Search the Community

Showing results for tags 'Property'.

-

Starting a thread to share bits and pieces of properties information 😀 For Condos pre and post 2009, there is a noticeable difference in their layout for Bay window and Balcony.

-

I'm beginning this thread so I can continue to discuss matters on a topic that interests me. I know there is a thread with similar content, but it's become a bit toxic, so if the mods don't mind, I'll start one here? Otherwise go ahead and merge. Basically we have an economic crisis on us, and internationally things are not doing well either. But in spite of this, property prices seem to be headed northwards and the agents will want to tell you, they won't drop. But job losses are on the way, and the capital appreciation on property isn't what it used to be and despite what agents try to tout, one must consider all factors rationally, and see if your money is better served elsewhere. Eg a good benchmark will be the 2.5% that CPF offers. But property remains enticing because it takes a lot more effort and investigation to find alternatives and not all Singaporeans are that hardworking or familiar with the investment instruments available. I wonder what the rest think? Cheers

-

New revamp ... new testing ... new thread lol happy reading 🙂 https://www.edgeprop.sg/property-news/singhaiyi-sells-324-units-parc-clematis-launch-weekend SingHaiyi sells 324 units at Parc Clematis on launch weekend

- 8,340 replies

-

- 19

-

-

-

- property news updates

- property

-

(and 2 more)

Tagged with:

-

I know we have a separate property thread, but IMO, this deserves a separate discussion. This area will be big, in size and impact.. https://www.tnp.sg/news/singapore/9000-housing-units-including-hdb-be-built-keppel-club-site https://www.channelnewsasia.com/news/singapore/ndr-2019-greater-southern-waterfront-pulau-brani-sentosa-keppel-11819376?cid=h3_referral_inarticlelinks_24082018_cna https://www.channelnewsasia.com/news/singapore/specific-measures-could-dampen-lottery-effect-of-public-housing-11825766 https://www.youtube.com/watch?v=y6xz58yCqGk

- 241 replies

-

- 6

-

-

- greater southern waterfront

- property

- (and 7 more)

-

Are they a sound buy? Anyone have properties there?

- 1,353 replies

-

- 5

-

-

- property

- property johor

-

(and 2 more)

Tagged with:

-

So we have checklists for buying a new car, and why not one for a new home? I've consolidated what I have previously written here, so everyone can benefit and also contribute and some of the info comes from other bros. Before we even go into the list, there are some basic things to do: - make sure everyone in the family agrees to this purchase, and whether it's for investment or as a home - check your financials well and get a large enough budget to buy and for renovations or other costs - do your homework! Check the online property forums, buy and sell places and see what your money can buy and which regions suit your needs best So, now onto the buying process Is it going to be landed, a flat or a condo? Some of the general principles which apply to all three types: Is the home paid for or is the seller still in debt and not bankrupt How many owners are there, and any divorce in process. Who is the legal owner or executer of the property if the owner is deceased? Is it tenanted and when does the lease run out Can you break the lease How old is the place. As a general rule, most places under 10 years can do without major renovations and you can use the piping, aircons and wiring. Most places above 20 years old will need more extension renovations - freehold, 999 years or Leasehold (how many years left) - location - is it within 1km to a primary school and how many places are there - sun direction - North South is the ideal - developer matters too - some are cheap and use poor quality materials - neighbours - good ones to whom you can entrust your keys, psycho ones, and nosy ones - visit the location at different times - if you go over a weekend it's usually quiet and the traffic is light, so see at at peak hours and see if there's any choke points and if the streets around it become very noisy or is there a school or some place that attracts a lot of noise - amenities eg market, food places, 24 grocery, petrol station, postbox - near work - near a clinic or GP - MRT, bus or good roads etc to work, school etc - wind : how well ventilated it the place - how high is the place - the interior of the place, can you salvage the parquet floor for example - TV reception - is there a fibre / home line (will cost $288 to run a new fibre line for example) - where is the mains and the PUB meter located - do you have the plans for the electricals Items specific to an apartment: - the shape of the unit, any odd unusable corners, how square is it - how many units are there? Is it going to be too crowded over the weekends to swim? - what are the amenities? Sometimes too many water features, landscaping or pools will mean higher costs to maintain - pools: regular shape? Good for swimming laps or merely for wading? Any lifeguards? - maintenance fees - sinking funds - more units will mean more people to share costs. Small developments will need larger contributions to fix items like lifts, repainting costs etc - number of lifts, is it private - ratio of parking lots to units and the number of visitor lots - number of entry and exits, side gates - how much power is there? As a rule, you need a minimum of 45A and up - any provision shops? - who runs the place? which security company do they employ? - get a copy of the house rules - eg no moving in hours and are there a lot of AirBnB listings? Items specific to houses: - plot ratio and GFA - zoning and potential developments of the area - who was the designer or builder and are they still around - cul de sac - land size, is it square or narrow, can you expand the built up area? (remember to account for set back if you do more than A&A) - soil analysis - is it reclaimed land - fengshui : water, wind and mountains etc - at a junction - noise level in the neighbourhood - any new developments - renovations or reconstruction can continue for years around the place - is there going to be enbloc or a new road running through the area - if the homes near you are going to be replaced by flats, the roads can be much busier - parking - flooding / ponding - any religious building around you or a popular eatery that attracts a lot of visitors eg illegal parking during peak periods and noise levels - any piped in gas... so you don't need to use gas tanks - any retaining wall, and is it near a 24 hour gas station - noise and fumes - is the place close to electrical plant or substation - how much power is there? Single Phase or Triple Phase (most modern terrace houses will have a triple phase 63A main DB, which can support the needs of most homes, even those with a swimming pool) Don’t forget to check for termites and mossies. How windy and well ventilated the place is. How wide is your lane and even the type of roof and tiles used. Bring a builder along to give you an idea of renovation costs.. But before you even look around, do the financials first. Make sure you have a loan approved in principle and also enough cash for the renovations with a 20 percent buffer. Then bring the check book for every viewing. A basic renovation for a landed place can go from 2-300k, and for a A&A you might be looking at twice that. Adding a new roof 50k, and a new floor around 150k. A tear down? It can be 600k and up and these costs don't include furniture or fittings. Time is the other factor you have to budget in. Add 20% to any schedule, especially if you are doing it around Chinese New Year or Christmas. Be detailed in your planning, for example: If you are doing a rebuild, make sure you work with your builder and neighbours. A small road - like the Countryside one, yes that 'wide' road, may not be able to take a full truck or a cement mixer coming in. And with such a long road, you need to coordinate with the entire road of owners, so they clear the road such that the truck can come in. Trust me, it's not a given nor an easy task. If a car gets scratched... be prepared for an ugly scene. So also check that your contractor is registered and has insurance. One of your neighbours might own a limited Maclaren that your builder just happens to nick whilst transporting your tiles into your plot... Are there any other persons building in the same area, maybe you two can work together and save cost on building materials or if the other person started first, they can share some of their experiences Is there space for your builders to park? Is there good road outs of your estate or are you reliant on a single exit which can get very clogged up during peak hours? Here's a BCA owner's checklist guide Finally, I would like to start that I'm not an agent. I'm just trying to share since others have helped me before and I'm giving a little back so everyone can benefit. But YOU and you alone need to get that info you need. No one will spoon feed you and there's no charity. You find those good deals, with the aid of a good agent. Look at as many areas as you can, and take your time. But timing is everything and sometimes, that dream home just pops up and you have to be ready. You snooze and you lose... Good luck! BCA Homeowners Guide.pdf

