Search the Community

Showing results for tags 'MONEY'.

-

Huat ah! https://www.straitstimes.com/singapore/1b-in-cash-and-assets-seized-and-frozen-30-foreigners-probed-for-money-laundering-and-forgery

- 888 replies

-

- 19

-

.png)

-

-

-

Let's start with this https://www.straitstimes.com/singapore/courts-crime/ocbc-bank-customer-lost-120k-in-fake-text-message-scam-another-had-250k-stolen Young couple lost $120k in fake text message scam targeting OCBC Bank customers SINGAPORE - It took a man and his wife five years to save about $120,000, but in just 30 minutes, scammers using a fake text message stole the money they had kept in their OCBC Bank joint savings account. The couple in their 20s were among at least 469 people who reportedly fell victim to phishing scams involving OCBC in the last two weeks of December last year. The victims lost around $8.5 million in total. The husband works in the e-commerce sector, while his wife is in the hospitality industry. The man said he received the phishing message with a link at around noon on Dec 21 last year. A 38-year-old software engineer who fell prey to the same scam on Dec 28 told ST that he lost about $250,000 he had been saving since 2010. The father of a young child with special needs said the loss has been devastating, and he has been hiding it from his family. The bank said it has since halted its plans to phase out physical hardware tokens by the end of March this year, and has also stopped sending SMSes with links in them in the light of the spate of phishing incidents. Cyber security expert Anthony Lim, who is also a fellow at the Singapore University of Social Sciences, said scammers have advanced software enabling them to spoof telecommunications services and send SMSes that appear in the same threads used by real organisations. He added that even if victims did not provide their one-time passwords (OTPs), they would have sealed their fate when they entered other bank details on the fraudulent sites. "Once the victim unwittingly responds by entering the bank account credentials, the hackers' technologies can divert and capture a copy of the SMS OTP issued by the bank," he said.

-

Lately had seen too many complaint in this forum, seem like many of us are unhappy about CPF, Life, property, Car and Money. Come across this article ( see link below) which is very enlightening. Hope you fine some happiness in you life no matter who you are😄 http://drwealth.com/2014/12/10/singaporeans-are-unhappy-and-poor/?utm_medium=DISPLAY&utm_source=OUTBRAIN&utm_campaign=NOV2014&utm_content=ARTICLE24_LIFESTYLE

- 187 replies

-

- 4

-

-

USD 500k per annum.. https://www.straitstimes.com/business/invest/money-does-buy-happiness-but-up-to-670k-only-survey

