Search the Community

Showing results for tags 'loan'.

-

anyone can shed some info on this? given the car is 120k. i need to loan ard 70-80k. how to do so for direct purchase?

-

I'm looking to change my bank home loan. (private housing) based on today's interests rate, anyone can recommend a bank who can offer a better deal? Income level and other criteria, sure meet the requirements. Loan amt, only $930k Current bank is UOB on FD rate package.

-

Hi all, Anyone got a spare wheelchair lying around wife just finished knee ops and not steady/comfortable walking with clutches, just need to loan for about 4 to 6 weeks before she could start her physio therapy. Many thanks in advance

- 36 replies

-

- wheelchair

- loan

-

(and 3 more)

Tagged with:

-

Car loan interest rates in S'pore hit 2.78% after US Fed's latest hike SINGAPORE - On top of rising car prices that come with record prices for certificates of entitlement, buyers of new cars here now have to fork out even more for loans. Some banks and financial institutions have raised interest rates to 2.78 per cent. This is an increase of 0.5 percentage point from the 2.28 per cent interest rate reported in May. https://www.straitstimes.com/singapore/transport/car-loan-interest-rates-in-spore-hit-278-after-us-feds-latest-hike

-

https://www.channelnewsasia.com/commentary/sri-lanka-economic-crisis-china-debt-trap-2626976?cid=FBcna&fbclid=IwAR3rVgAi-sCE5t3Emdlfnn_XszVT2i9AnrtVKcThOyxRyYFMp0qyb9JHueA MUMBAI: The island nation of Sri Lanka is in the midst of one of the worst economic crises it’s ever seen. It has just defaulted on its foreign debts for the first time since its independence, and the country’s 22 million people are facing crippling 12-hour power cuts and an extreme scarcity of food, fuel and other essential items, such as medicines. Inflation is at an all-time high of 17.5 per cent, with prices of food items such as a kilogram of rice soaring to 500 Sri Lankan rupees (US$1.56) when it would normally cost around 80 rupees (US$0.25). Amid shortages, one 400g packet of milk powder is reported to cost over 250 rupees (US$0.78), when it usually costs around 60 rupees (US$0.19). On Apr 1, President Gotabaya Rajpaksha declared a state of emergency. In less than a week, he withdrew it following massive protests by angry citizens over the government’s handling of the crisis. The country relies on the import of many essential items including petrol, food items and medicines. Most countries will keep foreign currencies on hand in order to trade for these items, but a shortage of foreign exchange in Sri Lanka is being blamed for the sky-high prices. IS SRI LANKA CRISIS BECAUSE OF CHINA RELATIONS? Many believe that Sri Lanka’s economic relations with China are the main driver behind the crisis. The United States has called this phenomenon “debt-trap diplomacy”. This is where a creditor country or institution extends debt to a borrowing nation to increase the lender’s political leverage – if the borrower extends itself and cannot pay the money back, they are at the creditor’s mercy. However, loans from China accounted for only about 10 per cent of Sri Lanka’s total foreign debt in 2020. The largest portion – about 30 per cent – can be attributed to international sovereign bonds. Japan actually accounts for a higher proportion of their foreign debt, at 11 per cent. Defaults over China’s infrastructure-related loans to Sri Lanka, especially the financing of the Hambantota port, are being cited as factors contributing to the crisis. But these facts don’t add up. The construction of the Hambantota port was financed by the Chinese Exim Bank. The port was running losses, so Sri Lanka leased out the port for 99 years to the Chinese Merchant’s Group, which paid Sri Lanka US$1.12 billion. So the Hambantota port fiasco did not lead to