 Said Huttons Asia’s director of research Lee Sze Teck: “The differentiation between mature and non-mature estates has blurred over the years. As connectivity and amenities improved in non-mature estates, some of the resale flat prices are very close to mature estates.” Based on his firm’s data, Mr Cheong from Savills Singapore pointed out that the resale HDB prices of non-mature estates have outpaced those in mature estates during the course of the pandemic. Comparing March 2021 and December 2019, average resale prices for flats in non-mature estates shot up by 11.9 per cent, while those in mature estates rose by 8.7 per cent. “Generally speaking, resale prices have risen across the board in both mature and non-mature estates. However, prices of resale flats in the non-mature estates rose more versus those from mature ones,” said Mr Cheong. The reasons behind this buoyant price trend for non-mature estates are also similar to those for mature estates — the current low cost of borrowing, pent-up demand after the circuit breaker, as well as optimism about vaccines and a recovering economy, said experts. Many of the buyers could also be downgrading from private property, or want to live close to family living nearby, which is why a location like Punggol and Sengkang could be popular, they added. Predicting a further 10 per cent increase in resale HDB prices by the end of 2021, Mr Cheong added: “The delays in the construction of Build-to-Order flats made some switch over to the resale market. Another reason is that Singaporeans who lost their jobs overseas are returning and are looking for an affordable home to move into quickly.” Based on HDB data, around 25,530 flats will be reaching their five-year minimum occupation period (MOP) this year, an increase from the 24,163 units in 2020. HDB flats may be sold on the open market only after its occupants have lived in the flat for this period of five years. A large portion will be in non-mature estates. Yishun, Sengkang and Choa Chu Kang, as well as the mature estate of Kallang are the towns that have the highest number of flats reaching their MOPs in 2021. Another 31,325 units will reach their MOP in 2022. Mr Lee from Huttons Asia explained that this would mean higher resale prices since newer flats often command a higher resale price than an older flat in the same vicinity. Property analyst Ong Kah Seng believes the milestone of a million dollar flat in a non-mature town may even be reached by the end of this year. “New cooling measures (for the HDB resale market) to rein exuberance and relentless resale flat price increases, and ensure price sustainability and affordability, could be necessary,” he said.

-

https://www.todayonline.com/singapore/cash-over-valuation-back-spotlight-rising-property-demand-drives-resale-prices Cash over valuation back in the spotlight as rising property demand drives resale prices up SINGAPORE — Having seen property prices tumble during the 1997 Asian Financial Crisis and the severe acute respiratory syndrome (Sars) outbreak in 2003, Mr Ng thought the ongoing Covid-19 pandemic would present him with a golden opportunity to secure his dream retirement home at a discount. Instead, the 66-year-old retiree saw prices “go up tremendously” as he ended up having to fork out about S$160,000 in cash over valuation (COV) for a five-room resale Housing and Development Board (HDB) flat in Pasir Ris. The 27-year-old recently renovated flat came with a price tag of around S$650,000. Mr Ng had sold his private property in late 2019, just months before the coronavirus ravaged economies worldwide. "I panicked as I felt that if I don’t buy now, the price may increase further,” said Mr Ng, who declined to give his full name. He eventually signed an option-to-purchase (OTP) early last week for the flat, which is located on the highest floor of its block. The COV refers to the difference in the sale price of a resale flat and its actual valuation by HDB. If the valuation is lower, the difference has to be paid in cash.

-

1.2 million for a 5 room DBSS flat between the 28th and 30th floor. Nowhere near the top floor and it can break all previous records. Strange times indeed. https://www.tnp.sg/news/singapore/dbss-flat-natura-loft-bishan-sold-12m Flats at Natura Loft in Bishan continue to fetch a handsome price, with the recent sale of a five-room unit there again crossing the $1 million mark. According to data from the Housing Board, the flat, with just under 90 years of its lease left, was sold for $1,208,000 this month. It is believed to be the highest resale price for a Design, Build and Sell Scheme (DBSS) unit, Chinese newspaper Shin Min Daily News reported yesterday. The 120 sq m unit is believed to be between the 28th and 30th storeys. The previous record price for a DBSS unit was the $1,205,000 paid for a five-room flat on the 39th-storey at City View in Boon Keng.