-

Worth spending 10 minutes reading it..... Yahoo news: 3 Big Money Mistakes Singaporeans in Their 30s are Making When you’re in your twenties, if you aren’t lucky enough to have a trust fund or a business to inherit, chances are you’re either scrambling to find a job or to find yourself. But you should have everything figured out by the time you’re 30… right? I’m not sure if it’s something in the water, but it seems like lots of the 30-somethings around me still haven’t quite gotten their act together. In fact, despite earning a lot more than they were in their 20s, it seems like more and more 30-somethings are getting mired in debt. I have a sneaking suspicion the following money mistakes have something to do with it. Let’s find out. Spending too much on their weddingsSpeak with a typical Singaporean 30-something in a relationship and there’s an 80% chance they’ll start talking about marriage and complaining about the high cost of wedding banquets. In fact, it’s become standard practice in Singapore to spend an average of $50,000 on a wedding, with many going up to $90,000. Truth be told, many of the grooms-to-be I’ve spoken to haven’t even been that keen on splashing out on a lavish wedding, gloomily stating that it’s their fiancees who want a dream wedding and they have no choice but to go along with it. Shane, a 30-year-old bank analyst, is going to tie the knot next year. “While I would prefer to have a smaller, more inexpensive wedding, my fiancee has a very large family and wants to have a hotel wedding banquet, so I’m bracing myself for the cost,” he says. Falling deeper into consumer debt instead of digging themselves out of itIn countries where young people move out of their parents’ homes during university or at least once they get their first jobs, the 20s are a time of being broke and paying off student loans, while in their 30s most start enjoying greater financial stability. In Singapore, however, for many people the opposite is true, as they continue to live under their parents’ roofs until well into their 20s. It is only when they start working, which can be as late as the mid to late 20s for those who have advanced degrees or males who do national service, that they are suddenly forced to bear the financial responsibility of supporting aged parents or purchasing property. That, and the persistent lifestyle inflation that dogs the young and upwardly mobile, has resulted in high levels of consumer debt amongst 30-somethings. Penelope, a 34-year-old HR executive, has recently run into cash flow issues. She goes on overseas vacations twice a year during the school holidays together with her husband and three kids to locations such as London and LA. Each time, the family spends close to $10,000. While she was mostly credit card-debt free in her 20s, she now has a credit card balance which she rolls over each month. “My family has grown, but my husband and I continue to be the only ones bringing in money. As a result, our spending has increased quite a bit.” she says. It’s not just those with kids who face credit card debt. Albert, a 31-year-old bank executive, carries about $10,000 worth of credit card debt, which is more than 2 months’ worth of salary. He survives by paying only the minimum sum each month. Most of his debt was chalked up while spending on food, drinks and entertainment. In fact, a recent report showed that one in five credit card holders in Singapore now pays only the minimum sum each month. And a fast-growing segment of the population with revolving debt consists of women aged 30 and above. Orchard Road might have something to do with it…. Overcommitting to houses and carsIn your 20s, most of your peers are still living at home and taking the MRT. But once you hit the big 3-oh, you look around and realise that more and more of your friends are buying property and driving cars. This sudden shift has led to many 30-somethings committing to property and car purchases that are really a bit more than they can afford. Many of the 30-somethings I’ve spoken to who’ve recently started paying for their own properties have admitted that their finances are tight and leave no room for error or accident. While the TDSR framework aims to stop people from overstretching themselves, it fails to consider their day-to-day expenses, which can amount to quite a bit. In addition to paying her home loan installments, Belinda, a 30-year-old bank executive, also gives her parents $1,000 a month, spends about $1,000 a month on her car and has personal expenses of about $2,000 a month. She depleted most of her savings to make the downpayment on her new condo unit and is now treading dangerous waters. “Basically, I can’t afford to stop working for many years to come,” she says. “I’m not really worried about losing my job as things are going well at work, but then again anything is possible.” (Names have been changed to protect the identity of respondents.) Link: https://sg.finance.yahoo.com/news/3-big-money-mistakes-singaporeans-160000290.html

-

Forklift operators in S’pore charged for bribery!!! On Dec. 11, two forklift operators in Singapore were charged for allegedly receiving small value bribes from truck drivers. The forklift operators, Chen Ziliang and Zhao Yucun, are Chinese nationals employed by Cogent Container Depot Pte Ltd. According to a press release by the Corrupt Practices Investigations Bureau (CPIB), both of them allegedly obtained bribes in exchange for not delaying the collection of containers. Chen was charged for attempting to obtain a S$1 bribe from a truck driver on Oct. 20, 2017, as well as receiving bribes from other truck drivers between May 2016 and March 2018. Chen’s counterpart, Zhao, was charged for obtaining similar bribes from truck drivers between September 2014 and March 2018. A Straits Times report mentioned that both Chinese nationals were each offered bail of S$5,000 and will be back in court on Jan. 9 next year. “Zero-tolerance approach” to corruptionThe total amount received from bribes was not stated by CPIB. However, CPIB emphasised that Singapore adopts a “zero-tolerance approach” towards corruption, and “bribes of any amount or kind will not be tolerated”: “Employees are expected to carry out their duties fairly instead of obtaining bribes in exchange for favours. Even if the bribe amount is as low as $1, they can be taken to task. Bribes of any amount or any kind will not be tolerated.” Under the Prevention of Corruption Act, any person who is convicted of a corruption offence can be fined up to S$100,000 or sentenced to imprisonment of up to five years or to both.

-

https://www.straitstimes.com/multimedia/graphics/2023/07/salary-guide-2023/index.html?shell I am poor. ccb pap.