a balance of payments crisis (where more money or exports are going out than coming in), it actually bolstered Sri Lanka’s foreign exchange reserves by US$1.12 billion. So, what are the real reasons for the crisis? IMF LOANS COME WITH CHALLENGING CONDITIONS Post-independence from the British in 1948, Sri Lanka’s agriculture was dominated by export-oriented crops such as tea, coffee, rubber and spices. A large share of its gross domestic product came from the foreign exchange earned from exporting these crops. That money was used to import essential food items. Over the years, the country also began exporting garments and earning foreign exchange from tourism and remittances (money sent into Sri Lanka from abroad, perhaps by family members). Any decline in exports would come as an economic shock and put foreign exchange reserves under strain. For this reason, Sri Lanka frequently encountered balance of payments crises. From 1965 onwards, it obtained 16 loans from the International Monetary Fund (IMF). Each of these loans came with conditions including that, once Sri Lanka received the loan, it had to reduce its budget deficit, maintain a tight monetary policy, cut government subsidies for food for the people of Sri Lanka and depreciate the currency (so exports would become more viable). But usually, in periods of economic downturns, good fiscal policy dictates that governments should spend more to inject stimulus into the economy. This becomes impossible with the IMF conditions. Despite this situation, the IMF loans kept coming, and a beleaguered economy soaked up more and more debt. The last IMF loan to Sri Lanka was in 2016. The country received US$1.5 billion for three years from 2016 to 2019. The conditions were familiar, and the economy’s health nosedived over this period. Growth, investments, savings and revenues fell, while the debt burden rose. DID SRI LANKA GOVERNMENT MAKE FATAL MISTAKES? A bad situation turned worse with two economic shocks in 2019. First, there was a series of bomb blasts in churches and luxury hotels in Colombo in April 2019. The blasts led to a steep decline in tourist arrivals – with some reports stating up to an 80 per cent drop – and drained foreign exchange reserves. Second, the new government under President Gotabaya Rajapaksa irrationally cut taxes. Value-added tax rates (akin to some nations’ goods and services taxes) were cut from 15 per cent to 8 per cent. Other indirect taxes such as the nation-building tax, the pay-as-you-earn tax and economic service charges were abolished. Corporate tax rates were reduced from 28 per cent to 24 per cent. About 2 per cent of the gross domestic product was lost in revenues because of these tax cuts. In March 2020, the COVID-19 pandemic struck. In April 2021, the Rajapaksa government made another fatal mistake. To prevent the drain of foreign exchange reserves, all fertiliser imports were completely banned. Sri Lanka was declared a 100 per cent organic farming nation. This policy, which was withdrawn in November 2021, led to a drastic fall in agricultural production and more imports became necessary. But foreign exchange reserves remained under strain. A fall in the productivity of tea and rubber due to the ban on fertiliser also led to lower export incomes. Due to lower export incomes, there was less money available to import food and food shortages arose. Because there is less food and other items to buy, but no decrease in demand, the prices for these goods rise. In February 2022, inflation rose to 17.5 per cent. In all probability, Sri Lanka will now obtain a 17th IMF loan to tide over the present crisis, which will come with fresh conditions. A deflationary fiscal policy will be followed, which will further limit the prospects of economic revival and exacerbate the sufferings of the Sri Lankan people.