- 88 replies

-

- 13

-

-

It dawned on me last night, that in the long term, as I grow older, it would make more sense to actually rent. Some of the reasons being that 1. Am single, so i have no need to put my assets in property. summore, nobody to pass on to 2. As I age, I free my properties for liquidity 3. I dun really need a home, but sth to sleep. I can sleep in a tent for alli care...hahaha, or get a MAser and sleep in it. Been reading and this argument has been debated ad nauseum. Discuss. http://www.forbes.com/sites/billconerly/2013/11/11/should-you-buy-a-house-or-rent-the-economics-of-homeownership/ Should You Buy A House Or Rent? The Economics Of Homeownership 4 comments, 4 called-out Comment NowFollow Comments All the 20-somethings who have jobs are asking me: should we buy a house or keep renting? The answer isn’t so easy. The common wisdom for decades was to buy a house as soon as you can, because it’s a great investment. That “wisdom” turned lots of people upside down in the past decade. Let’s take a cold, hard look at the economics of owning a home. In the past, the own-or-rent decision was largely about whether to live in a house or apartment. That’s no longer true. Condos allow ownership of a multi-family residence, and the opportunities to rent a stand-alone house are greater than ever before. So the own-rent decision should be apples-to-apples with comparable properties. If you are thinking about moving from a small apartment and buying a medium sized house, you’ll find that it’s more expensive simply because you’re getting more square footage and a yard. Is housing still a good investment? Since 1975, housing has appreciated by an average of 4.5 percent per year. (Good data start in 1975.) Estimates of housing appreciation since 1890 (courtesy of Robert Shiller) show 3.0 percent annual increases in nominal value, and just a hair above zero after adjusting for inflation. Stocks, on the other hand, have a long-run average return of 9.8 percent including dividends. Housing seems to be a great investment in good times because it is usually leveraged to a great degree. With a 20 percent down payment, a price increase of just three percent turns into a 15 percent increase in the homeowner’s equity. (Do some arithmetic with a hypothetical $100,000 home to verify that result.) Real estate proponents call this the “cash-on-cash” return. However, leverage applies to the downside as well. With 20 percent down, a 20 percent price decline wipes out all of the buyer’s equity. That’s not an outlandish scenario, we’ve learned from the price declines of the recent housing bust. Interest on home mortgages is deductible, which sounds good but is frequently overrated. Yes, it’s deductible. But the deductibility doesn’t offset the fact that you are paying someone interest. It’s an expense, and you are worse off because of it. If you want a big tax deduction, you could make a contribution to charity. You’ll end up with less money than before your contribution despite the deduction. The same is true for interest expense. It may be worthwhile, all things considered, but it’s still an expense. Talk to your accountant first, because the actual benefit from a deduction varies from family to family. The housing-stock market comparison ignores a key point: housing pays something like a dividend in that you can live in it without paying rent. To be as good as stocks (on average), the benefit from living in a house has to pay an “occupancy dividend” of about seven percent. So if you’re thinking of a $200,000 home, you need to get $14,000 per year of benefit from living in it. That’s comparable to $1,167 of monthly rent, before we get around to the pesky details. When you rent, the landlord picks up the taxes, insurance, maintenance and sometimes utilities. If you buy, plan on replacing the water heater some years, the back fence other years, the roof occasionally. Hope that you don’t need to replace all of them the same year. If you are going to hire out all of the maintenance, you’ll probably pay more than your landlord does. The landlord is in the business of maintaining properties and is probably very efficient. However, if you can do some of it yourself, your cash outlays will be much less than the landlord’s. And you can do it yourself if you’re be willing to learn. Try Googling “leaky faucet” and you’ll find plenty of advice. Most people thinking about buying compare monthly payments to rent, which is a good starting point. However, some of that monthly payment goes to principal. It’s like saving. To put buying on a level playing field with renting, look at just the part of the monthly payment that will go to interest. Example: you borrow $200,000 house with a 30-year mortgage at 4.25 percent. Your monthly payment would be $993, but $285 of that would be going to principal. (Your parents will be surprised that you’re paying so much to principal. When they got their first mortgage, rates were much higher and only a small portion of their payments went to principal.) To do your own calculations, use Excel functions PMT, IPMT and PPMT. Transaction costs are large in housing. Real estate agents charge six to seven percent commission on sales, which will make moving expensive. You can sell the house yourself, but keep in mind that it’s a lot of work and your house may not be exposed to as many buyers, reducing the price you can get for it. This argues against buying unless you are confident you want to stay in the house for several years, preferably even longer. Renters should keep in mind that they do not control their housing destiny. If the landlord decides to sell the property, you’ll be looking for a new home. The landlord can also raise the rent at the end of the lease. The landlord can also decide not to rent to you, though that’s rare for people who are well behaved. One of the benefits of owning a house is the ability to do with it what you want (subject to neighborhood rules, of course). When your daughter wants her bedroom walls black, you can be the cool parents who show her how to use a paint roller. You can build that gazebo in the back yard and have toilets in any color of the rainbow. Owning a house gives you some flexibility, but also requires flexibility. When you get a bonus from work, you can upgrade your housing by adding a hot tub. Renters don’t have that option. When you lose your job, you can defer replacing the carpet. Flexibility is required of you, too. When the roof starts to leak, there’s no telling the rain that this is a bad time. You need to have reserves for unplanned repairs. So now you’re ready for the economist to give you a conclusion. However, there are too many emotional factors for a mathematical solution. I recommend running the numbers as best you can, then asking yourself if the psychic benefits are worth the cost