-

Good article by Mr Bean, and RADX please watch and please stop changing car so fast! Do your part as a living being! Thanks 😊

-

Came accross this article in Yahoo ........... Yahoo news: Dear CPF: Give Me Back My Money! Dear CPF, For years you’ve taken a cut from my paycheck under the promise of social “protection.” In a way, you’re like a very well-intentioned gangster, protecting my money from well… me right? I’m grateful though that you at least “allow” me to use some of my money towards buying a home, or to subsidise (partially) my hospital bills. I’m not going to ask what you do with my money while it’s in your hands (I’m sure it’s just sitting there untouched right?). But I do ask that you let me use it for pressing emergencies that directly affect me and my family’s well-being. What do I mean? Let me enlighten you. 1. For Retrenchment My financial obligations won’t stop if I get retrenched. Finding a job takes 2-3 months at best. I’m lucky I have enough savings to last me 3 months, but what if it takes longer? What if I had no savings to begin with? Any unsecured debt I have (credit cards, car loan, personal loans, etc.) still needs to be paid – otherwise I risk damaging my credit with late payments or even default. The banks don’t care that I lost my job. They’re about as sympathetic as a cat watching a rodent struggle in a mousetrap. But if I could use my “account” to service my unsecured debt if I get retrenched, even if it’s just to make my minimum payments, that would give me the financial flexibility to weather the situation. Plus, it would discourage those without savings from worsening their financial situation by going to Ah Longs for money. 2. For Education Ultimately, the government wants me to be successful. The more successful I am, the more taxes I can contribute to our nation’s economy. So why can’t I use some of the money from my account towards education, whether I want to pursue an MDA-approved training course or a degree? You don’t need me to tell you that education improves my earning potential, which is a win-win for everyone. I improve my standard of living while the government takes a greater amount of tax revenue. Plus, if I’m working in a sunset industry that has a bleak outlook, I can get the training I need to transition to a more promising profession. But not everyone has the money on hand to pay for education… oh yeah, they do – you’re holding it CPF! So ease up a little on the funds distribution and let us chant Jerry Maguire’s “help me, help you” line together yeah? 3. For Growing Transportation Costs Paying for transportation in Singapore is like choosing how you want to be tortured. The choices differ, but the result is the same – you’re still paying hundreds or thousands of dollars a month just to commute daily! It doesn’t matter whether you own a car or use public transportation, the cost to travel to and from work, pick up the wife and kids, or take the family out to Sentosa is always increasing. All you have to do is see how much COE, ERP, taxi, and public transportation rates have increased over the last few years. Of course, I don’t own 3 cars, nor do I live in Sentosa Cove – and neither do a majority of citizens who suffer every time transportation costs rise. But it would help if I could use some of my funds as a monthly “transportation allowance” to offset the financial pain felt by price hikes. In Conclusion… Now, before you crumple up this letter (if you haven’t already), I have one more thing to say… Tax payers won’t need to support me with these situations. That’s because this money is already mine to begin with (or so you tell me). All I’m asking is that you make it easier for me to access my funds so I can patch up my social safety net. If you need to validate my situation before dispersing my funds to prevent “fraud,” I’m fine with that. I’d rather deal with the inconvenience of a sloth-like bureaucracy than have to worry about how I’m going to come up with cash in an emergency. Again, I’m grateful for the monthly shakedown that’s necessary for my retirement. But you’ve got to be a little more flexible when it comes to financial emergencies that cannot wait. Yours sincerely, A Messenger of Singaporean Frustrations P.S. Umm…. yeah, if you could let me use my funds to cover the hospital bill for childbirth (c’mon, we’re doing you a favor by creating more taxpayers) and for elderly friendly renovations to take care of my ageing grandparents without sending them to a home, that would be great. link: http://sg.finance.yahoo.com/news/dear-cpf-back-money-160000444.html Look like the person who wrote this has not reach the retirement age or 55yrs to withdraw his CPF. Thats why very important to save for raining days....

-

Genuinely curious. I give a few examples that i think are vague? Teacher's day presents? Hampers from clients to your company? Is someone asking for extra commission asking for a bribe? What about a tip? This question has on and off been in my mind but now the flavour of the month seems to be corruption and bribery so yes, curious.