-

https://asia.nikkei.com/Spotlight/Belt-and-Road/385bn-of-China-s-Belt-and-Road-lending-kept-undisclosed-report?utm_campaign=GL_asia_daily&utm_medium=email&utm_source=NA_newsletter&utm_content=article_link&del_type=1&pub_date=20210929190000&seq_num=11&si=44594 $385bn of China's Belt and Road lending kept undisclosed: report Beijing's loans to Pakistan cost 3.76% interest, while Western peers offer 1.1% China systematically underreports its debt to the World Bank's Debtor Reporting System by lending money through special purpose vehicles, a study reveals. (Source photos by AP and Reuters) ADNAN AAMIR, Contributing writerSeptember 29, 2021 14:16 JSTUpdated on September 29, 2021 20:22 JST KARACHI -- A staggering $385 billion of Chinese debt to other countries has been hidden from the World Bank and IMF thanks to the way the loans are structured, U.S.-based AidData said on Wednesday in its latest version of the Global Chinese Official Finance Dataset. The report also alleges that a major portion of Chinese development financing in Pakistan is composed of expensive loans. The AidData report claims Beijing has made its overseas development finance nontransparent. It says that China systematically underreports its debt to the World Bank's Debtor Reporting System by lending money to private companies in lower middle income countries by using special purpose vehicles (SPVs), rather than to state institutions. This makes it difficult for debtors and multilateral lenders to assess the costs and benefits of participating in the Belt and Road Initiative. It also heightens the possibility of debtors falling into debt traps with only one way to climb out: by selling geopolitically important assets to China. The report further says that due to debt spending by China under the banner of the Belt and Road Initiative, 42 countries now have levels of public debt exposure to China in excess of 10% of GDP. For instance, the China Exim Bank-financed China-Laos railway project, valued at $5.9 billion -- equivalent to roughly one-third of Laos' GDP -- is funded exclusively with hidden debt. Bradley C. Parks, executive director of AidData at the College of William and Mary, said the World Bank and the IMF are already aware of this problem. He told Nikkei Asia that this new report has quantified the scale of the problem. "We estimate that an average government is underreporting its actual and potential repayment obligations to China by an amount that is equivalent to 5.8% of its GDP, based on individual underreporting estimates for 165 countries," said Parks, who is also one of the co-authors of the report. The report also makes some interesting revelations about Chinese development financing in Pakistan in the context of the China-Pakistan Economic Corridor (CPEC), the $50 billion Pakistan component of Belt and Road. As per the report, between 2000 and 2017, China made total commitments worth $34.3 billion for development financing in Pakistan, out of which at least $27.8 billion has been official commercial-like loans with limited concessions. This report also says Chinese loans to Pakistan are expensive compared to loans provided by Organization for Economic Cooperation and Development's Development Assistance Committee (OECD-DAC) and multilateral creditors to Pakistan. The average Chinese loan to Pakistan, it says, has an interest rate of 3.76%, a maturity period of 13.2 years and a grace period of 4.3 years. "As a point of comparison, a typical loan from an OECD-DAC lender like Germany, France or Japan carries a 1.1% interest rate and a repayment period of 28 years, much generous than what China has offered to Islamabad," Ammar Malik, a senior AidData research scientist who leads the Tracking Underreported Financial Flows program, told Nikkei. Despite the high cost, lower-middle-income countries like Pakistan accept the loans offered by China to private entities in their countries. Experts believe that these countries accept the loans because they do not appear in their balance sheets. The Yuxi-Mohan railway between China and Laos under construction in May 2019 in China's Yunnan Province. © Getty Images "Borrowing via special purpose vehicles and joint ventures -- under off-balance sheet arrangements -- provides a way for a low-income or middle-income government to facilitate the implementation of large public infrastructure projects without going red in terms of debt limits," Parks said. While the AidData report is based on data available till 2017, experts believe that there have not been any major changes in the pricing of loans from public institutions in China. "Beijing's state-owned banks have consistently given priority to profitable, revenue-generating projects. Chinese state-owned banks are yield-maximizing surrogates of the state," Parks said. Despite the release of this report, the Chinese development financing pattern in Pakistan is unlikely to change. "In the 10th JCC (Joint Cooperation Committee) meeting of CPEC (last week), Pakistan decided against renegotiating the terms of $15 billion energy projects, which were initially deemed expensive, because Pakistan needs China's finance," an official linked with CPEC projects in Pakistan told Nikkei on condition of anonymity. The official added that Pakistan will continue to rely on Beijing for development financing, even if its terms are not concessional, because G-7 nations and other creditors are not very generous when it comes to financially supporting Pakistan. Jeremy Garlick, associate professor of international relations at the University of Economics Prague, said Pakistan has been short of cash and looking for investments for decades. "The Chinese loans are rather expensive, but Pakistan has actively sought them. It is not as if the Chinese are imposing them upon Pakistan," he told Nikkei.