- 113 replies

-

- renting buying

- renting

-

(and 2 more)

Tagged with:

-

Been happening for some time but this is a very good case where both cannot meet minimum sum https://singaporeuncensored.com/couple-divorce-so-they-can-buy-another-hdb-flat-to-earn-rental/ COUPLE DIVORCE SO THEY CAN BUY ANOTHER HDB FLAT TO EARN RENTAL ByHello Its me September 8, 2022 Bumped into an ex-colleague (who is the same age as me) earlier and had an interesting brief catch up chat over coffee. He and his wife are now divorced. But except that there is nothing wrong with their marriage and they are still living together. The sole purpose of getting the divorce is to be able to buy ANOTHER HDB FLAT (under the singles scheme). So they collectively own two HDB flats as two single individuals. You see, he was a manager that had recently been displaced by cheaper foreign labour. As all of us know, at our age, there is a real challenge in getting a job that would pay him a decent salary. Yes, there are lots of employers that wants to hire him. He is, afterall, a qualified professional with a wealth of 30 years’ experience behind him. However, these greedy employers are just not willing to pay him his worth and wants to exploit his skills and experience for a mean salary. He refused to prostitute his skills for a low salary. He end up driving a cab that (ironically) pays him more than any of the offers that he had received. He won’t be getting any of his CPF money next year because he won’t be able to meet his minimum sum. All his past CPF contributions (more than $800K) had already gone into his 5rm HDB flat that they are staying in now. His wife has some CPF left but she (too) won’t be able to get a single cent out in a few years’ time because she (too) won’t be able to meet the minimum sum as well. So they planned, got a divorce and bought a second HDB flat just before they could lock away her CPF as the minimum sum in her CPF. They then moved into the new flat and rented their older flat out legally because he had already and duly met the “Minimum Occupation Period” required for the legal renting out for that flat. And this rental income will serve an additional passive retirement income. When I asked if he would be flouting any HDB regulations by doing that, he replied, 1) They are legally divorced and they are both legally SINGLE now. 2) He can retain the existing 5rm flat under the singles scheme and his wife is eligible to buy another flat under the singles scheme. 3) There is no law in this land that prohibit two single persons (divorced or not) from living together as a couple regardless if they were previously married or not. 4) At his age, being legally married is just a marital status. It doesn’t stop them living together as man and wife. They both had made their wills. 5) Instead of having the money stuck as a minimum sum in their CPF, they might as well utilise whatever that they can get out of their CPF so as to get an alternative passive income since:- – – a) they won’t be able to get any of their CPF money anyway – – b) even when they do get their CPF monthly payouts after the age of 65 yrs old (which is still a long way to go), the amounts will be so miserable that they would hardly be able to do anything decent with it anyway… – – c) so…. they might as well get a second HDB flat with whatever money that they can siphoned out from their CPF (before the money is being locked away instead under the minimum sum)…. rent it out and (at least), the monthly rental income of $2,500 can help them live a more dignified retirement IMMEDIATELY (right away) rather than waiting till they reach 65 yrs old for that miserable delayed CPF payout that is so insignificant…. Thinking aloud now…. could this be the new norm of retirement in Singapore that Singaporeans will be planning for? Wouldn’t it be so sad that we have to come to this, in order that we can respond to how our hard-earned CPF money is being wilfully and forcefully withheld from us…