-

suppose a couple has S$150k and 4 kids below 10 now, and hoping by the time the kids reach 18, to have saved at least 120k per kid for their uni education....if the kids decide to pursue such a path... (else the couple promise themselves to blow it on a fast car then). what would be a safe option for the couple? they would NOT like to consider the following: stocks - they have a reverse midas touch property - their view is its not the right time now as its peaking all suggestions are appreciated. Thank you

- 89 replies

-

wah... lucky i peasant richie rich mcfers like t2 would probably kpkb about giving back 10 whole chickens 😱😅 https://www.businesstimes.com.sg/brunch/in-the-line-of-duty-on-wealth-taxes-singapore-must-decide-what-it-most-wants-to-achieve-and

- 27 replies

-

- 1

-

.png)

-

https://www.channelnewsasia.com/news/singapore/dog-owner-fined-for-causing-pet-unnecessary-pain-throws-11143444 If I no money to see doctor, who can I charge?

-

Did you guys hear about the new submission feature on MCF? Seems like a good way to earn some extra moolahh 🤑 since we're all on the roads already anyway... might as well get paid for seeing interesting things Gotta pass their review to be considered for payment.. I wonder what kind of submissions they accept though?? I see on their Facebook page, they paid people already. Like good money eh? Anyone here tried already? 😶