-

Lai which mcfer is this? Confess https://mothership.sg/2020/07/clementi-hdb-flat-1-million/ A five-room HDB flat at Clementi was purchased on July 5 for a staggering S$1.04 million, and it was done so in cash. Buyers paid for flat in cash The 1,248 sq ft unit at Block 441A Clementi Avenue 3 was priced at S$833 per sq feet, according to Edge Prop. The flat is located within Clementi Towers, a cluster of HDB blocks including 441A, 441B, 442 and 443. 4-room and 5-room flats are located in 441A. The other three blocks comprise 3-room and 4-room flats. Clementi Towers is also part of the Clementi integrated transport hub, including Clementi Mall, Clementi MRT station and the bus interchange. According to Edge Prop, the flats have 91 years left on their lease. Edge Prop reported that the buyers are an elderly couple who are downsizing from a landed property in West Coast. They also paid for the HDB flat in cash. The deal was closed in a day. The Clementi HDB flat was on the market for about 10 days and had two separate viewings. The previous record for the block was held by a five-room flat, also in Block 441A, sold for S$1.038 million (S$810 per sq ft) in July 2019.

-

Guys, I cant seem to get a definite answer on this. I'm planning to sell my existing place n move nearer to my kids' school. A friend is saying I should take the opportunity to get a HDB resale; as in my wife buy a resale HDB and I buy the condo but each of us has to finance each property individually. Is this allowed?

-

Anyone switch from a HDB to a resale pte property? Do you buy the pte property first then look to sell your HDB? Or the other way round? As for the pte property resale, does it mean that you can loan up to 90% of the price of the property? since upfront only need 1% + 4% + Stamp duty?

- 80 replies

-

- Purchasing

- resale

-

(and 3 more)

Tagged with:

-

Can any one advise as resale price is a old coe , how can price increase affect resale car price.

-

I own a KIA k3(top specs), around 11months, average mileage, accident free. I itchy backside wanted to change to the face lifted 2016 Vezel or Sportage 2016 and so i went to test water on how much my resale value of my k3 is. Quotes received from the various websites and PI. Sg Motorist - 74k Sg Carmart - 70k to 75k PI - 70k. If i were to take the price of 74k, my car depreciates by 40k in less than a year. But then I saw a 2013 Forte(the previous model, not k3) is selling for 75k by a dealer at sgcarmart(i assume the dealer bought @ 65 to 70k from the previous owner?). My question is are they trying to carrot me or the price is really so low? How do i really know the true value of how much my car can fetch? Anyone i scratch my backside already, not itchy anymore. Now just curious is this the norm....

- 23 replies

-

- kia

- kia#kia #k3 #resale

- (and 4 more)

-

In general, people are saying Mercs hold its value well. Using my own, it's a Jan 2011 C180 which I bought from a dealer for 140k around a year and half old. Coe was 35k. Fast forward. Taking a similar year and half C Oct 2014 below, they are selling at 147k but coe is 65k. http://www.sgcarmart.com/used_cars/info.php?ID=529153&DL=1013 Is this the indication how Mercs are holding their value? Of course, this is disregarding low-balling from dealers. I am looking at selling price in the market.

- 25 replies

-

- 3

-

-

-

- mercedes-benz

- mercedes benz resale value

-

(and 3 more)

Tagged with:

-

perhaps 5-10 years ago, kia resale value is probably tagged to near hyundai, whereby people stay away from them due to the low resale value after few years. Compared to toyota and honda whose resale value sustains. However, when getting my new ride k3 from kia comparing to the new altis, I was surprised by the outstanding functions that the car offers compared to altis. Cruise control, paddle shift, rear aircon vent , sunroof, 17inch wheels where altis has none of them. And definitely i would say kia has improved tremendously over the years and i believe that its resale value will catch up to the japan brands in few years time. What do you guys say?