- 67 replies

-

- 9

-

-

-

-

.png)

-

- divorce

- retirement

- (and 15 more)

-

Anyone gonna miss it?..... Bukit Batok residential redevelopment land for sale at S$42m guide price https://www.businesstimes.com.sg/real-estate/bukit-batok-residential-redevelopment-land-for-sale-at-s42m-guide-price

-

in my dealings with property agents I have NOT encountered a single honest hardworking agent YET I pray for one but the act of GOD has not given me one yet I hope i dont have to wait for 50 years my very first property that I bought b u s t a r d, the agent ask me for kopi money $15,000 if i dont give the property will go to another agent buyer s h i t how to complain complain cannot buy the property further more kena drink kopi and long long interview where got time so paid kopi money s h i t will continue please do contribute if you think will benefit our bros and sis here

-

Bros, I notice that there's usually no PUB aka City Gas which is piped into landed? That means that heaters, and some dryers etc can only be electric. I am used to gas for cooking, for heaters and I wonder if anyone has added City Gas to their homes? I did email them, and they quoted a few thousand just to get a connection: Is it worth the hassle? Thanks bros

-

The couple already have a private property in addition to a HDB flat, and yet in their greed to acquire another private property they used shady means to circumvent paying higher stamp duties. Such are the people who drove up property prices unnecessarily, and also caused troubles to the property agents involved (although I think they, the property agents, were also implicitly liable for participation in the scheme). Couple found guilty of backdating Option to Purchase to avoid higher stamp duties on condo unit https://www.channelnewsasia.com/singapore/couple-guilty-backdating-option-purchase-avoid-stamp-duties-condo-2152536 SINGAPORE: Two property buyers who backdated an Option to Purchase to evade newly raised stamp duties pleaded guilty to the offence on Thursday (Sep 2). Daniel Halim and his wife Lee Liu Ying, both 44, faced one charge each of violating the Stamp Duties Act. Court documents showed that the two - who already owned a condominium unit in West Coast Crescent and a Housing Board flat in Strathmore Avenue - wanted to buy a fourth-floor apartment at Sandy Palm condominium in Loyang. On Jul 24, 2018, Halim and Lee executed the Option to Purchase for the Sandy Palm unit, but backdated it in order to avoid paying additional duties. This was because on Jul 5 that year, the Government announced cooling measures, raising rates for the additional buyer's stamp duties from 10 to 15 per cent for Singaporeans buying their third and subsequent residential property. The revised rates kicked in on Jul 6, but residential properties purchased on or after that could qualify for the 10 per cent rate if they met certain conditions. These included buyers whose Option To Purchase for the property was granted on or before Jul 5, 2018. Investigations by the Inland Revenue Authority of Singapore (IRAS) found that after their first viewing of the property on Jul 7, Halim and Lee instructed their agent Mu Shen to instigate the seller’s agent Loy Thye Wei to backdate the Option to Purchase for the Sandy Palms apartment to Jul 4. This was to avoid paying the higher additional buyer's stamp duties rate of 15 per cent, said IRAS senior tax prosecutor Norman Teo. The couple told Mu they would only proceed with the transaction if the document was backdated, as they would otherwise not have enough cash on hand to complete the purchase. The additional buyer's stamp duties had to be paid in cash. Halim and Lee made an initial offer of S$1.35 million for the property, although this was increased to S$1.38 million upon their second viewing on Jul 8. The prosecutor noted that this S$30,000 increase in the transacted price only resulted in a S$1,500 increase in the minimum cash payable. However, in order to afford the initial cash outlay for the purchase of the property, the couple decided to save on the additional buyer's stamp duties, even though they did not qualify for the transitional remission. Halim also backdated the option cheque to Jul 4, 2018, to match the date of the backdated Option to Purchase to create the appearance that it was granted on Jul 4. Loy, acting on Mu’s instigation, wrote the backdated date of Jul 4 on the Option to Purchase form, without the seller’s knowledge. Halim and Lee did not at any point ask Mu to check with the seller on whether he agreed to such an arrangement, the prosecution noted. The amount of additional buyer's stamp duties underpaid by the couple amounted to S$69,000. On Jul 12 this year, Mu pleaded guilty to to one charge of abetting by instigating Loy into falsely stating the Option to Purchase date. Loy is expected to plead guilty on Friday. Halim, Lee and Mu will appear in court again on Sep 10 for sentencing.