-

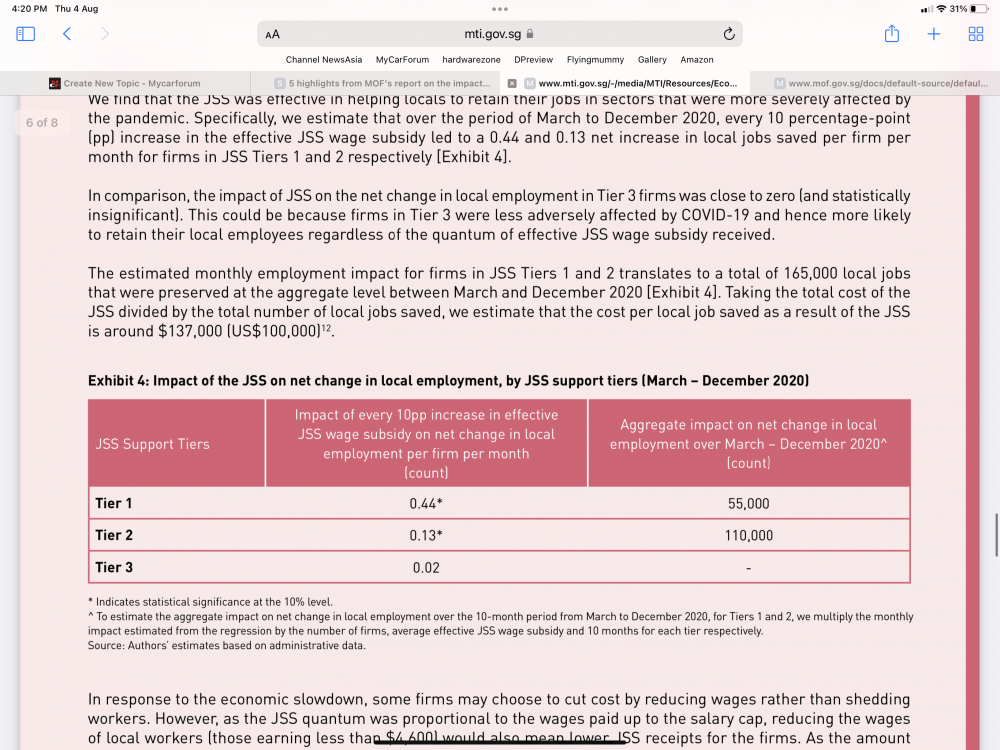

https://www.mof.gov.sg/docs/default-source/default-document-library/news-and-publications/featured-reports/17-feb-2022-6-30pm-assessment-of-the-impact-of-key-covid-19-budget-measures.pdf?sfvrsn=828ebb24_2 https://www.mti.gov.sg/-/media/MTI/Resources/Economic-Survey-of-Singapore/2021/Economic-Survey-of-Singapore-2021/FA_AES2021.pdf I always thought about the merits of the jss scheme as it is by far the most expensive policy ever costing 28 billions dollars. It is very different from other countries where by companies furlough workers and gov pay the support directly to the workers. In Singapore, the money is paid to capital, owners of companies and employers. I can understand roughly the reason for it but I don’t understand why is jss paid to every tier 3 company? Even firms in electronics, pharma, sectors which is not impacted at all by covid. Those money in reality will just be given to the rich employers which then fuel inflation which we are seeing now. by the gov own study, they spend more than 2x of the money funding tier 3 companies and it it’s cost effectiveness in terms of saving jobs is so much lower, just 0.02 vs 0.44 for tier 1 companies. I thought tier 3 companies should be opt in for jss on a need basis. We spend a total of 19 billion funding jss for tier 3 companies. A 10% savings would be 2 billion… and less hot money into the economy. If you want to blanket give money like ns55, at least give it to the workers not employers…. I was wondering why interest rate goes up and people still have lots of money to buy properties…. All full cash no need to take loan?

-

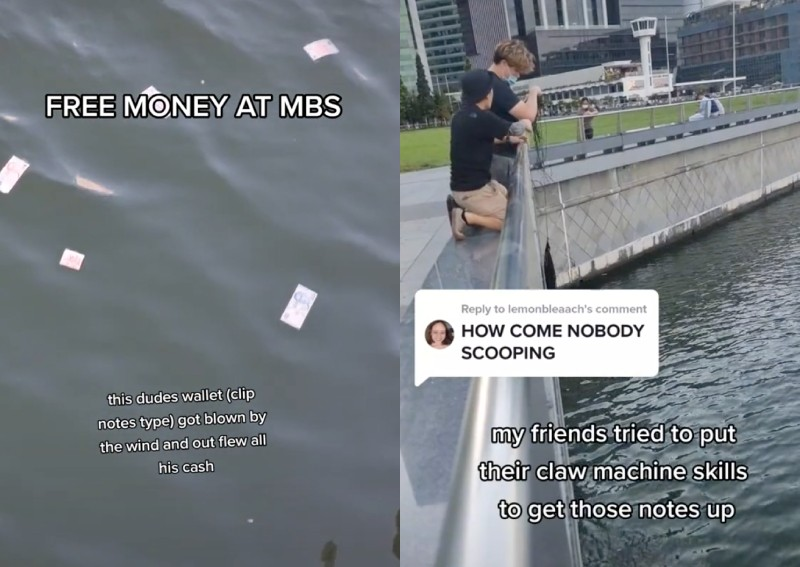

https://www.asiaone.com/singapore/feng-blew-his-money-shui-mans-wallet-falls-marina-reservoir-scattering-50-notes?utm_medium=Social&utm_source=Facebook&fbclid=IwAR03YbmQwF_06BzrLfltGpiaketb0z6xEzeK9ej5O9QOGSpswy5uew1zLdA#Echobox=1659003668 'Feng blew his money into shui': Man's wallet falls into Marina Reservoir, scattering $50 notes JULY 28, 2022PUBLISHED AT 5:30 PM By CLAUDIA TAN Bryan Lee and his friends witnessed a man's wallet get blown into Marina reservoir, and tried to retrieve some of the notes. Screengrab/TikTok/Bryan Lee It's painful when your money "flies", even more so when it happens literally. Well, that's what happened to one man whose his wallet was blown into Marina Reservoir on Wednesday (July 27) evening. The aftermath of the incident was captured by Bryan Lee, who happened to be in the area with his friends. "Free money at MBS," the 32-year-old video producer wrote in his TikTok video which showed an assortment of $10 and $50 bills floating in the water. As if the man wasn't unlucky enough, he had been telling someone over the phone how to "keep their wealth". "Dude, your money literally just flew away into the water," Lee wrote. Speaking to AsiaOne on Thursday, Lee said: "We overheard him talking about things like keeping wealth, water and metal elements and their chart, as well as a few other fengshui items". According to Lee, the man didn't seem to realise his own "wealth" had slipped away. "He was still engrossed in his phone call. We're not even sure if he realised that he had lost his money," remarked Lee. At the time of writing, the video has racked up more than 300,000 views on TikTok. "The feng [Chinese for 'wind'] literally blew his money into the shui [Chinese for 'water']," one commented. Several others also chimed in about how they would've jumped into the water to retrieve the floating bills. Responding to some of these comments, Lee said that jumping in wouldn't be a wise move, as it is illegal to swim in Singapore's reservoirs. However, that didn't seem to stop his friends from trying to net some fortune for themselves. In a second TikTok video, Lee showed his friends trying to scoop the notes out of the water using a makeshift net, attached to some rope they had in their car. Sadly, their attempt didn't yield any rewards. "By then, most of the cash had sunk into the water, and my friends weren't successful in retrieving whatever was left," he said.