-

Been seeing alot of dealers offering such promotions to unknowing customers or customers whom are financially unsound. This is the WORST decision you should NEVER ever make as people tend to get tempted only by looking at the monthly instalment. There are some hidden sums that people are unaware of and the interest accumulated is absolutely insane. You will be STUCK few years down the road if you decide not to keep the car and sell it off unless you have $$ to pay off your outstanding loan. You need to have $0 outstanding loan to do a transfer of car ownership (ignoring whatever grey areas possible). 'Disclaimer: The numbers are for illustration only and by no means an accurate reflection.' __________________________________________________________________________________ Let me give you an illustration based on the conditions below. 1. You get excited at this $0 driveaway promotion + 10 years loan and decided to buy a car @ $100,000 with parf value @$2500. 2. Loan interest rate est. 3% pa and you decided to loan for 10 years. 3. Now its time to do the sums! Car Purchase Price: $100,000 Interest incurred @ 3% pa: $100000 * 3% * 10 years = $30,000 [YES IT IS $30k] Total Cost: $100,000 + $30,000 = $130,000/- Monthly instalment: $130,000/10years/12mths = $1084/mth __________________________________________________________________________________ 3 Years Later So you've made the purchase and happily drove off but 3 years down the road, you had a change of mind and decided to sell off the car. Based on an estimated trade in price at a depreciation of $6.5k from dealers and now lets do the sums again. Trade in price: ($6500 * 7 years remaining) + parf value of $2500 = $48,000 + $5,000 (token sum from dealer) = $53,000 Outstanding loan (before rule 78): $13,000 * 7 = $91,000 With a trade in price of $53,000 and outstanding loan of $91,000, you have to fork out $38,000 to clear off the loan. __________________________________________________________________________________ 5 Years Later So you've made the purchase and happily drove off but 5 years down the road, you had a change of mind and decided to sell off the car. Based on an estimated trade in price at a depreciation of $6.5k from dealers and now lets do the sums again. Trade in price: ($6500 * 5 years remaining) + parf value of $2500 = $35,000 + $5,000 (token sum from dealer) = $40,000 Outstanding loan (before rule 78): $13,000 * 5 = $65,000 With a trade in price of $40,000 and outstanding loan of $65,000, you have to fork out $25,000 to clear off the loan. __________________________________________________________________________________ 7 Years Later So you've made the purchase and happily drove off but 7 years down the road, you had a change of mind and decided to sell off the car. Based on an estimated trade in price at a depreciation of $6.5k from dealers and now lets do the sums again. Trade in price: ($6500 * 3 years remaining) + parf value of $2500 = $22000 + $5,000 (token sum from dealer) = $27,000 Outstanding loan (before rule 78): $13,000 * 3 = $39,000 With a trade in price of $27,000 and outstanding loan of $39,000, you have to fork out $12,000 to clear off the loan. __________________________________________________________________________________ Hope this post and sharing will help as many people as possible to not fall into the debt trap for the sake of owning a car. These sums are already relatively conservative for illustration purposes.

- 178 replies

-

- 38

-

-

.png)

-

(Hi guys, like to ask regarding Car Loan, am planning to buy a PARF car value around $55k. The paper value is around $35k, I plan to sell within 1 yr... If I downpay $20k, and take a car loan, I should be on breakeven (i think) but how to settle the car loan without penalties if sell within 1 yr? Suggestions welcome 🙂