- 51 replies

-

Prices of resale (ECs) are catching up with those of private mass market homes as the increasingly luxe features at recent ECs have boosted the profile of these homes. The price gap between resale executive condo and comparable mass market homes has narrowed to just 17.2 per cent this year, data from the Singapore Real Estate Exchange (SRX) found. This is a sharp fall from the previous market peak of 32.2 per cent in 2007. SRX added that the price gap has been narrowing and stabilising since then. Last year, the gap was 17.4 per cent while it was 14.5 per cent in 2010. Executive condo combine elements of private and public housing and often have premium furnishings and condo-like facilities. Experts said they are becoming more popular now as many home buyers see them as value buys, particularly those that offer innovative and high-end features. Units at new executive condominiums launches are also typically 20 per cent to 25 per cent cheaper than new mass market homes owing to Housing Board rules applying to ECs such as a household monthly income cap of $12,000. Knight Frank research head Png Poh Soon added: "As buyers' perceptions of ECs and private homes are blurred, when ECs reach that fifth and 10th year, the price gap could narrow even further provided that the quality of EC finishings and features is equivalent to (that of) private homes." PropNex chief executive Mohamed Ismail expects the gap to be "marginal and as little as 5 per cent" as more and more EC projects, especially the recently launched ones, approach their 10-year-old mark. ECs are subject to a minimum occupation period of five years. They can then be sold only to Singaporeans and permanent residents. They become private property after 10 years and can then be sold to foreigners. Recently, developers have also upped the ante at EC projects as they battle for buyers spoilt for choice owing to the flood of new home launches. Penthouses and skysuites, for instance, have become more common at executive condominium projects. Some even feature private jacuzzi pools. However, the price gap varies among the six suburban districts that have at least two EC projects eligible for resale here, SRX noted. For instance, the gap in District 19 - comprising estates like Hougang, Punggol and Sengkang - is the highest at 22.4 per cent. Resale ECs in this area include The Florida and Park Green. District 18, made up of Pasir Ris, Simei and Tampines, and District 20, including EC projects like Bishan Loft and Nuovo in Bishan and Ang Mo Kio, have the lowest price gap of just 10 per cent. Experts said this is likely due to the string of new EC launches and sites being sold in the north-eastern estates that provide stiff competition to existing ones. OrangeTee managing director Steven Tan said home buyers are willing to pay more for ECs in mature estates such as Bishan as there is a limited supply of resale and new EC projects there. Estates with resale EC projects that are more than 10 years old are also likely to see narrower price gaps as these EC projects are fully privatised. "Some new buyers or foreigners might not even know that what they are buying are actually ECs," he added. The price gap is also expected to narrow further as ECs cement their reputation as being on a par with private condos. PropNex's Mr Mohamed noted that the new EC launches have been getting a lot of hype with lifestyle elements - such as concierge services and infinity pools - taking centre stage at some projects. "There is also an increasing demand for ECs as home prices increase. The overall quantum for private homes might no longer fit the budget of a buyer and so he might turn to ECs instead as an alternative," he added. "And so as demand for ECs increases, the price gap narrows in turn." Knight Frank's Mr Png noted that the many larger ECs units at recent launches are likely to see a smaller price gap after the fifth and tenth year of completion as their higher-end offerings could appeal more to buyers. The SRX collates transactions by major property agencies, which account for more than 80 per cent of the market.

- 1 reply

-

- executive condo

- executive condominiums

- (and 7 more)

-

Is it true that the sales rep's marked ups for these cars are very high so the new car prices are high but the resale values are later very poor? - ford - kia - Land Rover I heard about ford more than a few times.

- 1 reply

-

- resale vale

- ford

-

(and 4 more)

Tagged with:

-

Hello all. I am just wondering within these two or three months, have you ever tried to sell your car or gauge the value of your car in the second hand market. I did try to sell two cars and im in the midst of helping my brother in law selling his car. By now you should know that there are dealers pretending to be direct sellers when selling their cars. Their asking price is also very similar to the price displayed by the car dealers. I am sharing my personal experience when i sold my relative's car three weeks ago. It was a September 2008 corolla altis , 2 owners , car very tip top condition with a mileage of 116 000 . If you were to look at the price advertise by these dealers, it ranges from 54 000 to 59 000 but some of the calls i received by the dealers, they are just offering for 47k to 50k only. In fact, they have the cheek to tell me that once the car comes in to their garage , they will spend up to $3k to do up the car which i think is pure nonsense because the most they do is one coat of paintwork that costs around $800 to $1k. And these dealers also will charge admin fee and whatever else to further 'burden' the potential buyer. In another case, a dealer bought in a japanese mpv for 32k and two days later advertise it for over 41k. So ladies and gentlemen, i am just sharing with u as an end user we have to be very careful because the market practice is so bad and most of the time we are at the mercy of these dealers. I am sharing this so that we will be more aware of things and practices that happens around us. I hope there are other forummers who are willing to share your experience.