-

Lai Lai Lai! That time of year standby 16Feb2021, 1500hrs https://www.channelnewsasia.com/news/singapore/budget-2021-delivered-feb-16-3pm-heng-swee-keat-mof-14136910

-

https://garage36.wordpress.com/2021/11/26/the-rolls-royce-black-badge-ghost-lands-in-singapore-with-more-post-opulence-than-anything-our-filthy-minds-can-dream-of/

- 11 replies

-

- 5

-

-

- rolls royce

- money

-

(and 1 more)

Tagged with:

-

Any other alternatives? I suppose warranty will void if go service other workshops?

-

Real or not I don't know but we have seen enough of this kind of fight among sibling. I personally think we should not expect anything from our parents even if they have anything left after they have moved on. And that remind us on how we should treat our asset allocation fairly before we move on, like it or not we will have some money, plus our house for our next generation to fight on if we do not allocate them fairly before we say bye bye to the world. https://www.marketwatch.com/story/im-getting-the-short-end-of-the-stick-with-each-new-grandchild-my-parents-want-to-split-their-estate-with-their-grandkids-11631804438

-

https://en.wikipedia.org/wiki/Darwinism Darwinism is a theory of biological evolution developed by the English naturalist Charles Darwin (1809–1882) and others, stating that all species of organisms arise and develop through the natural selection of small, inherited variations that increase the individual's ability to compete, survive, and reproduce. https://www.straitstimes.com/business/companies-markets/ministry-of-food-winding-up-fails-to-pay-debt-of-200000 Ministry of Food winding up, fails to pay debt of $200,000 SINGAPORE - Home-grown restaurant chain Ministry of Food is winding up after failing to pay a debt of $200,000. We all know Charles Darwin so I'm not going to explain his theory of natural selection. Nevertheless, I created this thread because it's pretty amazing we're 1 year plus into the pandemic and there are businesses/individuals that still refuses to evolve. They continue to think the world will return to normal and rely on government aid (tax payers money) or cheap labor (maximize margin) to drive their organizations (plus complain a lot). Do you think they are worth saving?

-

https://www.channelnewsasia.com/news/singapore/director-envy-asset-global-trading-charge-nickel-fraud-1-billion-14465512 He is let out on bail.... for 1 million? Going to flee...