-

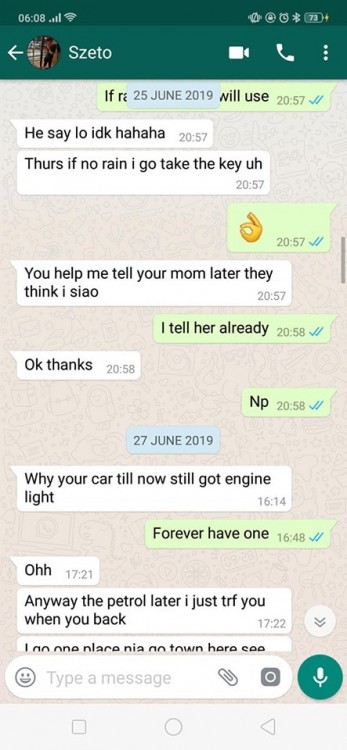

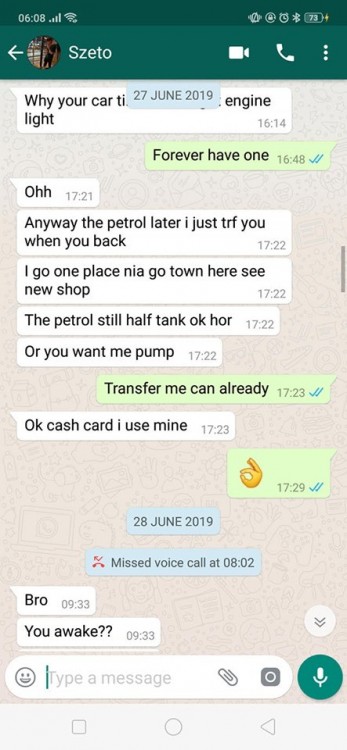

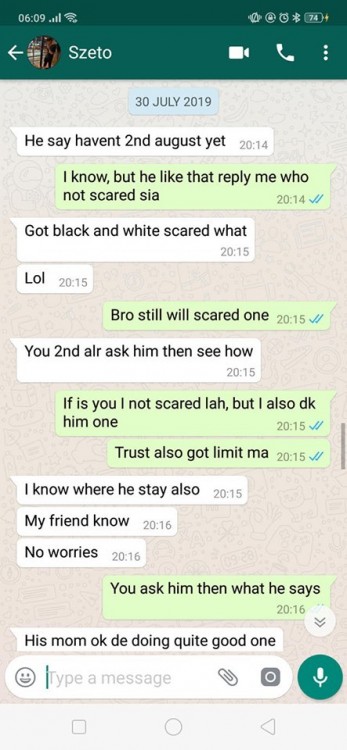

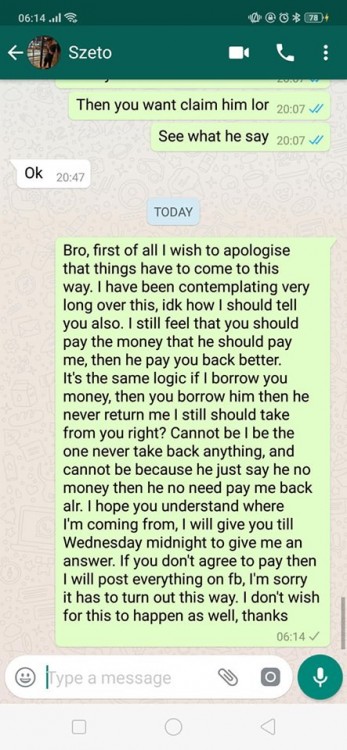

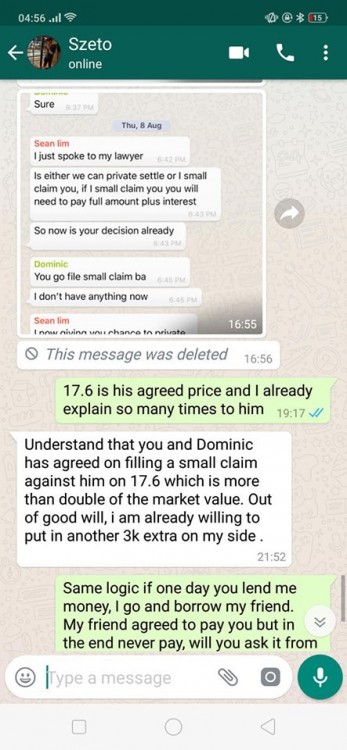

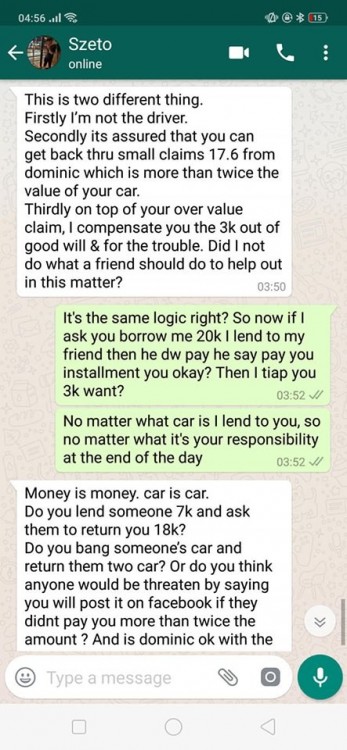

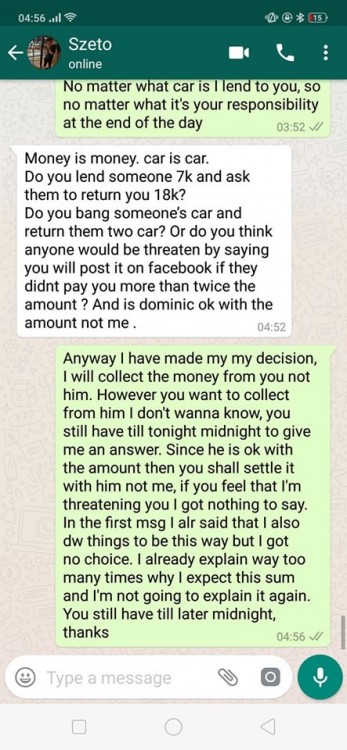

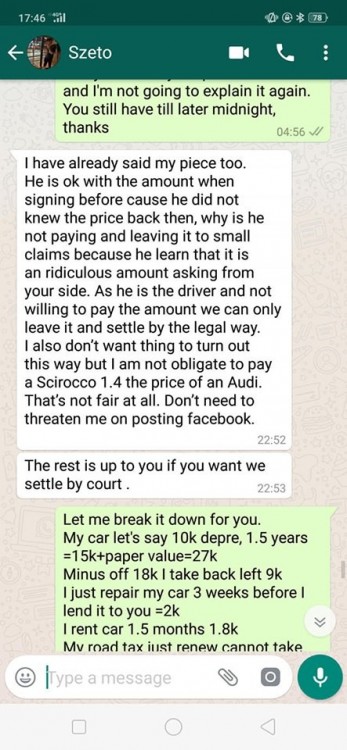

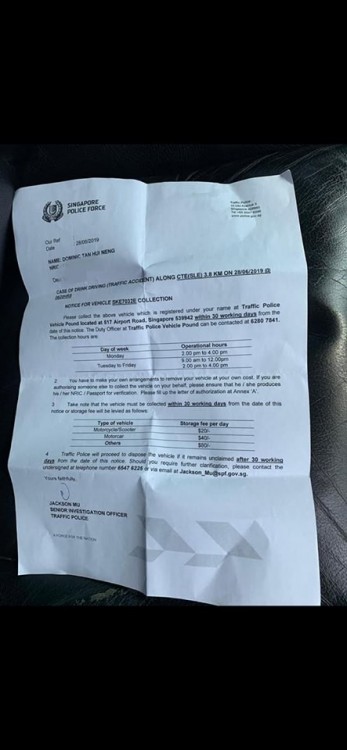

From Facebook https://www.msn.com/en-sg/news/singapore/friends-like-these-man-at-a-loss-after-pal-refuses-to-pay-sdollar176k-damages-following-car-accident/ar-AAHA7P6?ocid=spartandhp&fbclid=IwAR0bJtAeizlUU4T47eypa1jM89VAXbI3Pm0euCnf5emaTlEpOThVByZcXZ0 Hi all, this is going to be a long read but please take the time to read thru. So the story is that on the 25th June my dear friend Szeto St wants to borrow my car from me to use it on the 27th. As I was overseas at the point of time I agreed to lend it to him, it was not the first time I have lend it to him so I entrusted him with my car. On the 28th morning 8am he gave me a missed call, so when I call him back he told me that he got into an accident with my car then he said that the one driving was his friend. I entrusted my car to him and yet he asked his friend (Dominic) whom I don't even know who he is to drive my car back on that day, I was still very nice at that point of time I said wait till I reach sg then we settle. So I came back on the 29th I meet them on the 30th, they didn't have a solution for me. So we briefly spoke how we should settle it as the car was total loss, so dom suggest to give him more time. And so on the 2th July, we both agreed that he will pay me $17600 as my losses under the condition that I scrap my car. And he requested to give him a month for him to find the money, so me being nice I agreed to it. Once we sign the agreement I proceed to tow my car to the scrap yard and handle all the paperworks and send him documents from lta that I have scraped my car once I received it which was on the 8th July. And so I continue to wait for the 2nd aug to come, on the 30th July I texted Dom to ask on the 2nd aug what time should I meet him and he asked me to wait. So I texted szeto about this he told me not to worry why I scared, and I obliged and waited. So on the 2nd aug the worst nightmare happens, I texted him in the afternoon and Dom said he will let me know by 7pm. 7pm I called him and he simply told me this "我没有钱,你要我怎样。你去small claim 我咯" one simple reply and he expect to get away with the shit he create? Long story short, two days later he say he will only pay me 11k but thru installment of $500 every month. Which I believe nobody will accept. So now I'm stuck, both szeto and dom is not going to pay me any money. I believe that at the end of the day, the responsibility's szeto. Out of goodwill I lent him my car and he choose to ask his friend to drive. 好心被雷劈 Please help me to share this post and make the two of them famous, much appreciated.