- 110 replies

-

- 1

-

-

- car

- second hand

- (and 5 more)

-

http://www.channelnewsasia.com/news/singapore/hdb-resale-prices-fall-to/1251928.html Do you think will fall further or now is the best time to get resale?

- 8 replies

-

- 1

-

-

- hdb resale price fall 2 years

- resale

-

(and 3 more)

Tagged with:

-

http://www.straitstimes.com/breaking-news/singapore/story/singapore-budget-2014-agree-price-then-get-valuation-hdb-resale-deals- Surprise this hasn't been posted or discussed here. Cash-over-valuation (COV) figures will no longer be part of the negotiating process for Housing Board resale deals, as buyers and sellers will now have to agree upon a price first before getting an official valuation, National Development Minister Khaw Boon Wan said in Parliament on Monday. Previously, sellers usually got valuations first, and then negotiated with buyers over how much more - or less - should be paid. But negotiations should "rightly" be based on recent transaction prices, not the additional cash premium or COV, said Mr Khaw. So from 5 pm on Monday, a price must first be agreed upon and the Option to Purchase (OTP) granted, before buyers can request a valuation from the HDB. HDB will no longer give valuations to sellers, although existing OTPs and valuations will still be honoured until their expiry. This move will "restore the original intention of valuation, which is to help buyers get a housing loan," said Mr Khaw. He noted that with COVs now hitting zero or negative figures, this is a good time to make the move. There may still be a difference between the agreed price and the valuation, so COVs will still exist - but as a consequence, not as a standalone figure. To help buyers and sellers in their negotiations, HDB will publish daily figures on recent resale transactions starting Monday, rather than fortnightly as was previously the case. "This way, buyers and sellers can refer to latest market information during their negotiations," said Mr Khaw. "Negotiating on price rather than COV will take some getting used to," he added. "However, it is a useful move for long-term market stability."

- 5 replies

-

- 1

-

-

- hdb resale

- ruling

-

(and 1 more)

Tagged with:

-

Currently driving a 2010 Epica but is it a good time to sell now or sell on the 4th or 5th year? What do you guys suggest?i took 7yrs loan, OMV 15K+ & COE $42k.

-

hi brothers, as the title says it all, an unfortunate event where a friend's license got revoked and now having troubles selling off his car. hope all the mcf bros here can share any advice where should he start off with? 1. post an ad in used cars 2. consign unfortunate as it is, there's an existing bank loan tagged. and he is afraid no one might be able to fork 30k for an `06 fit. thanks in advance to all. have an enjoyable weekend. P.s. Apologies if this is posted in wrong cat.

-

Hi, I need some honest help from you guys here. If I already found a resale property I like and know the procedure for loan application, should I contact the seller agent directly and negotiate the transaction? Is there any benefit to engage a buyer agent to act on my behalf? Would a seller agent normally prefer to deal with direct buyer or a buyer agent?

-

Mr Han, I salute you for having the guts to speak out for citizens!!! Steady!!! Respect!!! http://forums.condosingapore.com/showthread.php?t=15547

-

Didn't think it'd happen but WOW finally! http://www.sgcarmart.com/used_cars/info.ph...780&DL=2351 Wonder if the owner had difficulties financing the car....

-

[extract] Ford of Europe has an interesting method to boost sales. The dealers sold cars to each other, without having actual customer orders. Dealers eventually sell the cars as used vehicles at huge discounts. This has artificially boosted car sales by up to 30%. Even more interestingly, Ford

-

- sales report

- discussions

- (and 11 more)