-

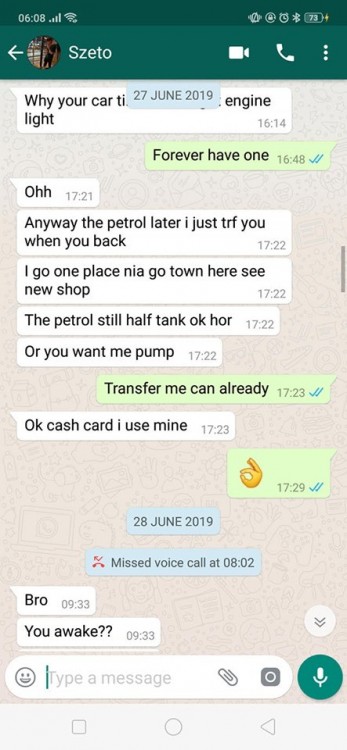

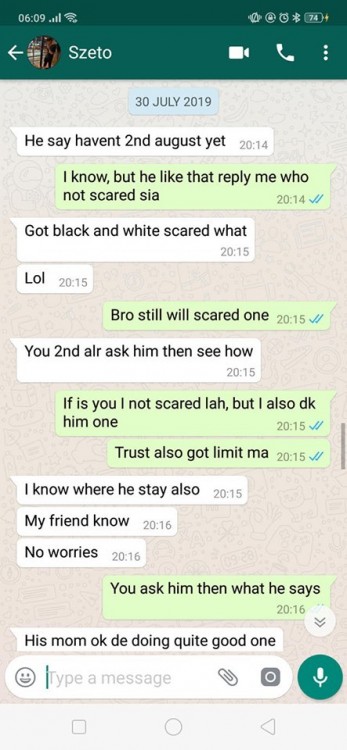

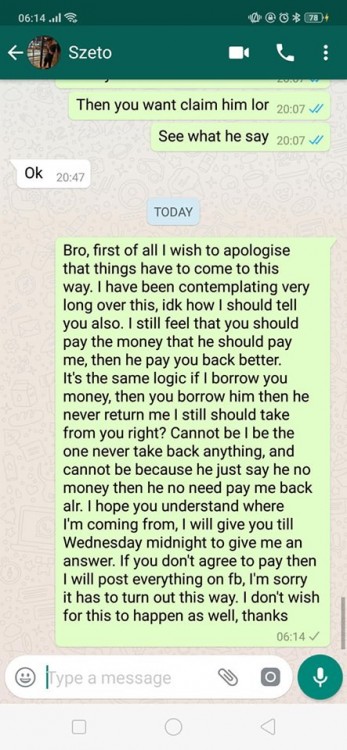

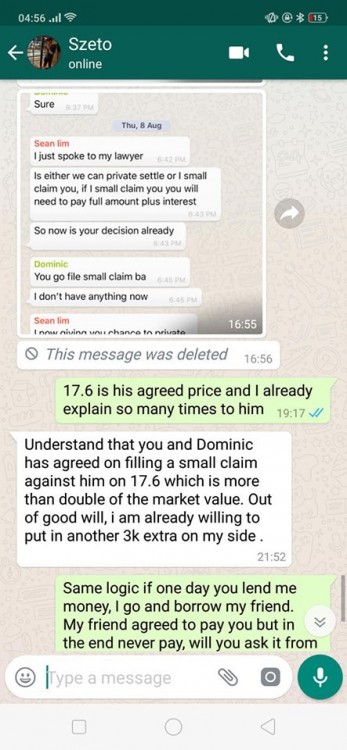

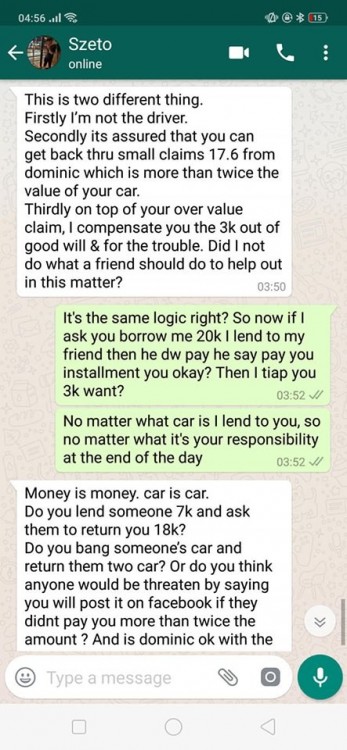

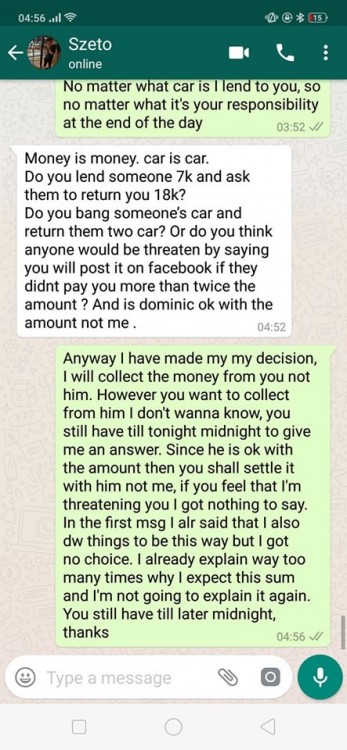

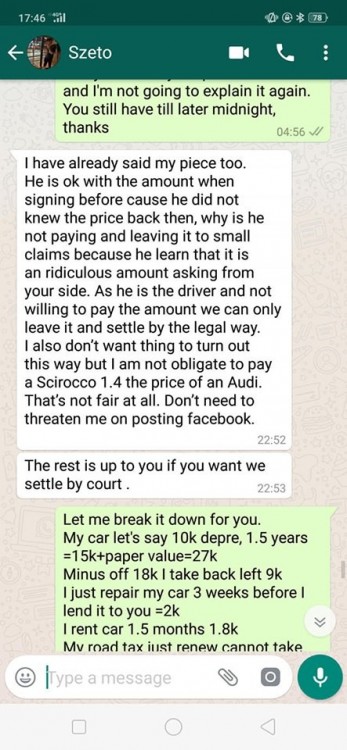

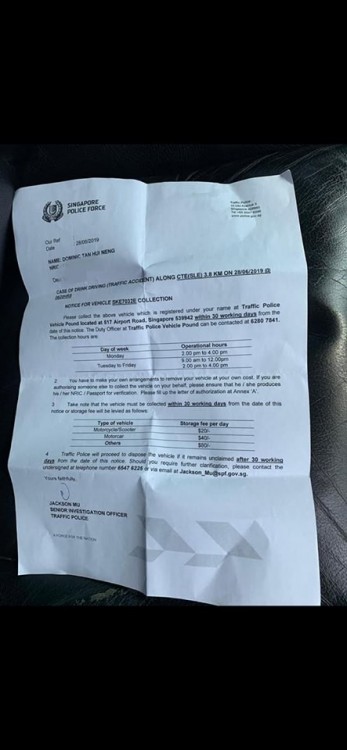

From Facebook https://www.msn.com/en-sg/news/singapore/friends-like-these-man-at-a-loss-after-pal-refuses-to-pay-sdollar176k-damages-following-car-accident/ar-AAHA7P6?ocid=spartandhp&fbclid=IwAR0bJtAeizlUU4T47eypa1jM89VAXbI3Pm0euCnf5emaTlEpOThVByZcXZ0 Hi all, this is going to be a long read but please take the time to read thru. So the story is that on the 25th June my dear friend Szeto St wants to borrow my car from me to use it on the 27th. As I was overseas at the point of time I agreed to lend it to him, it was not the first time I have lend it to him so I entrusted him with my car. On the 28th morning 8am he gave me a missed call, so when I call him back he told me that he got into an accident with my car then he said that the one driving was his friend. I entrusted my car to him and yet he asked his friend (Dominic) whom I don't even know who he is to drive my car back on that day, I was still very nice at that point of time I said wait till I reach sg then we settle. So I came back on the 29th I meet them on the 30th, they didn't have a solution for me. So we briefly spoke how we should settle it as the car was total loss, so dom suggest to give him more time. And so on the 2th July, we both agreed that he will pay me $17600 as my losses under the condition that I scrap my car. And he requested to give him a month for him to find the money, so me being nice I agreed to