-

OCBC turns the car loan approval process on its head so you can purchase your next car with confidence! Shopping for a new car but not entirely certain about what you can afford or whether your loan will be approved? Now there's a new, smarter way to purchase a car thanks to OCBC's simple, fast, and secure car loan application process! Buying a new car can be daunting. Not only will you have to shop for a vehicle that will be suitable for you and your family's needs, but you will also be making a significant financial commitment. And with that comes the added uncertainty of securing a car loan from your bank. Thankfully, OCBC takes the uncertainty out of the latter with its redefined car loan application process. OCBC's new redefined process now allows you to get approval for your car loan, even before you decide on a car, so you can concentrate on getting the right car when you're strolling through the showrooms! And as if shopping with the utmost confidence isn't appealing enough, OCBC's car loan application process is mighty easy as well. All you will need to do is apply online with MyInfo using your SingPass, and you can expect approval to be returned to you within 60 seconds, so long as all bank checks and application details are in order. How is that for speedy! The loan is only effective when you have finalised the car you wish to purchase and accepted the Hire Purchase Agreement so fret not that any penalty or fees will be incurred with your application. All personal information sent through this process goes directly to OCBC as well, so you can rest assured that the entire process is safe and secure. A hassle-free process And once you have decided on your perfect car, the rest of the process is as easy as pie. Simply inform your dealer that you already have an approved OCBC Car Loan, and the dealer will submit all the necessary car details over to OCBC. All you will need to do now is verify the information and you're good to go. OCBC will then send you the Hire Purchase Agreement immediately via SMS, further speeding up the process. Once you have reviewed and accepted the agreement digitally, you can start to look forward to receiving your car! OCBC is offering shoppers the options to borrow at loan tenures of up to seven years and at up to 70% of the total car price, at market competitive interest rates. And after you get behind the wheel of your car, you can still take heart in knowing that there a plethora of options available for you to repay your loan. OCBC deposit account holders will be able to opt to pay their monthly installments via a variety of options including a Direct Debit Account instruction, via an OCBC ATM or through mobile or internet banking. Additionally, you can also choose to use Interbank GIRO or drop off a cheque, which are available for non-OCBC deposit account holders as well. Tired of the slow, tedious, and uncertain approvals involved with purchasing a car? Turn those frowns upside down yourself with OCBC's redefined car loan application process. Apply here, get an approved OCBC Car Loan and you could be driving away with a car immediately!

-

Buy properties with little cash? It's too good to be true Beware of companies peddling such promises, do your homework and deal only with regulated firms https://www.straitstimes.com/business/invest/buy-properties-with-little-cash-its-too-good-to-be-true

-

Hi all. I intend to purchase a car for my Dad to drive for Grab. I will pay the 30% downpayment. The thing is I was initially quoted 2.4% interest rate. But upon hearing that my Dad is using it for Grab, the sales person increase the interest rate to 3.4% on the basis that PHV car loan will have higher interest rate even though Im only taking 70% loan. I called LTA to clarify and they say they there is no such regulation. I called the bank and the CSO tells me that as long as I register the vehicle under my Dads name (you can do that now for PHV) and not under a business entity, then the interest rate will not change. The thing is I told the agent about this but she is adamant that she is right and says that I am flouting the law if my Dad attempt to drive PHV under the usual car loan. She is even willing to give up my sales. So... who is right?!