-

https://asia.nikkei.com/Life-Arts/Life/As-Japan-s-empty-homes-multiply-its-laws-are-slowly-catching-up?utm_campaign=GL_JP_update&utm_medium=email&utm_source=NA_newsletter&utm_content=article_link&del_type=4&pub_date=20210612090000&seq_num=14&si=44594 As Japan's empty homes multiply, its laws are slowly catching up Unclaimed land could swell to the size of Hokkaido by 2040 if left unchecked An abandoned home with an ocean view, Kushimoto, Wakayama Prefecture. In Kushimoto, more than one out of four houses are vacant. (Photo by Thomas Shomaker) THOMAS SHOMAKER, Contributing writerJune 11, 2021 08:08 JST TANABE, JAPAN -- Outside of densely populated cities characterized by skyscrapers and tiny apartments lies another Japan. In much of this world, akiya, abandoned homes, and akibiru, abandoned buildings, form the backdrop to everyday life -- not a picture one immediately associates with the hustle and bustle of the world's third largest economy. But if current trends continue, more than 30% of Japan's housing stock -- 22 million units -- will be derelict by 2038, Nomura Research Institute predicts. In other words, Japan has a very large problem with unclaimed land -- one that could potentially reach the size of Hokkaido, the country's second-largest island, by 2040, according to another study, published in 2017. The most obvious reason for this situation is Japan's unfolding demographic crisis which has seen its population fall by roughly 200,000 people a year since its peak of 128.5 million in 2009. But a range of other factors -- many of which have legal and cultural underpinnings -- have exacerbated the problem. For the first four decades following World War II, Japan seemed destined for another fate. Buoyed by a surging economy, property was considered a sound investment, boosted by incentives such as tax relief for parcels of land with residences on them. Then came the collapse of Japan's bubble economy -- and with it property values -- in the early 1990s. As Japan entered a long period of economic stagnation, the precipitous decline in birthrates that began in the 1970s started to noticeably change Japanese society, especially outside the major cities. By 2010, as the total population actually began to fall, Japan's voluntary property registration system had become a problem. When property values were rising, heirs had an incentive to register land and dwellings left to them. But in a falling market, the expense and time needed to transfer the title of an inherited property simply became too much hassle for many. Top: A long abandoned home taken over by the forest. Hongu, Wakayama Prefecture. Bottom: The interior of an abandoned home, Hikigawa, Shirahama Wakayama Prefecture. (Photos by Thomas Shomaker) Complicating matters, the devastating March 11, 2011 earthquake and tsunami led to an exodus to higher ground, which in turn further emptied out coastal towns and cities up and down the country. While Japan's demographics and sensibilities have been steadily changing, the law is just now starting to catch up. This April, Japan's Real Estate Registration Law was revised to make inheritance registration mandatory, a potential sea change -- if enforced -- expected to take effect within three years. One person who has greatly raised awareness about Japan's outdated property laws is Shoko Yoshihara, a research fellow at the Tokyo Foundation for Policy Research and the author of the 2017 book "Land Issues in the Era of Depopulation." "Japan's Real Property Registration Law was modeled after France," Yoshihara said in an email, further explaining that the basic intent is to protect ownership from illegitimate third-party claims. But while France has stringent inheritance procedures, "in Japan there has been no strict system to foster inheritance registration which led to the current problem of land registrations remaining in the name of the deceased for a long period of time," Yoshihara said. Japan's lax property laws have created more problems than just empty houses. Until recently, local municipalities that wanted to tear down an unregistered building, either because it had become a hazard or for a public works project, were not able to take action until all living heirs had been contacted. Depending on how long the property had been left empty, living heirs could mean grandchildren or great grandchildren, who could be living elsewhere in the country or even abroad. Lacking the resources to go on expensive wild goose chases, most municipalities ended up leaving the abandoned properties to the elements, often tying up redevelopment projects for years. By 2017, the problem had reached epic proportions, with a private study led by former Iwate Governor and Internal Affairs and Communications Minister Hiroya Masuda estimating that Japan's unclaimed land, including residential, farmland and commercial, had grown to 4.1 million hectares, an area larger than the island of Kyushu, the third-largest island of Japan's five main islands. This was the same study that predicted the Hokkaido scenario by 2040. A cascade of legislative changes over the last decade, including a 2014 law that gave local governments badly needed power to act unilaterally, as well as laws passed this April making property registration mandatory, should gradually start making an impact. A system to manage land of unknown ownership was also recently established. Calling the reforms significant, Yoshihara said the national government still had to work quickly "to make people aware of the new systems." This in itself is not easy, given that many of Japan's smaller, rural governments have themselves disappeared over the last 20 years, with villages merging with nearby larger towns as their populations contract. Take the former town of Hikigawa, in Wakayama Prefecture south of Osaka, where half of the village is abandoned, and the remaining population elderly. Ensuring that the residents of areas like Hikigawa -- and their heirs -- are aware of mandatory inheritance registration will be challenging, to say the least. Manabu Shimoda, a professional photographer and a resident of Wakayama Prefecture's second-largest city, Tanabe -- abandoned buildings make up around 20.3% of the housing stock in Wakayama Prefecture, the second-highest in Japan -- recently worked part-time taking pictures of vacant properties that can be posted online to attract buyers. Top: An empty building, or akibiru, in Tanabe, Wakayama Prefecture. Bottom: A long-abandoned stroller next to a vacated home, Hikigawa, Shirahama, Wakayama Prefecture. (Photos by Thomas Shomaker) "There are people who are attracted to old, wooden Japanese houses called machiya," said Shimoda. "The price is often cheaper than the surrounding market." But common issues such as termites or rotten foundations can obliterate potential savings. "In particular, roof repairs are expensive," Shimoda said. Like many towns with contracting populations, Tanabe is trying to lure new residents, especially with the surge in the number of people working from home, due to the pandemic, and a growing nostalgia for small-town life. Still, there is a long way to go. "My personal impression is that the vacant house rate is higher in the central city area, where more homes are emptying due to tsunami concerns," said Shimoda. Another quirk of the Japanese housing market is that the growing number of vacant homes has not corresponded with a slowdown in housing starts, especially as many younger couples are looking to move to higher ground. The conversation about akiya in Japan usually touches on the issues of property values, regulation and how Japan is dealing with an accelerating demographic change. But there is also an element of sadness that is often unspoken. "Every house has a history and a story and each one is very interesting," said Shimoda, who knows of one such home in Tanabe that still bears World War II shrapnel wounds in a beam in the living room. "The debris wasn't removed during renovation and is still preserved as a memory of the war." As small cities compete for newcomers, Tanabe has a fighting chance. It is only 30 minutes away from Nanki-Shirahama Airport and large enough to provide most of the amenities that urban dwellers are accustomed to. But for every success, there will be a town or village that fades into memory. "The current problem of vacant houses and land is a structural problem that has spread between a declining population and the existing system," said Tokyo Foundation for Policy Research fellow Yoshihara. "There is no panacea. I believe it is important to accumulate short-term measures and medium-term institutional reforms one by one."