it. Once we sign the agreement I proceed to tow my car to the scrap yard and handle all the paperworks and send him documents from lta that I have scraped my car once I received it which was on the 8th July. And so I continue to wait for the 2nd aug to come, on the 30th July I texted Dom to ask on the 2nd aug what time should I meet him and he asked me to wait. So I texted szeto about this he told me not to worry why I scared, and I obliged and waited. So on the 2nd aug the worst nightmare happens, I texted him in the afternoon and Dom said he will let me know by 7pm. 7pm I called him and he simply told me this "我没有钱,你要我怎样。你去small claim 我咯" one simple reply and he expect to get away with the shit he create? Long story short, two days later he say he will only pay me 11k but thru installment of $500 every month. Which I believe nobody will accept. So now I'm stuck, both szeto and dom is not going to pay me any money. I believe that at the end of the day, the responsibility's szeto. Out of goodwill I lent him my car and he choose to ask his friend to drive. 好心被雷劈 Please help me to share this post and make the two of them famous, much appreciated.

-

My friend just got a mysterious call from someone at the bank , saying that her bank account is being used for money laundering and she must submit her NRIC to this person . Feeling suspcious , she called back the bank. Turns out it's a hoax . Apparently she suspect it's the work of some chinese sydnicates , as the person sounds like PRC. Anyways she reported this to the police So beware

-

Bought a 20mths old Trajet and the interior really needs to be clean up, where to get value for money Leather and Carpet cleaner that will work wonders in other words cheap ones