-

hope the poll works

-

Hi all, my car is currently financed under OCBC bank and the monthly installments are reflected on my CBS report and consequently I think it would also appear on my TDSR. The reason I ask this is because I'm considering buying a new home and don't want my car loan to affect my home loan application. Are in-house loans from credit companies like Motorway Credit reflected in the CBS Report of affect the TDSR? Thanks!

-

Just got a letter for revision of home loan interest rates (3.0 to 3.5%) I'm thinking of doing a repricing. But should I go for floating 0.75% + SIBOR rates (revised every 3months) (1yr locked in) OR 1% + SIBOR rates (capped at 1.49% if SIBOR goes high) (locked in 3yrs) Any suggestions?

-

Anyone done it yet and have FR? Thot last time some banks said cannot be done..... http://www.ocbc.com.sg/personal-banking/Lo...Autoloan_180612

-

Rule change allows car buyers to access bigger loans https://www.straitstimes.com/singapore/transport/rule-change-allows-car-buyers-to-access-bigger-loans

- 43 replies

-

- alfa romeo

- loan

- (and 6 more)

-

I received 2 sms from 2 hp numbers asking for payment which i never took. New scare tactics? Posted SMS with POSB account and $5000 payment. Anyone encountered?

- 59 replies

-

I always though that HDB loans awere heavily subsized that it is almost like lelong but then how come HLF can offer heartlanders cheaper loans I think we need an explanation from HBD as to why HLF stirs waters, cuts HDB home loan rates By SIOW LI SEN Hong Leong Finance (HLF) has slashed its HDB home loan rates in a bid to undercut the competition amid a low interest rate environment, but it seems some banks might have been even quicker on the draw. Related stories:

-

Hi, Need to ask the experts here. I bought used cars from direct sellers before and we did direct transfer and cashier order hand over in LTA. There is a line in the LTA transfer form for the seller to declare that he has no more outstanding loan. My question is , how do I know if one really has no outstanding loan? can one make a false declaration and end up my car get towed by finance company after the ownership is transferred? I guess once the ownership is transferred, finance company cannot reposes the car from the new owner?

- 23 replies

-

- used car

- outstanding load

-

(and 6 more)

Tagged with:

-

Would like to seek the opinion and advise from knowledgeable expert here. Planning to get new car from a AD. The SE offered me a good deal but on the condition that I will have to take up a private car loan from Hitachi at interest of 2.78% rather than the in house loan of 2.5% interest from UOB. The SE promise that he will compensate the 0.28% of extra interest that I have to pay in term of cheque. With that it seems like I'm not losing out from anything since the extra interest from Hitachi will be compensated back to me. Am I missing out on anything? Is there something I have to look out for? Are there any risk in doing so? Would appreciate is people can provide some feedbacks and advice. Thanks!

-

hi, my car due in 3 mths time and I want to keep my spare cash for other usage at the moment instead of 1 short pay up for 5 yrs renewal called up maybank and they said the 5yr loan for >10yrs car is only for new hire purchase, not for 5yr coe renewal any bros knew which company/bank can provide 5 yr coe renewal loan and are reliable ? Cheers ^^

- 152 replies

-

- 1

-

-

- toyota

- toyotacoe renewal loan

-

(and 4 more)

Tagged with:

-

SINGAPORE - Singapore Press Holdings-owned sgCarMart has started a financial services arm to muscle in on the billion-dollar car-financing market. The car portal will offer financing to used car dealers for their vehicle inventory as well as to car dealers to offer hire purchase loans to buyers. sgCarMart's wholly-owned online auction subsidiary, Quotz, will take a 30 per cent stake in sgCarMart Financial Services for $1.5 million. The remaining 70 per cent of the venture is held by T Financial (51 per cent) and five other parties, SPH said in an announcement to the Singapore Exchange. T Financial is a fully-owned subsidiary of Toh Capital, which used to be a major shareholder in four used car dealerships. The other shareholders are car trader Lake View Group and individual investors from the management team of sgCarMart. https://www.straitstimes.com/singapore/transport/sgcarmart-moves-into-financial-services?utm_medium=Social&xtor=CS1-10&utm_source=Facebook#Echobox=1541585998

-

Can I apply my own car loan for a new car instead of using those banks recommend by the SE? Cos I see POSB offering a low interest rate for online application compare to those apply thru SE.