-

Previous thread is too biggg https://www.mycarforum.com/topic/2714850-private-property-pricesstill-up-or-down-part-ii/page-533 Please continue below

- 3,201 replies

-

- real estate

- property

- (and 6 more)

-

Lai lai, weekend time, MCF has a lot of experts , come help this lady..... https://www.theguardian.com/money/2021/apr/05/my-boyfriend-wants-my-flats-rental-money-if-i-move-in-with-him-what-should-i-do In 2017, six months after buying my one-bedroom flat in 2017, I lost my job. I managed to get another one but at half my previous salary. I’m still able to pay my mortgage but my repayments now make up about half of my monthly income. Since 2018 I have been dating a guy who is now planning to buy a three-bedroom house for him and his two children. The house needs to be in a different area from where I live so that the children can be closer to their mother and in the catchment area of the school they hope to go to. We have been talking about me moving in with them. He suggested that I sell my flat but after talking to a few estate agents, I decided against selling as I would have got back less than I paid for it. So I’ve now decided that if I do move in with my partner, I will rent my flat out even though the potential rental income will not fully cover my monthly mortgage payments, which is not ideal. My real problem is that my boyfriend and I can’t agree on how to arrange our finances. My boyfriend expects me to contribute to the costs of his mortgage. I agree that it would be unfair of me to live in his house for free but I don’t agree that – as he has suggested – I should pay him the rent from my flat (after tax)....and read on using the link above..

- 52 replies

-

- 10

-

-

.png)

-

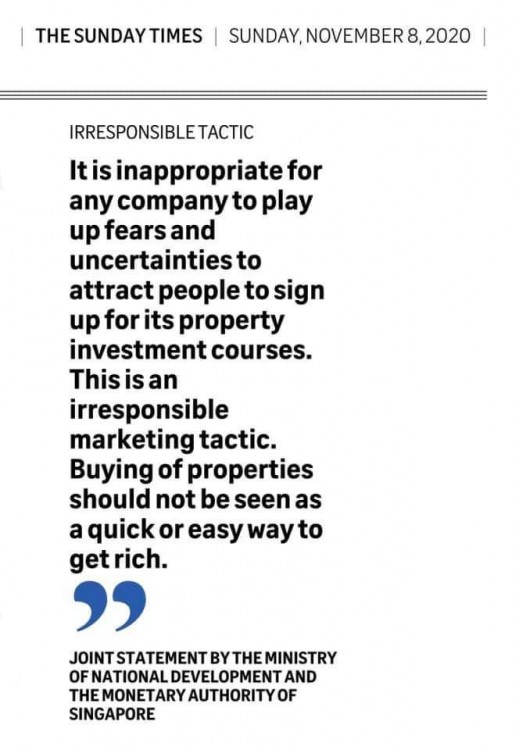

Buy properties with little cash? It's too good to be true Beware of companies peddling such promises, do your homework and deal only with regulated firms https://www.straitstimes.com/business/invest/buy-properties-with-little-cash-its-too-good-to-be-true

-

https://www.straitstimes.com/business/invest/irresponsible-tactics-to-lure-property-investors-come-under-fire-from-authorities

-

If you think your loud-sounding car is safe from the authorities just because you stay in a private property, you might want to think twice now. A photo of a Ferrari 488 GTB being inspected inside someone's front yard has been circulating around in most car group chats over the last weekend. From what we understand, it is almost unheard of for LTA enforcement officers to venture into a non-public area to inspect a car that might be flouting the laws. While we are unsure of the reasons while this particular Ferrari is being looked at, we reckon the reason might be neighbours who are unhappy about the loud exhaust noises emitting from the car. On a side note, those who are in the know will wonder why the officer is looking under the car when its belly is all covered up... Check out what neitzens on SG Road Vigilante have to say about this. Let us know if you agree!

-

HDB, private home prices rise in Q3, defying recessionary pressures Read more at https://www.todayonline.com/singapore/hdb-private-home-prices-rise-q3-defying-recessionary-pressures TD;LR HDB resale prices rose 1.4 per cent in the third quarter of the year from 2019 Private home prices grew 0.8 per cent in the same quarter Analyst pointed to the pent-up demand from homebuyers unable to view property in the second quarter Various government measures, BTO project delays and general investor confidence were also factors driving demand SINGAPORE — Property prices have continued to beat expectations despite the economic downturn. Prices of Housing and Development Board (HDB) resale flats rose 2.1 per cent in the third quarter from a year earlier, and private home prices gained 0.7 per cent year-on-year. Analysts noted that demand for homes has spiked substantially in the past three months since the end of the circuit breaker in June when stay-home curbs were lifted, and said that the Government's stimulus measures and past property curbs may have played an instrumental role in keeping home prices up during the economic headwinds. The unabated flurry of transactions from mid-June, when property viewings were allowed to resume, continued to drive demand for homes, suggesting that the euphoria over Singapore’s ongoing second phase of its economic reopening has yet to subside, they said. Quarter-on-quarter, HDB resale prices rose by 1.4 per cent, the largest quarterly increase in at least six years, flash estimates released by HDB on Thursday (Oct 1) showed. This is the fifth straight quarterly gain in the price index, which analysts said was further proof that the market has started to stabilise after six years of decline from 2013 to 2018. Based on data tracked by real estate agency PropNex, HDB resale flat transactions are on track to hit 7,000 units for the quarter. Ms Wong Siew Ying, the firm’s head of research and content, said that this would make it the strongest quarterly showing since the third quarter of 2018. Private property values rose 0.8 per cent in the three months ended Sept 30 in quarter-on-quarter terms, the highest quarterly rise since the third quarter of last year, the Urban Redevelopment Authority’s preliminary estimates on Thursday showed. The figures come on the back of an 11-month high in home sales in August, defying the usual market lull during the month of Hungry Ghost Festival on the Chinese calendar that ended mid-September. WHAT IS DRIVING DEMAND FOR HDB RESALE FLATS? 1. Government measures Ms Christine Sun, head of research and consultancy at property firm OrangeTee & Tie, said that stimulus packages totalling more than S$100 billion to prop up the economy during Singapore’s worst recession as well as past cooling measures have helped to keep HDB prices up. “The mortgage servicing ratio, which was imposed to tighten the disbursement of housing loans, may have prevented buyers from overleveraging and selling their flats at excessively low prices during the current market slowdown,” she said. Mr Lee Sze Teck, director of research at real estate firm Huttons Asia, said that revisions in government policies last year have also continued to drive the market as homebuyers are now looking at resale flats more favourably. He noted that the raised income ceiling and higher grants for first-time buyers announced in September last year for those applying to buy a resale flat continued to boost demand. He expects prices to continue appreciating in the current fourth quarter. 2. Delay in BTO housing projects Analysts said that the expected delay in Build-to-Order (BTO) public housing projects due to the halt in construction work during the two-month circuit breaker period in April and May has also diverted some demand to the resale market. Ms Sun said: “Some buyers have also bought HDB resale flats that were more affordable than private homes during the current economic uncertainties.” Ms Wong of PropNex estimated that HDB resale prices could rise as much as by 3 per cent for the whole of this year. “We think the signs are positive and point to further stabilisation in values,” she said. WHAT IS DRIVING DEMAND FOR PRIVATE HOMES? 1. Relief measures The gains in private home prices were led by landed property, which surged 3.8 per cent in the past three months, as well as by property outside of the core central region, which refers to the prime districts. Various temporary relief measures have also removed the need for homeowners and developers to slash prices too drastically to move sales, Ms Sun said. These measures include the waiver of charges for developers applying to extend their completion or disposal deadlines as well as allowing borrowers to defer their loan repayments. Ms Sun also said that market sentiment may continue to improve and demand for properties may remain strong in the coming months, as more sectors reopen and the country eases into the third phase of reopening the economy. 2. Investor confidence PropNex's chief executive officer Ismail Gafoor believes that investors remain confident in the market, even as the recent clampdown on the re-issue of options to purchase for buyers may have a slight cooling effect on demand. “Several factors probably prompted buyers to action, including the low interest rates, liquidity in the system, sensitive pricing by developers and re-sellers, and the buyers’ faith in the positive outlook of the property market over the long term,” he said. Mr Leonard Tay, head of research at real estate company Knight Frank Singapore, said: “This is a little bit reminiscent of 2009 when the private residential market in Singapore witnessed a fast and furious recovery in the midst of the global financial crisis, where prices and sales volumes rebounded in a time of uncertainty. “Perhaps in a somewhat similar manner, overall private home prices that were originally expected to fall by about 5 per cent in 2020, would now generally remain unchanged from end-2019.”

- 2 replies

-

- 3

-

-

- hdb

- private home

-

(and 1 more)

Tagged with:

-

I am starting this thread as a complement to the main thread on property news and prices. I hope some of these tips/suggestions gained from actual dealing on the ground would be helpful to homeowners/buyers. I will start off with the below burning question that I get all the time....why some units break record prices but some could not be sold for months and months. Selling your property for top dollar Firstly, let's define what is top dollar? In my terms, top dollar would means selling above market valuation. Often, it also means breaking the record price of similar units in the same estate/condo. Over time, I observed that these price record transactions had a similar trend. To get top dollar, contrary to most beliefs, it definitely has much more science to it than art. Top dollar deals seldom come from just listing and pray; it has a method to it. Unfortunately most sellers/agents never really took the method seriously and in most cases, never get top dollar for their units. As this is a post and not a blog, I will keep it short and concise. To sell for top dollar, you need to understand the below on the psychology of a buyer when they come for viewing: 1) Buyers use very little logic when viewing, they tend to follow their emotions more 2) Emotions arise not just from what they see, but also from the other senses such as smell, feel, touch and hear 3) Sellers always make mistake by assuming that the buyer can imagine an empty house. The buyers don't and they won't 4) The key then is to be able to reach down to the sub-conscious of a buyer by invoking their positive emotions during viewing. Houses that gets top dollar often make the buyer feel 'right" and they then use their emotion to justify their logic. Failure to consider the above is the key difference between getting no offers (or market valuation at best) and one with a top dollar offer. Understanding the above,here are my 10 tips for sellers based on my experience: 1) A cluttered house kills good emotions. Always un-clutter the house before viewing. Throw away junks and keep the house tidy. The owner is selling the house and will need to move soon...use that opportunity to start clearing the house. This issue is so prevalent in many units that the seller think that the buyer will imagine an empty house. Again they won't! 2) Fix all minor defects. Again, too many sellers thinking that the house gonna be sold, what is the point of fixing it up. You don't have to renovate the house, but you should fix up all visible defects. Even a new coat of paint on any old house does miracles in getting good offers 3) Clean the kitchen top and uncluttered it. A clean good looking kitchen makes a lot of difference in getting top dollar. If there is one place that make the difference in offers, it is the kitchen. The buyer's wife/gf/mother has a lot of emotions attached to the kitchen and in most cases, they are also the CFO to the purchase. Unclutter the kitchen top and make sure the stove and built-in oven looks clean. I even had a seller once storing his microwave away just to clear up space for his very limited kitchen top space. 4) Dining table. Another culprit which is always full of everything except dining stuff. Clear it, and put an attractive piece, a vase with flowers, etc at the center. Pull the buyer eyes to the center of the dining table and let him feel that they can eat comfortably at that table. 5) A well lit, unblock, entrance door. Clear away your shoes or anything untidy at the entrance. An unblock well lit entrance creates eagerness to explore more of your house. 6) Masterbed room is important and it must look like it is ready for relaxation and sleep. I have seen many master bedrooms that has clothes hang in it, or the seller cramped a study table into the master. If you confuse the buyer over the purpose of that room, chances of getting a good offer is as good as nil. 7) Always give exclusive to your trusted agent. I seldom see record selling deals that are from open listing. Open listing agents are prone to be "tested" by the buyer agent and their motivation to close will bring you a lower price. Furthermore exclusive agents are motivated to do every viewing for you hence has minimal viewing leakage. 8) Be flexible in your ability to open doors for viewing. Great offers can come from any viewing time and if you restrict your viewing time to evening or weekends only, you are restraining your ability to get good offers, Two of my record breaking sales came from afternoon weekday viewing. Hence, never, never have viewing leakage. 9) Check if your house has certain odors especially for those with pets. The houseowner is often immune to any smell, but the buyer will sense it at a distance. And if you have pets that could walk around the house, (or make noise, for.e.g barking) , please bring them out somewhere if you have viewings. Again, please don't assume that the buyer can imagine that your pet won't be there when they make the purchase. They won't. Remember, the sense of smell and hearing invoke powerful emotions so if you want to get top dollar, make sure those senses of the buyer are not affected. 10) I leave the last point to the advertising. Good advertising attracts viewers. Unfortunately I've seen many seller/agents use mediocre handphone photos to advertise. Some photos are so bad that a young Instagram-obsessed teen would probably take better. If you already took the effort to do fix up, unclutter the house, etc, the last thing you want is to have photos that does not depict your house accurately. Wide angle photos, imo, is the minimal requirement. Videos and virtual tour are great, but only if your house is of a certain size. Buyers will sub-consciously drawn to sellers/agents who take pride in advertising their house and first impression does count in this business. Don't neglect this which I somewhat keep seeing all the time. There are many more concepts that I can keep going (the use of colours for e.g) but the above is suffice for most sellers if they want their property to fetch good offers. Infact, I seldom see all 10 points click into place, but if they do, that property should get good offers. It is very often for me to hear that some units could not be sold for months, but when another agent took over, it get sold within one month at the same asking price. I don't believe it is all luck. It has to do with the method right from advertising to preparing the house for sale. I hope the above helps in giving some ideas in getting good offers for your property at your location. Your property is one of your biggest investment so it is worth the effort in putting the right "sciences" into it and get the top dollar offers.

- 101 replies

-

- 21

-

-

My folks thinking about purchasing a landed (F/H) property now (to stay). It's about 980K. Land size 1300 sqft, built up about 1500 sqft. Is it wise for them to get it now? Is the price okay? Thanks.

- 710 replies

-

What is the market rate for commission for selling a private property ? Or it is up to the seller ? Any expert can help clear this ?

- 361 replies

-

what was your deciding factor when you chose your HDB flat in your block ? not talking about location as in road, but how you made your choices on the level and either corner or center of beside lift or staircase ? all this - if you had a choice during your selection ? I would hope to get a corner flat so only the door is the only accessible point of entry. so that I can keep my hall or room windows opened all the time without worry of my neighbors/stalkers walking past my unit and looking inside.

-

I can see one can check CEA for the agent but there is only basic information on it. What are the information I shall use to ensure I am talking to a normal agent? Name Reg. No. Reg. Period Awards Disciplinary Actions Remarks Est. Agent Name Licence Number